¿Qué es un libro de pagos?: Guía esencial para principiantes

Have you ever wondered how you can keep track of all your financial transactions effortlessly? Whether you’re managing personal finances or handling business accounts, understanding where your money goes is crucial.

That’s where a payment ledger comes into play. Imagine having a tool that records every single transaction, providing you with a clear overview of your financial health. Intrigued? You should be. This article will unravel the mysteries of a payment ledger, explaining its importance and how it can be your financial best friend.

Stick around to discover how mastering this tool can lead to smarter financial decisions and a more organized life. Your financial clarity is just a read away!

Payment Ledger Basics

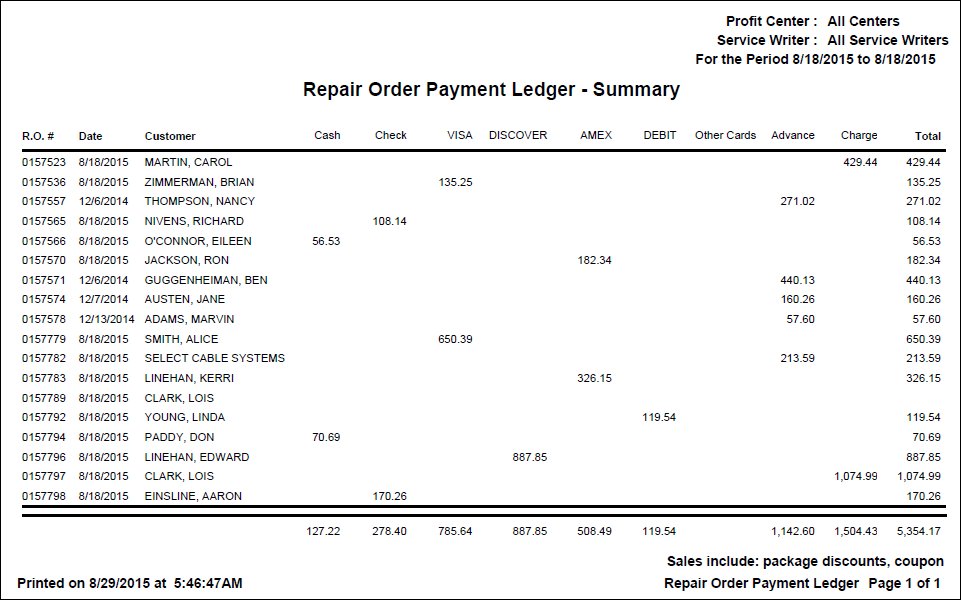

A payment ledger is a record book for money transactions. It shows payments made and received. This ledger helps track money flow. Businesses use it to keep things organized. It can be digital or on paper. The ledger shows who paid and how much. It also shows when the payment happened. This is important for keeping records clear and accurate.

The ledger has several key parts. Fecha records when the payment happened. Cantidad shows how much money was involved. Descripción explains what the payment was for. Payee is who received the payment. Payer is who made the payment. These parts make the ledger easy to understand. They help track the money and keep everything organized.

Types Of Payment Ledgers

Manual ledgers are paper records. People use pens to write entries. They can be slow and need care. Mistakes are easy to make. Checking them takes time. They are not good for big businesses. But some small shops still use them.

Digital ledgers use computers. They are fast and accurate. You can find data quickly. They save space and time. Many businesses use them today. Software helps to keep them secure. They are better than manual ledgers.

Blockchain ledgers are very safe. They use blocks of data. Each block links to another. It is hard to change them. Many people trust them. They are good for online payments. Banks and companies use them often.

How Payment Ledgers Work

Payment ledgers help track money in and out. Every time you pay or get money, it gets recorded. This helps you know where your money goes. Each record shows the date, cantidad, y who was paid.

Accuracy is very important. Mistakes can cause problems. Always check your records. Make sure all numbers are correcto. If you find an error, fix it right away. This keeps the ledger confiable.

Balancing means checking if your records are right. You add up all pagos y ingresos. They should match your bank statement. If not, find out why. Balancing helps you know your financial health.

Benefits Of Using A Payment Ledger

Keeping track of payments can be tough. A payment ledger makes it easy. It shows you what money comes in and goes out. You will see everything clearly. Organization helps you find mistakes. It also saves time. You won’t lose track of anything important.

Mistakes happen often with money. A ledger helps catch these errors. It keeps records neat and clear. You can check numbers easily. Errors become less frequent. This helps you keep money safe. It also saves you from big problems later.

Planning money can be hard. A ledger gives you the info you need. It shows what you spend and earn. You can plan better with this info. Good planning helps you save money. You will know where to spend less. This helps your future.

Common Challenges

Mistakes happen during data entry. Numbers and names can mix up easily. This causes problems in balancing the ledger. Errors make it hard to trust the data. Careful checking is needed to keep the ledger accurate. Double-checking entries saves time later.

Fraude is a big worry with payment ledgers. Bad people may try to steal data. Keeping information safe is very important. Use strong passwords and security measures. This helps stop fraud and protects sensitive details.

Ledgers often need to work with other systems. Problems happen if they don’t fit well. Integration issues slow down work and cause confusion. Good software helps ledgers match with other tools. Make sure all systems talk to each other for smooth operations.

Tips For Beginners

A payment ledger is a simple tool for tracking financial transactions. Beginners can use it to record expenses and income systematically. This helps in understanding and managing money better.

Choosing The Right Ledger

Pick a ledger that fits your needs. Understand what you need from it. Investigación different types before deciding. Some ledgers are simple. Others can be complex. Choose one that’s easy to use. Ease of use is very important. Costo matters too. Some ledgers are free. Others might be expensive.

Regular Updates

Keep your ledger updated. Actualizar it regularly. Track all transactions. Daily updates help. Stay organized with updates. It helps to see where money goes. Missing updates can cause problems. Set a routine for updates.

Leveraging Technology

Use technology to help with your ledger. Many tools are available. Digital ledgers are easy to use. They save time. Some apps sync with banks. Automation is key. It reduces errors. Elegir tools wisely. They should be user-friendly.

Future Of Payment Ledgers

A payment ledger records transactions, detailing credits and debits. These ledgers help businesses track financial activities efficiently. Future ledgers may integrate blockchain, enhancing transparency and security in financial operations.

Emerging Technologies

New technologies change payment ledgers fast. Blockchain is one of these technologies. Blockchain makes transactions clear and safe. It removes middlemen. This saves time and money. Artificial Intelligence (AI) helps too. AI predicts trends. It spots errors quickly. This improves ledger accuracy.

Impact On Businesses

Businesses see big changes with new ledgers. Velocidad is crucial. Fast transactions mean happy customers. Seguridad is vital. Safe ledgers protect money and data. Costo matters. Less cost means more profit. Small businesses benefit most. They compete better now. Large businesses gain too. They streamline operations. They serve clients faster.

Preguntas frecuentes

What Is The Purpose Of A Payment Ledger?

A payment ledger records all financial transactions in an organized manner. It ensures transparency, accuracy, and accountability in managing finances. Businesses and individuals use it to track payments, receipts, and balances. This helps in financial planning and avoiding discrepancies.

How Does A Payment Ledger Work?

A payment ledger records transactions chronologically with details like date, amount, and parties involved. Each entry is documented to maintain accurate financial records. It helps in tracking cash flow and financial status. Regular updates ensure comprehensive financial oversight.

Why Is A Payment Ledger Important?

A payment ledger is crucial for financial management. It helps monitor income, expenses, and cash flow. Accurate records prevent financial discrepancies and aid in budgeting. Businesses use ledgers for tax preparation and audits. Individuals benefit by tracking personal finances effectively.

Can A Payment Ledger Prevent Financial Errors?

Yes, a payment ledger reduces financial errors by providing organized transaction records. Accurate entries help avoid discrepancies and miscalculations. Regular ledger reviews ensure errors are identified and corrected promptly. It is a critical tool for maintaining financial accuracy.

Conclusión

A payment ledger is a vital tool for tracking finances. It helps manage transactions and monitor cash flow efficiently. Businesses and individuals can stay organized by recording each payment and receipt. This practice simplifies budgeting and financial planning. Using a ledger reduces errors and saves time.

It provides a clear financial overview. Anyone can benefit from keeping an accurate payment ledger. Simple and effective. Essential for financial health. Start maintaining one today to ensure smooth financial operations.