Cómo retirar dinero de una tarjeta Visa virtual: trucos sencillos

Are you looking to unlock the cash hidden in your Virtual Visa Card? If so, you’re in the right place.

Many people have Virtual Visa Cards, but not everyone knows how to convert that digital balance into real money. Whether you want to pay bills, shop, or simply cash out, understanding the process can save you time and frustration. In this guide, you’ll discover practical strategies that make it easy to access your funds.

From using ATMs to exploring online options, we’ll walk you through each step. Get ready to transform your Virtual Visa Card into cash you can use today. Don’t miss out on these valuable tips that could change how you handle your finances. Let’s dive in!

Credit: www.aimtuto.com

¿Qué es una tarjeta Visa virtual?

A Virtual Visa Card is a digital version of a standard Visa card. It allows users to make online purchases without needing a physical card. This card is linked to a bank account or a prepaid account. You can use it to shop at any website that accepts Visa.

Virtual Visa Cards provide a secure way to pay. They help protect your personal information. When you use a virtual card, your real card details stay safe. This reduces the risk of fraud during online transactions.

These cards come with a unique card number, expiration date, and CVV code. You can get them instantly through various financial services. Some platforms offer free virtual cards, while others may charge a fee.

How To Obtain A Virtual Visa Card

Getting a virtual Visa card is simple. Many banks and financial apps offer this service. You can sign up online or through their app. Provide your details and follow the steps. Your card will be ready within minutes.

Beneficios de usar una tarjeta Visa virtual

Virtual Visa cards have many benefits. They are convenient for online shopping. You can easily control your spending. These cards often come with added security features.

How To Use A Virtual Visa Card

Using a virtual Visa card is straightforward. Enter the card number and details at checkout. You can use it just like a regular card. Keep track of your balance to avoid overspending.

Crédito: www.youtube.com

Common Uses Of Virtual Visa Cards

Virtual Visa cards are useful for many online activities. They provide a safe way to shop online. Users can easily manage their spending. Here are some common uses of virtual Visa cards.

Compras en línea

Virtual Visa cards are perfect for online shopping. They allow you to buy items securely. You can shop at your favorite websites without worry. This helps protect your personal information.

Servicios de suscripción

Many people use virtual Visa cards for subscriptions. Services like streaming and gaming often require them. You can sign up without sharing your main card details. This keeps your financial information safe.

Travel Expenses

Travelers find virtual Visa cards helpful. They can book flights and hotels online. Using a virtual card adds an extra layer of security. It helps avoid fraud while traveling.

Presupuesto

Virtual Visa cards assist with budgeting. You can load a set amount of money. This helps control your spending habits. It’s easier to stick to your budget this way.

Gift Giving

Virtual Visa cards make great gifts. You can send them via email. Recipients can use them anywhere Visa is accepted. This is a thoughtful and flexible gift option.

Online Donations

Many people use virtual cards for online donations. You can support your favorite causes safely. It allows you to give without exposing your main card. This makes charitable giving secure and easy.

Cómo consultar el saldo de su tarjeta

Knowing your Virtual Visa card balance is important. It helps you manage your spending. You need to check it regularly. This ensures you have enough funds for your needs.

There are several easy ways to check your balance. Each method is quick and simple. Choose the one that works best for you.

Online Account Access

The most common way is through an online account. Visit the card issuer’s website. Log in with your credentials. This gives you instant access to your balance. You can also see transaction history here.

Aplicación móvil

Many card issuers offer mobile apps. Download the app on your smartphone. Log in to your account. The balance is displayed on the main screen. This method is convenient for checking balances on the go.

Phone Support

Another option is to call customer support. Use the phone number on the back of your card. Follow the prompts to check your balance. This method is useful if you prefer speaking to a person.

Atm Inquiry

You can also check your balance at ATMs. Insert your card and select the balance inquiry option. This works only if the ATM accepts your Virtual Visa card. Make sure to find an ATM that does.

Alertas de transacciones

Consider signing up for transaction alerts. These alerts notify you of your balance changes. You can receive them via email or text. This keeps you updated without checking manually.

Transferencia de fondos a una cuenta bancaria

Transferring funds from a virtual Visa card to a bank account is simple. This process helps you access your money easily. Many people prefer this method for its convenience.

Here is how you can do it effectively. Follow these steps to ensure a smooth transfer.

Check Your Virtual Visa Card Balance

Before transferring, check your card balance. Make sure you have enough funds. This step prevents any issues during the transfer.

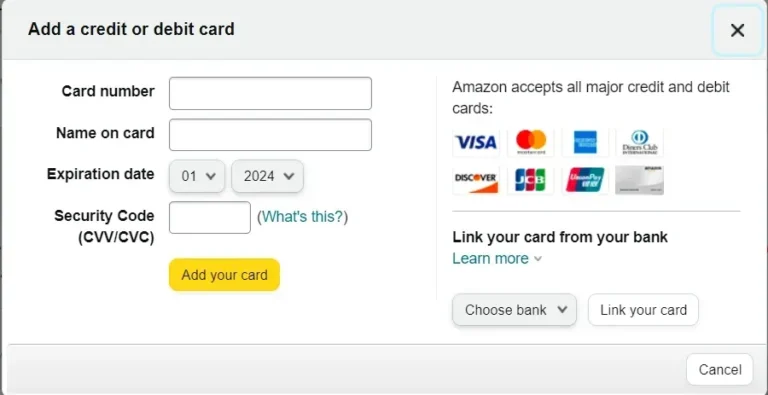

Vincula tu cuenta bancaria

You need to link your bank account to your virtual Visa card. Log in to your card provider’s website or app. Follow the instructions to add your bank details.

Iniciar la transferencia

After linking, go to the transfer section. Enter the amount you wish to send. Confirm the details before proceeding.

Confirm The Transfer

Review all information carefully. Ensure everything is correct. Click the confirm button to complete the transfer.

Revise su cuenta bancaria

After a few hours, check your bank account. The funds should appear soon. If there is a delay, contact customer support.

Uso de servicios de pago en línea

Online payment services offer a simple way to get money off a Virtual Visa Card. Services like PayPal and Venmo make this process quick and easy. You can transfer funds from your card to these platforms. This allows you to withdraw or spend your money easily.

These platforms are popular for their user-friendly interfaces. Setting them up only takes a few minutes. Once connected, managing your funds becomes hassle-free.

Connecting To Paypal Or Venmo

Start by creating an account on PayPal or Venmo. Both services require basic personal information. After that, link your Virtual Visa Card to your account. This is usually done in the payment settings.

Enter your card details as requested. Make sure everything is correct. After linking, you can transfer money from your card to your account.

Withdrawal Options

Once the money is in your PayPal or Venmo account, you have options. You can transfer the funds to your bank account. This process usually takes one to three business days.

Alternatively, you can use the money directly from your PayPal or Venmo balance. Both services allow for online purchases or payments to friends. This gives you flexibility in how you use your funds.

Crédito: www.youtube.com

Purchasing Gift Cards

Purchasing gift cards is a smart and effective way to access funds from your Virtual Visa Card. Not only do gift cards offer flexibility, but they also can be used in a variety of stores. Let’s look at how you can turn your virtual card balance into usable cash through gift cards.

Finding The Right Gift Cards

Start by identifying retailers that offer gift cards. Popular choices include:

- Amazonas

- Walmart

- Objetivo

- Starbucks

- iTunes

Look for online platforms that allow you to purchase these gift cards using a Virtual Visa Card. Many retailers have their gift cards available for direct purchase through their websites.

Using Gift Cards To Access Cash

Some retailers allow you to buy gift cards and then resell them for cash. Websites like CardCash or Raise let you sell unwanted gift cards for a percentage of their value. This can be a quick way to convert your virtual funds into cash.

Consider buying gift cards for stores where you frequently shop. If you buy a $50 gift card for a store you visit regularly, you can effectively use that value for your everyday purchases. This method helps you manage your budget while using your Virtual Visa Card.

Maximizing Your Gift Card Value

Look for promotions or discounts on gift cards. Retailers sometimes offer bonus amounts when purchasing gift cards during special events or holidays. This gives you more value for your money.

Be cautious with expiration dates and fees associated with certain gift cards. Always check the terms before purchasing to avoid losing money on unused balances.

Staying Safe While Purchasing

Protect your Virtual Visa Card information at all costs. Make sure you are buying gift cards from reputable websites. Look for secure payment options and read reviews if you are unsure.

Have you ever thought about how simple it can be to turn your Virtual Visa Card into cash? By carefully selecting and utilizing gift cards, you can maximize your card’s potential while shopping smartly. Give it a try and see how it can work for you!

Spending Through Online Shopping

Online shopping has become a go-to option for many, offering convenience and a vast array of choices. Spending through a Virtual Visa Card can enhance your online purchasing experience, allowing you to shop safely and efficiently. You can enjoy the benefits of digital transactions while keeping your financial details secure.

Understanding Virtual Visa Cards

A Virtual Visa Card is a digital version of a traditional credit or debit card. It offers a unique card number, expiration date, and CVV for online transactions. You can use it just like a regular card, but it’s often pre-loaded with a specific amount.

Where To Use Your Virtual Visa Card

You can use your Virtual Visa Card at many online retailers. Popular sites include Amazon, eBay, and Walmart. Always check if the merchant accepts Visa for seamless transactions.

Maximizing Your Online Shopping Experience

- Compare prices across different platforms before making a purchase.

- Look for online discounts and promotional codes.

- Consider joining loyalty programs for additional savings.

Have you ever found a better deal on a different site after committing to a purchase? It’s always worth checking for savings.

Tracking Your Spending

Keep track of your Virtual Visa Card balance as you shop. Many providers offer mobile apps that make it easy to monitor your spending. This helps you stay within your budget and avoid overspending.

Security Tips For Online Purchases

Your security is paramount when shopping online. Use secure Wi-Fi connections and avoid public networks. Enable two-factor authentication when available, adding an extra layer of protection.

What To Do If You Encounter Issues

If a transaction doesn’t go through, don’t panic. Check your card balance and ensure it’s still active. Contact customer service for both the merchant and your card provider if problems persist.

Online shopping with a Virtual Visa Card can be a hassle-free experience. It offers flexibility and security, allowing you to shop smartly. Are you ready to make the most of your online shopping adventures?

Converting To Cryptocurrency

Converting money from a Virtual Visa Card to cryptocurrency is easy. Many people choose this method for various reasons. Cryptocurrencies offer privacy, lower fees, and potential growth. This guide will show you how to make the switch.

Choose A Cryptocurrency Exchange

The first step is to find a reliable exchange. Look for one that supports Virtual Visa Card deposits. Popular exchanges include Coinbase, Binance, and Kraken. Check their fees and supported currencies.

Create An Account

After choosing an exchange, sign up for an account. Provide necessary information like your email and password. Some exchanges may require identity verification. This keeps your account safe.

Link Your Virtual Visa Card

Next, link your Virtual Visa Card to your exchange account. Go to the payment methods section. Enter your card details carefully. Ensure that the name matches the cardholder’s name.

Deposit Funds

Once your card is linked, deposit funds into your exchange account. Select the amount you want to deposit. Confirm the transaction. Funds will appear in your exchange wallet shortly.

Buy Cryptocurrency

Now you can buy cryptocurrency. Choose the crypto you want to purchase. Bitcoin and Ethereum are popular choices. Enter the amount you want to buy and confirm the transaction.

Transfer To A Wallet

Consider transferring your cryptocurrency to a secure wallet. This adds an extra layer of security. Hardware wallets are highly recommended for long-term storage.

Keep Track Of Your Investments

Monitor your cryptocurrency investments regularly. Prices can change quickly. Stay informed about market trends and news. This helps you make better decisions in the future.

Using At Physical Stores

Using a virtual Visa card at physical stores is simple. Many people may think it only works online. But you can easily use it in stores too. This opens up more ways to spend your money.

Follow these steps to use your virtual Visa card at physical locations. It can be a great way to access funds quickly.

Adding To Mobile Wallets

Mobile wallets make using a virtual Visa card easy. Start by downloading a mobile wallet app. Popular options include Apple Pay, Google Pay, and Samsung Pay.

Once you have the app, add your virtual Visa card. Enter the card number, expiration date, and security code. This process is quick and secure.

After adding the card, you can pay at stores. Look for the contactless payment symbol at checkout. Just hold your phone near the terminal to complete the transaction.

Aceptación del comerciante

Not all stores accept virtual Visa cards directly. Check if your favorite stores accept mobile wallet payments. Most major retailers do accept them.

Pay attention to the signs at the store entrance. Many will show which payment methods they accept. If unsure, ask the cashier before making a purchase.

Using a virtual Visa card at physical stores is straightforward. It offers flexibility and convenience for daily spending.

Cómo evitar errores comunes

Many people face challenges with virtual Visa cards. Understanding common pitfalls can help you use them wisely. This section highlights important issues to watch for.

Hidden Fees

Virtual Visa cards can come with hidden fees. These fees may reduce the money you receive. Always read the terms and conditions carefully. Look for monthly fees, transaction fees, or ATM withdrawal fees. Even small fees can add up quickly. Make sure to check the card balance regularly. This helps avoid unexpected charges.

Scam Prevention

Scams are a real threat with virtual cards. Be cautious about where you enter your card details. Use trusted websites and services. Avoid sharing your card information via email or text. Scammers often trick people into giving away their details. Report any suspicious activity immediately. Protecting your money should be a top priority.

Preguntas frecuentes

How Can I Withdraw Cash From A Virtual Visa Card?

You cannot directly withdraw cash from a Virtual Visa Card. However, you can transfer the funds to a linked bank account or use third-party services. Some ATMs also allow you to use your Virtual Visa Card for purchases, which can help you access cash indirectly.

Can I Use A Virtual Visa Card For Online Shopping?

Yes, a Virtual Visa Card is ideal for online shopping. It works like a regular credit or debit card. Simply enter the card details during checkout. This method provides security and convenience for your online purchases.

Are There Fees Associated With Virtual Visa Cards?

Yes, there may be fees linked to Virtual Visa Cards. These can include issuance fees, transaction fees, or monthly maintenance fees. Always check the terms and conditions before obtaining a card to understand any potential costs involved.

How Do I Check My Virtual Visa Card Balance?

You can check your Virtual Visa Card balance online or through the issuing bank’s app. Log in to your account and navigate to the balance section. Additionally, some providers offer a customer service number for balance inquiries.

Conclusión

Getting money off a Virtual Visa Card is simple and practical. Use it wisely to manage your funds. Follow the steps mentioned in this guide to access cash. Always check fees and limits. This way, you can make the most of your card.

Enjoy the benefits without complications. With careful planning, a Virtual Visa Card can serve you well. Take control of your finances today. Make informed choices and stay secure while using your card.