¿Puedo transferir dinero de Cash App a Chime?

You've probably spent an eternity wondering if you can transferir dinero from Cash App to Chime – a million years, give or take. But the answer is surprisingly simple: yes, you can. By linking your Chime bank account to Cash App, you'll be able to move funds with ease. But, there are a few requirements and steps you need to follow to make it happen. You'll have to navigate to the "Cuentas vinculadas" section, add your Chime account details, and verificar la información. And that's where things can get a little tricky…

Chime Compatibility With Cash App

Because Chime offers a full-fledged bank account con un número de ruta y de cuenta, you can link it to Cash App as a payment method. This compatibility allows you to transferir fondos from Cash App to Chime. You can consider Chime as a bank account within the Cash App platform, enabling you to initiate depósitos directos and transfers. From a technical standpoint, this integration relies on standard banking protocols, such as ACH (Automated Clearing House) transfers, ensuring transacciones seguras. By linking your Chime account to Cash App, you're fundamentally treating Chime as an external bank account, which facilitates the transfer process. This functionality provides Chime users with a convenient and secure way to receive and manage their funds within the Cash App ecosystem.

Requirements for Transferring Funds

Para iniciar una transferir de Aplicación de efectivo to Chime, you'll need to meet certain requirements, including having a verified Cash App account and a linked Chime bank account. Your Cash App account must be in buena reputación, meaning it can't be suspended, restricted, or have any outstanding issues. Additionally, your Chime account must be eligible to receive transfers. You can check your Chime account's eligibility by contacting Chime's servicio al cliente or checking their website. You'll also need to verify that the recipient information is accurate and up-to-date. If you've met all these requirements, you can proceed with the transfer. It's important to note that Cash App may request additional information or verification steps to guarantee the transfer is secure.

Configuración del depósito directo

Once you've met the requirements for transferring funds, setting up depósito directo de Aplicación de efectivo to Chime involves linking your Cuenta de Chime to Cash App's direct deposit feature. You'll need to access Cash App's direct deposit settings, typically found within the app's banking or account options. Look for a section labeled 'Direct Deposit' or 'Get Direct Deposit Form' and follow the in-app instructions. Next, you'll be prompted to enter your Chime account details, which can be found on the Chime mobile app or your Chime debit card. Accuracy is key when entering this information to guarantee a smooth deposit process. By linking your Chime account to Cash App's direct deposit feature, you can securely transfer funds and set up recurring deposits.

Connecting Chime to Cash App

Vinculando tu Cuenta de Chime a Aplicación de efectivo involves adding your Chime debit card or bank account to Cash App's cuentas vinculadas list. To connect your Chime account, you'll need to open the Cash App, navigate to the 'Linked Accounts' or 'Banking' section, and select 'Agregar banco' or 'Add Card.' You'll then be prompted to enter your Chime debit card details or log in to your Chime bank account through Cash App's secure portal. After verifying your account, you can confirm the connection. Make sure to double-check your account details for accuracy and verify you're using a conexión segura a Internet to protect your financial information. Once linked, you can manage your accounts and settings as needed.

Transferencia de dinero entre cuentas

When you're ready to move funds, transferring money from Cash App to Chime involves a few straightforward steps that can be completed within the Cash App. First, verify your Chime account is linked to your Cash App. Then, navigate to the 'Banking' tab and select 'Transfer.' Choose your Chime account as the destination and enter the transfer amount.

| Método de transferencia | Tiempo de transferencia | Tarifa de transferencia |

|---|---|---|

| Transferencia instantánea | Inmediato | 1,5% de importe de transferencia |

| Transferencia estándar | 1-3 días hábiles | Gratis |

| Transferencia manual | 1-3 días hábiles | Gratis |

Carefully review your transfer details before confirming the transaction. If everything looks correct, tap 'Confirm' to initiate the transfer. Cash App will handle the rest, and your funds will be on their way to your Chime account.

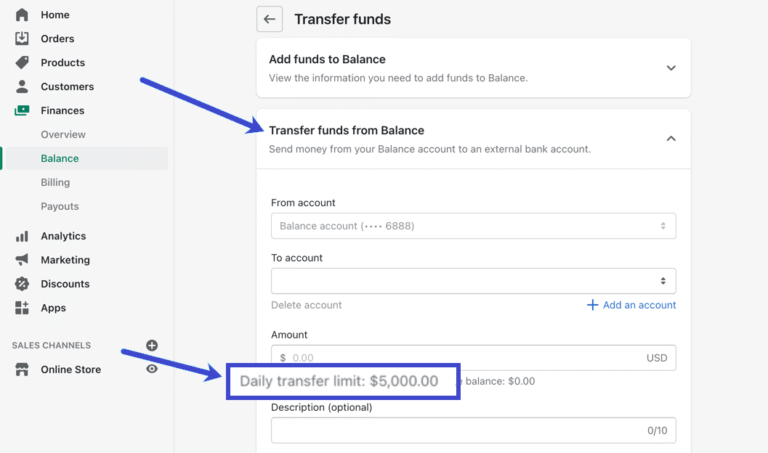

Límites y restricciones de transferencia

How much can you transfer from Aplicación de efectivo a Repicar, and are there any restrictions you should be aware of? When transferring money from Cash App to Chime, you should know that Cash App has a límite de envío semanal of $7,500. Chime, on the other hand, has a límite de recepción diario of $10,000 and a monthly receiving limit of $25,000. If you try to transfer an amount exceeding these limits, the transaction will be declined. Additionally, if your account is new or you're making an unusually large transfer, Cash App or Chime may flag the transaction for security review. To avoid any issues, verify your accounts are verified and the recipient information is accurate. Always review the limits before making a transfer.

Tarifas y cargos potenciales

In addition to transfer limits, you'll want to contemplate the potential fees associated with transferring money from Cash App to Chime, as both services may charge fees under certain circumstances. To minimize surprise charges, it's vital to understand the fee structures of both Cash App and Chime.

| Tipo de tarifa | Aplicación de efectivo | Repicar |

|---|---|---|

| Tarifa de transferencia | 0% – 1.5% | $0 |

| Tarifa de retiro de cajero automático | $2 | $0 |

| Monthly Maintenance Fee | $0 | $0 |

| Overdraft Fee | $0 | $0 |

Reviewing the fee structures of both services will help you make informed decisions about your money transfers. Be aware that fees are subject to change, so it's important to check the Cash App and Chime websites for the most up-to-date information.

Transfer Processing Timeframe Details

Entendiendo el transfer processing timeframe is essential to managing your finances effectively, as it affects when the funds will be available in your Chime account after being transferred from Cash App. The processing time for transfers from Cash App to Chime can vary. Typically, it takes 1-3 días hábiles for the funds to be deposited into your Chime account. However, this timeframe may be affected by factors such as weekends, holidays, or technical issues. It's also important to note that Cash App usually processes transfers immediately, but Chime may hold the funds for a short period to verificar la transacción. You'll receive a notification from Chime once the funds are available in your account. Be sure to check your account regularly to confirm the status of your transfer.

Solución de problemas comunes de transferencia

Several common issues can arise when transferencia de dinero from Cash App to Chime, and identifying the cause is essential to resolving the problem efficiently. You may encounter errors if your internet connection is unstable or if the Cash App or Chime servers are experiencing technical difficulties. Verify you've entered the datos del destinatario correctly and that your accounts are linked properly. Also, check if your transfer exceeds the límites diarios set by either service. If issues persist, you can contact Cash App or Chime support for assistance. Be cautious of estafas de phishing and never reveal your account information to unauthorized parties. By being aware of these common issues, you can take steps to prevent them and complete your transfers securely.