Cómo transferir dinero de una cuenta personal a una cuenta comercial: pasos sencillos

Are you finding yourself wondering how to manage your business finances more efficiently? Transferring money from your personal account to your business account might be the solution you need.

This process can seem daunting, but it’s crucial for keeping your business finances organized and separate from your personal funds. By mastering this skill, you can gain better control over your cash flow, make tax time less stressful, and even project a more professional image to clients and partners.

But how exactly do you transfer money smoothly and legally? In this guide, you’ll discover a step-by-step approach that simplifies the process, minimizes stress, and ensures your business remains on track. Let’s dive in, so you can focus on what truly matters—growing your business.

Understanding Account Types

Transferring money between personal and business accounts is a common task for entrepreneurs and small business owners. Yet, understanding the different types of accounts can be daunting. Knowing the differences and benefits of each can help you manage your finances more effectively and ensure compliance with financial regulations.

Cuentas personales vs. cuentas de empresa

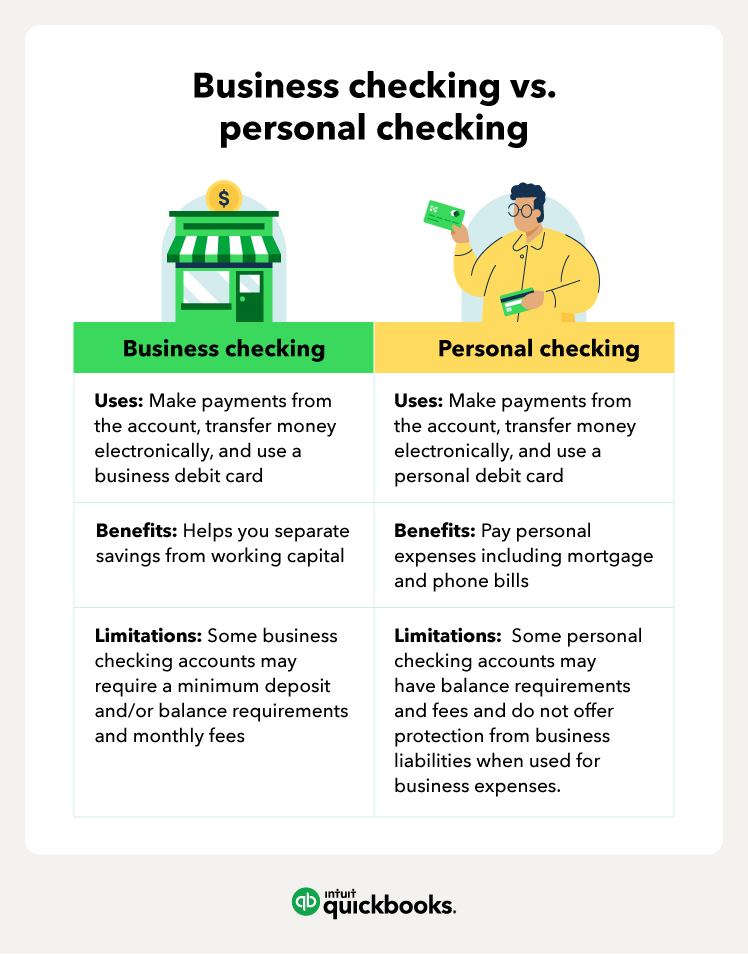

Personal accounts are primarily used for individual financial activities. They handle your everyday expenses like groceries, rent, and entertainment. Business accounts, on the other hand, are specifically designed for business transactions. They manage revenues, expenses, payroll, and other business-related financial activities.

One major difference lies in the features offered. Business accounts often come with tools to help with accounting, payroll, and tax preparation. They may also offer higher transaction limits and better interest rates on deposits. As a business owner, having a business account can simplify financial management.

Consider your own situation. Are you keeping your personal and business finances separate? If not, mixing the two can create confusion and complicate tax reporting. You might also miss out on business-specific benefits offered by banks.

Benefits Of Separate Accounts

Maintaining separate accounts can streamline your financial operations. It allows for clear distinctions between personal and business transactions, which is crucial for accurate bookkeeping. This separation can make tax time much easier, as you won’t have to sift through personal expenses.

Separate accounts also offer protection. Imagine a scenario where your business faces legal issues. Having your personal finances intertwined with your business can increase risk. By keeping them separate, you protect your personal assets from business liabilities.

Furthermore, having a business account can enhance your professionalism. It shows clients and partners that you are serious about your business. It’s a simple way to build trust and credibility in your industry.

Have you considered how separate accounts might benefit you? Do you see how they could simplify your financial management and protect your assets? Taking this step might be the organizational boost your business needs.

Preparándose para la transferencia

Transferring money from a personal account to a business account requires careful planning. Ensure all necessary documentation is ready, including bank details and transfer forms. Verify limits and fees to avoid unexpected costs during the process.

Recopilar la información necesaria

First, make sure you have all the essential details at your fingertips. This includes your personal bank account number, the business account number, and any reference numbers that might be needed. Having this information ready can prevent delays and ensure the transfer is accurate. Double-check the account names to avoid transferring money to the wrong account. A small mistake can lead to significant issues, especially when dealing with business funds. Consider how often you will make such transfers. If it’s a regular occurrence, setting up automatic transfers could be beneficial.Check Bank Policies

Before proceeding, take a moment to review your bank’s policies regarding transfers between personal and business accounts. Banks often have specific guidelines about such transactions, including fees or limits. Some banks might charge a small fee for each transfer, while others might offer free transfers if both accounts are within the same bank. Knowing these details can help you avoid unexpected charges. Have you ever transferred a large sum only to find out it exceeded your daily limit? It’s a common oversight. Understanding these limits can help you plan your transfers more effectively. A quick call to your bank can clarify any doubts and provide peace of mind. Don’t hesitate to ask questions; it’s your money and your business.Using Online Banking

Transferring money from a personal to a business account online is straightforward. Log into your online banking. Choose the transfer option. Enter the business account details. Confirm the transaction. It’s fast and secure, making it easy to manage your business finances from anywhere.

Iniciar sesión en su cuenta

First, access your bank’s website or open their mobile app. Ensure you have your login details ready. If you’re like many, you may have experienced the hassle of forgetting a password. It’s crucial to store your credentials securely. Consider using a password manager for easy access. Once you’re logged in, take a moment to verify your account balances. This will help you decide how much money you can transfer without affecting your personal finances. ###Iniciando la transferencia

Look for the “Transfer” option in your bank’s menu. It’s typically located in the main navigation bar or under a “Payments” section. Select your personal account as the source and your business account as the destination. Enter the amount you wish to transfer, keeping your business’s immediate needs in mind. Have you ever wondered how quickly these transfers can happen? Many banks offer instant transfers, but some might take a business day or two. Knowing this helps you plan your business expenses better. Double-check all details before confirming the transfer. A small mistake could lead to unnecessary delays. Once satisfied, hit the “Confirm” button, and you’re done! Transferring money online is a straightforward task that empowers you to manage your business finances effectively. Have you considered setting up regular transfers if you frequently move funds between accounts? This can save time and keep your business accounts well-managed without frequent manual intervention.Aplicaciones de banca móvil

Transferring money from a personal to a business account using mobile banking apps is straightforward. Open the app, select ‘Transfer Money’, choose accounts, enter the amount, and confirm. Ensure both accounts are linked for smooth transactions.

Mobile Banking Apps have revolutionized how you manage your finances, making it easier than ever to transfer money from your personal account to your business account. The convenience of handling transactions from your smartphone means you can keep your business running smoothly, even on the go. Imagine being at a cafe when an urgent payment needs to be made—mobile banking apps ensure you can respond promptly without needing to rush to a physical bank.Descargar la aplicación

To start, you need to download the mobile banking app provided by your bank. Visit the App Store or Google Play and search for your bank’s official app. It’s crucial to download the correct app to ensure security and access to your accounts. Check for the bank’s logo and read reviews to confirm authenticity. Once downloaded, open the app and log in using your banking credentials. If you haven’t registered yet, there should be a simple sign-up option available.Guía de transferencia paso a paso

Navigating the app might seem daunting at first, but it’s straightforward once you get used to it. Locate the transfer or payments section on the main menu. This section is typically marked with clear labels like “Transfers.” Select the option to transfer money and choose the accounts involved—your personal and business accounts will likely be among the choices. Input the amount you wish to transfer. Before confirming the transaction, double-check the details. Is the amount correct? Are you transferring to the right account? A small error can lead to financial headaches, but the app usually provides a summary for you to review. Your transaction will usually be processed within minutes, but sometimes it might take a bit longer depending on your bank’s policies. If you run into issues, most apps have a help section or customer support you can contact directly through the app. Isn’t it reassuring to know that you can manage your money effortlessly and efficiently? What has been your experience with mobile banking apps?Bank Branch Transfers

Transferring money between personal and business accounts at a bank branch offers security. It ensures the funds reach the correct account with proper documentation. This method is straightforward for those who prefer face-to-face interactions. It involves visiting your bank and completing necessary forms. Here’s how you can do it effectively.

Visiting Your Bank

Start by choosing a convenient branch of your bank. Check the branch’s working hours before heading there. Bring valid identification for verification purposes. This could be a driver’s license or passport. Also, carry any necessary bank account details with you. The bank staff will guide you through the process.

Filling Out Transfer Forms

Once at the bank, ask for a money transfer form. Fill out the form with accurate information. Include both personal and business account details. Double-check the account numbers to avoid errors. Indicate the amount you wish to transfer clearly. Sign the form as required for authorization.

Submit the form to the bank teller. They will process your request promptly. Keep a copy of the form for your records. This helps track the transfer in case of any issues.

Third-party Payment Services

Transferring money from your personal account to your business account can sometimes feel like a daunting task. However, third-party payment services simplify this process, offering secure and efficient ways to manage your finances. These services act as intermediaries, making transactions seamless and convenient. You’ll find numerous options available, each with unique features and benefits. Let’s dive into how you can choose the right service and set up transfers effectively.

Choosing A Service

Start by identifying your business needs. Are you looking for speed, low fees, or international capabilities? Some services prioritize quick transactions, while others focus on affordability.

Research the security measures of each service. Your money’s safety is paramount, so ensure the service uses encryption and fraud protection. Read reviews from other users to gauge reliability.

Consider the user interface. A service that’s easy to navigate will save you time and frustration. Test out a few options to see which one feels intuitive for you.

Setting Up Transfers

Once you’ve chosen a service, setting up transfers is straightforward. Begin by linking your personal and business accounts. You’ll typically need to verify both accounts with small transactions.

Many services offer automated transfers. Set these up to save time and ensure consistent funding to your business account. You can usually choose daily, weekly, or monthly schedules.

Monitor your transactions regularly. This helps you catch any discrepancies early. Regular checks also give you insights into your financial habits, enabling better planning.

Have you ever considered how simplifying this process could impact your business efficiency? A streamlined transfer system can free up your time for more strategic tasks.

Don’t underestimate the power of convenience. A hassle-free transfer setup can be a game-changer for your business operations.

Garantizar la seguridad

Transferring money from your personal account to a business account can be straightforward, but ensuring security in this process is vital. You must safeguard your financial transactions against potential threats and fraud. Let’s explore practical measures you can take to enhance security when making such transfers.

Using Strong Passwords

Your first line of defense is a strong password. This is crucial for protecting your accounts from unauthorized access. Opt for passwords that are complex and unique, avoiding common words or easily guessable phrases.

Consider using a combination of uppercase and lowercase letters, numbers, and symbols. For instance, instead of “Business123,” try something more intricate like “B!zN3ss#456”.

Have you ever thought about using a password manager? These tools can help you generate and store complex passwords securely, ensuring you don’t have to memorize them all.

Monitoring Transactions

Keeping an eye on your transactions can alert you to any unusual activity early. Regularly review your bank statements and transaction history. This practice not only enhances security but also helps you manage your finances better.

Set up notifications for every transaction. This way, you can quickly spot anything suspicious. Have you ever caught an error or unauthorized transaction this way? Many people find it invaluable.

Do you think you would notice if a small transaction was made without your consent? Often, fraudsters start with small amounts to test the waters.

Incorporating these security practices into your routine can significantly reduce risks when transferring money between accounts. Remember, your vigilance is your best defense against potential threats. Always keep security at the forefront of your financial operations.

Seguimiento de la transferencia

Tracking the transfer of money from a personal to a business account is crucial. It ensures peace of mind. You can be sure the funds reach the right place. This step helps keep your business finances organized. It also prevents any potential financial hiccups. Let’s explore how to monitor the transfer effectively.

Comprobación del estado de la transferencia

Keep track of your transfer by checking its status online. Most banks provide real-time updates. Log into your online banking account. Look for recent transactions. There should be a section showing pending transfers. Check the date and time of the transfer. Compare it with your records. This helps ensure accuracy. Some banks send email or text notifications. Sign up for these alerts. They provide instant updates on your transfer’s progress.

Resolving Issues

If the transfer faces delays or errors, don’t panic. Contact your bank immediately. Use the customer service hotline. Explain the problem clearly. Provide all necessary details. This includes the transfer amount and date. The bank might request additional information. Be prepared to offer it. Most issues are resolved quickly. Keep a record of all communications. This is useful for future reference. If the issue persists, consider visiting the bank in person. Speak to a customer service representative. They can provide a more detailed explanation.

Implicaciones fiscales

Transferring money from a personal to a business account can seem simple. Yet, it holds tax implications that require careful consideration. Understanding these implications is crucial for financial health and compliance. Missteps in this area can lead to unnecessary tax burdens. It’s essential to grasp the tax responsibilities involved.

Understanding Tax Responsibilities

Transferring money between accounts can affect your tax situation. Personal funds moved to a business account may be considered investments or loans. Each has different tax treatments. Loans may involve interest, affecting both accounts. Investments might change the tax basis. Knowing these distinctions is key.

Keep records of all transactions. Documentation supports tax reporting. It helps clarify the nature of transfers. Proper records ensure accuracy in financial statements. This prevents potential issues during audits.

Consulting With An Accountant

Professional guidance is invaluable. An accountant can provide insights into tax rules. They help navigate complex regulations. Accountants offer advice tailored to your business needs. Their expertise minimizes tax liabilities.

Consulting an accountant ensures compliance. They assist in setting up proper documentation. Accountants help categorize transactions correctly. Their support is essential for understanding tax obligations. Regular consultations keep your business on track.

Preguntas frecuentes

How Do I Transfer Money From Personal To Business Account?

To transfer money, use your bank’s online portal or mobile app. Select the transfer option, enter the business account details, and confirm. Ensure both accounts are linked and verified for seamless transactions. Check any transfer limits or fees imposed by your bank.

Are There Fees For Transferring Money Between Accounts?

Yes, some banks may charge fees for internal transfers. Fees vary based on account type and bank policy. It’s best to check with your bank for specific charges. Consider this when planning regular transfers to manage costs effectively.

Is It Legal To Transfer Funds Between Accounts?

Yes, transferring funds between personal and business accounts is legal. Ensure proper documentation for accounting purposes. Maintain clear records for tax and auditing purposes. Always consult with a financial advisor to comply with legal requirements and best practices.

How Long Does A Money Transfer Take?

Transfers between accounts at the same bank are usually instant. However, they can take up to 24 hours. For different banks, it might take 1-3 business days. Check with your bank for specific timelines and any potential delays.

Conclusión

Transferring money between accounts can feel tricky. Follow these steps carefully. Keep track of transaction details. Ensure accurate information for each transfer. Use secure methods to protect your funds. Consult your bank for any doubts. They offer valuable guidance. Regularly review your account statements.

This helps you spot errors early. Stay organized with clear records. This makes future transactions easier. Remember, managing finances wisely strengthens your business. With practice, transferring money becomes simple. Always prioritize safety and accuracy. These small efforts lead to smooth financial operations.