¿Cuánto cuesta el pago inicial para un condominio?: Guía de expertos

Are you dreaming of owning a condo but unsure about how much you need for a down payment? You’re not alone.

The condo market can be a maze, especially when it comes to understanding the financial commitment required upfront. But imagine this: a cozy space that’s all yours, where you can finally paint the walls any color you like and decorate to your heart’s content.

Sounds good, right? Before you get there, you need to tackle the big question of the down payment. In this guide, we’ll break down everything you need to know about condo down payments. You’ll discover how much you really need and why it’s crucial to get it right. Stick with us, and you’ll gain the clarity you need to take confident steps toward your condo ownership dreams.

Factors Influencing Condo Down Payment

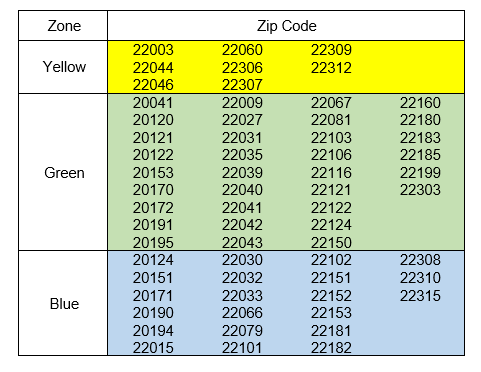

Ubicación affects condo prices. Cities with high demand cost more. Market trends change often. Prices can rise or fall. Always check current market conditions before buying. This helps in planning your budget wisely.

Different condos have different prices. A luxury condo requires a bigger down payment. Studio condos may cost less. Always compare types before deciding. Consider size and amenities. These factors impact price.

Credit score matters a lot. A good score reduces down payment. Income level is important too. Lenders check your earnings. Higher income can lower payment needs. Debt-to-income ratio also plays a role. Keep debts low for better rates.

Typical Down Payment Percentages

Most people pay a minimum of 5% for a condo. This is a common rule. Some lenders might ask for 10% or more. First-time buyers might get some help. They could pay even less. Always check with your bank.

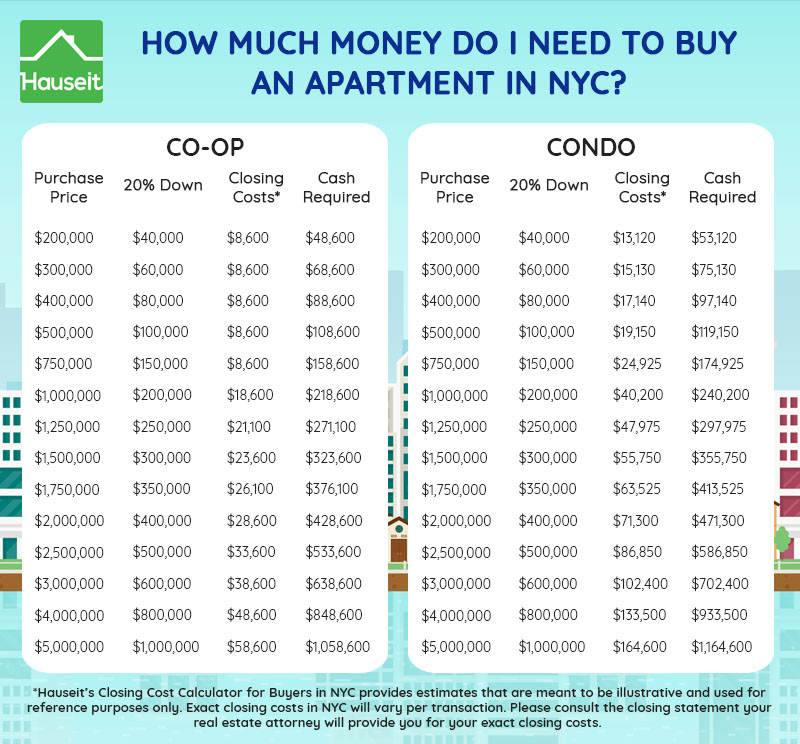

Buying a luxury condo is different. Lenders often ask for 20% down payment. The price of a luxury condo is high. So, the down payment is also high. Some places might ask for 25% or more. Always plan ahead. Save money early.

Financing Options And Assistance Programs

Exploring financing options helps in understanding condo down payments. Assistance programs can ease financial burdens. These programs offer support for first-time buyers, making homeownership more accessible.

Traditional Mortgages

Traditional mortgages are common for buying a condo. You need a depósito. It is usually 20% of the condo price. Banks and credit unions offer these loans. They need good credit scores. Also, proof of income is a must. Interest rates can vary. Lower rates mean you pay less over time. Fixed-rate loans have the same payment every month. Adjustable-rate loans can change. This means payments can go up or down.

Government Assistance Programs

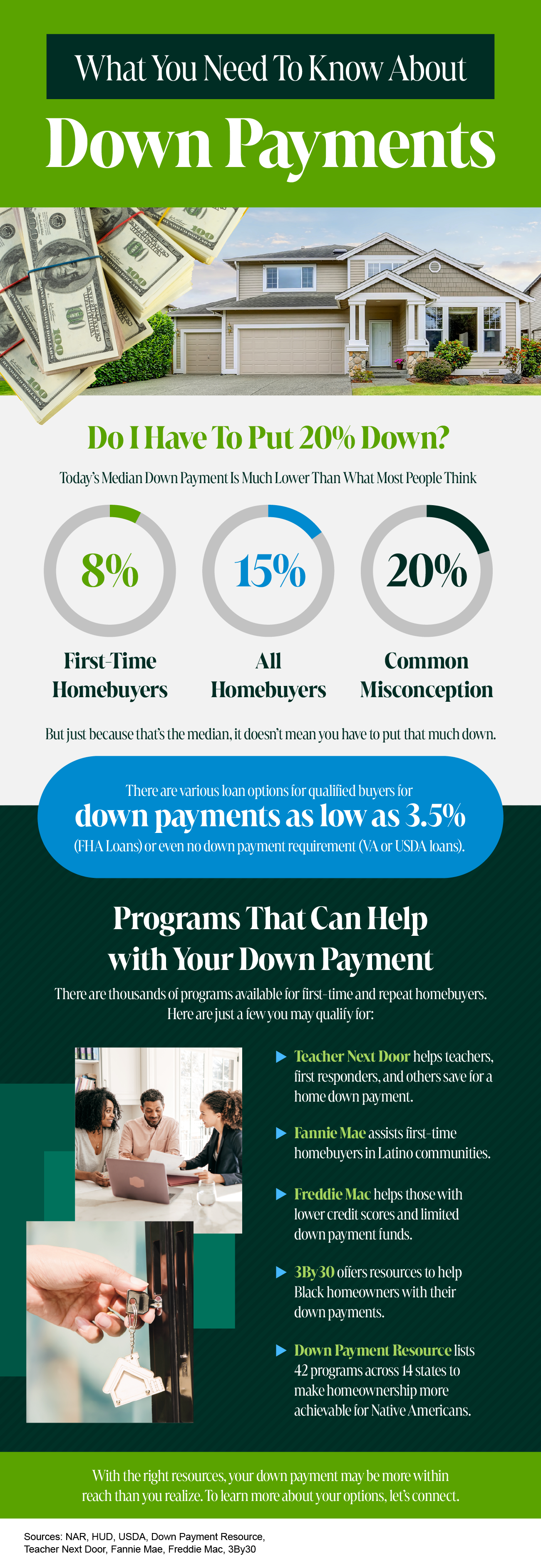

Some programs help with condo down payments. FHA loans need only 3.5% down. These are for first-time buyers. VA loans help veterans. They might need no down payment. USDA loans are for rural areas. They also might not need any down payment. Each program has rules. Check if you qualify. Some need you to live in the condo.

Private Lender Options

Private lenders offer different loans. They can be more flexible. You might need less depósito. Interest rates might be higher. Some private lenders allow negotiation. Always read the terms. Make sure you can afford the payments. Private lenders might ask for extra fees. Compare options before deciding.

Saving Strategies For A Condo Down Payment

Start by listing all monthly expenses. Identify areas to reduce costs. Cook at home instead of eating out. Use public transport instead of driving. Cancel unused subscriptions. Save money from small changes. Every dollar counts towards your down payment. Track spending with apps to stay on budget. This helps you understand where your money goes.

Investing can grow your savings faster. Look into low-risk options. Consider bonds or mutual funds. These offer steady returns. Keep an eye on market trends. Talk to a financial advisor for guidance. Diversify investments to minimize risk. Small investments can lead to big savings over time.

Open a savings account for your condo fund. Choose accounts with good interest rates. Some banks offer special savings plans. These may have higher returns. Automate monthly savings deposits. This ensures you save consistently. Watch your savings grow over months. Small deposits add up.

Pitfalls To Avoid

Many people focus only on the condo price. Extra costs often surprise them. These costs include closing fees, inspection fees, y seguro. Gastos de cierre can be quite high. Inspection fees ensure your condo is safe. Seguro is important for protection. Ignoring these costs can lead to trouble. Plan ahead Para evitar sorpresas.

A puntuación crediticia is very important. It affects your loan approval. Low scores can mean tasas de interés más altas. This makes the loan expensive. Work on improving your score. Pay bills on time. Check your credit report. Fix errors if there are any. A good credit score saves money.

Expert Tips For First-time Buyers

Buying a condo can be confusing. Experts can help. They know the market. They understand the paperwork. A real estate agent is useful. They can find the right condo. asesores financieros help too. They explain loans. They talk about down payments. It’s important to ask questions. Getting advice can save money. It can prevent mistakes. Choosing the right expert matters. They guide you in buying a condo.

Technology can help find good deals. Online tools are available. Websites list condos for sale. Apps show prices. They offer details. Virtual tours let you see condos. Alerts notify you of new listings. They keep you updated. Comparing prices is easy. Technology can show price trends. It helps decide the best time to buy. It’s smart to use these tools. They can help save money.

Preguntas frecuentes

What Is The Average Condo Down Payment?

The average condo down payment typically ranges from 10% to 20% of the purchase price. This percentage can vary depending on your lender and financial situation. First-time buyers might find lower down payment options through certain loan programs.

Can I Buy A Condo With 5% Down Payment?

Yes, some lenders offer condo loans with as low as 5% down payment. These options might come with higher interest rates or private mortgage insurance (PMI). It’s essential to explore different lenders and programs to find one that suits your financial needs.

How Does Credit Score Affect Condo Down Payment?

A higher credit score often leads to a lower required down payment. Lenders view good credit scores as less risky, potentially reducing down payment requirements. Conversely, lower scores might require a higher percentage to secure the loan.

Are There Programs For First-time Condo Buyers?

Yes, several programs assist first-time condo buyers with down payments. FHA loans, for example, offer lower down payment options. State-specific programs might also provide grants or assistance to reduce initial costs for eligible buyers.

Conclusión

Buying a condo requires planning and saving for a down payment. The amount depends on location and your financial goals. Research is key. Understanding your budget helps in setting realistic targets. Save consistently to meet your down payment needs. Explore different financing options available.

Consult a real estate expert if needed. Patience and preparation are vital in this journey. With time and effort, owning a condo becomes achievable. Remember, every small step counts towards your homeownership dream. Stay committed and informed to make wise financial decisions.

Your future condo awaits!