¿Cómo realizar un pago ACH a un proveedor?: Guía sencilla

Have you ever found yourself tangled in the web of paying vendors and thought, “How do I make an ACH payment to a vendor?” You’re not alone.

With digital payments becoming the norm, understanding ACH (Automated Clearing House) payments is crucial for smooth and efficient transactions. Imagine cutting down on paperwork, reducing errors, and ensuring timely payments—all while saving money. Sounds appealing, right? In this blog post, we’ll guide you through the simple steps to make an ACH payment to a vendor.

By the end, you’ll feel confident and ready to streamline your payment process. Ready to simplify your financial management? Let’s dive in!

Ach Payment Basics

ACH stands for Automated Clearing House. It moves money between banks. It is a safe and fast way to pay. ACH payments are used for bills and paychecks. Many people trust ACH for money tasks.

ACH payments are very rentable. They save money on fees. ACH is also seguro. It keeps your bank details safe. Payments are quick and easy to track. This method is great for regular payments.

Preparing For Ach Payment

Collect all the needed vendor details. This includes bank account numbers y números de ruta. Ensure that you have the exact payment amount ready. Double-check for accuracy to avoid errors.

Confirm vendor’s name y DIRECCIÓN. Make sure the bank details match with the vendor records. Check if they accept ACH payments. Contact them if details are unclear. A mistake could delay payment.

Setting Up Ach Payments

First, decide how you want to pay. You can pay through transferencia bancaria directa o una servicio de terceros. Direct bank transfers are simple. They often cost less. Third-party services can offer extra features. These might include tracking y seguridad. Choose what fits your needs best.

Sign up with your chosen bank or service. Fill out all forms carefully. You might need your business details y vendor information. Banks will often ask for these. Make sure all info is correct. This helps to avoid any retrasos. After registration, you can start making payments.

Executing The Payment

To start, open your bank’s online portal. Find the section for ACH payments. This might be under “Transfers” or “Payments”. Enter the vendor’s datos bancarios carefully. Double-check the routing and account numbers. Mistakes here can cause problems. Enter the payment amount. Make sure it is correct. Review your own bank details too. Errors can delay the transfer. Confirm everything before moving forward.

Look at all the payment details again. This includes the vendor’s information and the amount. Ensure all information is accurate. Verify the date for the transaction. It should match your plan. Check any additional notes or references. These help the vendor recognize your payment. After confirming, submit the payment. You might need to enter a password or code. This step is for security. Once done, your payment is on its way.

Post-payment Steps

It’s important to record the payment once it’s made. This helps in tracking your expenses. Use a notebook or a simple app. Write down the vendor’s name, el cantidad, y el date. Keeping track ensures you know where your money goes. It also helps in future reference.

After making the payment, inform the vendor. You can send an email or a message. Let them know the payment has been made. This keeps everything clear. It also helps prevent any misunderstandings. Always check for a confirmation reply. This shows that the vendor got your message.

Solución de problemas comunes

Setting up an ACH payment involves verifying bank account details. Ensure correct vendor information for a smooth transaction. Double-check routing numbers to avoid errors.

Payment Delays

Payment delays can be frustrating. Vendors expect timely payments. Check the datos bancarios. They must be correct. Verify the número de ruta y número de cuenta. Sometimes, bank holidays cause delays. Look for any problemas de red. These might slow transactions. Inform your vendor about any delays. They should be aware.

Discrepancies In Amount

Discrepancies can cause confusion. Always check the invoice amount first. Match it with the payment amount. Mistakes happen. Maybe a typo in the amount. Check for cargos ocultos. Banks sometimes add these. Contact your bank for clarification. Vendors expect the right amount. Ensure it matches their invoice.

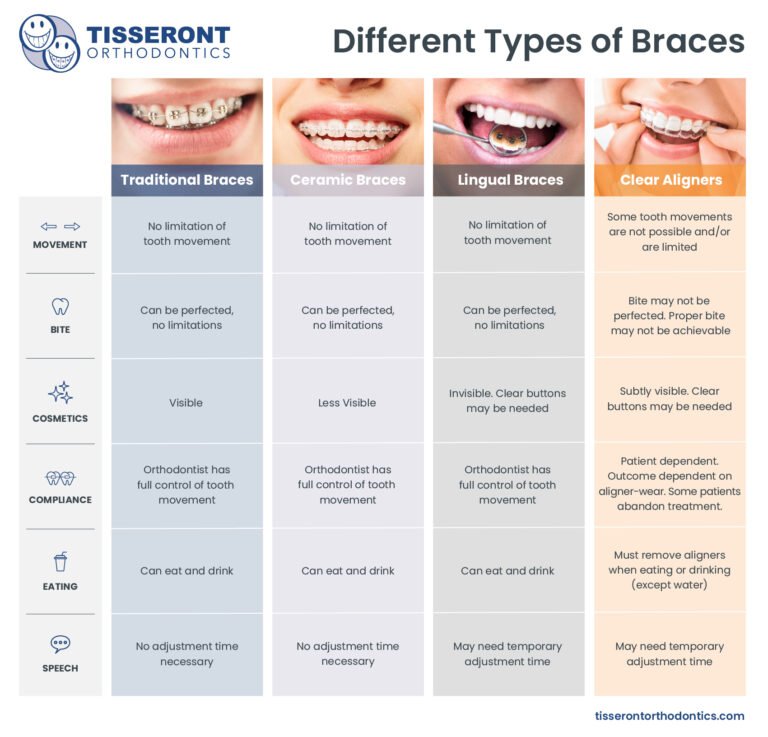

Security Tips For Ach Payments

Protecting sensitive information is crucial. Use strong passwords to keep data safe. Never share passwords with anyone. Ensure your network is secure. Use firewalls to block threats. Encrypt data during transfers. Always verify vendor details. Double-check account numbers.

Regularly monitor transactions for unusual activity. This helps spot errors early. Set alerts for large transactions. Review bank statements often. Track all transactions closely. Report suspicious activity immediately. Keeping a record helps track changes.

| Security Tip | Descripción |

|---|---|

| Strong Passwords | Use complex passwords to secure accounts. |

| Network Security | Implement firewalls and encryption. |

| Alertas de transacciones | Set alerts for unusual activity. |

Preguntas frecuentes

What Is An Ach Payment?

An ACH payment is an electronic transfer of funds between banks. It’s processed through the Automated Clearing House network. This system ensures efficient, secure transactions. Businesses often use ACH payments for payroll, vendor payments, and more. They are a cost-effective alternative to checks or wire transfers.

How Do I Set Up Ach Payments?

To set up ACH payments, you need your bank details and authorization from the vendor. Contact your bank to initiate the process. Ensure you have the vendor’s bank account information. Once set up, you can schedule regular payments. This streamlines your payment process and enhances efficiency.

Are Ach Payments Safe For Vendors?

Yes, ACH payments are secure and reliable for vendors. They offer encrypted transactions, reducing fraud risk. Banks monitor ACH transactions to ensure safety. Vendors benefit from timely payments without handling physical checks. This makes ACH payments a preferred choice for many businesses.

How Long Do Ach Payments Take?

ACH payments typically take 1-3 business days to process. The duration depends on the banks involved and the transaction type. Some payments might be processed faster with same-day ACH options. This timeframe is generally quicker than traditional check processing, providing efficiency for both parties.

Conclusión

Making an ACH payment is straightforward and efficient. Start by gathering the vendor’s bank details. Ensure accuracy to prevent errors. Log into your bank’s online portal. Navigate to the ACH payment section. Enter the required information carefully. Double-check the details before submitting.

Confirm the payment is processed. ACH payments are secure and cost-effective. They help streamline vendor transactions. Remember to keep records for future reference. This method saves time and reduces paperwork. Feel confident using ACH for vendor payments. It’s a reliable choice for businesses.

Stay organized and manage your payments with ease.