¿Declaras los pagos por acogida familiar en tus impuestos? Descubre cómo.

Navigating the labyrinth of taxes can often feel like an overwhelming task, especially when you’re dealing with unique situations like foster care payments. Have you ever found yourself wondering if these payments should be claimed on your taxes?

You’re not alone. Many people find themselves perplexed by this very question. In this blog post, you’ll discover the answers you need, unraveling the complexities of foster care payments and tax implications. By the end, you’ll have a clear understanding of whether these payments affect your tax return and how you can handle them efficiently.

Let’s dive into the details and ease your tax season stress.

Foster Care Payments Explained

Foster care payments help families caring for children. These payments cover basic needs like food and clothing. They also provide for health care and education. Payments vary by state and child’s needs.

Some payments are not taxable. This means you do not report them on taxes. Payments used for the child’s needs are usually non-taxable. If payments are used for other things, they may be taxable.

Check with a profesional de impuestos for advice. They help understand what needs reporting. Keeping records of payments is important. This helps when filing taxes.

Each state has different rules. Learn about local rules for foster care payments. This ensures compliance and proper reporting.

Taxability Of Foster Care Payments

Foster care payments are often seen as a form of support. Most foster payments are not taxed. These payments help with the child’s daily needs. Food, clothing, and schooling can be costly. The government understands this. So, it offers tax-free benefits. Payments from state or local agencies are usually not taxable. This is important for foster families. It keeps more money in your pocket. Families can use it for other needs. Some exceptions exist, though. Always check with a tax expert. They can guide you properly. Every family’s situation is unique. This advice helps plan better.

Determining Non-taxable Payments

Foster care payments are often non-taxable. These payments help cover care costs. They are not income for foster parents. Non-taxable payments don’t need reporting on tax returns. It’s important to know what counts as non-taxable. Some states have special rules. Always check local guidelines. Ask a tax expert if unsure. Understanding the rules is key. This helps avoid mistakes on taxes. Remember, not all payments are non-taxable. Some additional payments might need reporting. Always read guidelines carefully.

Understanding Irs Guidelines

Foster care payments can be confusing. The IRS has rules about them. These payments are generally not taxed. Payments for child’s care are not income. This is because they cover specific needs. Sometimes, extra payments might be taxable. Personal services payments might be taxable. Always check if payments are for services or care. If unsure, it’s best to ask a tax expert. Mantener registros of all payments received. This helps if questions arise later. Foster parents should stay informed. Rules can change over time. It’s important to update knowledge regularly.

State-specific Tax Rules

Each state has its own normas fiscales for foster care payments. Some states may not tax these payments at all. Other states might have requisitos específicos you must follow. It’s important to check the state tax guidelines. This helps you know if you need to report these payments. Some states provide exenciones for foster care income. This means you might not pay taxes on it. It’s crucial to understand what your state requires. You can find this information on your state’s tax website. Always ensure you follow the right rules for your state.

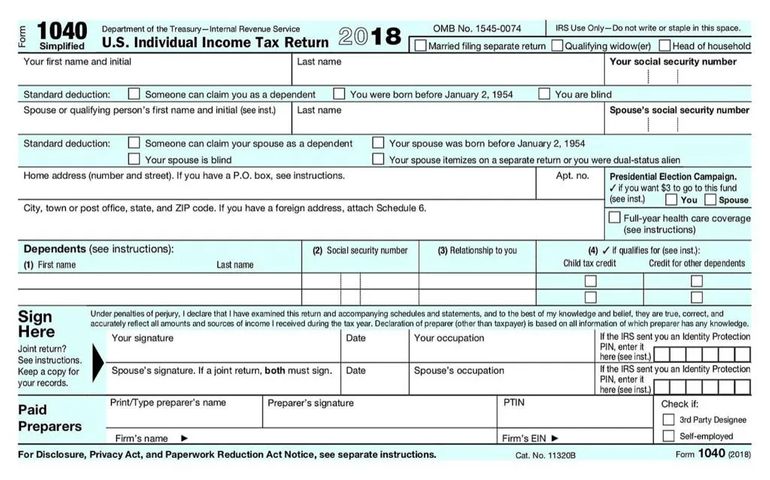

Filing Taxes With Foster Care Income

Foster care payments are often not taxed. They are seen as reimbursement. These payments cover the child’s care. El Servicio de Impuestos Internos (IRS) has rules for this. You must meet certain conditions. The child must be placed by a government agency. Or by an approved organization. You may need to file if the payments exceed certain limits. Always check IRS guidelines.

Tax credits might be available. You could qualify for the Child Tax Credit. Or the Earned Income Credit. These can reduce your tax. Always keep good records. They help if you are audited. Keep all documents safe and organized.

Conceptos erróneos comunes

Many people think foster care payments are taxable. This is often not true. Foster payments are usually not taxed. They help cover basic needs. The money is for food, clothing, and shelter. It’s not extra income for families. Foster care is not a job. It is a service to help children. Families get payments to support the child. These payments are often seen as reimbursement. Not as earnings. Some may worry about forms or taxes. But foster payments are often excluded. They are meant to assist, not to profit.

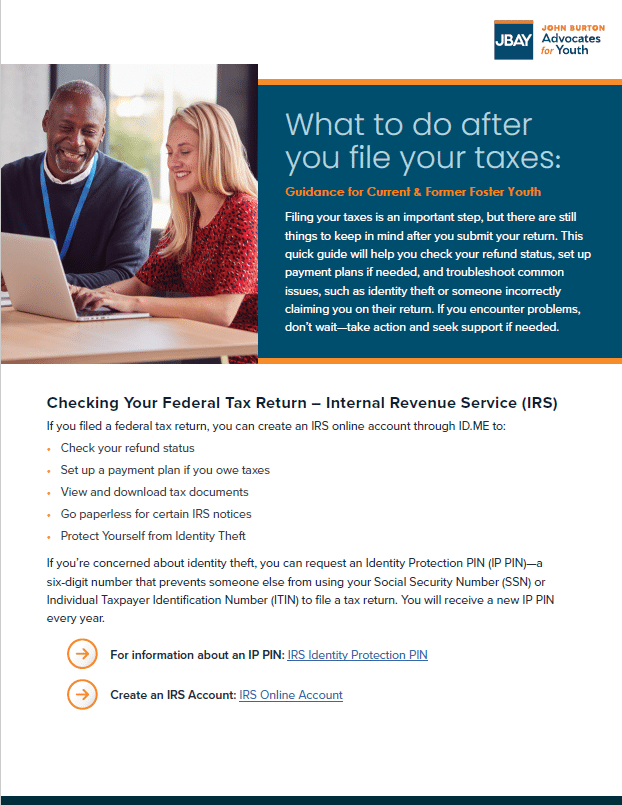

Buscando asesoramiento profesional

Foster care payments can be tricky with taxes. It’s smart to get help. A tax expert knows the rules well. They can explain if you need to report the payments. Some payments may not need reporting. Others might. Each situation is different.

Experts can guide you through the tax paperwork. They make sure you follow the rules. This way, you avoid mistakes. Mistakes can lead to trouble. You want to be safe and correct.

Finding a good expert is key. Ask them about their experience. Check if they have worked with foster payments before. This ensures they give the best advice.

Resources For Foster Parents

Foster care parents need apoyo y guía. Many resources are available. Help is essential for foster families. Support groups can help share ideas. Training programs offer valuable skills. Books and online guides provide tips. These resources make parenting easier.

Local organizations offer asistencia financiera. This helps families manage expenses. Foster parents should check eligibility. Some groups offer emotional support. This helps parents handle stress. Parenting is a big job. Every resource counts.

Foster parents can connect with other parents. Sharing experiences is helpful. Many parents join forums. These forums are useful for advice. Community centers offer events. These events build friendships. Foster care is a journey. Resources make the journey smoother.

Preguntas frecuentes

Do Foster Care Payments Need To Be Reported On Taxes?

Foster care payments are generally not taxable. They are considered reimbursements for the care provided. However, if you receive more than the foster care reimbursement rate, that excess amount may be taxable. Always consult with a tax professional for your specific situation.

Are Foster Care Payments Considered Income?

No, foster care payments are typically not considered taxable income. They are viewed as reimbursements for the cost of caring for a foster child. However, any payment beyond the standard foster care rate might be taxable. Always check with a tax advisor for your specific case.

Can Foster Parents Claim Foster Children As Dependents?

Yes, foster parents can sometimes claim foster children as dependents. The child must meet certain criteria, such as living with you for more than half the year. Additionally, you must provide over half of their support. Check the IRS guidelines or consult a tax professional for details.

Do Foster Care Payments Affect Tax Credits?

Foster care payments do not usually affect tax credits. However, claiming a foster child as a dependent might make you eligible for certain credits. These can include the Child Tax Credit or Earned Income Tax Credit. Always consult a tax professional to understand your situation better.

Conclusión

Understanding foster care payments and taxes is essential. Properly handling them ensures compliance. Always check current tax laws. They can change yearly. Consult a tax professional for personalized advice. This helps avoid mistakes. Remember, clear records are crucial. Keep all documents organized.

This makes filing easier. Foster care responsibilities are significant. So, financial clarity is key. It supports both caregivers and children. Making informed decisions benefits everyone involved. Stay updated and informed. It empowers you. And it secures your financial peace of mind.