¿Puedo realizar pagos de mis impuestos estatales de Georgia? Guía simplificada

Are you feeling overwhelmed by your Georgia state taxes and wondering if you can make payments instead of paying it all at once? You’re not alone.

Many people in Georgia face the same challenge each tax season. The good news is, there are options available for managing your tax payments without breaking the bank. We’ll explore how you can make payments on your Georgia state taxes, making the process less daunting and more manageable.

By the end of this read, you’ll not only feel more informed but also more empowered to tackle your tax obligations with ease. Dive in, and let’s simplify your tax payment process together.

Georgia State Tax Payment Options

Paying Georgia state taxes online is quick and easy. Use the Georgia Tax Center website. Create an account or log in. Follow the steps to make a payment. Choose tarjeta de crédito o transferencia bancaria. Confirm your payment. It’s safe and fast. You will get a receipt.

You can mail your tax payments. Write a check to the Georgia Department of Revenue. Incluye tu tax ID number on the check. Send it with your payment voucher. Use the address on the voucher. Make sure your mail has enough postage. Keep a copy for your records.

Visit the local tax office in Georgia. Find the nearest Department of Revenue location. Bring your payment and tax form. Pay by dinero, check, o tarjeta de crédito. Staff will help you with your payment. Get a receipt for your payment.

Electronic Payment Systems

Georgia Tax Center helps pay state taxes easily. Crear una cuenta first. After that, acceso to access your tax information. The site lets you see amounts due and payments made. Choose the método de pago that suits you best. Options include bank account transfers o pagos con tarjeta de crédito. Follow the steps to complete your payment. All details are saved for future reference. The system is seguro y confiable.

Use third-party processors to pay Georgia state taxes. PayPal is one option. Another choice is Visa o MasterCard. These platforms offer secure transactions. They also provide receipt confirmations. Some may charge a small fee for their service. Always check fees before you pay. Follow instructions provided by each processor. Complete your payment with ease and confidence.

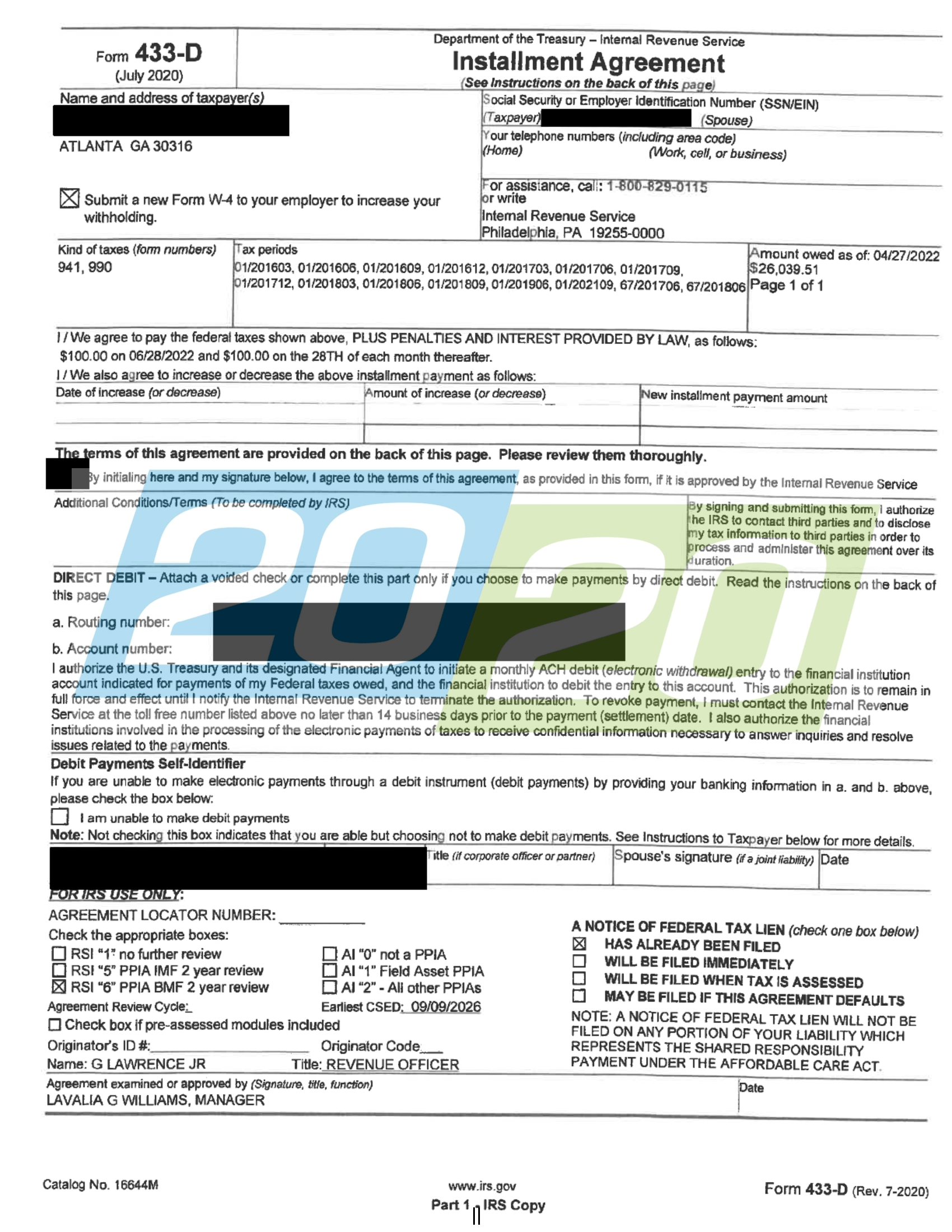

Payment Plans And Installments

To be eligible for a payment plan, you must owe state taxes. Your tax return must be filed on time. The amount owed should be above a certain limit. Some taxpayers may not qualify for all plans. Eligibility depends on individual circumstances.

Start by contacting the Georgia Department of Revenue. They will guide you through the steps. Complete a form with your details. Submit the form online or by mail. Wait for approval of your application. Once approved, start making pagos mensuales.

Interest applies to unpaid taxes. It is calculated monthly. Penalties may apply for late payments. Paying on time avoids additional costs. Over time, interest can add up. It is best to pay as soon as possible.

Tax Payment Deadlines

Georgia tax returns are due by April 15 each year. Filing on time is very important. Late filing can lead to penalties. Ensure all documents are ready before the deadline.

Quarterly payments help manage tax amounts. Payments are due in April, June, September, and January. Each quarter has a specific due date. Pay on time to avoid extra charges.

Extensions give extra time to file taxes. Request an extension if needed. Late payments can have extra fees. It’s best to pay by the due date.

Problemas comunes de pago

Sometimes, paying taxes online can be hard. Websites may crash or load slow. You may see error messages that confuse you. It is important to stay calm. Try refreshing the page or using another browser. Double-check your internet connection. If problems continue, contact support for help.

Payment reversals can happen if details are wrong. If you enter incorrect bank or card details, the payment may fail. Always check information before sending. Keep a copy of the payment receipt. This helps in fixing any issues that arise. Reach out to the tax office if a reversal occurs.

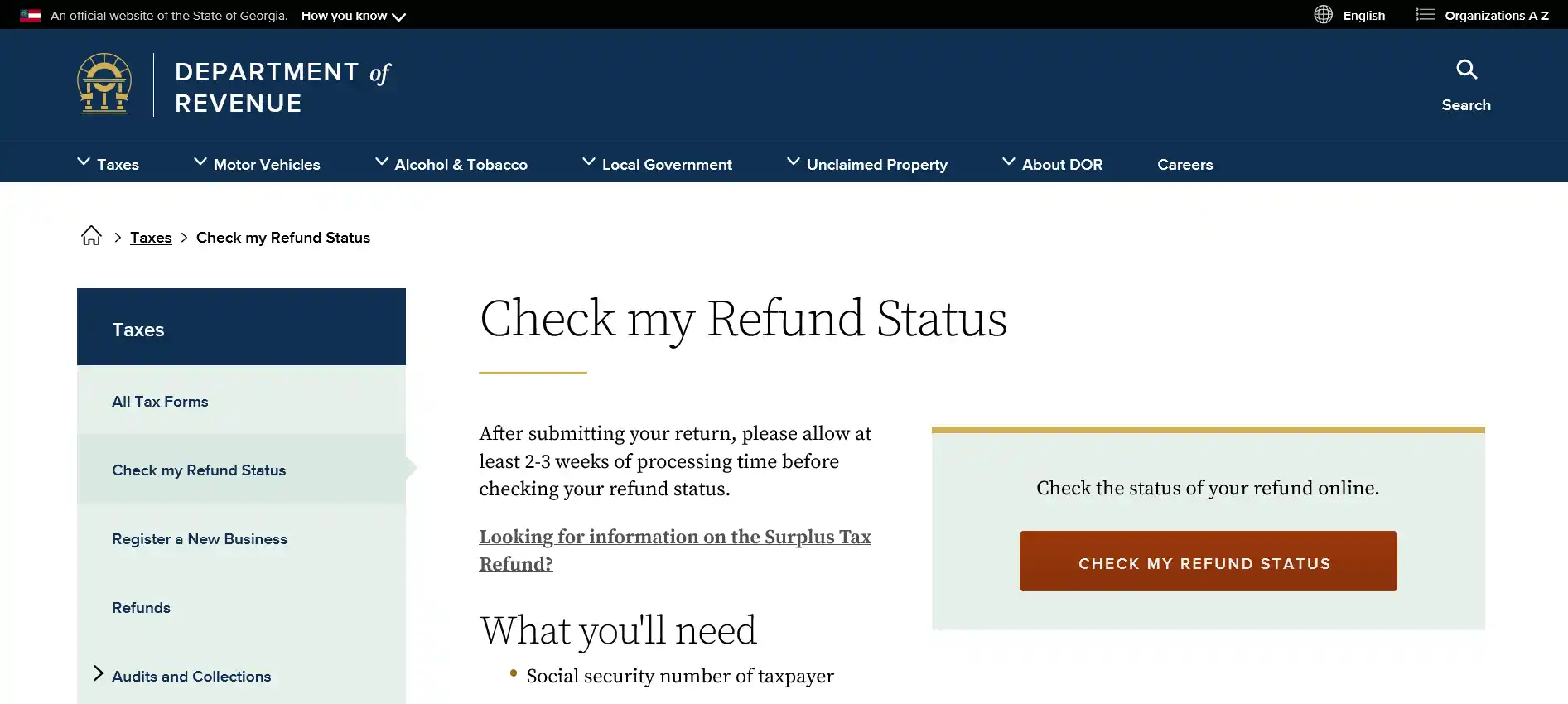

Overpaying taxes is common. It can occur by mistake or misunderstanding. If you pay too much, don’t worry. Contact the tax office to discuss refunds. Have your payment details ready. They will guide you on how to get your money back. Ensure to correct errors to avoid future overpayments.

Contacting Georgia Department Of Revenue

Georgia Department of Revenue offers several ways to get help. You can call their línea de atención al cliente. They also have an email support for questions. Online chat is another choice. It’s fast and easy. All these options are available during office hours. Make sure to have your tax information ready when you contact them.

The department has a Sección de preguntas frecuentes on their website. It answers many common questions about taxes. You can find info on métodos de pago. The section explains filing dates y sanciones. These FAQs are updated regularly. They help you solve issues without calling.

There are many local offices in Georgia. Each office has trained staff ready to help. You can visit these offices in person. Office locations are listed on the website. Check the opening hours before visiting. It’s wise to call ahead and book an appointment.

Preguntas frecuentes

How Do I Pay Georgia State Taxes Online?

You can pay Georgia state taxes online via the Georgia Tax Center. It offers a secure platform for payments. You’ll need your account information to proceed. The process is simple and efficient, ensuring timely payments.

Can I Set Up A Payment Plan For Georgia Taxes?

Yes, Georgia allows payment plans for state taxes. You can arrange an installment agreement online. This helps manage your tax liability more effectively. Ensure you comply with all terms to avoid penalties.

What Methods Are Available For Georgia Tax Payments?

Georgia accepts several payment methods for state taxes. You can use credit/debit cards, bank transfers, or checks. Online payments are often the quickest and most convenient. Select the method that best suits your needs.

Are There Penalties For Late Georgia Tax Payments?

Yes, late payments incur penalties and interest in Georgia. It’s crucial to pay on time to avoid extra charges. Penalties can accumulate, increasing your total tax liability. Always aim to meet payment deadlines.

Conclusión

Georgia offers flexible tax payment options. This helps manage your finances better. You can explore installment plans. These make payments easier over time. Contact the Georgia Department of Revenue for guidance. They provide detailed information and support. Remember to keep track of deadlines.

Timely payments prevent penalties and interest. Using these options can ease financial stress. Managing taxes doesn’t need to be overwhelming. With proper planning, you can stay on top of your obligations. Stay informed and proactive. This ensures a smoother tax experience in Georgia.