¿Cómo calcular el interés de un pago atrasado? Una guía sencilla

Have you ever found yourself staring at a bill, wondering just how much extra you owe because it’s late? Calculating interest on a late payment can feel daunting, especially when you’re juggling numbers, percentages, and deadlines.

However, understanding how this interest is calculated is crucial. It not only helps you manage your finances better but also ensures you’re not overpaying. Imagine having the power to control your expenses more effectively, simply by grasping this one concept.

We will break down the steps to calculate interest on a late payment in the simplest way possible. By the end, you’ll feel more in control of your financial obligations and ready to tackle any late payment charges with confidence. Ready to demystify those intimidating numbers? Let’s dive in!

Understanding Late Payment Interest

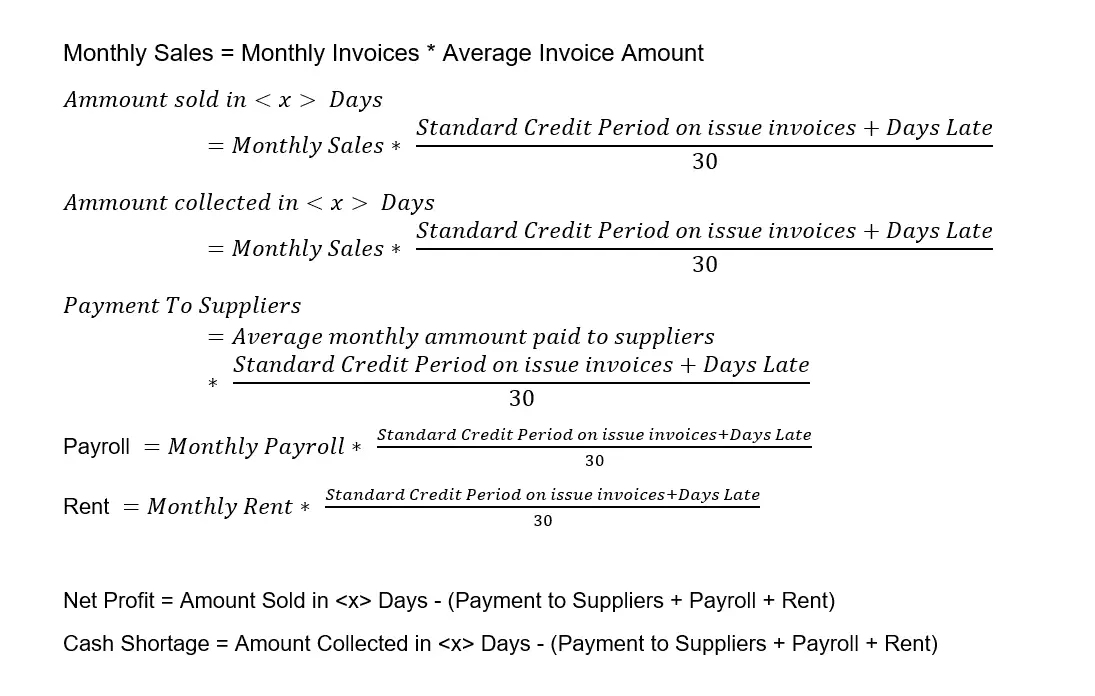

Late payment interest is extra money you pay when a bill is paid late. It is like a penalty for not paying on time. If you pay after the due date, you may owe more money. This interest is usually a small percentage of the amount owed. It encourages people to pay bills on time. The longer you delay, the more interest you might owe. Different companies have different rules. Always check what the rules are.

Calculating late payment interest helps you know how much extra you owe. It can help you plan your payments better. Knowing the interest amount can avoid surprises. It also helps you administra tu dinero wisely. If you pay late often, interest can add up. Too much interest can make paying bills hard. Be sure to pay before the due date to save money.

Types Of Interest Rates

Simple interest is easy to understand. It is interest on the original amount. The formula is: Interest = Principal x Rate x Time. Principal is the starting amount. Rate is the percentage of interest. Time is how long the money is borrowed or late. This type of interest does not change. It is the same each time. Many people use simple interest for short loans. It is less confusing.

Compound interest is more complex. It is interest on the original amount and on past interest. This means the interest can grow quickly. The formula is: Interest = Principal x (1 + Rate)Time – Principal. Here, each period, interest is added to the principal. Then, interest is calculated on the new total. Many banks use compound interest for savings. It helps money grow faster.

Determining The Applicable Interest Rate

Contracts often have tasas de interés for late payments. Check your agreement first. Look for a section about late fees. It may specify a fixed rate. Sometimes, the rate is a porcentaje of the amount owed. This is important for understanding your obligations. Read the contract carefully. If unsure, ask a lawyer for help.

Many places have laws about late payment interest. These laws protect people from unfair charges. The law might set a maximum rate you can charge. Always check local regulations. Some regions have special rules for businesses. Knowing the law helps avoid mistakes. It also ensures fair treatment. Stay informed to follow the rules.

Steps To Calculate Simple Interest

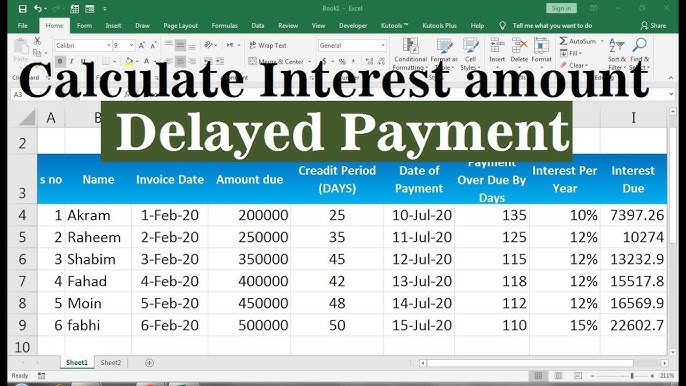

Calculating interest on a late payment involves a simple formula. Multiply the principal amount by the interest rate, then by the time period. The result shows how much extra is owed due to the delay. Understanding this helps manage financial obligations effectively.

Identify The Principal Amount

First, find the principal amount. This is the original money borrowed or owed. Look at the bill or loan document. Write down the number. This is your starting point.

Determine The Interest Rate

Next, find the tasa de interés. This rate is usually shown as a percentage. Check your agreement or bill. Write down the percentage. This tells you how much extra money you pay.

Calculate The Time Period

Then, know the time period. This is how long the payment is late. Count the days, months, or years. Make sure you have the exact time. This helps in accurate calculation.

Compute The Simple Interest

Finally, calculate the simple interest. Use the formula: Principal x Rate x Time. Multiply the numbers together. This gives you the interest amount. Add this to the principal for the total amount owed.

Steps To Calculate Compound Interest

Compounding frequency is how often interest is added. It can be daily, monthly, or yearly. More frequent compounding means more interest. If interest compounds daily, it grows quicker. Monthly compounding is slower than daily. Yearly compounding is the slowest.

The compound interest formula is crucial. It is A = P(1 + r/n)^(nt). ‘A’ is the amount after time. ‘P’ is the principal, or starting amount. ‘r’ stands for the interest rate. ‘n’ is the number of times interest compounds per year. ‘t’ is the number of years money is invested or borrowed. Plug in the numbers to get the final amount.

Tools And Resources For Calculation

Online calculators are easy to use. They help calculate interest on late payments. These tools are often free. You just need to enter the amount and days late. The calculator will show the interest owed. It’s quick and simple. Many websites offer these calculators. They are useful for businesses and individuals. They save time and reduce mistakes. You don’t need to be a math expert to use them. They provide clear results. This makes understanding interest easier for everyone.

Financial software helps with late payment calculations. Popular choices include QuickBooks and FreshBooks. They automate interest calculations. This reduces human errors. You can track payments and interest easily. Financial software is user-friendly. It shows detailed reports. These reports help in understanding payment history. Many businesses rely on these tools. They simplify financial tasks. Using software saves time and effort. It’s a smart choice for managing late payments. It helps keep finances organized.

Practical Tips For Managing Late Payments

Clear payment terms help clients understand their duties. Write terms simply. Tell clients when and how to pay. Use due dates and explain late fees. Clear terms reduce confusion and lateness.

Talk to clients often. Good communication can prevent late payments. Send friendly reminders before due dates. Offer help if clients face payment troubles. Honest communication builds trust and avoids issues.

Automated reminders make payment easy. Use software to send alerts. Set reminders before and after due dates. Automating saves time and reduces mistakes. Automatic alerts keep everyone informed and prompt payments.

Legal Implications Of Late Payments

Calculating interest on late payments involves applying an agreed interest rate to the overdue amount. It’s crucial to understand the terms set in the contract. Companies often specify a daily, monthly, or annual interest rate, which impacts the total cost of late payment.

Penalties And Fees

Late payments often lead to extra penalties and fees. These charges add to the original amount. Prestamistas might charge a flat fee or a percentage. The longer you wait, the more you pay. It is important to pay on time.

Impact On Credit Ratings

Los pagos atrasados pueden hurt credit ratings. A low credit score makes loans hard to get. People with low scores may pay higher interest. Creditors report late payments to credit bureaus. Reports can stay on your record for years.

Preguntas frecuentes

How Do You Calculate Late Payment Interest?

To calculate late payment interest, first determine the principal amount due. Next, identify the annual interest rate and the number of days late. Use the formula: Interest = (Principal x Rate x Days Late) / 365. This will give you the interest accrued on the late payment.

What Is The Interest Rate For Late Payments?

The interest rate for late payments varies depending on your contract or agreement. Commonly, it is outlined in terms and conditions. It may be a fixed percentage or tied to a benchmark rate like the Federal Reserve’s rate. Always check your agreement for specific details.

Why Is Late Payment Interest Charged?

Late payment interest is charged to compensate the creditor for the delayed payment. It encourages timely payments and offsets potential financial losses. Charging interest also acts as a deterrent to prevent future late payments, maintaining cash flow and financial stability for the business.

Can Late Payment Interest Be Waived?

Yes, late payment interest can sometimes be waived. This depends on the creditor’s policies and your payment history. Communicate directly with the creditor, explain your situation, and request a waiver. They may agree to waive the interest as a goodwill gesture, especially for first-time delays.

Conclusión

Calculating interest on late payments ensures fairness in financial dealings. It helps both parties understand their responsibilities. Knowing the formula aids in accurate calculations. This avoids confusion and potential disputes. The process is straightforward with clear steps. Regular practice can make it easier over time.

Staying informed on interest rates is important too. It keeps calculations up-to-date and relevant. Understanding these basics builds trust and transparency. It also promotes better financial management. Now, you’re ready to manage late payments effectively. Keep practicing and refine your skills.