¿Puede alguien hacerse cargo de los pagos de mi RV?: Descubra las opciones

Are those RV payments starting to feel like a heavy burden? You’re not alone.

Many RV owners find themselves in a situation where continuing payments is no longer feasible. Whether it’s due to a change in lifestyle, financial strain, or simply a shift in priorities, the thought of someone else taking over those payments can be a tempting solution.

But is it possible? And if so, how can you make it happen smoothly and legally? We’ll explore the ins and outs of having someone else take over your RV payments. We’ll guide you through the necessary steps and crucial considerations, ensuring you’re well-equipped to make an informed decision. Stay with us as we unravel this financial puzzle, and discover how you can potentially ease your financial load.

Exploring Rv Payment Challenges

Owning an RV can be costly. Monthly payments can be a burden. Some owners struggle to keep up with these payments. Gastos inesperados like repairs add to the stress. Monthly insurance fees are another challenge. Missing payments can lead to penalties. The fear of losing the RV is real. Some people try to find someone to take over payments. This can relieve financial stress. It is important to find a trustworthy person. Agreements must be clear and legal. This ensures both parties are protected. Proper documentation is essential. It helps avoid misunderstandings. Seeking advice from financial experts can be helpful. They can guide on the best options. Talking to the RV company is also wise. They might offer solutions or advice. It’s crucial to stay informed about potential risks. Always read agreements carefully. This helps prevent future problems.

Transfer Of Ownership

Selling your RV can be a way to transfer ownership. You find a buyer who agrees to take over the payments. The buyer pays you for the RV. Then, they continue the pagos mensuales. It’s important to check the contrato de préstamo. Some lenders may not allow this. Always inform your lender. This ensures a smooth transfer. Getting help from a professional can be a good idea. They know the process well.

An assumable loan means someone else takes over your loan. They continue with the same terms. This can be easier than getting a new loan. Check if your loan is assumable. Not all loans are. The new owner must qualify for the loan. This means they must meet certain conditions. It’s a good option if you want to sell your RV quickly.

Lease Transfer Options

Lease assumption lets someone else take over your RV payments. First, contact your lender. Ask if they allow lease transfers. Some lenders may not. Others have strict rules. Next, find a qualified assignee. This person must meet the lender’s criteria. They should have a good credit score. Also, they must be willing to take on your payment plan.

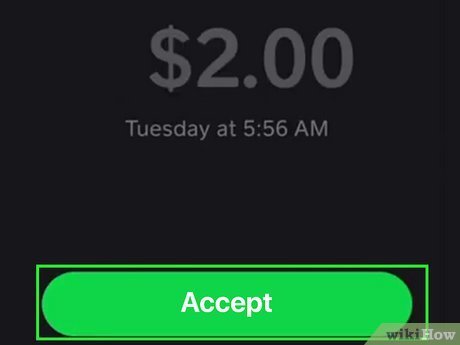

Once you find someone, both parties fill out an application. The lender reviews it. If approved, the assignee signs a new lease agreement. Finally, the lender transfers the lease to them. You are now free from the RV payments. But always read the contract. Ensure there are no hidden fees.

Finding the right person is crucial. Start by asking friends or family. They might know someone interested. Online forums and social media are good places too. Post an ad. Be clear about the Términos y condiciones. Include details about the RV. Mention the monthly payment amount. People need this information to decide.

Always meet potential assignees in person. Discuss their financial situation. Ensure they can handle the payments. Trust your instincts. Choose someone reliable. This will make the process smoother for both of you.

Subleasing The Rv

Thinking about subleasing your RV? Someone can take over your RV payments. This option helps manage costs while keeping your RV in use.

Consideraciones legales

Before subleasing your RV, check your loan agreement. Some loans may not allow subleasing. Contratos can have rules that prevent subleasing. Consulting a legal expert is wise. They can help understand legal terms. Revisar state laws on subleasing. Each state has its own rules. Ensure compliance with all legal requirements. Violating rules can lead to penalties. Protect yourself legally. Make sure you have proper insurance. Documento all agreements clearly. This avoids misunderstandings. Legal advice safeguards your interests. It’s important for safe transactions.

Pros And Cons

Subleasing an RV has benefits and drawbacks. Ventajas include sharing costs. It can reduce monthly payments. Extra income can help cover expenses. Contras involve risks. Renters may damage the RV. Confianza issues can arise with strangers. Seguro might not cover all damages. Responsibility for maintenance remains with you. Comprensión both sides is crucial. Make informed decisions. Weigh pros and cons carefully. Consider long-term impacts. Balance benefits with potential risks. It’s a big decision.

Refinancing The Rv Loan

Wondering if someone can take over your RV payments? It’s possible through loan assumption or refinancing. This option can relieve you from financial strain while transferring the responsibility to another party.

Lowering Monthly Payments

Refinancing can help lower your monthly payments. This process involves getting a new loan. The new loan pays off the old one. You might get a better interest rate. A better rate can make payments smaller. It’s important to compare different lenders. Some might offer better deals than others. Always check for any additional fees. These fees can add to your costs.

Extending Loan Terms

Extending the loan term means you pay for a longer time. This can reduce your monthly payment amount. But remember, you might pay more in total interest. It’s important to think about how long you plan to keep the RV. Longer terms mean smaller payments each month. But the loan takes more time to finish. Always weigh the pros and cons before deciding.

Seeking Financial Assistance

Credit counseling helps people manage their money. They teach smart spending. They guide on paying bills on time. Experts help in planning budgets. This support can prevent big money problems. Credit counselors give ideas to lower costs. They help you understand debts better. It’s important to ask them questions. They will explain things clearly. They are friendly and ready to help.

Debt consolidation means combining all debts into one. It makes paying easier. You pay one monthly bill instead of many. This can lower monthly payments. It might save money on interest. Talk to a bank or credit union. They can offer debt consolidation loans. These loans usually have lower interest rates. Always read the terms carefully. Ask about hidden fees. Make sure to understand everything before deciding.

Negotiating With Lenders

Payment Plan Adjustments can ease your RV payment worries. Lenders may offer new plans. These plans can lower monthly payments. You might pay less over a longer time. It’s important to talk to your lender. Ask about options they can provide. Some lenders are more flexible than others. They might change your payment dates. Or, they might offer temporary relief. Be honest about your financial situation. This helps lenders understand your needs.

Loan Modification Opportunities could be a solution. Lenders sometimes modify loan terms. This can make payments easier to handle. You might get lower interest rates. Or, they might extend the loan term. This can reduce monthly payments. Not all lenders will offer this. It’s crucial to ask about it. Prepare your financial documents. Show lenders why you need a change. This might help your case.

Exploring Rv Consignment

Consignment helps sell your RV without much hassle. You give your RV to a dealer. The dealer sells it for you. You keep the RV until it sells. The dealer handles advertising y paperwork. You pay a fee to the dealer. This fee comes after the RV sells. This way, you get rid of your RV payments easily.

Pick a dealer with good reviews. Ask friends for suggestions. Check the dealer’s license. A licensed dealer is safe. Visit the dealer’s location. See how they work. Talk to them. Make sure you understand their fees. Always read their contract. Ask questions if confused. This way, you find a good dealer.

Legal And Financial Implications

Transferring RV payments involves understanding legal and financial aspects. Proper documentation is crucial to avoid future disputes. Both parties should ensure credit checks and agree on terms before proceeding.

Impact On Credit Score

Allowing someone to take over your RV payments can affect your puntuación crediticia. Late payments might hurt your credit. Keeping track of payments is crucial. Make sure payments are on time. Missing payments can lower your score. A good credit score is important. It helps in future financial plans.

Legal Responsibilities

Legal responsibilities are crucial in this decision. You must review all legal papers. Understand the contract before agreeing. A contract holds legal power. It ensures both parties follow rules. Seek legal advice if uncertain. Lawyers can explain terms clearly. They help avoid legal troubles. Ignoring legal advice can be risky.

Preguntas frecuentes

Can Someone Legally Assume My Rv Loan?

Yes, someone can legally assume your RV loan. The process involves transferring the loan agreement to the new party. However, the lender must approve the new borrower. They will assess the new applicant’s creditworthiness. Ensure all paperwork is completed to avoid future issues.

Is It Easy To Transfer Rv Payments?

Transferring RV payments can be complex. It requires lender approval and legal documentation. The new borrower must qualify for the loan. It’s important to communicate with your lender. This ensures the process is smooth and straightforward.

What Are The Risks Of Someone Taking Over Payments?

There are risks if someone takes over your payments. If they default, you might be liable. Ensure the transfer is legally binding. Check the new borrower’s financial stability. Proper documentation can mitigate these risks.

How Can I Find Someone To Take Over Payments?

To find someone to take over payments, advertise in RV forums. Use online marketplaces and social media. Ensure interested parties meet lender requirements. Always verify their financial stability. Proper vetting can prevent future issues.

Conclusión

Exploring options for RV payment transfer can ease financial stress. Communicate clearly with potential buyers. Ensure all legal documents are correctly handled. Remember, honesty builds trust and smooth transitions. Potential buyers need clear information about your RV’s condition and terms.

Consider seeking advice from financial experts. They can guide you through the process. Always review agreements carefully. This protects both parties involved. Taking these steps makes payment transfer straightforward. Stay informed and proactive. Successful transfer of RV payments is achievable.

Your diligence ensures a positive outcome for everyone.