Cómo transferir dinero a Nicaragua

Estás a punto de enviar dinero a Nicaragua, pero no sabes por dónde empezar. Tienes varias opciones, entre ellas giros postales, cheques de caja, y plataformas en línea como Xoom o Western Union. Si bien estos servicios pueden funcionar, tienen diferentes tarifas, tipos de cambio y... velocidades de transferenciaEs importante evaluar estos factores cuidadosamente para garantizar que su dinero llegue a su destino de forma rápida y segura. Pero antes de elegir un método, debe saber más, incluyendo algunos posibles inconvenientes que podrían costarle tiempo y dinero.

Formas de enviar dinero al extranjero

Enviar dinero al extranjero implica elegir entre una variedad de métodos, incluidos transferencias bancarias, servicios de dinero en línea, y operadores de transferencias bancarias, cada uno con sus propias tarifas, tipos de cambio y opciones de entrega. Deberás tener en cuenta... seguridad y reputación del proveedor de servicios, así como su cumplimiento de los requisitos regulatorios. Los servicios de dinero en línea, como PayPal o Xoom, ofrecen una opción conveniente y relativamente económica, mientras que las transferencias bancarias brindan una capa adicional de seguridad. Los operadores de transferencias bancarias, como Western Union o MoneyGram, ofrecen una amplia gama de opciones de entrega, incluyendo la recogida en ventanilla. Al seleccionar un método, priorice los servicios con licencia. regulado, y tienen medidas de seguridad robustas Para proteger su transacción, esto le ayudará a garantizar una transferencia segura y confiable.

Costos de los servicios de transferencia de dinero

Ahora que ha seleccionado un método para enviar dinero a Nicaragua, deberá evaluar los distintos costos asociados con cada servicio, incluidos tarifas de transferencia, tipos de cambio, y cualquier cargos adicionalesLas tarifas de transferencia pueden variar desde una tarifa fija hasta un porcentaje del monto de la transferencia, mientras que los tipos de cambio pueden afectar considerablemente el monto recibido. Algunos servicios también pueden cobrar por servicios como transferencias urgentes o notificaciones de entrega. Compare estos costos entre proveedores para asegurarse de obtener lo mejor. la mejor ofertaTenga cuidado con los servicios con comisiones iniciales bajas pero tipos de cambio desfavorables, ya que podrían resultar más costosos a largo plazo. Revise siempre la costo total de la transferencia antes de confirmar su transacción.

Envío de efectivo a Nicaragua

Si necesita enviar efectivo a Nicaragua, existen varias opciones, como giros postales, cheques de caja y servicios de retiro en ventanilla que permiten a los destinatarios recoger el dinero en puntos designados. Estos servicios son rápidos y convenientes, lo que permite a los destinatarios acceder al efectivo rápidamente. Aquí tiene algunas opciones para evaluar:

- Giros postales:Una opción segura y confiable, los giros postales se pueden comprar a una tarifa baja y enviar directamente a su destinatario.

- Cheques de caja:Otra opción segura, los cheques de caja están respaldados por los fondos del emisor, lo que garantiza que el destinatario reciba el monto total.

- Servicios de recogida de efectivo:Empresas como Western Union y MoneyGram ofrecen servicios de retiro de efectivo en ubicaciones designadas.

- Servicios de entrega local:Algunos servicios, como Xoom, ofrecen entrega de efectivo directamente a la puerta de su destinatario en Nicaragua.

Elige la opción que mejor se adapte a tus necesidades y prioridades.

Transferencia de fondos a cuentas bancarias

Las transferencias de cuentas bancarias ofrecen una seguro y eficiente forma de transferir fondos a destinatarios en Nicaragua, lo que le permite enviar dinero directamente a sus cuentas en bancos participantesPara iniciar una transferencia, necesitará los datos bancarios del destinatario, incluyendo su nombre, número de cuenta y código de ruta bancaria. También deberá asegurarse de que el banco del destinatario sea una institución financiera participante. Una vez que haya recopilado la información necesaria, puede proceder con la transferencia. Transferencias de cuentas bancarias generalmente implican tarifas más bajas y tipos de cambio más competitivos en comparación con otros métodos de transferencia. Además, ofrecen una pista de auditoría clara, lo que facilita el seguimiento de sus transacciones. Este método es ideal para transferencias grandes o para quienes prefieren la seguridad de los sistemas bancarios.

Proveedores de servicios de transferencia de dinero

Además de las transferencias bancarias, también puede utilizar proveedores especializados en transferencias de dinero para enviar fondos a destinatarios en Nicaragua. Estos proveedores ofrecen una variedad de servicios y opciones para transferir dinero. Aquí hay cuatro aspectos a considerar al elegir un proveedor:

- Disponibilidad de ubicaciones:Verifique si el proveedor tiene una ubicación física cerca de usted y su destinatario, lo que facilita el envío y la recepción de efectivo.

- Velocidad de transferencia:Reflexione sobre el tiempo que tarda en entregarse los fondos a su destinatario.

- Tarifas de transferencia:Busque proveedores con tarifas competitivas para minimizar el costo de su transferencia.

- Medidas de seguridad:Verifique que el proveedor tenga medidas de seguridad sólidas para proteger su transacción e información personal.

Plataformas de transferencia de dinero en línea

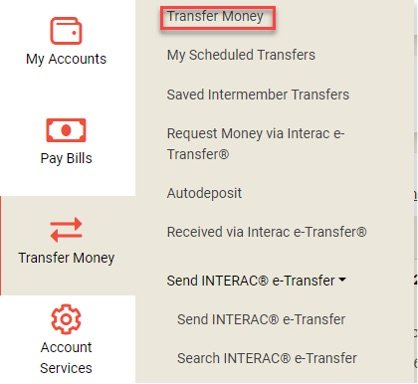

Las plataformas de transferencia de dinero en línea te permiten enviar dinero a Nicaragua desde la comodidad de tu hogar, usando tu computadora o dispositivo móvil. Necesitarás... crear una cuenta con un plataforma de buena reputación, como PayPal, Xoom o WorldRemit, y vincula un método de pago como una cuenta bancaria o una tarjeta de crédito. Una vez configurado, puedes iniciar una transferencia ingresando los datos del destinatario y el monto que deseas enviar. La plataforma... convierte tus fondos a córdobas nicaragüenses y entregarlos en la cuenta bancaria, tarjeta de débito o punto de pago de su destinatario. Busque plataformas que utilicen medidas de seguridad robustas, como el cifrado y la autenticación de dos factores, para proteger su información personal y financiera.

Cómo evitar comisiones de transferencia excesivas

Para minimizar el costo de enviar dinero a Nicaragua, es fundamental comprender las diversas comisiones asociadas con las transferencias internacionales y tomar medidas para evitar cargos excesivos. Le recomendamos investigar y comparar las comisiones de diferentes proveedores. A continuación, se presentan algunas comisiones clave a tener en cuenta:

- Tarifas de transferencia:cobrado por el proveedor por iniciar la transferencia.

- márgenes de beneficio del tipo de cambio:se agrega al tipo de cambio mayorista, aumentando el costo de la transferencia.

- Comisiones de los bancos intermediarios:cobrados por los bancos que facilitan la transferencia.

- Recepción de honorarios:cobrado por el banco del destinatario por recibir la transferencia.

Seguimiento de su transferencia de dinero

Una vez que haya iniciado su transferencia de dinero A Nicaragua, querrás estar al tanto de su progreso para garantizar que llegue a tu destinatario de forma rápida y eficiente. Normalmente, recibirás actualizaciones por correo electrónico o notificaciones de texto sobre el estado de su transacción. También puede acceder a su cuenta en línea o usar el aplicación del servicio de transferencia a seguir el progreso En tiempo real. Los mensajes suelen indicar si surge algún problema, como retrasos o problemas con los detalles de la transferencia. Si surge algún problema, puede responder a través del método de comunicación del servicio o contactar con su... personal de apoyo Directamente. Vigilar cuidadosamente su dinero a medida que se mueve a través del sistema de transferencias internacionales le brindará mayor tranquilidad de que los fondos se procesan de forma segura para su destinatario.