Qu'est-ce que l'auto-paiement : libérer la liberté financière

Have you ever wondered about the concept of self payment? It’s a term that might not be on everyone’s radar, but it holds significant importance for anyone managing their own finances.

Understanding self payment can empower you to take control of your financial future. Imagine a world where you decide when, how, and what you pay yourself. Sounds intriguing, right? This article will unravel the mysteries of self payment, guiding you step-by-step through its benefits and how you can incorporate it into your life.

Prepare to gain insights that could transform your financial habits and lead to greater peace of mind. Dive in, and discover the power of paying yourself first.

Self Payment Concept

Self payment means paying for things yourself. This can include bills, shopping, or services. People manage their own money. They decide how much to spend. No help from others is needed.

It teaches compétences en gestion de l'argent. Kids learn to save money. They understand how to budget. Self payment helps in planning. It builds indépendance financière. Everyone should know how to do it.

Parents can guide children. They show how to spend wisely. Kids can learn to compare prices. They make smart choices. Wise spending is important. This concept is useful for all ages.

Benefits Of Self Payment

Self payment means you are in control of your money. You decide where to spend and save. Financial independence gives freedom from relying on others. You learn to manage your finances. This skill is very important. It helps you become self-reliant.

Creating a budget helps control spending. You know how much money is coming in and going out. Budget control prevents overspending. It keeps your finances healthy. You can set goals. Save for future needs. This helps keep your money safe.

Paying on your own reduces debt. You manage expenses wisely. Debt reduction is achieved by avoiding loans. Paying bills on time is crucial. It saves from high interest rates. You gain peace of mind. You live stress-free without debt.

How Self Payment Works

Paramètre objectifs financiers is the first step. Think about what you want to achieve. Save for a toy, book, or game. Write down your goals. This helps in knowing your target. It gives you a roadmap. The goal can be big or small. But it must be clear. Check your goals often. Make changes if needed. Stay focused. This way, you will reach your goals.

Automating payments makes life easy. You don’t need to remember due dates. Set it up once. Your bank can help. Payments happen on time. This saves you from late fees. It keeps your credit score good. Just check your bank balance regularly. Make sure you have enough money. This helps in managing money wisely.

Keep track of all your dépenses. Write down what you spend. Use a notebook or an app. This shows where your money goes. It helps in cutting down costs. You can save more money. Review your expenses weekly. Look for patterns. Find areas to save more. Tracking expenses builds good money habits.

Challenges Of Self Payment

Self payment involves individuals paying for services or products without using insurance. Challenges include managing unexpected costs and budgeting effectively. Understanding pricing can be difficult, leading to financial stress. Balancing expenses and making informed decisions becomes essential.

Discipline And Consistency

Staying disciplined is hard for many people. Keeping track of money needs focus. Consistency helps in sticking to budget plans. Missing one payment can cause trouble. It takes effort to be consistent every month. Suivi des dépenses is vital to avoid overspending. Regular checks on spending habits are necessary. People must stay committed to manage money well.

Unexpected Expenses

Life can surprise us with coûts imprévus. Car repairs or medical bills can pop up. These expenses can ruin well-planned budgets. Planning ahead can help tackle these surprises. Emergency funds can save the day. Without them, it’s hard to cover sudden costs. Saving a little every month can help. It’s important to prepare for the unknown.

Adjusting Spending Habits

Changing how we spend money is tough. People get used to certain spending ways. Adjusting habits needs patience and understanding. Cutting back on unnecessary buys is challenging. It requires looking at what’s important. Saving money means spending wisely. Being mindful of expenses helps in adjusting. Small changes can make a big difference in savings.

Tools For Self Payment

Budgeting apps help manage money better. They let you track spending. You can set objectifs financiers easily. Some popular apps include Mint and YNAB. These apps can show where your money goes. They are easy to use for everyone.

Online banking makes managing money simple. You can check your balance anytime. It helps in paying bills quickly. Transfers between accounts are hassle-free. Most banks offer apps for easy access. It is a safe way to handle finances.

Financial advisors give advice on money matters. They help in planning budgets. Advisors can offer tips on investments. They are experts in saving strategies. Meeting with them can be very helpful. They make financial planning easier.

Histoires de réussite

Many people use self-payment for their needs. They share their stories. One woman saved money for her dream trip. She worked extra hours. She controlled her spending. Her dream came true. Another person paid off debts. He learned to budget well. He felt less stress. He felt more freedom.

Self-payment teaches important lessons. People learn to budget wisely. They plan their spending. They save for future needs. It also teaches discipline. They avoid impulse buys. They think before spending. They reach their goals. They feel proud.

Tips For Implementing Self Payment

Begin with simple transactions. Use it for small purchases first. This helps you understand the process. Avoid big risks early. Confidence builds gradually. Make sure everyone is comfortable. Ease into the new way.

Keep up with latest trends. Read about new technologies. Talk to experts. Join forums et discussions. Learn from others’ experiences. Knowledge is power. Updates are important. Stay ahead of changes.

Vérifiez votre self payment system often. Look for mistakes and errors. Fix them quickly. Ask users for feedback. Improve your process. Regular checks ensure bon fonctionnement. Stay alert to problems. Garder everything running well.

Questions fréquemment posées

What Does Self Payment Mean?

Self payment refers to individuals covering costs out of their own pockets. This is common when insurance doesn’t cover specific services. It involves direct payment to service providers. Self payment often requires budgeting and financial planning. It is a flexible option for those without insurance.

How Does Self Payment Work?

Self payment involves directly paying for services or products. Individuals manage transactions without third-party involvement. This requires understanding the costs beforehand. Often, it includes negotiating fees with providers. It is crucial to track expenses for better financial management.

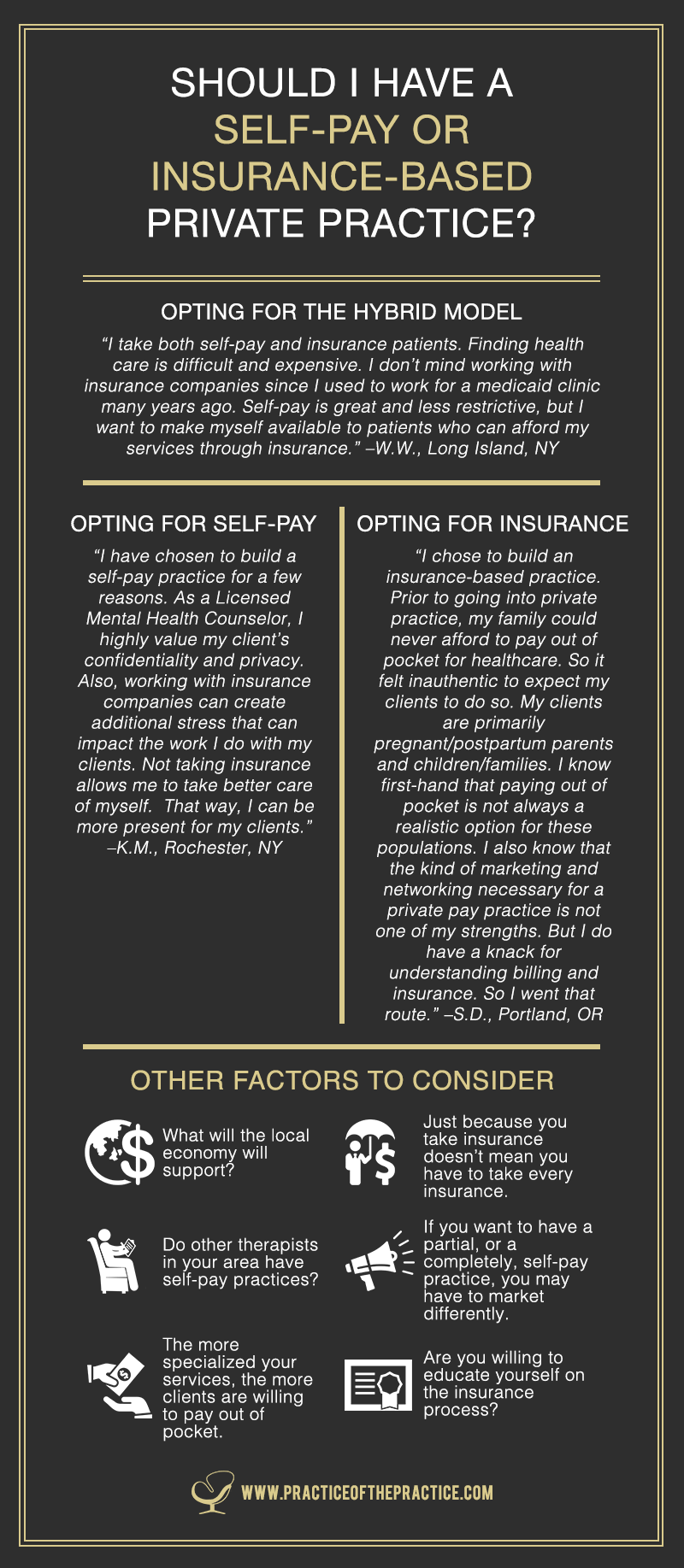

Why Choose Self Payment Over Insurance?

Choosing self payment allows for greater flexibility and control. It eliminates the need for dealing with insurance restrictions. Often, it results in quicker access to services. It is ideal for those with limited insurance coverage. It can also lead to negotiated lower costs.

Is Self Payment Accepted Everywhere?

Not all providers accept self payment. It is essential to confirm with service providers beforehand. Many healthcare and service industries offer self payment options. Always inquire about payment methods during consultations. Some businesses may offer discounts for self payment.

Conclusion

Self-payment offers control over how you manage your finances. It allows you to decide payment timing and amounts. This method is especially useful for budgeting. You gain flexibility and financial independence. Understanding self-payment is crucial for managing personal funds. People can tailor it to their unique needs.

Explore self-payment options that suit your lifestyle. Make informed choices for a stress-free financial life. Stay aware of your financial situation. This knowledge can lead to better money management. And peace of mind. Use self-payment wisely for a secure financial future.