Cómo usar la tarjeta Visa virtual en tiendas: consejos de expertos

Imagine walking into your favorite store without the need to carry cash or a bulky wallet. That’s exactly what using a virtual Visa card in-store can do for you.

It’s convenient, secure, and incredibly easy to use. But how exactly do you make it work for your in-store purchases? You might be wondering if it’s as simple as using a regular credit card or if there’s a special trick to it.

Fear not! This guide will walk you through everything you need to know to seamlessly use your virtual Visa card when shopping in-store. Say goodbye to the hassle of traditional payment methods and hello to a smarter way to shop. Ready to unlock the full potential of your virtual Visa card? Let’s dive in and make your shopping experience smoother than ever before!

¿Qué es una tarjeta Visa virtual?

A Virtual Visa Card is an online payment card. It is not a physical card. People use it for secure online shopping. It works like a normal Visa card. You get a card number, expiry date, and security code. Many websites accept these cards. They make online shopping easy.

These cards are safer than real cards. They protect your personal data. Your bank information stays hidden. This makes shopping safe and easy. You can use them for one-time payments. This helps to avoid scams.

Some stores let you use them too. Just show the card details on your phone. Many apps help you manage these cards. They are easy to use. You can buy them online or get them from banks.

Beneficios de usar una tarjeta Visa virtual

A Virtual Visa Card offers many benefits. It is safe and secure. You can use it for compras en línea and also in stores. Many people feel safer with virtual cards. They protect your información personal. You can also control your spending easily. You set limits on your card. This helps with budgeting.

Virtual cards are very convenient. You can get them quickly. No need to wait for a physical card. They are easy to use. Just like your regular credit card. They work almost everywhere. Many stores accept them. This makes shopping easy and fast.

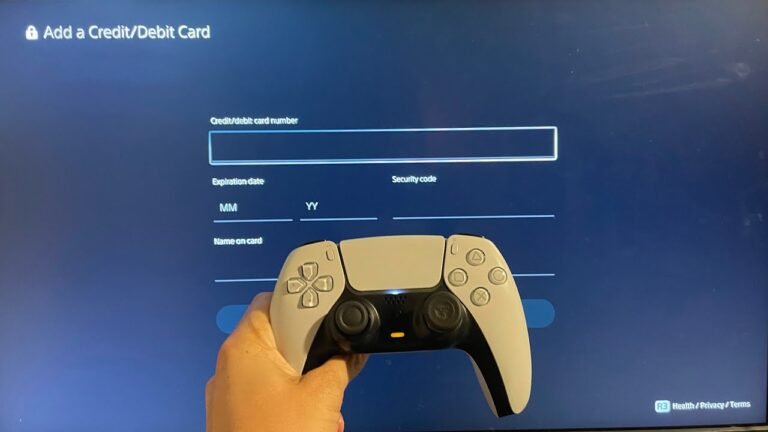

Setting Up Your Virtual Visa Card

Select a trusted provider for your virtual Visa card. Check for tarifas bajas y strong security. Compare different options to find the best fit. Providers like PayPal, Revolut, or Wise are popular choices. Always read customer reviews. This helps in making an informed decision. Look at their Atención al cliente options. It’s essential if you need help later.

First, visit the provider’s website. Click on Inscribirse o Register. Fill in your detalles: name, email, and password. Ensure your password is strong. You might need to verify your email. Check your inbox for a verification link. Click it to confirm. After that, you may need to add your payment details. This is usually a bank account or another card. Follow the prompts to complete setup. Now, your virtual Visa card is ready!

Linking Virtual Visa To Mobile Wallet

Linking your virtual Visa card to a mobile wallet simplifies in-store purchases. Just add the card to your wallet app. Then, use your phone’s NFC feature to pay at any contactless terminal.

Compatible Wallet Apps

Many wallet apps can link a virtual Visa card. Popular choices are Apple Pay, Google Pay, and Samsung Pay. Ensure your phone supports these apps. Not all phones are compatible. Check your phone settings for wallet app options.

Guía paso a paso

Open the wallet app on your phone. Look for the option to add a card. Select the add card button. Enter the virtual Visa card details. Follow on-screen instructions to verify the card. Ensure internet connection is stable during setup. Once added, you can use it in-store.

Making In-store Purchases

Many stores now accept Virtual Visa Cards. Check if the store has a Visa sign. You can ask a staff member for help. Some big stores like Walmart o Objetivo accept these cards. Small shops might not accept them. Always check before buying.

Virtual Visa Cards work well with contactless payments. Keep your phone ready. Open your card app. Hold your phone near the payment machine. Wait for the beep sound. It means your payment is done. Make sure your card balance is enough. Some machines might ask for a code. Enter it if needed. It’s very simple!

Security And Privacy Tips

Shopping in-store with a virtual Visa card is easy and secure. Add the card to your mobile wallet. Tap your phone at the payment terminal to complete the purchase. Keep your information safe by using strong passwords and avoiding public Wi-Fi.

Enjoy safe transactions with your virtual Visa card.

Protecting Your Card Details

Keep your card information safe. Use a contraseña segura for your accounts. Never share your card details with others. Always check the website URL for security signs. Look for HTTPS in the address bar. Avoid using public Wi-Fi for transactions. It can be risky. Use a private network instead. Actualizar your device software regularly. This helps keep hackers away. Always log out after a purchase. Clear your browser history often. It removes saved data.

Monitoring Transactions

Controlar your card statements frequently. Look for any strange charges. Report them quickly. Use alerts for transactions. Get email or text notifications. This helps you track spending. Keep your datos de contacto updated. The bank needs them for alerts. Use apps to monitor your card. They show tiempo real usage. Set límites on your card spending. This prevents overspending. Be aware of your spending habits. Control them well.

Solución de problemas comunes

Using a Virtual Visa Card in-store can be tricky. Ensure the card is activated and accepted by the retailer. Also, check the balance and use it as a credit card during checkout.

Transacciones rechazadas

Declined transactions can confuse anyone. Check your card balance first. Always make sure your card has enough money. Double-check your entered details. Ensure your card number and date are correct. Sometimes, the store’s system might have errors. Try again after a few minutes. Contact the card provider if the issue continues. They can help solve problems. Keep your card safe from damage. A damaged card might not work.

Fallos técnicos

Technical glitches are frustrating. Restart your device first. This simple action solves many issues. Ensure your device software is up-to-date. Old software may cause problems. Confirm your internet connection is stable. Slow internet can disrupt transactions. Clear cache and cookies on your browser. These can slow down processes. If the card still fails, contact support. They may have special solutions for you. Keep all receipts for records. They help in tracking issues.

Maximizing Rewards And Offers

Paying with a virtual Visa card in-store is simple. Load your card details onto a mobile wallet app. Tap your smartphone at the checkout terminal to enjoy rewards and special offers.

Cashback Opportunities

Usando un virtual Visa card can earn you reembolso on purchases. Many stores offer this perk. Check your card’s app or website. See if they list any special offers. These offers can help you save money. Always read the terms carefully. Not all stores give cashback. So, plan your shopping wisely.

Descuentos exclusivos

Virtual cards may offer descuentos exclusivos at certain stores. Some retailers have special deals for card users. Check the card’s app for these deals. You might find a discount on your favorite items. Make sure the store accepts virtual cards. This way, you can enjoy your savings without trouble.

Preguntas frecuentes

Can I Use A Virtual Visa Card In-store?

Yes, you can use a virtual Visa card in-store. Simply add your virtual card to a mobile wallet like Apple Pay or Google Pay. Then, at checkout, use your smartphone to tap and pay. Ensure the store accepts contactless payments for a seamless transaction.

How Do I Add A Virtual Visa Card To My Phone?

To add a virtual Visa card to your phone, open your mobile wallet app. Enter the card details manually or scan the card’s information. Follow the on-screen instructions to complete the setup. Ensure your phone supports contactless payments for successful transactions in-store.

Are Virtual Visa Cards Accepted Everywhere?

Virtual Visa cards are widely accepted where contactless payments are available. However, acceptance may vary by store and location. Always confirm with the retailer if they accept mobile wallet payments. Using a virtual card is convenient, but check before shopping to avoid issues.

Do I Need Internet To Use A Virtual Card?

No, you don’t need internet to use a virtual card in-store. Once your card is added to a mobile wallet, transactions occur offline. Ensure your phone is charged and NFC is enabled. However, internet may be required for initial card setup and updates.

Conclusión

Using a virtual Visa card in-store is simple and convenient. Follow the steps to make your purchases smoothly. First, ensure your card is ready and loaded with funds. Next, inform the cashier about your virtual card. Then, provide the necessary card details when prompted.

Finally, confirm your transaction and collect your items. With these steps, shopping becomes efficient and hassle-free. Enjoy the flexibility and security of virtual Visa cards today. Ideal for tech-savvy shoppers and those seeking modern payment solutions.