Cómo cancelar la tarjeta de crédito de Costco

Did you know that nearly 30% of credit card holders cancel their cards within the first year? If you're among those considering canceling your Costco credit card, you might have a few pasos importantes to take to guarantee a proceso sin problemas. Understanding how to approach this can save you time and prevent potential issues down the line. So, what are the key factors you should keep in mind before making that call to customer service?

Razones para cancelar su tarjeta

Hay varias razones por las que podrías considerarlo canceling your Costco credit card, de altas tarifas anuales a cambios en sus hábitos de gasto. If you find that the benefits no longer align with your purchasing patterns, it might not make sense to keep the card. Additionally, if you're luchando con la deuda, cutting back on credit cards can help you regain financial control.

You may also want to reflect on your overall credit utilization; closing an account can impact your credit score if you have limited credit available. Finally, if you're unhappy with the customer service or terms, it's wise to explore better options. Whatever the reason, ensuring your financial safety should always be a priority when making such decisions.

Revisar el estado de su cuenta

Before deciding to cancel your Costco credit card, it's important to review your account status to understand any potential impacts on your finances. This includes checking your current balance, payment history, and rewards accrued. Here's a handy table to help you assess your account:

| Aspecto de la cuenta | Detalles |

|---|---|

| Saldo actual | $XXX |

| Historial de pagos | On-time / Late Payments |

| Recompensas ganadas | $XX in cash back or points |

Pagar los saldos restantes

Para garantizar una proceso de cancelación sin problemas, make certain you've paid off any remaining balances on your Costco credit card. Check your account online or through the app to see your current balance. If you have cargos pendientes, either pay them off immediately or verify you can cover them before initiating the cancellation. It's essential to avoid any late fees or penalties that could arise from unpaid balances. If you're making a payment, allow sufficient time for it to process, especially if you're close to your payment due date. Once everything's settled, you'll have peace of mind knowing that your financial responsibilities are fully managed before you proceed with canceling your card. This step helps protect your credit score and guarantees a hassle-free cancellation.

Canjear recompensas y beneficios

Once you've settled your account, it's time to canjear cualquier recompensa restante and benefits associated with your Costco credit card before canceling it. Check your saldo de recompensas online or through the app to see what's available. Often, you can redeem rewards for devolución de efectivo or discounts on future purchases. Make certain to use these benefits before your cancellation takes effect, as you might lose them otherwise. Additionally, consider any ofertas promocionales o extended warranties tied to your card; it's wise to take advantage of these before you close the account. If you have any questions about redeeming your rewards, familiarize yourself with the terms to guarantee you maximize your benefits safely and effectively.

Contact Costco Customer Service

If you need assistance with canceling your Costco credit card, reaching out to Costco customer service is an essential step in the process. They can guide you through the necessary steps and address any concerns you may have. To guarantee a smooth experience, consider the following:

- Tenga su información lista: Gather your account details, including your credit card number and personal identification.

- Choose Your Contact Method: You can call customer service, chat online, or visit a Costco location for assistance. Each method offers a different level of convenience.

- Be Prepared for Questions: Customer service may ask about your reasons for canceling or any issues you've faced, so be ready to share.

Following these steps will help you feel secure during the cancellation process.

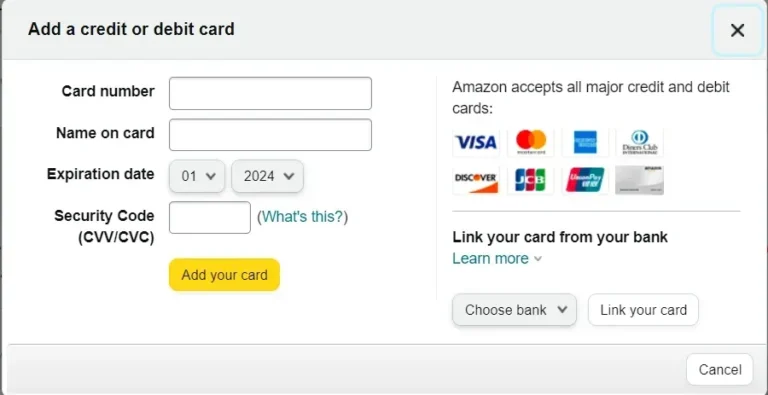

Envíe su solicitud de cancelación

Enviando su solicitud de cancelación is a straightforward process that can typically be done online or over the phone. To begin, log into your Costco account on their website and navigate to the credit card section. Here, you should find an option to cancel your card. Alternatively, you can call Costco's número de atención al cliente. When you reach a representative, clearly state your intention to cancel. They may ask for confirmation details, so have your account information ready. Make certain to note down any número de confirmación you receive for your records. If you're concerned about security, verify you're on a secure connection when submitting your request. This way, you can protect your personal information throughout the process.

Confirmar detalles de cancelación

After you've submitted your cancellation request, it's important to confirm the details with Costco to guarantee everything is processed correctly. This step guarantees that your account is closed, and you won't encounter any unexpected fees in the future. Here are three key points to verify:

- Estado de la cuenta: Check if your account is marked as closed in their system.

- Final Statements: Request any final statements to guarantee no pending charges are left unpaid.

- Confirmation Number: Make sure you receive a confirmation number or email for your records.

Monitorea tu puntaje de crédito

Once your Costco credit card is canceled and you've confirmed the details, it's a good idea to monitor your credit score to understand how this change affects your overall credit health. Canceling a credit card can impact your tasa de utilización del crédito and, consequently, your score. Regularly checking your score helps you spot any unexpected changes or inaccuracies. You can use servicios gratuitos de monitoreo de crédito or request a free credit report annually to stay informed. If you notice a significant drop in your score, consider reviewing your overall credit strategy. Maintaining a mix of credit accounts and making timely payments can help mitigate any negative effects from the cancellation. Staying proactive about your credit health offers peace of mind and financial safety.

Deseche su tarjeta de forma segura

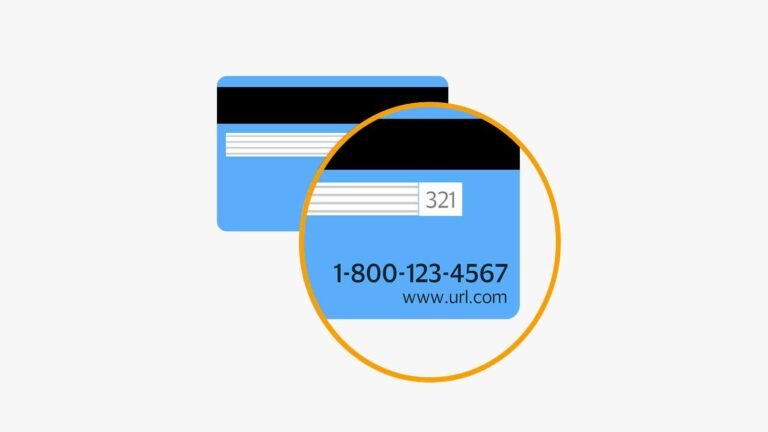

Safely disposing of your Costco credit card is essential to protect your personal information and prevent identity theft. Simply throwing it in the trash isn't enough; it's crucial to take extra precautions. Here's how to do it securely:

- Cortar la tarjeta: Use scissors to cut your card into small pieces, making sure to sever the chip and magnetic strip.

- Mix the Pieces: Dispose of the pieces in different trash bags or containers to make it harder for anyone to reconstruct your card.

- Destrúyelo: If you have a shredder, run the card through it for added security.

Explorar opciones de crédito alternativas

Exploring alternative credit options can help you find a financial solution that better fits your needs and lifestyle. It's crucial to evaluate secure and trustworthy options to guarantee your financial safety. Here are some alternatives:

| Type of Credit Option | Beneficios |

|---|---|

| Secured Credit Card | Builds credit while minimizing risk. |

| Low-Interest Credit Card | Saves money on interest payments. |

| Retail Store Card | Often offers discounts and rewards. |

| Préstamos entre pares | Flexible terms and lower rates. |

When looking for a new credit option, assess each one based on fees, interest rates, and rewards. Always choose options that align with your financial goals and promote responsible spending habits.