Cómo transferir dinero de Brasil a Estados Unidos

You're about to send money from Brazil to the USA, but you're not sure where to start. Don't worry, you've got several options to choose from, including servicios de transferencia en línea, banks, and specialized currency brokers. You'll want to compare their fees and exchange rates to guarantee you get the best deal. But before you begin, you'll need to gather some documentos esenciales, such as your Tax Identification Number and proof of identity and address. Now, let's explore how to navigate these requirements and find the most secure and cost-effective way to make your transfer.

Entendiendo las tarifas de transferencia

You can follow these directions to meet their output requirements:

When transferring money from Brazil to the USA, you'll typically encounter a range of fees that can eat into your transfer amount, so it's essential to understand the different types of charges you'll face. You'll likely be charged a tarifa de transferencia by the service provider, which can range from 1-5% of the transfer amount. Additionally, you may be charged a conversion fee, which can range from 1-3% above the wholesale exchange rate. There may also be banking fees, como receiving fees, which can range from $10 to $30. Understanding these fees will help you make an informed decision and minimize your costs. Be sure to review the estructura de tarifas of your chosen transfer service to guarantee you're getting the best deal.

Cómo elegir el mejor método de transferencia

Seleccionar el ideal transfer method is crucial for minimizing costs and maximizing the amount received by the beneficiary, as various services offer distinct exchange rates, transfer limits, and delivery options. You'll want to take into account what works best for you and your recipient. Compare the pros and cons of digital transfer services, which often provide tipos de cambio competitivos and lower fees, with traditional methods. Online platforms, like money transfer operators, usually offer faster and more affordable options. Assess the level of Atención al cliente and the user experience when making your decision. Look for reputable and licensed transfer services to guarantee your transaction is secure. By choosing the right method, you'll save money and get the best value for your transfer.

Bank Transfer Options

When it comes to moving funds across borders, bank transfer options are often a popular choice, as they offer a secure and widely accepted way to send money from Brazil to the USA. You can initiate a bank transfer through a Brazilian bank, such as Banco do Brasil, Itau, or Bradesco, to a recipient's bank account in the USA. The recipient's bank will receive the funds and convert them to US dollars. Keep in mind that bank transfers may involve tarifas más altas y tipos de cambio desfavorables compared to other transfer methods. It's important to check with both the sending and receiving banks for their requirements, fees, and processing times to guarantee a smooth transaction. This will help you plan and budget accordingly.

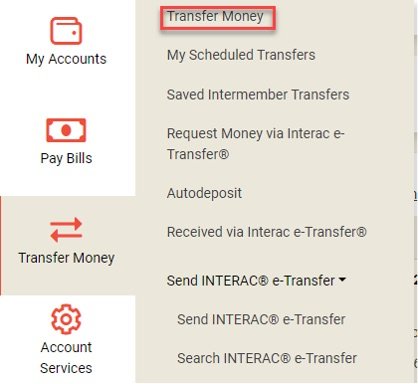

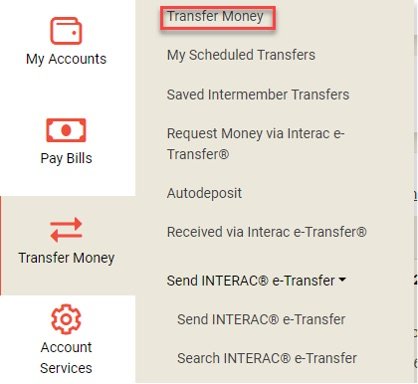

Online Transfer Services

Online transfer services, such as TransferWise, PayPal, and WorldRemit, offer a faster and often more cost-effective alternative to traditional bank transfers for sending money from Brazil to the USA. You'll typically get a better exchange rate and lower honorarios compared to traditional banks. These services usually have user-friendly online platforms and mobile apps, allowing you to send money from anywhere. You'll also get to track your transfer's progress and receive notifications when the money is received. Before choosing an online transfer service, research their medidas de seguridad, fees, and exchange rates to verify they meet your needs. Also, check if they are registered with regulatory bodies such as the US Treasury's Financial Crimes Enforcement Network (FinCEN) and the Brazilian Central Bank.

Corredores de divisas especializados

Specialized currency brokers, like OFX and Currencies Direct, can offer more competitive exchange rates and personalized services for larger transactions or more complex currency exchange needs. When you work with a specialized currency broker, you'll typically be assigned a dedicated account manager who can help you navigate the transfer process and advise on the best time to make your transfer.

Here are some benefits of working with a specialized currency broker:

- Servicio personalizado: You'll have a dedicated account manager to guide you through the transfer process.

- Tipos de cambio competitivos: Brokers often have access to better rates than banks and online transfer services.

- Market expertise: Your account manager can help you make informed decisions about when to make your transfer.

- Secure transfers: Reputable brokers are licensed and regulated, ensuring the security of your funds.

Your ability to navigate tipos de cambio effectively is vital in guaranteeing you get the best possible deal when transferencia de dinero from Brazil to the USA. You'll need to understand how exchange rates work and how they can impact your transfer. Exchange rates can fluctuate constantly, so it's important to stay up-to-date with the current rates. You can use online tools or consult with a currency specialist to get a better understanding of the market. It's also significant to take into account the fees and commissions charged by transfer services, as they can eat into your transfer amount. By being informed and doing your research, you can make decisiones informadas and guarantee a smooth transfer process. This way, you'll get the most out of your money.

Regulatory Requirements Explained

Transferring money from Brazil to the USA involves complying with a range of regulatory requirements, including those related to taxation, anti-money laundering, and know-your-customer regulations. You'll need to understand these regulations to guarantee a smooth transfer. Here are some key requirements to take into account:

- Tax Identification Number: You'll need to provide a valid tax identification number, such as an ITIN (Individual Taxpayer Identification Number) or an EIN (Employer Identification Number).

- Documentos de identidad: You'll need to provide identification documents, such as a passport or driver's license.

- Comprobante de domicilio: You'll need to provide proof of address, such as a utility bill or bank statement.

- Compliance with Anti-Money Laundering Regulations: You'll need to comply with anti-money laundering regulations, which may require additional documentation.

Ensuring Secure Transfers

Once you've navigated the regulatory requirements for transferring money from Brazil to the USA, the next step is to guarantee the security of your transfer, which involves understanding the safeguards that protect your funds and personal data. You want to make certain your money and information are safe from potential threats. Here are key security measures to take into account:

| Medida de seguridad | Descripción | Beneficios |

|---|---|---|

| Cifrado | Secure online transactions with encrypted data | Protects against data breaches |

| Autenticación de dos factores | Additional verification step for login and transactions | Prevents unauthorized access |

| Cumplimiento normativo | Adherence to anti-money laundering and know-your-customer regulations | Ensures transparency and legitimacy |