Tarifa de transferencia de Money Network a cuenta bancaria: Ahorre inteligentemente

Do you ever feel like your money is slipping away with every bank transaction? If you’ve ever wondered why transferring funds from your Money Network to your bank account comes with a fee, you’re not alone.

Understanding these fees can feel like piecing together a puzzle. But here’s the thing: knowing how these charges work can actually save you money. Imagine having more control over your finances just by being informed. We’ll dive into the nitty-gritty of Money Network transfer fees to your bank account.

By the end, you’ll not only understand where your money is going but also how to keep more of it in your pocket. Ready to unlock the secrets of these fees and take charge of your financial decisions? Let’s get started!

Entendiendo las tarifas de transferencia

Money network transfer fees apply when sending money from a digital wallet to a bank account. These fees vary based on the service provider and transaction amount. Understanding these costs helps in planning transfers efficiently.

Understanding transfer fees can sometimes feel like navigating a maze, but it’s crucial for managing your finances wisely. Whether you’re sending money to family, paying bills, or moving funds between accounts, knowing what fees you might encounter helps you avoid surprises. Let’s break down what you need to know about these costs. ###Types Of Transfer Fees

Transfer fees come in different shapes and sizes. Flat fees are common, where you pay a set amount regardless of how much you’re transferring. Percentage-based fees mean the cost varies with the transfer amount. Some services also have tiered fees, where the rate decreases as the amount increases. Each type can significantly impact how much you end up paying, so understanding the differences is key. ###Factors Influencing Fees

Several elements can affect how much you pay in transfer fees. The proveedor de servicios you choose can have a big impact. Banks, third-party apps, and money transfer services each have their own fee structures. The speed of the transfer also matters. Instant transfers usually cost more than ones that take a few days. Lastly, the destination of your money—domestic or international—can alter the fees significantly. It’s crucial to ask yourself: Are you paying extra for convenience, or can you plan ahead to save? By being aware of these factors, you can make smarter decisions and keep more money in your pocket.Comparing Transfer Methods

Transferring money from a network account to a bank comes with choices. Each method has its own costs and benefits. Understanding these can save both time and money. Different transfer methods suit different needs and situations. Below, we explore various ways to transfer money.

Online Vs. Offline Transfers

Online transfers offer convenience and speed. You can transfer money anytime, anywhere. Many online services charge lower fees compared to offline methods. They also provide instant confirmation of transfers. But, they require internet access and digital literacy.

Offline transfers, like bank visits or phone calls, provide a human touch. They are ideal for those who prefer speaking with someone. These methods usually involve higher fees and longer processing times. But, they offer added security for those wary of online transactions.

Domestic Vs. International Transfers

Domestic transfers involve sending money within the same country. They often incur lower fees and quicker processing. Most banks and services offer this with ease. Domestic transfers are straightforward and efficient.

International transfers are more complex. They involve moving money across borders. Fees are generally higher due to currency exchanges and regulations. Processing times are longer. But, they enable global connectivity, allowing for international business and personal transactions.

Fee Structures Of Major Providers

Understanding the fee structures of major providers is crucial when transferring money from your Money Network to a bank account. Hidden fees can quickly add up, and knowing what each provider charges can save you money and stress. Whether you’re using a traditional bank, a modern money transfer app, or a versatile payment service, each has its own fee setup. Let’s dive into the details.

bancos

Banks are often the first choice for many when transferring money. They offer security and reliability. However, their fees can be higher than other options. A typical bank might charge a flat fee for each transfer, or they might take a percentage of the total amount. Some banks waive fees for customers with certain account types or minimum balances. Compare your options thoroughly. Do you know what your bank charges?

Money Transfer Apps

Money transfer apps provide a convenient and often cheaper alternative. Apps like PayPal, Venmo, or Cash App have revolutionized how we move money. They usually charge lower fees than banks. A friend once shared how she saved on fees using an app instead of her bank. Most apps charge a small percentage of the transfer amount or offer free transfers for specific account types. Are you leveraging the right app to cut costs?

Servicios de pago

Payment services like Western Union or MoneyGram offer global reach but often come with higher fees. They charge based on the transfer amount, destination, and speed of delivery. These services are ideal for international transfers where banks and apps might fall short. A colleague once paid a premium for urgent overseas transfer using a payment service. Always check if the convenience is worth the cost. Have you weighed all your options?

Knowing these fee structures helps you make informed decisions. Compare and calculate costs, and choose the most cost-effective method for your needs. Each provider has its strengths; it’s up to you to decide which one aligns with your financial goals.

Strategies To Minimize Fees

Transferring money to a bank account often involves fees. These fees can add up over time, reducing your overall savings. Learning strategies to minimize these costs can help you save more money. This section covers effective strategies to keep fees low.

Choosing Cost-effective Providers

Research various money transfer services. Compare their fees and exchange rates. Some providers offer lower fees for certain types of transfers. Look for those offering promotions or discounts. Use reviews to gauge reliability and customer satisfaction. Choose a provider that suits your needs and budget.

Timing Your Transfers

Transfer money during off-peak times. Fees might be higher during peak business hours. Plan your transfers in advance. Avoid transferring money during weekends or holidays. These times can incur higher fees. Monitor currency exchange rates. Transfer when rates are favorable to save on costs.

Leveraging Technology For Savings

In today’s fast-paced digital world, leveraging technology can save money. Especially on money network transfer fees. Many individuals face high fees when transferring money to bank accounts. But technology offers solutions to reduce these costs. Understanding and using these technological advancements can lead to significant savings.

Using Mobile Apps

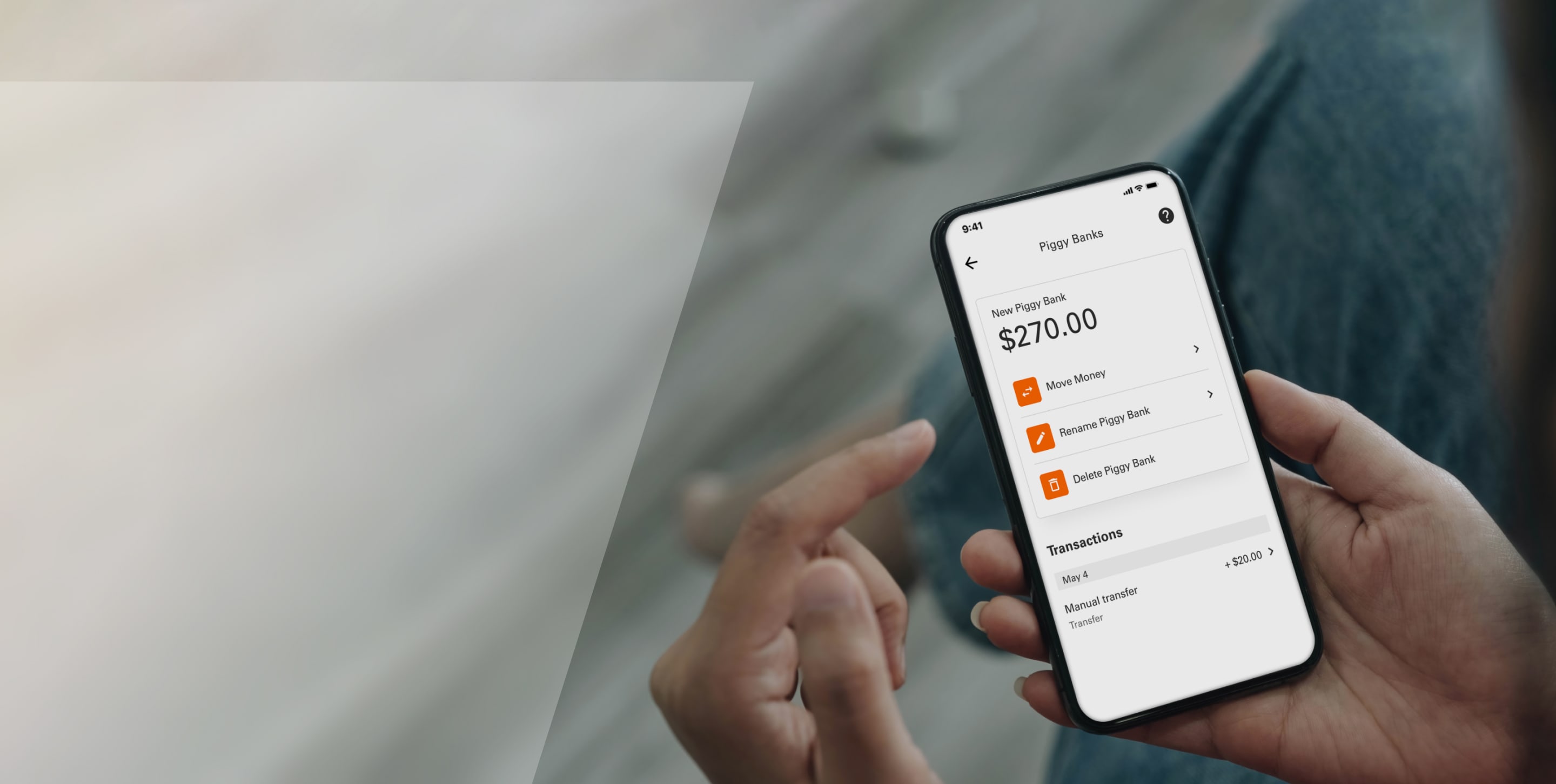

Mobile apps have transformed the way we handle money transfers. They offer a user-friendly interface to manage transactions. Many apps provide lower fees compared to traditional banks. Users can send money quickly and efficiently. These apps often feature instant notifications and updates. This ensures transparency and helps track transactions. It also builds trust among users.

Exploring Blockchain Solutions

Blockchain technology offers a new way to transfer money. It is secure and decentralized. This means fewer intermediaries are involved. With fewer middlemen, transaction costs decrease. Blockchain networks offer transparency in each transaction. This reduces the risk of fraud and errors. As a result, users feel more secure about their money transfers.

Understanding Hidden Costs

Sending money to a bank account often involves hidden fees. These charges can quietly reduce your funds. Understanding these costs helps you manage your budget better.

Exchange Rate Markups

When transferring money internationally, exchange rate markups can significantly impact the amount you receive. Often, the rate advertised isn’t the rate you’ll get; there’s usually a markup added by the service provider. This subtle increase can seem negligible at first, but it can add up over multiple transactions. Think about the time you exchanged currency at an airport. You might have noticed that you received less than expected. That’s a classic example of exchange rate markups. Always compare rates across different services before proceeding with your transfer to ensure you’re getting the best deal.Additional Service Charges

Service providers often tack on additional charges for the convenience of transferring money. These can be flat fees or percentages based on the amount you’re sending. Understanding these charges is crucial to avoid unexpected costs. Consider the last time you used an ATM not affiliated with your bank. You likely incurred a fee for that convenience. Similarly, money transfer services may charge extra fees for faster delivery or special handling. Are these additional services worth the cost? Weigh the benefits against the fees to make a sound decision. By being aware of these hidden costs, you can better manage your finances and avoid unpleasant surprises. Always read the fine print and ask questions if anything is unclear. Your wallet will thank you for it.Tomar decisiones informadas

Transferring money to a bank account often involves fees. Understanding these fees helps in making informed decisions. Knowing the costs ensures better financial planning and avoids unexpected expenses.

Making informed decisions about transferring money to a bank account can save you time and money. Understanding the fees involved and choosing the right service provider is crucial. With the right knowledge, you can avoid unexpected charges and ensure your money reaches its destination safely.Researching Provider Options

Choosing the right provider starts with thorough research. Compare different money transfer services to find the best fit for your needs. Check out user reviews, compare fees, and evaluate the speed of transfers. Consider the purpose of your transfer. Are you sending money abroad or just to a friend in the same city? Different providers may excel in different areas. For example, some might offer lower fees for international transfers, while others are better suited for domestic ones. Ask yourself: What are the additional services offered by the provider? Some companies might offer benefits like loyalty programs, which can save you money in the long run.Reading The Fine Print

Understanding the terms and conditions is vital. Always read the fine print to avoid hidden fees. Some providers may have charges that aren’t immediately apparent. Look for details about currency conversion rates. A seemingly low transfer fee can be offset by a poor exchange rate. Make sure you know exactly how much your recipient will receive. Consider any limits on transfer amounts. Some services might charge extra for larger transfers. Knowing these details helps you plan better and avoid surprises. When I first transferred money internationally, I overlooked a small fee in the terms and conditions. That unexpected charge taught me the importance of understanding every detail. Have you ever encountered a surprise fee? What did you learn from it? Taking these steps ensures that you’re making a well-informed decision. By doing your homework, you protect your finances and ensure a smooth transfer experience.

Preguntas frecuentes

What Is The Fee For Transferring Money To A Bank Account?

The fee for transferring money to a bank account can vary. It depends on the service provider and the type of transfer. Some providers might charge a flat fee, while others may have a percentage-based fee. Always check with your provider for the most accurate fee information.

How Can I Avoid Transfer Fees?

To avoid transfer fees, consider using a service with no-fee options. Some banks offer free transfers between accounts. Additionally, promotional offers might waive fees for first-time users. Always read the terms and conditions before initiating the transfer.

Are Fees Different For Domestic And International Transfers?

Yes, fees are typically different for domestic and international transfers. Domestic transfers usually incur lower fees compared to international ones. International transfers may include additional costs like exchange rate fees. Always verify the fee structure with your provider for both domestic and international transactions.

Do All Banks Charge Transfer Fees?

Not all banks charge transfer fees. Some banks offer free transfers between their accounts. Others might charge fees based on the transfer method or amount. It’s essential to check with your bank about their specific fee policies before proceeding with a transfer.

Conclusión

Understanding Money Network fees is important. It helps manage your finances better. Fees can vary depending on transaction types. Always check the fee structure before transferring money. This ensures no unexpected charges surprise you. Knowing these details can save money over time.

Researching different transfer options might be beneficial. It could lead to better choices. Keeping track of your expenses helps in budgeting. A little effort now can lead to savings later. Stay informed and make smart financial decisions. Your wallet will thank you!