¿Puedo usar Cash App para transferirme dinero?

Probablemente te estés preguntando si puedes usar Aplicación de efectivo a transferir dinero a ti mismo, y la respuesta es sí. Pero antes de empezar, es crucial comprender el proceso y cualquier posibles implicacionesTransferirte dinero a ti mismo con Cash App es similar a enviarle dinero a otra persona: deberás ingresar tus datos como destinatario y especificar el monto. Pero ¿qué hay de las comisiones? riesgos de seguridad¿Y vincular varias cuentas? Si está considerando usar Cash App para autotransferencias, le conviene saber más sobre estos factores para garantizar un uso eficaz del servicio.

Transferencia de dinero entre cuentas

Cuando lo necesites mover fondos de una cuenta de Cash App a otra, puede hacerlo de manera rápida y sencilla, y lo guiaremos a través del proceso. Para transferir dinero Entre cuentas, deberá tener ambas cuentas vinculadas a la misma dirección de correo electrónico o número de teléfono. Luego, puede usar la función "Pagar" para enviar dinero de una cuenta a la otra. Simplemente ingrese el... dirección de correo electrónico del destinatario o número de teléfono, elige la cantidad que deseas transferir y confirmar la transacciónLos fondos estarán disponibles al instante en la cuenta del destinatario. Asegúrate de verificar la información del destinatario para evitar errores. Con Cash App, transferir dinero entre cuentas es muy sencillo. proceso sencillo y seguro.

Cómo funciona Cash App

Para comprender los pormenores de Aplicación de efectivoVeamos más de cerca su funcionamiento, empezando por lo básico para enviar y recibir dinero a través de la plataforma. Al registrarte en Cash App, vincularás una tarjeta de débito. tarjeta de crédito, o cuenta bancaria a su cuenta. Esta fuente de financiación se utiliza para enviar dinero a los demás, y también es donde tú recibir dinero Te lo enviamos. Para enviar dinero, ingresa la dirección de correo electrónico, el número de teléfono o el nombre de usuario de Cash App del destinatario, y la cantidad que deseas enviar. El destinatario recibe una notificación y los fondos se depositan en su cuenta de Cash App. También puedes solicitar dinero a otras personas mediante un proceso similar.

Configuración de varias cuentas

Puedes tener varias cuentas de Cash App, pero cada cuenta debe estar vinculada a una dirección de correo electrónico única o número de teléfono y tener un cuenta bancaria separada o tarjeta de débito como fuente de financiación. Esto es esencial. medida de seguridad Para evitar el acceso no autorizado y garantizar la seguridad de sus transacciones. Configurar varias cuentas puede ser útil si desea mantener separadas sus finanzas personales y comerciales, o si administra las finanzas de un familiar. Para crear una cuenta adicional, deberá seguir el mismo proceso. proceso de registro Al igual que con tu primera cuenta, usa una dirección de correo electrónico o un número de teléfono diferente. Asegúrate de seguir las mismas prácticas de seguridad para cada cuenta.

Vinculación de cuentas bancarias a Cash App

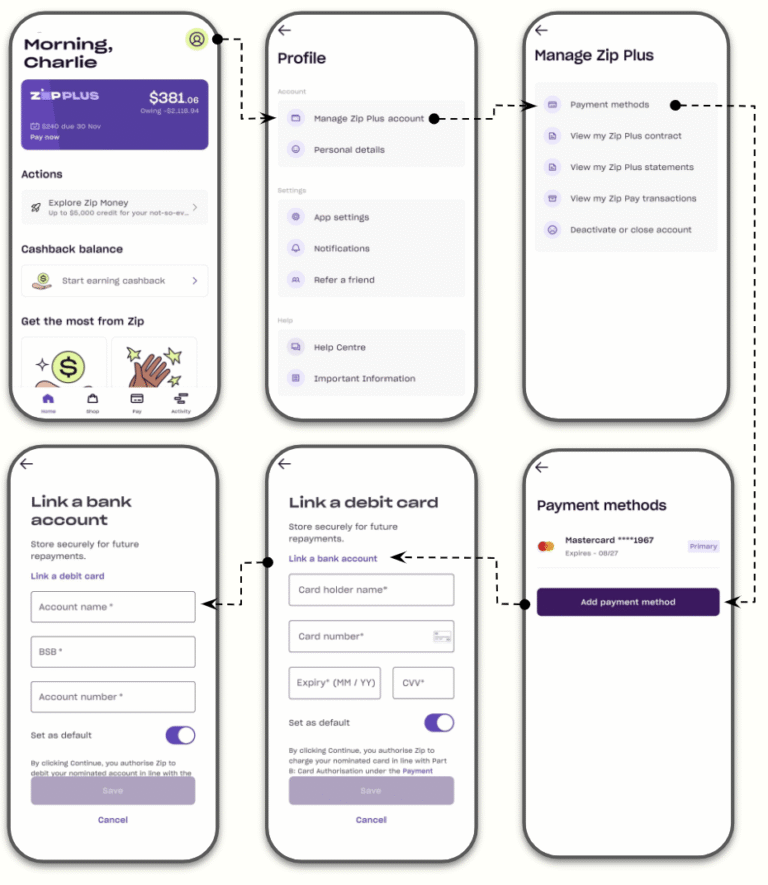

Vincular una cuenta bancaria a Aplicación de efectivo es un proceso sencillo que permite depósitos directos y permite transferencias sencillas entre tu banco y tus cuentas de Cash App. Para ello, ve a la pestaña "Banca" en la pantalla de inicio de Cash App y selecciona "Banco de enlaces," y luego elija su banco de la lista de opciones disponibles. Si su banco no está en la lista, puede ingresar manualmente la información de su banco. Es posible que se le solicite iniciar sesión en su cuenta bancaria en línea o proporcionar los datos de su cuenta bancaria. Una vez que su cuenta esté vinculada, deberá verificarlo, lo cual puede tardar unos días. Después de la verificación, puedes... transferir fondos entre su cuenta bancaria y su cuenta Cash App de forma segura y sencilla.

Enviándose dinero a sí mismo

Además de enviar dinero a otros, Aplicación de efectivo También permite a los usuarios transferir fondos entre sí en diferentes cuentas o métodos de pago, lo que facilita mover dinero a donde se necesita. Puedes envíate dinero a ti mismo de una cuenta de Cash App a otra, o de su cuenta de Cash App a su cuenta bancaria vinculada o tarjeta de débito. Esta función es útil cuando necesitas transferir dinero de una cuenta a otra o quieres depositar fondos en una nueva. Para enviarte dinero a ti mismo, simplemente sigue los mismos pasos que para enviar dinero a otra persona, pero ingresa tu información como destinatario. Cash App plataforma segura garantiza que sus transacciones estén protegidas y se completen rápidamente.

Recibir dinero de ti mismo

Recibir dinero de uno mismo a través de Cash App es básicamente la contrapartida de enviarse dinero a uno mismo, ya que los fondos llegan a la cuenta de destino con la misma rapidez y seguridad. Aquí hay algunos aspectos a tener en cuenta al... recibir dinero de ti mismo:

- Obtendrás un notificación cuando llegan los fondos en tu cuenta.

- El dinero será disponible para uso inmediato, ya sea que desee enviarlo a otra persona, invertirlo o retirarlo.

- Recibir dinero de ti mismo No requiere ninguna tarifa adicional (más allá de lo que ya está asociado con la transferencia).

- Los fondos se depositarán en su cuenta Saldo de Cash App.

Tarifas de transferencia de Cash App

Ahora que sabes cómo funciona recibir dinero de ti mismo, probablemente te estés preguntando cuánto costará mover tu dinero, que es donde entra en juego Cash App. tarifas de transferencia Adelante. Cash App cobra una tarifa de transferencia de 1.5% por depósitos instantáneos en su tarjeta de débito o cuenta bancaria. Sin embargo, no hay cargos por depósitos estándar, que tardan entre uno y tres días hábiles. Además, si recibe dinero a través de depósito directoNo hay comisiones por transferencia. Es importante tener en cuenta que estas comisiones solo se aplican al transferir fondos desde Cash App a otra cuenta. Al enviar o recibir dinero dentro de Cash App, no hay comisiones por transferencia. Esto te ayudará a planificar y calcular las posibles comisiones al administrar tus finanzas.

Riesgos potenciales de seguridad involucrados

Su Seguridad de la cuenta de Cash App es esencial, y hay varias riesgos potenciales Debes tener en cuenta esto para mantener tu dinero e información personal seguros. Al transferirte dinero a ti mismo, asegúrate de proteger tu cuenta de posibles amenazas. Estos son algunos riesgos de seguridad potenciales que debes tener en cuenta:

- *Estafas de phishing*: Los estafadores pueden intentar engañarlo para que revele sus credenciales de inicio de sesión u otra información confidencial.

- *Acceso no autorizado*: Si alguien obtiene acceso a su cuenta, podría transferir dinero sin su conocimiento.

- *Malware y virus*: El software malicioso podría comprometer la seguridad de su cuenta.

- *Riesgos del Wi-Fi público*: Usar Wi-Fi público para acceder a tu cuenta de Cash App podría poner en riesgo tu información.

Alternativas al uso de Cash App

Si estás buscando otras formas de transferir dineroExisten varias alternativas al uso Aplicación de efectivo que ofrecen servicios similares, a menudo con sus propias características y beneficios únicos. Quizás quieras considerar... PayPal, que le permite enviar y recibir dinero a nivel mundial. Venmo es otra opción, especialmente si estás transfiriendo dinero a amigos o familiares. Zelle También es una excelente opción si quieres transferir dinero directamente desde tu cuenta bancaria. Por otro lado, Google Pay y Apple Pay ofrecen una forma cómoda y segura de enviar y recibir dinero con tu smartphone. Cada una de estas alternativas prioriza la seguridad y ofrece diversas funciones, como cifrado y autenticación de dos factores, para proteger tus transacciones. Vale la pena explorarlas si buscas más opciones.