¿Qué significa el pago en lugar del preaviso? Explicado de forma sencilla

Have you ever heard the term “payment in lieu of notice” and wondered what it actually means for you? Whether you’re facing a job transition or simply curious about employment terms, understanding this concept can make a big difference.

Imagine being in a situation where you’re leaving a job, but instead of serving your notice period, you receive a payment. Sounds intriguing, right? This option can offer you financial security and flexibility during a potentially stressful time. You’ll discover exactly what payment in lieu of notice entails, how it can impact your career decisions, and why it’s essential to know your rights.

Stay with us to unravel the details and see how this term might just work in your favor.

Payment In Lieu Of Notice Defined

Payment in lieu of notice means paying money instead of giving notice. Workers get paid for their plazo de aviso without working. This helps when jobs end quickly. Companies use it to avoid waiting. Employees receive money equal to their salary for the notice time.

This payment is common in job contracts. It ensures workers get money even if they leave fast. It can be helpful in sudden job changes. Workers should understand their rights about this payment. Knowing this helps in planning future steps.

Legal Context

Payment in lieu of notice allows employees to leave a job immediately. Employers pay them instead of requiring notice. This payment compensates for the notice period not worked.

Employment Contracts

Employment contracts are like a promise between boss and worker. These contracts tell normas at work. Payment in lieu of notice is part of these rules. If a worker leaves, they get money instead of notice time. This means they leave work sooner. The contract explains how much money they get. It also explains if the worker must work during notice. Understanding contracts helps workers know their rights.

Labor Laws

Labor laws protect workers. These laws say how bosses should treat workers. Payment in lieu of notice is in these laws. It makes sure workers get fair treatment. If a boss wants a worker to leave fast, they must pay. This payment helps workers while they find new jobs. Laws make sure both boss and worker follow rules. Knowing these laws helps workers feel safe.

Cómo funciona

Payment in lieu of notice is a choice for employers. Employers give money instead of notice time. This means no waiting. Quick end to work is possible. It helps when the worker is needed elsewhere. Fast solution for business needs. Costo saving is a benefit too. No extra salary for notice period. Employer has control over timing. It can be used if worker agrees. Flexibilidad is important for company plans.

Employees get money for notice time. Compensation covers missed notice period. They can leave early if paid. Rights protect their interests. Payment should be fair. Agreement must be clear. Employee can say no if unhappy. Choice is theirs to accept or not. Protection from unfair practices is vital. Employees should understand terms. Clear communication is key.

Ventajas

Employers can save time by offering payment instead of notice. It allows for a quick exit of an employee. This can help avoid workplace disruptions. Employers can also reduce costs related to maintaining a position that is no longer needed. The transition becomes smoother and more efficient.

Employees receive pago inmediato without working notice periods. This helps them plan ahead. They can use the time to look for new jobs. Employees also benefit from having seguridad financiera during the transition. It provides a sense of relief and freedom. Payment in lieu of notice is often seen as a fair option.

Desventajas

Payment in lieu of notice can cause financial uncertainty. It may affect job security and disrupt future employment plans. Employees might struggle with sudden changes, impacting their budgeting and stability.

Potential Downsides

Payment in lieu of notice can bring some challenges. One issue is that employees might feel unfairly treated. They expect to work their notice period. Missing this time can lead to confusion. It can also create uncertainty about their future. Another problem is a sudden loss of income. Employees might not have planned for this. It can be hard to find a new job quickly.

Legal Challenges

Legal challenges can arise with payment in lieu of notice. Employers must follow the rules. Failing to do so can lead to legal disputes. Employees may seek legal advice. They could argue they were treated unfairly. This can result in costly court cases. It’s important to handle these matters carefully. Legal experts can help avoid problems.

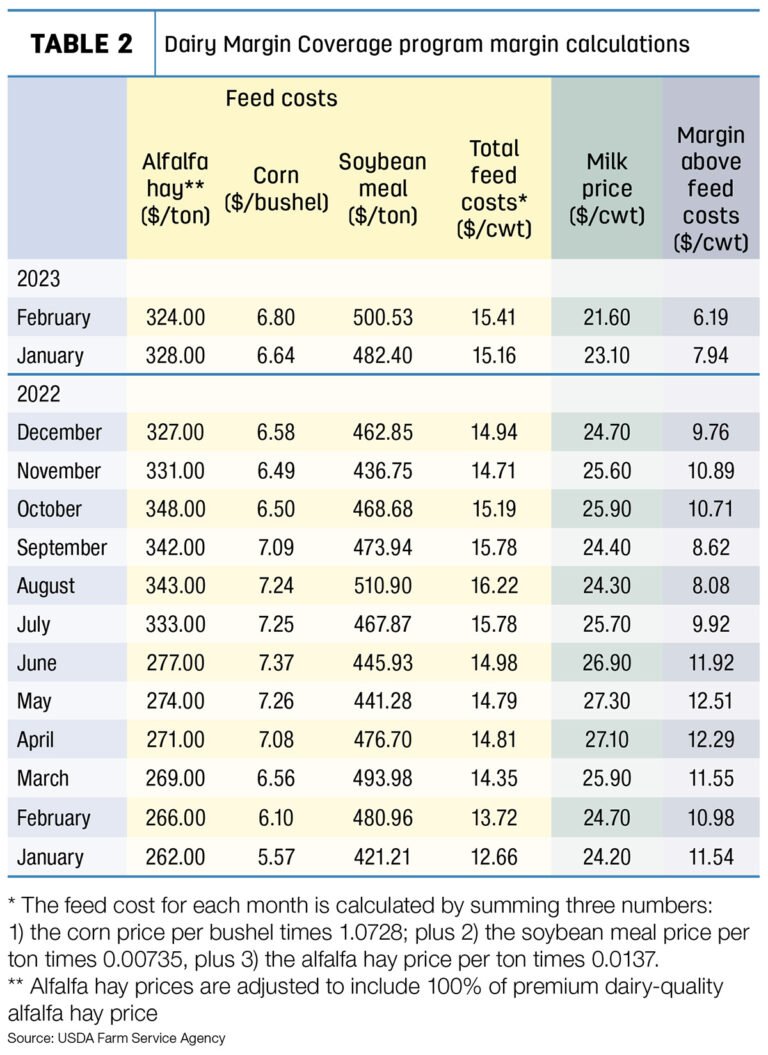

Calculating Payment

Payment in lieu of notice depends on several key factors. The length of the notice period affects the payment amount. A longer notice means a larger payment. Employee salary plays a big role. Higher salary equals higher payment. Company policy matters too. Each company has its own rules. Some offer more generous payments.

Past employment agreements can influence the payment. What is written in the contract is important. Legal requirements must be followed. Laws vary in different places. Make sure to check local regulations. Additional benefits might be included. Health insurance, bonuses, or vacation pay can add value. Each factor is important for calculating the payment.

There are common methods for calculating payment. One method uses weekly salary. Multiply the weekly salary by notice weeks. Another method is based on annual salary. Divide the annual salary by 52 weeks. Then multiply by notice weeks. Some companies use a fixed formula. They have a set way to calculate. Always check the company’s method.

Negociación is sometimes possible. Employees can discuss payment terms. Some get extra benefits through negotiation. Consultation with HR can help. HR knows the company’s policies well. Use these methods to understand payment calculations. This helps in planning future steps.

Implicaciones fiscales

Payment in lieu of notice is often taxable incomeincome tax y National Insurance on it. This can mean less money in your pocket. Check with a tax expert for details.

Some payments might be exempt from tax. If the payment is for damages, it might not be taxed. Certain conditions may apply to this rule. Always ask a professional for the best advice. Know what is taxable and what is not.

Global Variations

In the UK, Payment in Lieu of Notice is common. Employers give money instead of notice time. This helps employees leave quickly. It also helps businesses keep moving. Contracts must mention this payment option. Employees need to check their contracts carefully. There can be tax impacts. The money is often taxed. This depends on each case. Consulting a tax expert may help.

The US has a different approach. Payment in Lieu of Notice is less common. Many states use “at-will” employment. This means either party can end work anytime. Some companies offer severance pay instead. Severance is for longer service. It is not the same as notice payment. Employees should read their agreements. Asesoramiento legal is helpful for understanding terms.

Other countries have their own rules. Some follow UK practices. Others use US ideas. Cultural factors play a big role. Laws differ widely. Employees must understand local laws. It helps to seek local advice. Global businesses need to know each country’s rules. This ensures fairness and compliance. Understanding local customs is also key. This helps in smooth transitions.

Real-life Scenarios

John worked at a company for five years. He got a new job. His boss said he could leave early. John received payment in lieu of notice. This meant he got money instead of working his notice period.

Sarah was let go from her job. She was surprised. Her company gave her money. This was payment in lieu of notice. She didn’t work for the notice period.

Many think payment in lieu means extra money. It is not extra pay. It replaces the notice period pay. Others believe it is a gift. It is not a gift. It is a legal requirement. Some confuse it with severance pay. They are different. Severance pay is for job loss. Payment in lieu is for notice period.

Negotiating Payment

Payment in lieu of notice is often given when leaving a job. It’s important to know your rights. Understand the amount due to you. Check if taxes will be deducted. Consider any impact on benefits.

Discuss terms clearly with your employer. Ensure you get everything in writing. Ask questions if unclear. Protect your interests. Be polite but firm.

Know your contract details. Read terms carefully. Ask for payment details. Ensure you receive the correct amount. Keep all records safe. Stay calm in discussions. Know your rights.

Seek advice if unsure. Use online resources. Talk to HR for clarity. Stay informed about changes in law. Act confidently but respectfully.

Preguntas frecuentes

What Is Payment In Lieu Of Notice?

Payment in lieu of notice (PILON) is compensation given to employees when their employment ends without notice. Instead of serving the notice period, employees receive a lump sum. This payment ensures immediate contract termination, allowing employees to leave immediately while still receiving the benefits of their notice period.

How Is Pilon Calculated?

PILON is typically calculated based on the employee’s salary and the length of the notice period. It includes basic pay and often covers benefits like pensions or bonuses. The exact calculation can vary depending on the employment contract and local labor laws.

Is Pilon Taxable Income?

Yes, PILON is usually considered taxable income. It is subject to standard income tax and National Insurance contributions. Employers often deduct these taxes before making the payment. It’s advisable to check specific tax obligations with a financial advisor or tax authority.

Can Employers Enforce Pilon?

Employers can enforce PILON if it’s included in the employment contract. It allows them to terminate employment immediately without breaching contract terms. If not specified in the contract, enforcing PILON may require mutual agreement between the employer and employee.

Conclusión

Understanding payment in lieu of notice is essential for employment clarity. This option provides flexibility for both employers and employees. It helps avoid lengthy notice periods. Employees receive compensation without having to work through the notice. Employers can quickly fill positions or adjust staffing needs.

It’s a practical solution in many work situations. Knowing your rights and options in this process is crucial. Always read your employment contract carefully. Seek advice if unsure about terms. Being informed helps you make better decisions. Payment in lieu offers a smoother transition in the workplace.