¿Puedo cambiar mi tarjeta Visa a Mastercard?: Guía sencilla

Are you considering switching from a Visa card to a Mastercard? You’re not alone.

Many people find themselves asking this very question. Whether it’s for better rewards, lower fees, or simply a desire for change, knowing your options is crucial. We’ll explore everything you need to know about making the switch. You’ll discover the benefits of Mastercard, the process of changing your card, and tips to make the transition smooth.

Don’t miss out on valuable information that could enhance your financial experience. Keep reading to find out how you can make the best choice for your wallet.

Reasons To Switch Between Visa And Mastercard

Choosing between Visa and Mastercard can be tough. Each card offers unique benefits. Understanding these benefits helps you make a smart choice. Here are some reasons to consider switching.

Wider Acceptance

Mastercard is accepted in more places worldwide. Traveling abroad? You may find Mastercard more useful. Visa also has broad acceptance, but Mastercard leads in some regions.

Programas de recompensas

Different cards offer different rewards. Mastercard often has cashback or travel rewards. Visa also has rewards but may not match Mastercard’s options. Check the rewards that suit your spending habits.

Características de seguridad

Both cards offer solid security. Mastercard provides features like zero liability protection. Visa also offers fraud protection but may differ in coverage. Compare their security measures before switching.

Tarifas y cargos

Fees can vary widely between the two. Mastercard may have lower foreign transaction fees. Visa might charge annual fees that are higher. Always read the terms before making a choice.

Servicio al cliente

Customer service quality matters. Mastercard often gets positive reviews for support. Visa also has reliable service but may differ by issuer. Research customer feedback for both options.

Credit: support.anydesk.com

Key Differences Between Visa And Mastercard

Understanding the key differences between Visa and Mastercard can help you make informed choices about your payment options. Both brands are widely accepted and offer various benefits, but they cater to different needs. Knowing these distinctions can enhance your financial decisions.

Acceptance And Reach

Visa and Mastercard are both globally recognized. However, they have varying acceptance rates in some regions.

- Visa is often more accepted in certain countries.

- Mastercard may offer better deals in others, especially with specific merchants.

It’s wise to check acceptance before traveling. You don’t want to find out your card isn’t accepted at your destination.

Recompensas y beneficios

Both Visa and Mastercard offer rewards programs, but they differ in structure and availability.

- Visa often provides more options through its various card types.

- Mastercard frequently teams up with specific retailers for exclusive offers.

Consider your spending habits. Do you shop more at certain stores? That could sway your choice.

Características de seguridad

Security is a top priority for both brands. They offer robust fraud protection, but there are slight variations.

- Visa has its Zero Liability policy, which protects you from unauthorized charges.

- Mastercard offers similar protections with its Identity Theft Protection service.

Feeling secure while using your card is essential. Which features matter most to you?

Tarifas y cargos

Card fees can vary based on the issuer, not just the card network. However, you can find trends.

- Visa cards may have lower annual fees on average.

- Mastercard can have higher fees, especially on premium cards.

Review your budget. Are you comfortable with the potential fees associated with your choice?

In the end, understanding these differences helps you choose a card that fits your lifestyle. Are you ready to make the switch?

Steps To Change Your Visa Card To Mastercard

Changing your Visa card to a Mastercard can be simple. Follow these steps to make the switch smoothly. Each step is important for a successful change.

Contacting Your Bank Or Card Issuer

Your first step is to call your bank. Ask about switching to a Mastercard. Speak with a customer service representative. They will guide you through the process. Take note of their advice and any required documents.

Checking Eligibility For A New Card

Next, check if you qualify for a Mastercard. Each bank has specific rules. They may look at your credit score and account history. Make sure you meet these requirements before applying. This step saves time and helps avoid issues.

Understanding Fees And Charges

Before submitting your application, learn about any fees. Some banks charge for card changes. Others may have annual fees for the new card. Knowing these costs helps you make an informed decision.

Submitting The Application

Now, it’s time to apply for the Mastercard. Fill out the application form carefully. Ensure all details are correct. Submit the application and wait for approval. Your bank will contact you once the process is complete.

What Happens To Your Old Visa Card

Changing from a Visa card to a Mastercard raises questions. One main concern is what happens to your old Visa card. Understanding the process can ease your worries.

Deactivating The Old Card

Deactivating your old Visa card is the first step. Contact your bank or card issuer to request cancellation. They will guide you through the process.

Keep in mind, do not just cut the card without informing them. This may lead to issues with outstanding transactions.

Manejo de saldos pendientes

What about any outstanding balances? Your balance will remain on your Visa card until paid off. You must continue to make payments as usual.

Check with your bank on how to transfer or manage the balance. Some banks may offer options to simplify this process.

Updating Linked Accounts

Updating your linked accounts is crucial. Many services use your Visa card for payments. Make a list of all accounts connected to your card.

Log into those accounts and change the payment method to your new Mastercard. This ensures no missed payments or service interruptions.

Factors To Consider Before Switching

Thinking about changing your Visa card to a Mastercard? Many factors can affect your decision. It’s important to weigh your options carefully. Each card type has its own features. Understanding these will help you choose the right card.

Recompensas y beneficios

Rewards programs differ between Visa and Mastercard. Some cards offer cash back, travel points, or discounts. Check which rewards interest you the most. Look at annual fees tied to these programs. A card with great rewards may not be worth it if fees are high.

Acceptance Around The World

Both Visa and Mastercard are widely accepted. However, some places prefer one over the other. Research where you plan to use your card. If you travel often, this could matter a lot. Make sure your choice will work globally.

Credit Limits And Interest Rates

Credit limits can vary between Visa and Mastercard. Some cards may offer higher limits. Interest rates can also differ. Compare rates before making a switch. A lower rate can save you money over time. Consider your spending habits too.

Credit: www.ally.com

Alternatives To Switching Cards

Changing from a Visa card to a Mastercard might not be necessary. There are several other options available. These alternatives can help you manage your payments better. They can also save you time and effort.

Requesting Additional Cards

Many banks allow you to request additional cards. You can keep your existing Visa card and get a Mastercard. This way, you benefit from both cards. You can use the card that fits your needs at the moment.

Check with your bank about their policies. Ask how to apply for another card. Some banks offer special deals for new cards.

Using Digital Wallets

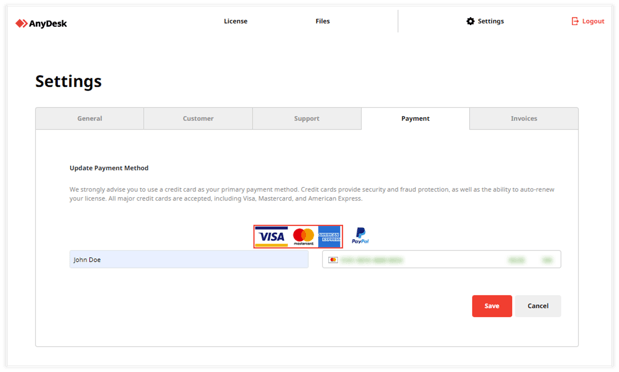

Digital wallets are a convenient option. They let you store multiple cards in one place. You can use your Visa or Mastercard without carrying them. Popular options include PayPal, Apple Pay, and Google Pay.

These wallets help you manage payments easily. They are often secure and user-friendly. Plus, they work with many retailers.

Explorando otras opciones de pago

Many other payment methods exist. Consider using prepaid cards or bank transfers. Prepaid cards can work like credit cards. They allow for easy budgeting.

Bank transfers are secure and direct. They let you send money without a card. Explore these options to find what suits you best.

Common Questions About Changing Cards

Changing from a Visa card to a Mastercard can raise many questions. People want to know about the process, fees, and benefits. Here are some common questions that arise when considering this change.

Can I Switch My Visa Card To Mastercard Easily?

Yes, switching is usually straightforward. Most banks offer easy options for card changes. You may need to fill out a form or contact customer service.

Will I Lose My Rewards Or Points?

It depends on your bank’s policy. Some banks transfer rewards. Others may reset your points. Always check the terms before switching.

Are There Any Fees For Changing My Card?

Fees can vary by bank. Some banks charge a fee for card changes. Others may not charge anything. It’s best to ask your bank directly.

How Long Does It Take To Get My New Card?

Typically, it takes a few days to a few weeks. Processing times can vary. Your bank will provide an estimated delivery date.

What Happens To My Old Card?

Once you receive your new Mastercard, destroy your old Visa card. Cut it up to protect your personal information. Ensure you pay off any remaining balance.

Can I Keep My Old Account Number?

No, your account number will change. Each card has a unique number. This is for security reasons.

Will My Credit Score Be Affected?

Changing cards usually does not impact your credit score. However, closing an account can have an effect. Keep your credit utilization low for better scores.

Credit: www.ally.com

Preguntas frecuentes

Can I Switch From Visa To Mastercard Easily?

Yes, switching from Visa to Mastercard is generally straightforward. You need to apply for a Mastercard through your bank or credit card issuer. Once approved, cancel your Visa card and activate the new Mastercard. Ensure any recurring payments are updated with your new card information.

What Are The Benefits Of Mastercard Over Visa?

Mastercard offers various benefits, such as exclusive discounts and rewards programs. Additionally, Mastercard has a wider acceptance in some regions compared to Visa. Both cards have strong security features, but Mastercard may provide additional travel perks. Evaluate your needs to determine which card suits you best.

Is There A Fee To Change My Card Type?

Typically, there is no fee to change from Visa to Mastercard. However, some banks may charge a fee for card issuance or account changes. It’s best to check with your bank for any specific fees associated with the card switch.

Understanding potential costs will help you plan accordingly.

How Long Does It Take To Receive My New Mastercard?

The time to receive your new Mastercard varies by issuer. Generally, you can expect to receive it within 7 to 14 business days. Some banks offer expedited shipping for an additional fee. Always confirm the delivery time frame with your card issuer for accurate information.

Conclusión

Changing your Visa card to a Mastercard is possible. Many banks offer this service. Consider your reasons for the switch. Think about fees, rewards, and acceptance. Check with your bank for specific steps. They will guide you through the process.

A new card can meet your needs better. Make sure to update any automatic payments. Stay informed about your options. This change can enhance your financial experience. Choose wisely and enjoy your new card benefits.