Combien de mensualités de voiture puis-je manquer avant la saisie ? Guide essentiel

You’re staring at your calendar, and the due date for your car payment is creeping closer. Maybe you’re struggling to make ends meet this month or facing unexpected expenses.

You’re not alone. Many people find themselves in a similar situation, wondering, “How many car payments can I miss before repo? ” It’s a question that can cause sleepless nights and anxiety. But understanding the answer could be the key to avoiding stress and keeping your vehicle safe.

We’re diving into the realities of car repossession, what you can do if you’re behind on payments, and strategies to regain control of your finances. Stick around, and you’ll discover practical advice that could save you from losing your car.

Factors Influencing Repossession

Lenders have rules for missed payments. Some may allow one late payment. Others might start repossession after two missed payments. Understanding lender policies is crucial. Each lender has its own guidelines. Stay informed to avoid surprises. Read their terms carefully.

State laws affect repossession. Laws vary by state. Some states require advance notice. Others may allow swift action. Knowing your state law is essential. It helps in planning. Stay aware of your state’s rules. This knowledge can protect your car.

Loan agreements explain payment terms. These terms are legally binding. They detail what happens if payments are missed. Read the agreement thoroughly. Understanding these terms is vital. It helps in knowing your rights. Agreements hold important information.

Grace Periods And Late Fees

Most lenders offer a grace period for car payments. This period is often 10 to 15 days. During this time, no late fees are charged. It’s a helpful time cushion for many. Missing payments can be stressful. Knowing your grace period helps reduce stress.

Late fees add extra cost to your missed payment. These fees vary by lender. Some charge a montant fixe. Others charge a percentage of the payment. Late fees make catching up harder. It’s important to pay on time to avoid them.

Talking to your lender helps if you miss payments. They may offer options or solutions. Lenders can suggest payment plans. They might offer to defer a payment. Communicating early helps avoid bigger problems. Always keep your lender informed.

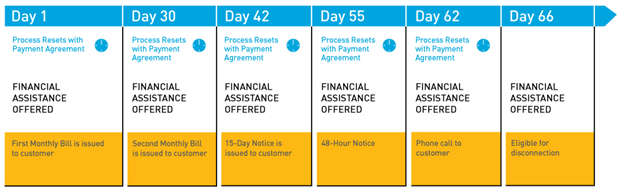

Steps Before Repossession

Missing car payments can lead to repossession. Typically, missing three payments may trigger the process. Lenders might allow a grace period before taking action. Always check your loan agreement for specific details.

Default Notices

Missing car payments can lead to default notices. These notices warn you about missed payments. They tell you how much you owe. You must act quickly. Ignoring them can lead to repossession. Always read them carefully.

Opportunities To Cure Default

Sometimes, lenders offer opportunities to cure default. This means fixing your missed payments. You might get a chance to pay what you owe. This can stop repossession. It’s important to ask your lender about this.

Alternatives To Repossession

There are alternatives to repossession. You can sell your car. You can trade it for a cheaper one. You might refinance your loan. These options can help avoid losing your car. Talk to your lender about them.

Consequences Of Repossession

Missing car payments can hurt your credit score. Lenders report missed payments to bureaux de crédit. Your score drops. A lower score means you can’t get loans easily. You might pay more for loans. It takes time to fix credit score problems. Be careful.

You still owe money after repossession. Dette remains. Lenders sell the car. If they sell it for less than you owe, you pay the difference. Collection agencies might contact you for payments. This adds stress. Paying on time helps avoid these problems.

Repossession affects future loan options. Lenders see repossession on your record. They may not trust you with new loans. Housing and car loans become hard to get. Higher interest rates might apply if approved. Pay attention to payments. Avoid repossession.

Avoiding Repossession

Faire un budget helps manage money better. List all your expenses. Compare them to your income. Find areas to cut back. Save extra money for car payments. Planning keeps you on track. It helps avoid missing payments.

Considérer refinancing your car loan. It can lower monthly payments. Talk to your bank or lender. Ask about better rates. This can make payments easier to manage. Remember, refinancing can be a good option.

Sometimes, help is needed. Talk to a financial advisor. They give advice on money matters. They help with budgeting and saving. Professional help can prevent car repossession. It’s okay to ask for help.

Legal Rights And Protections

Car owners have legal rights. Knowing these rights is important. Car repossession can’t happen without proper notice. Lenders must follow lois de l'État. They should send written warnings before repossession. This gives owners a chance to settle debts. It’s important to read these notices carefully.

Repossession can be unlawful sometimes. If someone takes your car without notice, it might be illegal. Breaking into a garage or driveway is wrong. Owners can report such actions. Proof is needed to show unlawful repossession. This can include videos or photos.

Help is available if a car is taken wrongly. Lawyers can offer guidance. They know how to deal with lenders. It is crucial to contact them quickly. Free legal aid might be available. They can help you understand your rights. Act fast to protect your car and rights.

Questions fréquemment posées

How Many Missed Car Payments Lead To Repossession?

Most lenders can initiate repossession after two or three missed payments. However, this varies depending on your loan agreement. It’s crucial to contact your lender if you’re struggling to make payments. Open communication can sometimes prevent repossession and offer alternative solutions to manage your car loan more effectively.

What Happens If I Miss One Car Payment?

Missing one payment often results in late fees and a negative impact on your credit score. Lenders typically allow a grace period before taking further action. It’s important to pay as soon as possible. Communicating with your lender can help you avoid additional penalties and understand your options.

Can I Negotiate With My Lender After Missed Payments?

Yes, you can negotiate with your lender after missing payments. Many lenders are willing to work out a payment plan. Contact them as soon as possible to discuss your financial situation. This proactive approach can prevent repossession and help you manage your car loan more effectively.

How Can I Avoid Car Repossession?

To avoid repossession, communicate with your lender and explore alternative payment options. Consider refinancing your loan or setting up a payment plan. Stay informed about your loan terms and address financial issues promptly. This proactive approach can help you maintain your vehicle and protect your credit score.

Conclusion

Missing car payments can lead to repossession. Stay informed and proactive. Communicate with your lender if you face financial issues. They may offer solutions. Prioritize your car payments in your budget. Understand your loan terms clearly. Know the grace periods and policies.

This helps avoid surprises. Educate yourself on your rights. Each lender may have different rules. Protect your credit score by staying current. Late payments impact it negatively. Seek financial advice if needed. Better to act early than face repossession. Keep your transportation secure.

Stay ahead of financial challenges. Plan wisely for a smoother journey.