¿Los pagos de cuidado temporal se consideran ingresos para cupones de alimentos?

Navigating the complexities of financial assistance programs can often feel overwhelming, especially when you’re juggling responsibilities at home. If you’re a foster parent, you might be wondering how different forms of income impact your eligibility for essential benefits like food stamps.

Specifically, you’re probably asking yourself: “Do foster care payments count as income for food stamps? ” This question is more than just a technical detail; it’s about ensuring that you and your foster child have access to the support you need without unnecessary hurdles.

Understanding how your foster care payments are classified could be the key to unlocking additional resources for your household. We’ll break down the rules and regulations in simple terms, so you can focus on what truly matters—providing a safe and nurturing environment for the children in your care. Stay with us as we delve into the nuances of food stamp eligibility and how it relates to your unique situation. Your peace of mind starts here.

Foster Care Payments Overview

Foster care payments help families care for children. These payments are not considered ingreso for food stamps. They are meant for the child’s needs. Families use this money for clothes, food, and school supplies. It supports the child’s well-being. The government provides these funds to help foster parents. This ensures children have what they need. Many families rely on these payments. They make a big difference for children in foster care. Understanding this helps families budget better. It’s important to know what counts as income. Foster care payments do not affect food stamp eligibility.

Eligibility For Food Stamps

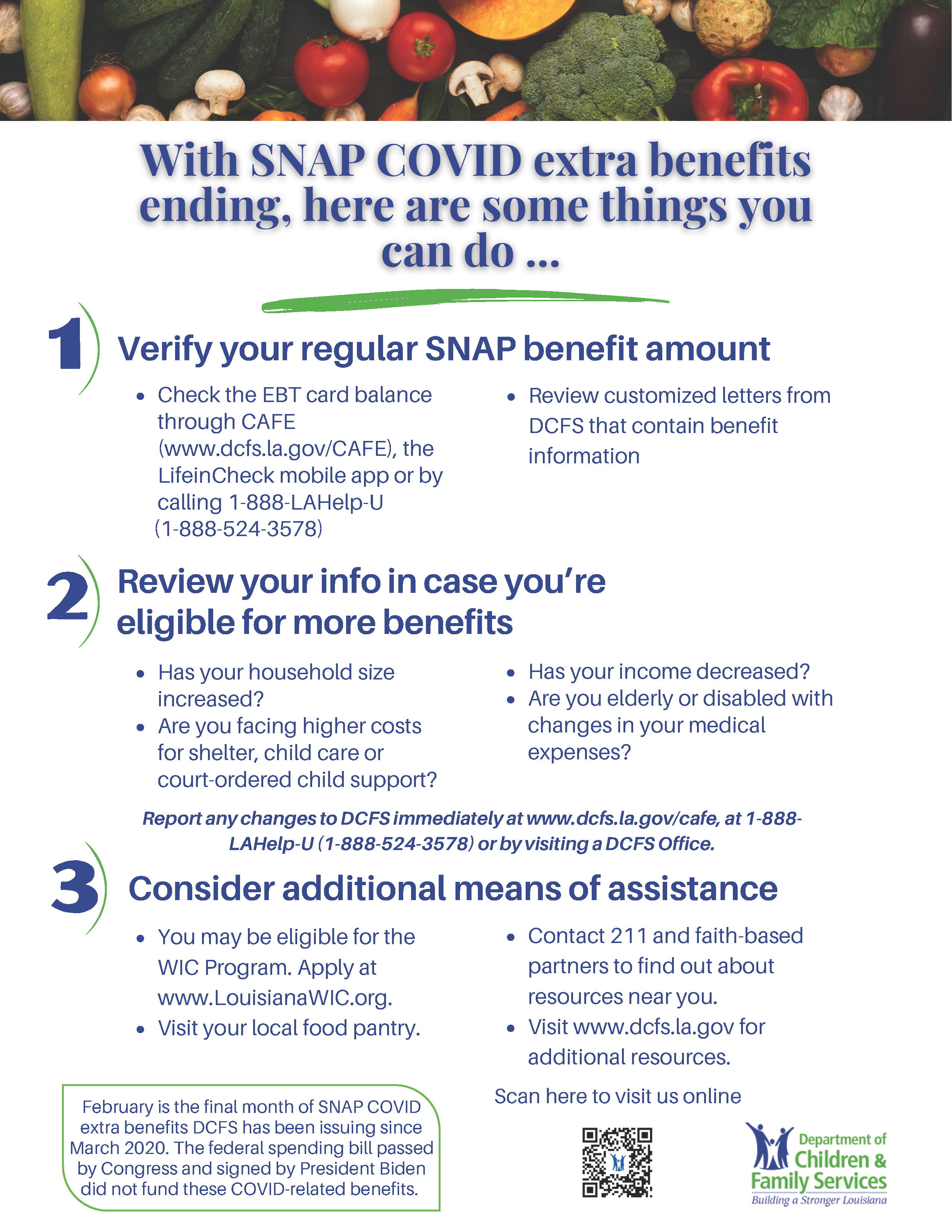

Food stamps help families buy food. Income limits decide who can get them. These limits are set by the government. Foster care payments are not always counted as income. Each state may have different rules. It’s important to check local guidelines. Families must report their income. This includes salaries, benefits, and other money received. Foster care payments can be excluded. This helps families get more support. Always check with local offices for details.

Household composition affects food stamp eligibility. It means who lives in your house. More people might mean more benefits. Each person adds to the household count. Foster children can be counted. This increases household size. Larger families may get more help. Report each member correctly. Include all children and adults. Foster children can be included in the count. This helps families in need. Always update household details as changes happen.

Foster Care Payments And Income

Income helps the government decide who gets food stamps. Wages, salaries, and business earnings are types of income. Government benefits and some gifts also count as income. People with low income can apply for help. They can get food stamps to buy food.

Foster care payments are for taking care of children. The government gives these payments to foster parents. Foster care payments do not count as income for food stamps. This means foster parents can still get food stamps if they need them. The goal is to help families take care of children without losing food aid. Families can use this support to buy food and other essentials.

State Variations

Each state has its own rules. Some states count foster care payments as income for food stamps. Others do not. This can affect how much help families get. It’s important to know your state’s policy. Families need to check their local rules.

Families should ask local offices. They can find out how foster payments are treated. Call or visit the office. Ask direct questions. This helps families understand their benefits. Local rules may change, so keep updated.

Impact On Benefits

Foster care payments might affect food stamp eligibility. These payments are not always counted as income. Some states exclude them from income calculations. This can help families keep their benefits. In certain cases, food stamps may still be reduced. It depends on the state’s rules.

Families need to understand the rules. Each state has different guidelines. Knowing these can help balance payments and assistance. Foster care payments are vital. They support the child’s needs. But, families must also manage their own finances. Careful planning is important. This ensures both the child and family receive support.

Filing And Reporting Tips

Keeping records is very important. Documents need to be clear and correct. Foster care payments have special rules. Follow them carefully. Food stamps need good documentation. Write down all the money received. This helps avoid problems later. Make sure all details are right. Mistakes can cause trouble.

Talking to experts can be helpful. They can give good advice. They know the rules well. Professional help ensures everything is correct. You can avoid mistakes with their help. It’s smart to ask questions. Experts can explain what you don’t understand. Their guidance is valuable.

Resources And Support

Foster care families need help. Government programs offer support. These programs help with food and money. Food stamps aid families in need. Non-profit groups also offer help. They give food and clothes. Volunteers often help, too. They work in food banks.

Local agencies provide details. They explain how to apply. Call them for more info. Some offer help online. Websites have guides. Guides explain steps. They show forms and addresses. Libraries can help find info. They have computers. Use them to search online.

Centros comunitarios host events. Events share support tips. Families meet and learn. Social workers attend. They offer advice and help. Ask questions there. Get help from people who care.

Preguntas frecuentes

Do Foster Care Payments Affect Food Stamps?

Foster care payments typically don’t count as income for food stamps. These payments are meant to cover the child’s needs, not household income. However, rules can vary by state. It’s important to consult local guidelines or a caseworker for specific details.

Are Foster Care Payments Taxable Income?

Foster care payments are generally not considered taxable income. They are intended for the child’s care, not as income for the foster parent. Always check with a tax professional or local authorities for the most accurate information.

How Are Food Stamps Calculated?

Food stamps, or SNAP benefits, are calculated based on household income and size. Foster care payments usually aren’t included in this calculation. Each state’s guidelines may differ, so consulting local resources is recommended for precise information.

Can Foster Parents Receive Food Stamps?

Yes, foster parents can apply for food stamps. Eligibility depends on household income and size, excluding foster care payments. State-specific guidelines may apply, so it’s advisable to check with local authorities for accurate information.

Conclusión

Understanding foster care payments and food stamps is essential. They impact your benefits. Foster care payments usually don’t count as income. This keeps your food stamp eligibility secure. Each state may have different rules. It’s wise to check local guidelines.

Always stay informed about changes. This helps in managing your benefits well. Seek advice from local agencies if unsure. They provide valuable insights and support. Proper knowledge helps make better decisions. Keep your information updated regularly. This ensures you maximize your available resources.

With clear understanding, you can navigate these systems confidently.