¿Qué es el Pago Automático? Simplifique sus facturas

Are you tired of missing payment deadlines and dealing with the stress of late fees? Imagine a world where your bills are paid on time, every time, without you lifting a finger.

That’s exactly what auto draft payment offers. It’s like having a personal assistant who takes care of your financial commitments, ensuring peace of mind and freeing you from the hassle of manual payments. But what exactly is auto draft payment, and how can it transform your financial routine?

By the end of this article, you’ll discover how this simple tool can bring order to your financial life, saving you both time and money. Dive in to find out how you can take control and make your financial life easier.

Auto Draft Payment Basics

Auto Draft Payment means money is taken from your account. This is done automatically. You do not need to remember to pay bills. Companies like banks and utilities use this method. It helps them get paid on time. Customers save time and avoid late fees. You must have enough money in your account. If not, the payment can fail. Seguridad is important. Always check your account for mistakes. Confianza is needed with the company taking your money.

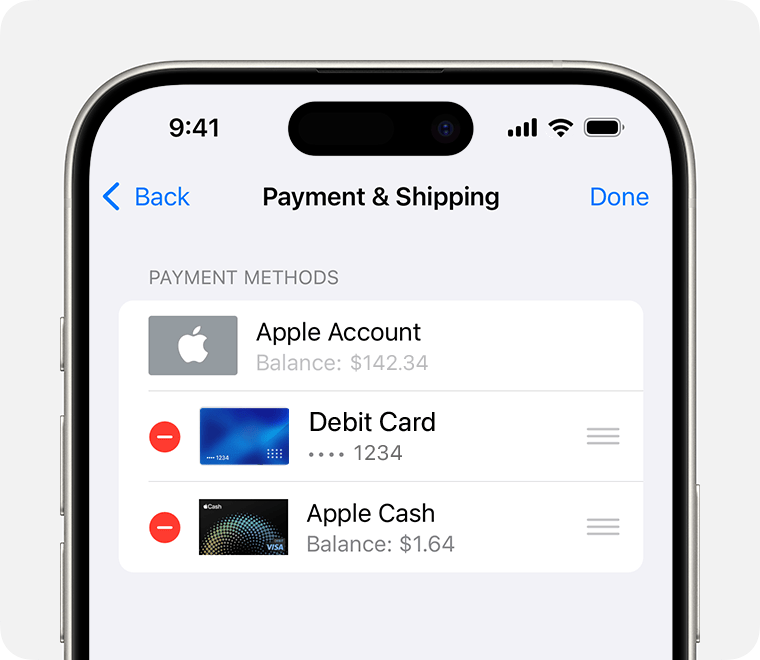

Many use tarjetas de crédito o tarjetas de débito for auto payments. Others use cuentas bancarias directly. Some prefer using servicios de pago en línea. PayPal is one example. You must give permission first. Configuración is easy. Just provide your payment details. Always keep your information safe. Updating payment details is important. This ensures payments are successful.

Benefits Of Auto Draft Payment

Auto draft payment saves a lot of time. You don’t have to write checks. No need to visit banks often. Payments happen automatically. This means less work for you.

It helps in managing money better. You can set it once. Then relax, knowing bills get paid on time. This makes planificación financiera easier. Less stress about forgetting payments.

Late fees can be a pain. Auto draft payment ensures no more late fees. Payments are on schedule. This saves money in the long run.

Setting Up Auto Draft Payment

Auto draft payment is easy to set up. First, pick the right accounts. Choose one with enough funds. This helps you avoid extra fees. Consulta el saldo de tu cuenta often. Make sure it’s enough to cover bills. Some accounts offer auto draft features. These make payments easier. Ensure your account supports these features. Ask your bank for help if needed. Always know your account details. Keep them safe and secure.

Authorizing payments is very important. Give permission to the company to take money. This is called autorización. Read the terms before you agree. Understand how much will be taken. Know when payments will be made. Ensure you can stop payments if needed. Contact your bank to set up autorización. They can guide you through the steps. Always keep a record of what you agree to. This helps avoid problems later.

Preocupaciones de seguridad

Personal information must stay safe. Always use strong passwords. Keep them private. Never share your banking details. Use two-step verification. This adds extra security. It’s like a secret code. Only you know it. Update passwords often. Choose different ones. Don’t use easy words or dates. Watch for strange emails. They may ask for details. Never click unknown links. These steps help protect your data.

Fraud is a big threat. Know the signs. Check your bank statements often. Look for strange charges. If something is wrong, tell your bank. They can help. Be wary of fake calls or emails. They may pretend to be your bank. Always verify their identity. Scammers may use threats. Don’t be fooled. Report any fraud attempts. Stay alert. Protect your money.

Managing Auto Draft Payments

It’s important to know when payments will occur. Keep a simple calendar to track dates. Mark each auto draft payment on it. This helps you to avoid missed payments. You can also use phone apps for reminders. These apps alert you before a payment is due. Staying organized means no late fees. Always check if the payment was successful. This ensures peace of mind.

Plans might change, so adjustments are necessary. To change a payment, contact your bank. They will guide you through the steps. You might need to fill out some forms. For cancelling, act before the next payment date. This avoids unwanted charges. Always confirm changes with your bank. This is to ensure the process is complete. A quick call can save future troubles.

Common Challenges

Auto draft payment can cause overdraft riskspenalties for overdrafts. Some people forget to check account balances. This can lead to overspending.

Bill amounts can change each month. This can confuse people. Some bills may be higher than expected. Account balance may not cover these amounts. People must check bills regularly. This helps avoid surprises.

Auto Draft Payment Tips

Checking your bank statements is very important. Errores can happen. You might pay too much or pay twice. Look at the statement each month. Find errors early. Notify the bank if you see any mistake. They can help you fix it. Regular checks keep your money safe.

Payment alerts remind you about bills. They tell you when a payment is due. You can set alerts on your phone. Email alerts work too. Alerts help you avoid late fees. Stay organized with alerts. They ensure you pay on time.

Preguntas frecuentes

What Is Auto Draft Payment?

Auto draft payment is an automated transaction system. It automatically deducts payments from your bank account. This ensures timely payments without manual effort. It’s commonly used for recurring bills, like utilities and subscriptions. It helps avoid late fees and maintain good credit.

How Does Auto Draft Payment Work?

Auto draft payment works by linking your bank account. Once set up, payments are automatically deducted. This usually happens on a predetermined date. It simplifies bill management and reduces the risk of missed payments. Ensure your account has sufficient funds to avoid overdraft fees.

What Are The Benefits Of Auto Draft Payment?

Auto draft payments offer several benefits. They ensure timely payments and reduce late fees. They streamline bill management by automating transactions. This can improve your credit score over time. Additionally, it provides peace of mind and saves time by eliminating manual payments.

Is Auto Draft Payment Safe To Use?

Yes, auto draft payment is generally safe. Financial institutions use encryption to protect your data. Ensure you trust the company handling your payments. Regularly monitor your bank statements for unauthorized transactions. Setting alerts can help detect any unusual activity promptly.

Conclusión

Auto draft payment makes managing bills simpler. It saves time and effort. Payments happen automatically, so you never miss a due date. No more late fees. It helps budget your expenses better. Your financial life becomes more organized. Consider setting it up with your bank or service provider.

Always monitor your account for accuracy. Understanding auto draft payments benefits your financial health. Make sure it fits your needs and preferences. Keep control of your finances while enjoying convenience. Start experiencing less stress in bill management today.