¿Qué es un sistema de pago?: Descubriendo el futuro de las transacciones

Imagine you’re at a bustling marketplace, ready to buy your favorite products. You hand over cash, and the transaction is complete.

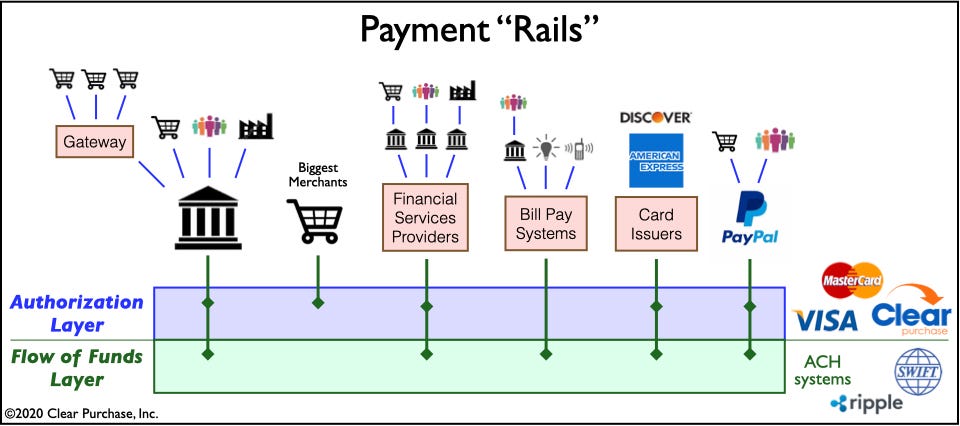

But what if this exchange wasn’t physical? What if it happened over invisible pathways that connect banks, businesses, and individuals worldwide? These invisible pathways are known as payment rails. Understanding payment rails can be as essential as knowing how to swipe your card or tap your phone.

They form the backbone of every digital transaction you make. Whether you’re buying coffee with a contactless card or sending money to a friend overseas, payment rails ensure your money gets where it needs to go, quickly and securely. Curious to know more about these crucial financial highways and how they impact your everyday transactions? Keep reading to uncover the fascinating world of payment rails and how they make your life easier.

Payment Rail Essentials

A payment rail is a system for moving money. It helps in transferring funds between banks and people. Payment rails are like roads for money. They make sure money goes where it should. They are safe and fast. Banks and companies use them every day. People trust payment rails for their transactions. They are important for the economy. Without them, moving money would be hard.

There are different types of payment rails. ACH is one type. It moves money between banks. It is slow but cheap. Transferencias bancarias are another type. They are fast but cost more. Card networks like Visa and Mastercard are also payment rails. They are used for credit and debit cards. Each type has its own features. People choose based on needs and costs. Payment rails are everywhere in daily life.

Traditional Payment Rails

A payment rail is a network that allows money to move from one place to another. Traditional payment rails include systems like bank transfers and credit card networks. They form the backbone of financial transactions, ensuring secure and reliable money transfers.

Transferencias bancarias

Bank transfers move money from one bank to another. They are safe y trusted. People use them for big payments. bancos check all the details. This makes transfers take longer. They are not the fastest. But they are very reliable.

Credit And Debit Card Networks

Credit and debit cards are very common. Almost everyone uses them. They are fast and easy. You swipe or insert the card. Money moves quickly from your account. Seguridad is important here too. Card networks watch out for fraude. They keep your money safe. But sometimes, there are honorarios for using cards.

Emerging Payment Rails

Blockchain is a digital ledger. It keeps records safe and transparent. Each transaction forms a block. These blocks link together. This creates a chain. No one can change past transactions. This makes blockchain confiable. Many people use it for criptomonedas. Bitcoin is a popular example. Companies also use blockchain for other tasks. It offers speed y seguridad.

Blockchain reduces fraud. It cuts out middlemen. This saves money. It also speeds up transactions. People like its eficiencia. It works day and night. No need for banks to open. This helps global trade. More companies are adopting blockchain. They see its many benefits.

Digital wallets store dinero electronically. They are like real wallets. But on a phone or computer. People use them to buy things. They can also send money. Many apps offer digital wallets. PayPal and Apple Pay are examples. They are fácil to use. Just link a bank account or card.

Digital wallets are conveniente. No need to carry cash. Just scan and pay. Many stores accept them. This makes shopping faster. They also keep track of spending. This helps with budgeting. Digital wallets are becoming popular. Many people find them helpful.

Key Features Of Modern Payment Rails

Payment rails move money fast. No more waiting for days. Transactions happen in seconds. This is good for online shopping. People like quick payments. Businesses also benefit. They can manage their cash flow better. Efficiency saves time and effort. Payments are smooth and easy. Customers enjoy this speed. It makes shopping fun and stress-free. Everyone wins with fast payments.

Keeping money safe is important. Payment rails use strong security systems. They protect your money and data. Hackers can’t steal your information. Cifrado is a key tool. It scrambles data and keeps it safe. Regular checks find weaknesses. Security teams fix them fast. Safety builds trust. People feel secure using these systems. They know their money is safe. Businesses also trust these measures. It helps them keep customer data safe.

Impact On Global Commerce

Payment rails help move money between countries. They make it easy and fast. With these systems, you can send money to different parts of the world. Businesses use these rails to trade with other countries. This helps them grow. Customers can buy goods from far away places. They feel happy and safe using payment rails. They trust these systems. The cost to send money is usually low. This is good for everyone.

Many people don’t have access to banks. Payment rails can help them. With these systems, they can send and get money. They don’t need a bank account. This makes life easier for many families. People in remote areas can receive money from loved ones. They can use this money for important things. Like food or school fees. More people can join the financial world. This brings hope and growth to many communities.

Challenges In Payment Rail Evolution

Payment rail refers to the infrastructure enabling money transfer between parties. Adapting to digital demands and enhancing security are major hurdles. This evolution requires balancing innovation with reliability to ensure smooth, secure transactions.

Regulatory Hurdles

Payment rails often face rules from many places. Different laws make things hard. Companies must follow these rules. This takes time and money. Rules can change quickly. Keeping up is tough. New laws can surprise companies. They must react fast. This is tricky for small firms. They may not have enough resources.

Technological Barriers

Old systems slow down payment rails. Updating them is costly. New tech is hard to understand. Training is needed to use it. Many companies struggle with this. Tech changes fast. Staying updated is hard. Small businesses feel this more. They might lack tech experts. This makes growth difficult.

Future Trends In Payment Rails

Payment rails are systems enabling money transfer between banks and institutions. These mechanisms are evolving with technology. Blockchain and digital currencies promise faster and secure transactions. New trends focus on enhancing efficiency and transparency. Payment rails continue adapting to meet global financial demands.

Integration Of Ai And Machine Learning

AI and machine learning change how payment systems work. They make payments faster and safer. These tools can find bad actions quickly. AI helps to predict what users want. Machine learning learns from past payments. It helps make better choices. This makes the payment system smart. It saves time y dinero for companies. People trust these systems more. AI can also handle big data. This helps businesses grow. It improves user experience. People like easy payments. AI and machine learning make this happen.

Rise Of Decentralized Finance

Decentralized finance, known as DeFi, is growing fast. It lets people control their money. There is no need for banks. Blockchain technology supports DeFi. It keeps money transactions safe. People use DeFi for loans and payments. It is open to everyone. It offers low fees. DeFi is flexible and global. People can use it anytime. DeFi changes how people manage money. More people choose DeFi over old systems. It brings new choices for users. It is a big trend in payments.

Preguntas frecuentes

What Is A Payment Rail?

A payment rail is the infrastructure that enables the transfer of funds. It facilitates transactions between banks and financial institutions. Payment rails can be traditional, like credit card networks, or digital, like blockchain technology. They ensure secure and efficient money movement in various financial systems.

How Do Payment Rails Work?

Payment rails work by connecting banks and financial institutions to process transactions. They use secure networks to transfer funds between accounts. Each transaction follows a specific protocol to ensure safety and efficiency. This infrastructure supports various payment methods, including bank transfers and digital payments.

Why Are Payment Rails Important?

Payment rails are crucial for the smooth operation of financial systems. They enable quick, secure, and efficient money transfers. Without them, transactions would be slower and riskier. Payment rails support global commerce by facilitating international payments and enhancing financial inclusion.

What Are Examples Of Payment Rails?

Examples of payment rails include SWIFT, ACH, and credit card networks. SWIFT is used for international transfers between banks. ACH handles domestic electronic transactions in the U. S. Credit card networks facilitate payments between consumers and merchants globally.

Conclusión

Understanding payment rails is crucial in today’s digital world. They form the backbone of financial transactions. Payment rails facilitate seamless money transfers. Businesses rely on them for efficient operations. Individuals benefit from their convenience and speed. These systems ensure secure and reliable transactions.

As technology evolves, payment rails will keep improving. They adapt to meet consumer needs and preferences. Learning about payment rails aids in navigating modern finance. It empowers users to make informed financial decisions. Stay informed and make the best use of payment rails.

They are the future of financial transactions.