Comment transférer de l'argent depuis Empower Retirement

As it happens, you're probably thinking about transférer de l'argent from Empower Retirement at the same time many others are taking a closer look at their retirement plans. You've decided it's time to move your funds, but you're not sure where to start. You'll need to gather some documents essentiels et fill out transfer forms, but don't worry, it's a relatively straightforward process. The question is, what are the specific steps you need to take to guarantee a transfert en douceur? Let's break it down, and you'll be on your way to making the most of your retirement savings.

Understanding Empower Retirement Plans

Empower Retirement plans are a type of employer-sponsored retirement account that allows you to save and invest a portion of your income on a pre-tax or after-tax basis. As a participant, you'll contribute a portion of your paycheck to your account on a regular basis. Your employer may also match a portion of your contributions. The funds are then invested in a variety of assets, such as stocks, bonds, or mutual funds. You'll have the opportunity to choose from a range of options d'investissement, allowing you to tailor your portfolio to your individual risk tolerance and financial goals. It's crucial to understand the specifics of your Empower Retirement plan, including the investment options, fees, and distribution rules, to make informed decisions about your retirement savings.

Reasons to Transfer Funds

You may want to contemplate transférer des fonds de votre retirement account for various reasons, such as seeking better investment options, consolidating accounts, or gaining more control over your retirement savings. Perhaps you're unhappy with Empower Retirement's fees, investment choices, or customer service. Alternatively, you might be seeking more flexibility in managing your retirement assets or wanting to simplify your financial life by consolidating multiple accounts into one. Additionally, you may be looking to take advantage of frais moins élevés or more competitive investment options offered by another provider. Whatever your motivation, transferring funds from Empower Retirement can be a viable option to achieve your retirement goals. It's important to weigh the pros and cons before making an décision éclairée.

Choosing a New Account

Quand transférer des fonds d'un retirement account, selecting a suitable new account requires careful consideration of factors such as frais, options d'investissement, et account management features. You'll want to choose an account that aligns with your objectifs financiers and risk tolerance. Consider the types of investments offered, such as stocks, bonds, or mutual funds, and the associated fees. Also, think about the level of account management you need, including online access, mobile banking, and customer support. Look for accounts with low or no fees, competitive interest rates, and flexible investment options. Additionally, verify the new account is registered with the relevant regulatory bodies and offers adequate security measures to protect your funds. By carefully evaluating these factors, you can choose a new account that meets your needs and provides a secure and stable environment for your retirement savings.

Gathering Required Documents

Pour initier le processus de transfert, documentation verifying the account owner's identity and account details must be collected. You'll need to gather the necessary paperwork, including your account statements, identification, and any beneficiary information. Typically, Empower Retirement requires a copy of your pièce d'identité émise par le gouvernement, Social Security number or Individual Taxpayer Identification Number (ITIN), and proof of your current address. Additionally, you may need to provide documentation verifying your propriété du compte, such as a copy of your Empower Retirement account statement or a confirmation of account ownership letter. Having these documents readily available will help facilitate a smooth transfer process and prevent any retards potentiels. Verify all documents are accurate and up-to-date to avoid any complications.

Filling Out Transfer Forms

Filling out the transfer forms requires attention to detail and accuracy, as incorrect or incomplete information can cause delays or rejection of the transfer request. You'll need to provide personal and account information, including your name, address, and Empower Retirement account number.

| Informations requises | Pourquoi c'est nécessaire |

|---|---|

| Your name and address | To verify your identity and guarantee accurate processing |

| Empower Retirement account number | To locate the correct account and facilitate the transfer |

| Montant du transfert | To specify the exact amount you want to transfer |

| Receiving account information | To guarantee the funds are deposited into the correct account |

| Signature and date | To authorize the transfer and confirm your request |

Double-check your entries to guarantee everything is accurate and complete.

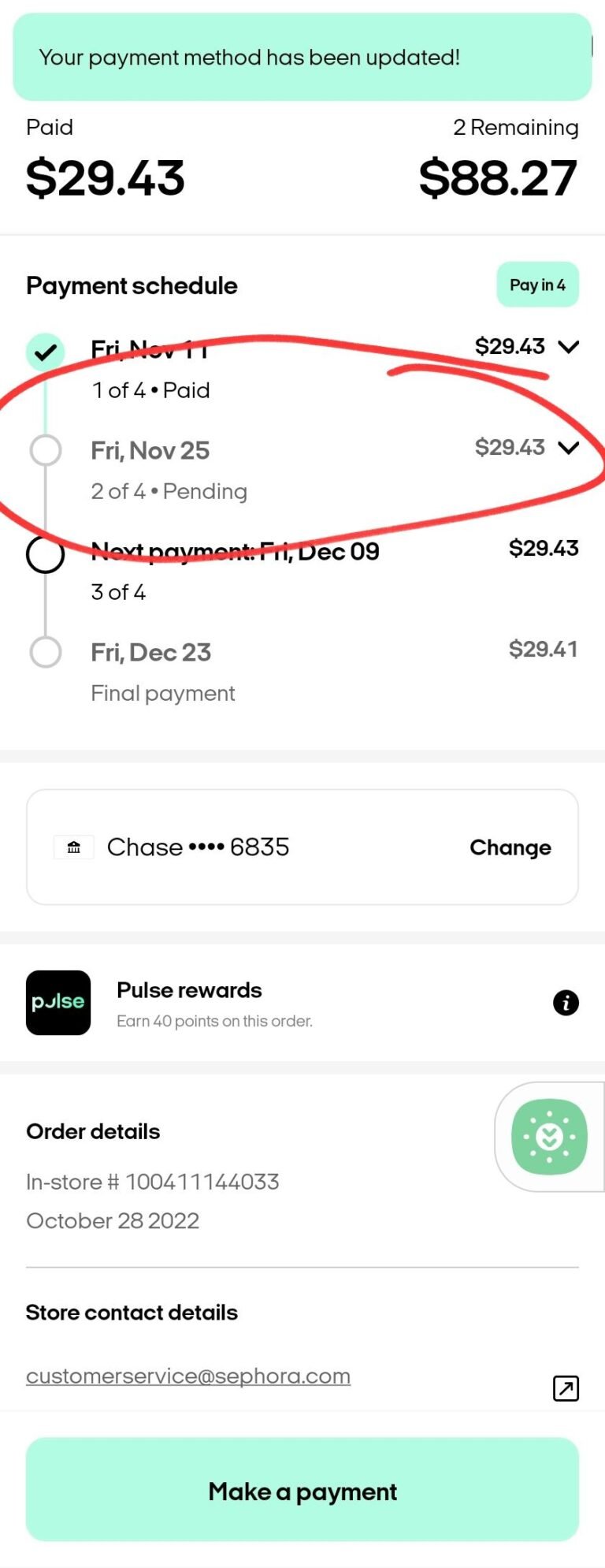

Submitting the Transfer Request

Once you've completed and double-checked the transfer forms, your next step is to submit them à Empower Retirement for processing. You can do this by mailing or faxing the forms to the address or number provided on the Empower Retirement website or documentation. Make sure to keep a copy of the forms for your records. Alternatively, you may be able to submit the transfer request online, depending on your plan's options. To do this, log in to your Empower Retirement account and follow the online instructions for submitting a transfer request. Confirm all information is accurate and complete to avoid delays. By submitting the request, you're authorizing Empower Retirement to initiate the transfer. Processing times may vary, so it's crucial to plan accordingly.

Paying Transfer Fees

As you finalize your demande de transfert with Empower Retirement, you'll typically need to pay frais de transfert, which vary depending on your plan and the type of transfer you're initiating. These fees can range from a flat rate to a percentage of the transferred amount. Your plan documents or Empower Retirement's website should disclose the frais applicables. You can also contact their support client to confirm the fees associated with your transfer. It's important to factor in these costs when planning your transfer to make sure you're aware of the total amount that will be deducted from your account. By understanding the transfer fees, you can make an informed decision and avoid frais inattendus.

Tracking the Transfer Progress

Après avoir soumis votre demande de transfert and accounting for the associated fees, you can monitor the status of your transfer through Empower Retirement's online platform or by contacting their équipe de support client. You'll receive updates on the progress of your transfer, including when the funds are disbursed from your Empower Retirement account and when they're deposited into your designated account. To guarantee a transfert sécurisé, Empower Retirement verifies the recipient account information before releasing the funds. If any issues arise during this process, they'll notify you promptly. You can also log in to your online account to check the status of your transfer at any time. This transparence allows you to stay informed and confident throughout the transfer process.