¿El costo de cierre es lo mismo que el pago inicial? Diferencias clave

Are you planning to buy a new home and feeling overwhelmed by all the financial jargon? You’re not alone.

Understanding terms like “closing costs” and “down payment” can be confusing, especially when they seem to pop up everywhere in the home-buying process. You might even wonder if they’re the same thing. Spoiler alert: they’re not. But knowing how they differ is crucial to managing your budget and avoiding surprises.

We’ll break down these terms in simple language, so you can step confidently into your new home. Ready to demystify the process and take control of your finances? Let’s dive in!

Closing Costs Explained

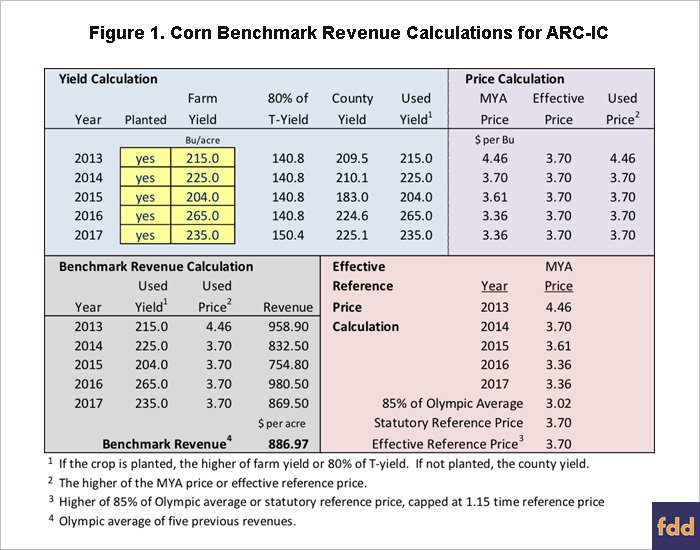

Closing costs are extra fees paid at the end of a home purchase. These costs cover various expenses. Loan application fees are part of closing costs. Appraisal fees also included. They check the home’s value. Title insurance is another component. It protects against title problems. Escrow fees cover the handling of documents and funds. Sometimes, there are property taxes. Every component is essential.

| Component | Objetivo |

|---|---|

| Loan Application Fees | Process the loan |

| Honorarios de tasación | Assess property value |

| Seguro de título | Protect against title issues |

| Escrow Fees | Manage funds and documents |

| Impuestos sobre la propiedad | Government tax on property |

Both buyers y sellers share closing costs. Buyers often pay most fees. They cover appraisal and loan fees. Sellers might pay real estate agent fees. Sometimes, sellers help with buyer’s costs. This is called seller concessions. It’s a way to make the deal smooth. Discuss this with your agent.

Down Payment Details

A down payment is the initial amount paid when buying a home. It shows the buyer’s commitment to the purchase. This payment helps secure the loan from the bank. The bank sees the buyer is serious about buying the house. With a larger down payment, the monthly mortgage payment can be smaller. This is helpful for families. A down payment also builds equity in the home. The home becomes a valuable asset over time.

Most down payments are 5% to 20% of the home’s price. A larger down payment can mean a better interest rate. Some loans allow as low as 3% down payment. This helps buyers with less savings. First-time buyers often choose lower down payments. Saving for a down payment takes time. It’s important for buyers to plan ahead. The right down payment depends on each buyer’s needs.

Key Differences

Closing costs are paid at the end of the home buying process. They are paid before you get the house keys. A depósito is paid at the start of the home purchase. It shows the lender you are serious. Timing for both is crucial. Missing payments can delay your home purchase.

A down payment affects your loan size. Bigger payments mean smaller loans. Closing costs do not change the loan amount. They are extra fees to cover paperwork and services. Both affect overall money spent. Knowing this helps you budget better.

The down payment is key for loan approval. It shows you can pay back. Closing costs do not affect approval. They are just part of buying a home. Lenders focus on your down payment more. Make sure to plan for both costs.

Conceptos erróneos comunes

Closing costs y pagos iniciales are not the same. Many people think they are. This can lead to confusion. Closing costs cover extra fees. These are not part of the home price. Down payment is part of the price. You pay this to buy the house.

Interchangeable Terms

Some believe these terms mean the same thing. But they don’t. Closing costs are for services like inspections. Down payments go straight to the home price. It’s important to know the difference.

Influence On Home Purchase

Mixing up these terms can affect buying a home. Buyers might pay more than needed. It’s smart to learn what each term means. This helps in planning costs better.

Financial Planning Tips

Planning is key to handle big payments. Closing costs y pagos iniciales are different. You need money for both. Make a list of all costs. This helps to see the total amount needed. Savings can help a lot. Save a little each month. Soon, you will have enough. Check your budget often. Adjust if needed. Keeping track is very important.

Smart talking can save you money. Ask for lower costos de cierre. Some sellers agree to help. Compare offers from different lenders. They might have better deals. Be clear about what you want. Show why they should help. This can make them listen. Always stay polite. Politeness makes a good impression. Good impressions can win deals.

Expert Insights

Understanding the difference between closing costs and down payment is crucial for homebuyers. Closing costs include fees for processing the loan, while the down payment is the upfront money paid to secure the property. Both are essential parts of the home purchasing process.

Advice From Real Estate Professionals

Closing costs y pagos iniciales are different. Many people confuse them. Closing costs pay for services. They include inspections and fees. Down payments lower the loan amount. Buyers pay them upfront. Both are important.

Real estate experts suggest planning early. Know the costs before buying. Ask questions to understand them. Save money for both. Avoid surprises later. Prepare a budget. This helps buyers make smart choices.

Common Pitfalls To Avoid

Many buyers make mistakes. They confuse closing costs with down payments. This leads to trouble. Some forget extra fees. Others don’t save enough money. This causes stress. Experts advise clear understanding. They suggest asking many questions. Learn all the costs. Prepare well to avoid problems.

Preguntas frecuentes

What Are Closing Costs In Real Estate?

Closing costs are fees paid during the finalization of a real estate transaction. They typically include fees for loan origination, appraisal, title insurance, and escrow services. These costs are separate from the down payment. It’s important for buyers to budget for both closing costs and the down payment.

How Does A Down Payment Work?

A down payment is an upfront payment towards the purchase price of a home. It is usually expressed as a percentage of the total home price. A larger down payment can reduce the monthly mortgage payment and may eliminate the need for private mortgage insurance.

Can Closing Costs Be Included In A Mortgage?

Yes, some lenders allow closing costs to be rolled into the mortgage. This means that instead of paying them upfront, the costs are added to the loan amount. However, this will increase the total loan balance and monthly payments. It’s important to understand the long-term financial implications.

Why Are Closing Costs And Down Payments Different?

Closing costs and down payments serve different purposes in a home purchase. The down payment reduces the loan amount needed, while closing costs cover transaction-related fees. Understanding both is essential for budgeting and financial planning when buying a home.

Conclusión

Understanding closing costs and down payments is crucial for homebuyers. They are separate expenses. Closing costs cover fees for finalizing the loan. Down payments are the initial money paid for the home. Knowing the difference helps budget effectively. It also prevents surprises during the buying process.

Always consult with a financial advisor. They can provide guidance tailored to your needs. Planning ahead makes purchasing smoother. So, approach home buying with knowledge and confidence. Your dream home awaits.