¿Puede reclamar los pagos de manutención infantil en sus impuestos?: Perspectivas fiscales

Navigating the complexities of taxes can be stressful, especially when you’re trying to figure out what you can and cannot claim. If you’re receiving child support payments, you might be wondering if these funds have any implications for your tax return.

Can you claim child support payments on your taxes? This question is crucial for many, impacting how you manage your finances and ensuring you maximize your tax benefits without any costly mistakes. Imagine the relief of knowing exactly how to handle child support payments in your tax filings.

Understanding this could save you time, money, and a lot of headaches. You’re not alone in seeking clarity on this issue, and we’re here to simplify it for you. We’ll break down the essentials, giving you clear, actionable information so you can approach tax season with confidence. Stick with us, and you’ll find answers that empower you to make informed decisions about your financial future.

Child Support Payments: Tax Basics

Child support payments are not deducible de impuestos for the payer. This means you can’t reduce your taxes by the amount you pay. These payments are also tax-free for the recipient. The recipient does not need to report them as income. This makes child support different from alimony payments. Alimony can affect taxes for both parties. It’s important to understand the tax rules for child support. This helps in planning your finances well. Knowing these basics can prevent any confusion during tax time. Always keep track of your payments and receipts. This ensures you have all needed records. It keeps everything clear and organized.

Defining Child Support

Child support is money paid by one parent to another. This money helps with the child’s needs. It covers things like food, clothes, and school supplies. Parents decide who pays child support. Usually, the parent without custody pays.

These payments are important for the child’s well-being. They make sure kids have what they need. Manutención infantil is not a gift; it’s a legal duty. Parents must follow the court’s decision on payments.

Child support payments cannot be claimed on taxes. They are not tax-deductible. The parent getting the money does not pay taxes on it. This is because child support is for the child’s benefit, not the parent’s income.

Tax Implications For Payors

Child support payments are not tax-deductible. Payors cannot deduct these payments. The IRS considers them personal expenses. Manutención infantil differs from other payments like alimony. Alimony may have tax implications, but child support does not.

Reporting child support on tax returns is unnecessary. The payor should not include it as income. Likewise, the recipient does not report it as income. This keeps tax matters simpler for both parties.

Clear records of all payments are important. Keep receipts or bank statements. These documents provide proof of payments. They can be useful in case of disputes or legal matters.

Tax Considerations For Recipients

Child support payments are not considered taxable income. Tax rules state that recipients do not pay taxes on these payments. Recipients do not report child support on their tax returns. Importante to note: child support and alimony are different. Alimony is taxable, but child support is not. This difference is crucial for tax filing. Tax laws make child support non-taxable for recipients. Comprensión this helps avoid tax errors. Siempre check with a tax professional if unsure. Clear understanding prevents confusion. Tax filing can be complex. Knowing the rules helps. Stay informed to manage taxes correctly. Knowledge is key to handling tax matters.

Child Support Vs. Alimony

Manutención infantil y alimony are two different things. Child support is money given for a child’s needs. Alimony is money for a spouse after a separation. They are not the same. Child support helps pay for food, clothes, and school. It is not for the parent. Alimony helps the spouse live like before. It is for rent, bills, and personal needs. Both are important. But they have different roles. Child support is not taxable. It is not income. Alimony used to be taxable. But not anymore. Since 2019, it changed. Now, it’s tax-free.

Impact On Tax Deductions

Child support payments are not tax-deductibleChild support payments are also not taxable

Reporting Requirements

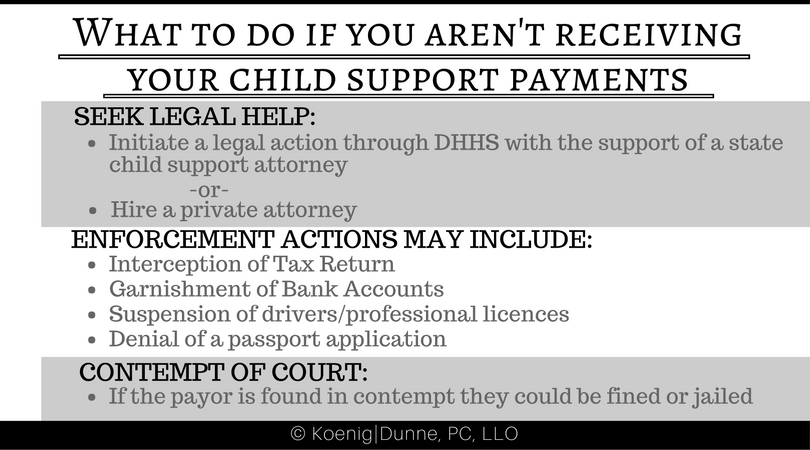

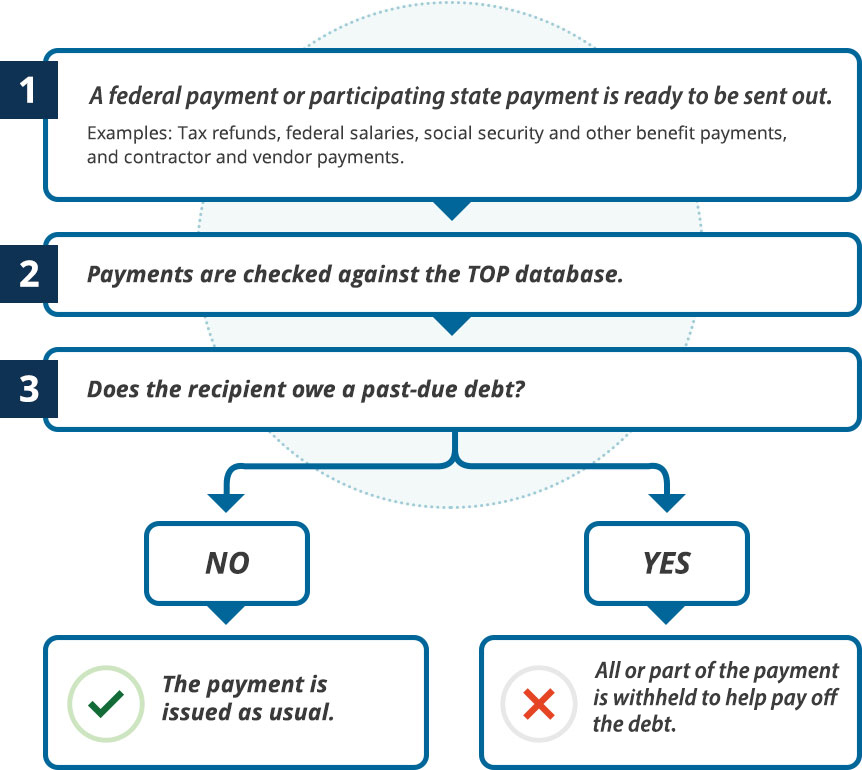

Child support payments are not tax-deductible for the payer. Also, they are not considered taxable income for the recipient. The IRS does not require these payments to be reported. These payments are seen as a personal expense. Unlike alimony, child support is handled differently. Alimony payments may be deductible for the payer. But child support does not follow the same rules. Tracking payments is still important for record-keeping. Accurate records help avoid disputes. Knowing the rules ensures peace of mind. Always consult a tax professional for advice. They provide guidance on complex situations. Laws can change, affecting tax decisions. Stay informed about any changes.

State-specific Regulations

Child support rules can change based on where you live. Each state has its own leyes about child support payments. Some states allow for certain beneficios fiscales. Others do not. Knowing your state’s rules is important. It helps when you prepare your taxes. Some states might let you deduct these payments. Most states do not. Always check with a tax expert in your area. They can give you the best advice. This ensures you follow the right rules. Avoid mistakes by seeking help. It makes tax time easier for everyone.

Errores comunes que se deben evitar

Many think child support is tax-deductible. It’s not. This is a common misunderstanding. Only alimony payments might qualify. It’s crucial to know the difference. Some parents forget this detail. They try to claim child support. This leads to errors on tax forms. These errors can cause penalties. It’s best to check the rules first. Tax rules change often. Keeping up is important. Misunderstanding can be costly. Ensure you have the right information. Always ask a tax advisor. Experts can help avoid mistakes. They know the latest updates. They offer guidance and support. Following their advice is wise. It saves time and money.

Buscando asesoramiento profesional

Consulting a tax expert can be very helpful. They know the normas and can offer guidance. Child support and taxes can be confusing. Experts can explain how it works. They help you understand what you can and cannot do. A good expert keeps you updated on changes. Laws change often, and experts stay informed. It’s important to know if you can claim child support payments. They also help with paperwork. Filling forms can be tricky, but experts make it easier. They ensure you don’t make mistakes. Wrong information can cause problems. Experts give you peace of mind.

Preguntas frecuentes

Are Child Support Payments Tax Deductible?

No, child support payments are not tax deductible. Payments are considered a personal expense. They do not qualify for any tax deductions. This applies to both federal and state tax returns.

Do You Pay Taxes On Child Support Received?

No, child support payments received are not taxable income. They do not need to be reported on your tax return. Child support is treated as a non-taxable income source.

Can Child Support Affect Tax Credits?

Child support payments do not affect tax credits. They are neither income nor deductions. Therefore, they do not impact eligibility for tax credits.

How Does Child Support Impact Dependency Claims?

Child support does not directly impact dependency claims. The custodial parent usually claims the child as a dependent. However, agreements can alter this standard rule.

Conclusión

Understanding child support and taxes can be tricky. Child support payments are not tax-deductible. Recipients do not count them as income. This simplifies tax filing for many. Always keep track of all financial documents. Consult a tax professional for personalized advice.

Laws can change, impacting your situation. Staying informed helps you make better decisions. It’s important to know your obligations and rights. Resources are available if you need help. Remember, proper planning eases financial stress. Make taxes less daunting by staying organized.

Your financial peace depends on it.