Cómo transferir dinero de una tarjeta Greendot a un banco rápidamente

If you’ve ever found yourself puzzled over how to move money from your Green Dot card to your bank account, you’re not alone. This process might seem tricky at first, but rest assured, it’s simpler than you think.

Imagine the peace of mind knowing that your hard-earned money is just a few clicks away from the safety of your bank account. You’ll discover the step-by-step process to effortlessly transfer funds, ensuring your financial transactions are as seamless as possible.

Whether you’re saving for a rainy day or need quick access to your cash, understanding this transfer process can make your life a whole lot easier. Get ready to unlock the convenience of managing your finances with confidence. Let’s dive in and simplify your money transfers today!

Understanding Greendot Cards

Greendot cards are a convenient financial tool for many. Whether you’re managing daily expenses or saving for a vacation, these prepaid cards offer flexibility and control. But how much do you really know about them? Understanding Greendot cards can enhance your financial management skills and help you make informed decisions.

Features Of Greendot Cards

Greendot cards come with a range of features designed to simplify your financial transactions:

- Prepaid Option: Unlike traditional credit cards, you load money onto your Greendot card. This ensures you spend only what you have.

- Direct Deposit: You can add funds directly from your paycheck, making it easier to budget and save.

- Mobile App: With the Greendot app, tracking your balance and spending becomes hassle-free.

These features make Greendot cards a versatile choice. Have you ever wished you could avoid overdraft fees? With a Greendot card, you can.

Benefits Of Using Greendot

Why should you consider using a Greendot card? Here are some compelling benefits:

- Sin verificación de crédito: You don’t need a perfect credit score to obtain a Greendot card. This opens doors for many who face challenges with traditional banks.

- Financial Control: By using only preloaded funds, you develop better spending habits and avoid debt.

- Access to ATMs: Withdraw cash easily at numerous ATM locations nationwide.

Imagine never worrying about overspending again. Greendot cards help you stay on track financially. Have you ever thought about how much you could save by cutting unnecessary expenses?

Understanding these features and benefits can transform the way you handle your money. How might your financial life change if you leveraged the advantages of a Greendot card?

Linking Greendot Card To Bank Account

Transferring money from a Greendot card to a bank account is straightforward. First, log into your Greendot account online. Then, find the option to link your bank account. Follow the prompts to complete the transfer.

Linking your Green Dot Card to your bank account is a crucial step if you want to transfer money effortlessly. Whether you’re consolidating funds or just simplifying your financial management, this connection can make life easier. You might wonder how straightforward it is to link these accounts. Let’s dive into the process, focusing on checking bank compatibility and setting up the connection.Checking Bank Compatibility

Before you proceed, ensure your bank supports transfers from Green Dot Cards. This is an often-overlooked step, yet it’s vital for a seamless transaction. Banks have varying policies on linking prepaid cards. Some might have restrictions or require additional verification. Have you ever tried linking a card only to find your bank doesn’t support it? It’s frustrating. Save yourself the hassle by confirming compatibility first.Setting Up The Connection

Once you’ve checked compatibility, it’s time to set up the connection. Start by logging into your Green Dot account online or via the app. Navigate to the section where you can link a bank account. You’ll likely need your bank’s routing number and your account number. Remember, accuracy is key here. Double-check the numbers you input to avoid any mishaps. Think about the last time you mistakenly typed a digit in an account number. It can delay your transactions and create unnecessary stress. Have you considered the benefits of linking accounts? Doing so can streamline your money management, reducing the need for multiple logins or trips to the bank. What’s stopping you from getting started today? By linking your Green Dot Card to your bank, you’re taking a vital step towards financial convenience.Using Mobile App For Transfer

Easily transfer money from your Green Dot card to your bank account using the mobile app. Open the app, select ‘Transfer Money’, and follow the prompts. Enjoy quick and secure transactions right from your phone.

Downloading The Greendot App

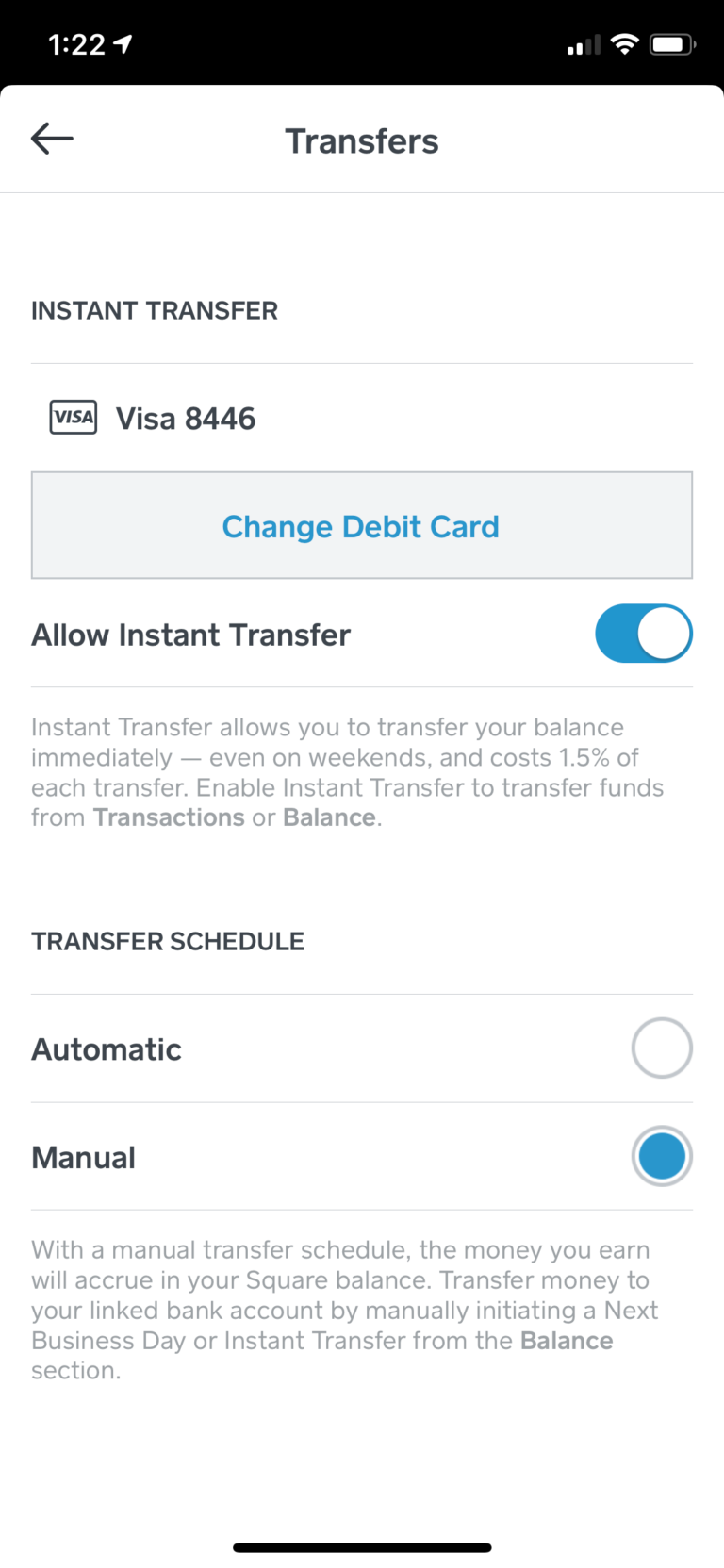

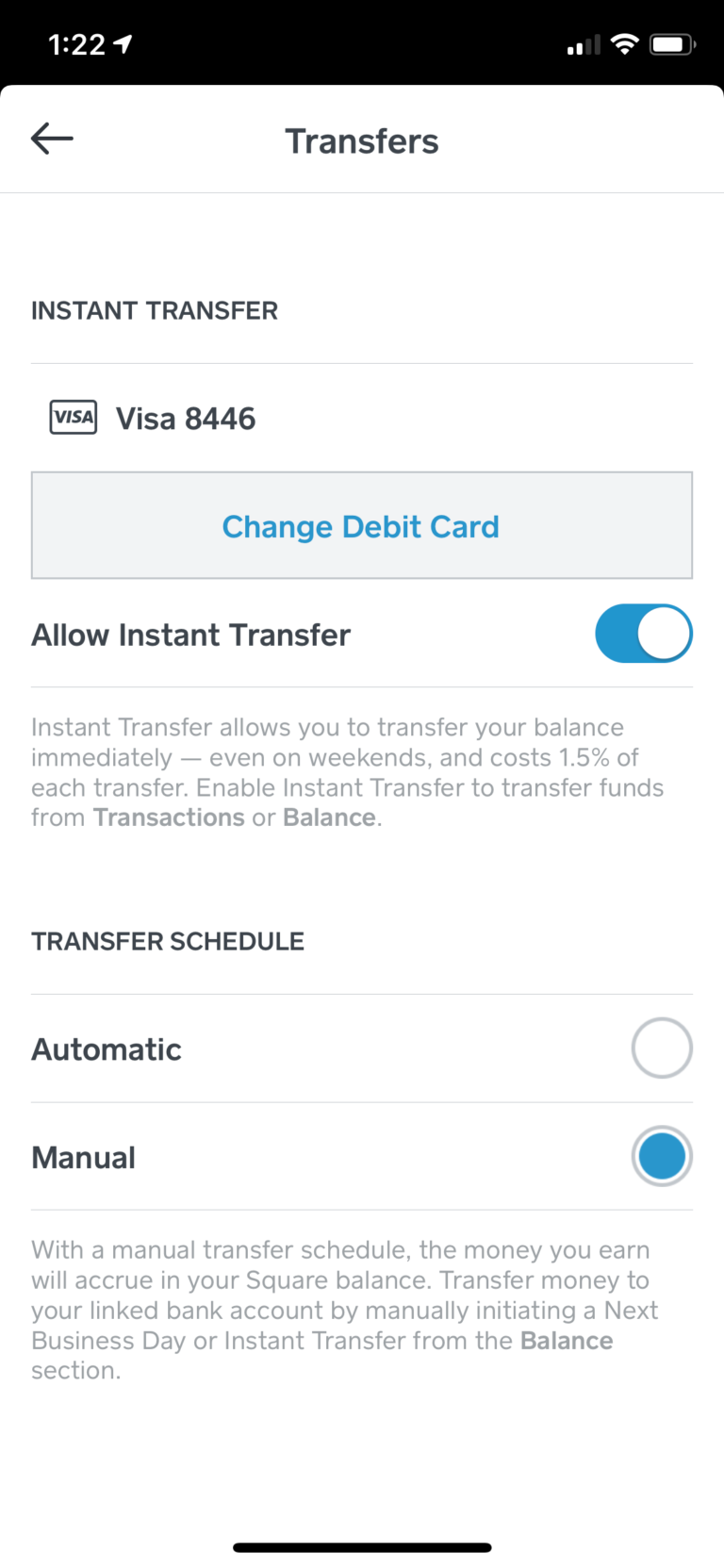

Start by downloading the Greendot mobile app. It’s available on both the App Store for iOS devices and Google Play for Android. Just search for “Greendot” and ensure you select the official app for security. Once downloaded, open the app and log in using your Greendot account credentials. If you haven’t set up an account yet, you can easily create one using your card details.The app’s user-friendly interface makes it easy to find what you need. Once logged in, you’ll see a dashboard displaying your current balance and recent transactions. Look for the “Transfer” option, typically at the bottom of the screen or in a menu. This section allows you to initiate a transfer from your Greendot card to your bank account effortlessly. Have you ever felt overwhelmed by complicated app interfaces? Thankfully, Greendot keeps it simple. The app guides you step-by-step through the transfer process. You’ll need your bank’s routing number and your account number, so keep those handy. After entering the required details, review the information carefully. Double-checking ensures your money goes where you intend. Confirm the transfer, and you’re done! Isn’t it amazing how technology simplifies our lives? How do you think mobile apps have changed the way we manage our finances?

Iniciar una transferencia

Transferring money from a Greendot card to a bank account is straightforward. Log into your Greendot account online. Select the option to transfer funds, enter your bank account details, and specify the amount. Confirm the transaction to initiate the transfer.

Introducción de datos de cuenta bancaria

The first step is entering your bank account details. Have your bank’s routing number and your account number handy. These are essential for directing your funds correctly. Double-check these numbers; a small error can lead to delays or misdirected funds. It’s like giving directions to a taxi driver—you want to get it right the first time. ###Confirmación del monto de la transferencia

Next, you need to confirm the transfer amount. Decide how much you’d like to move from your Green Dot card to your bank account. Consider any upcoming expenses to avoid transferring too little or too much. You don’t want to end up short when your electricity bill is due next week. Once you’ve decided, enter the amount. This is your chance to ensure everything is accurate before you hit that transfer button. Does this process make you feel more in control of your finances? It should. This is about empowering you to manage your funds effortlessly. Having a plan and understanding each step can transform what seems like a complex process into a simple routine. Ready to take the plunge and initiate your transfer?Entendiendo las tarifas de transferencia

Discovering how to transfer money from a Greendot card to a bank account can simplify your financial management. Start by linking your Greendot account to your bank account, then follow the bank’s transfer instructions to move funds easily. Enjoy seamless transactions while keeping your money secure.

Fee Structure Overview

Greendot charges fees for various services, including money transfers. These fees can vary based on the method used. Typically, a flat fee is charged for each transfer. Some transfers may also have a percentage-based fee. The total cost depends on the transfer amount. Checking the fee structure beforehand is advisable. This ensures you are not caught off guard.Formas de minimizar las tarifas

There are ways to reduce transfer fees. One option is to transfer larger amounts less frequently. This can often reduce the per-transaction fee. Another way is to look for promotional offers. Sometimes, Greendot may offer fee waivers. Regularly reviewing their terms can help you find such offers. Also, consider using linked services that offer lower fees. These strategies can help you save money over time.

Ensuring Security During Transfer

Transferring money from a Greendot Card to a bank account requires careful steps to ensure security. Start by logging into your Greendot account, selecting the transfer option, and entering your bank details accurately. Always verify transaction details before confirming to protect your funds from unauthorized access.

Ensuring security during money transfers is crucial. It protects your finances from unauthorized access. When transferring money from a Green Dot card to a bank account, prioritize safety. Use reliable methods to safeguard your transactions. Avoid common pitfalls that can compromise your information.Using Secure Networks

Ensure you use secure networks. Public Wi-Fi can be risky for financial transactions. Use private, secure networks at home or office. Check if your connection is encrypted. Encryption adds a layer of protection. It keeps your data safe from hackers.Cómo reconocer intentos de phishing

Learn to recognize phishing attempts. Fraudsters use emails to trick you. They may ask for sensitive information. Real organizations never ask for personal details via email. Check sender details carefully. Look for spelling errors and suspicious links. Never click on unverified links. Always log in directly through the official website. Stay vigilant to protect your assets.Solución de problemas comunes

Transferring money from a Greendot card to a bank account can sometimes pose challenges. Ensure your card is active and linked correctly. Verify bank account details to avoid errors and delays.

Transacciones fallidas

If you’ve tried to transfer money but the transaction fails, don’t panic. First, check your card balance. Ensure you have enough funds for the transfer, including any applicable fees. It’s also crucial to verify your bank account details. A single incorrect digit can derail the whole process. Re-enter your account and routing numbers carefully to prevent errors. Sometimes, the issue might be with the network. If you’re facing repeated failures, try again later. Network outages are temporary and usually resolve themselves. ###Problemas de verificación de cuenta

Account verification is essential for security, but it can sometimes be a stumbling block. If you’re having trouble, start by ensuring your personal information matches what you provided to Green Dot. Double-check your email and phone number for accuracy. If they’re incorrect, you may not receive verification codes or alerts. Consider if your bank has any restrictions. Some banks require additional steps for linking external accounts. Contact your bank to understand any specific requirements. Have you ever felt the frustration of waiting for an email that never arrives? Ensure your spam folder isn’t hiding important messages from Green Dot. Sometimes, communication gets lost in the digital shuffle. Do you have any other tips for overcoming these issues? Share your experiences in the comments!Métodos de transferencia alternativos

Transferring money from a Greendot card to a bank account doesn’t need to be difficult. Several alternative methods make the process simple and efficient. Discovering these methods can save time and effort. Let’s explore two popular ways: Using Third-Party Services and Direct Bank Deposits.

Uso de servicios de terceros

Third-party services offer a simple money transfer option. These services act as intermediaries between your Greendot card and bank account. PayPal is one such service. First, link your Greendot card to your PayPal account. Then, transfer funds from your Greendot card to PayPal. Next, move the money to your bank account. Each step is straightforward. Other services like Venmo or Cash App work similarly. Check their terms and fees before using them. Understanding these can help avoid extra charges.

Direct Bank Deposits

Direct bank deposits provide another effective method. Some banks allow direct deposits from prepaid cards. This includes Greendot cards. Start by logging into your Greendot account. Look for the option to transfer funds. Then, select your bank account as the destination. Enter the bank details carefully. Verify everything before confirming the transfer. This method is direct. It often incurs fewer fees than third-party services. Ensure your bank supports this feature to avoid issues.

Preguntas frecuentes

How Can I Transfer Funds From My Green Dot Card?

Transferring funds from your Green Dot card to a bank account involves logging into your Green Dot account. Navigate to the transfer section, then follow the prompts to enter your bank details. Confirm the transaction to complete the transfer. Ensure your bank accepts electronic transfers for a seamless process.

Are There Fees For Green Dot To Bank Transfers?

Green Dot may charge fees for transferring money to a bank account. Review the terms on their website for specific fee information. Fees can vary based on the transfer amount or destination. It’s advisable to check for any promotions or fee waivers that might apply.

How Long Does A Green Dot Transfer Take?

A transfer from Green Dot to a bank account usually takes 1-3 business days. Processing times may vary based on your bank’s policies. Delays can occur during weekends or holidays. Check your bank’s processing times for more accurate expectations regarding transfer duration.

Can I Transfer To Any Bank Account?

You can transfer funds to any bank account that accepts electronic transfers. Ensure your bank is compatible with Green Dot’s system. Some banks may have specific requirements or restrictions. Verify this information with your bank before initiating the transfer.

Conclusión

Transferring money from a Greendot card to a bank account is simple. Follow the steps carefully to ensure a smooth transaction. Keep your account information secure. Always double-check details before confirming. This process helps manage your finances better. Make sure to keep track of all transfers.

It helps you stay organized. Regular checks on your account balance are wise. This helps avoid any unexpected surprises. Understanding these steps makes money management easier. Stay informed and confident in handling your finances. Success in managing your finances starts here.