¿Son gravables los pagos del CRP?: Revelando verdades financieras

Are you receiving CRP payments and wondering if they are taxable? It’s a question that many landowners and farmers grapple with, and understanding the tax implications is crucial for your financial planning.

Imagine the relief of knowing exactly how these payments impact your taxes, allowing you to make informed decisions and avoid any unexpected surprises from the IRS. We’ll dive into the nitty-gritty of CRP payments and taxes, unraveling the complexities in simple terms.

Get ready to gain clarity and confidence as we guide you through everything you need to know about the taxability of CRP payments. Stay with us, and by the end of this read, you’ll be armed with the knowledge to handle your CRP payments like a pro.

Crp Payments Explained

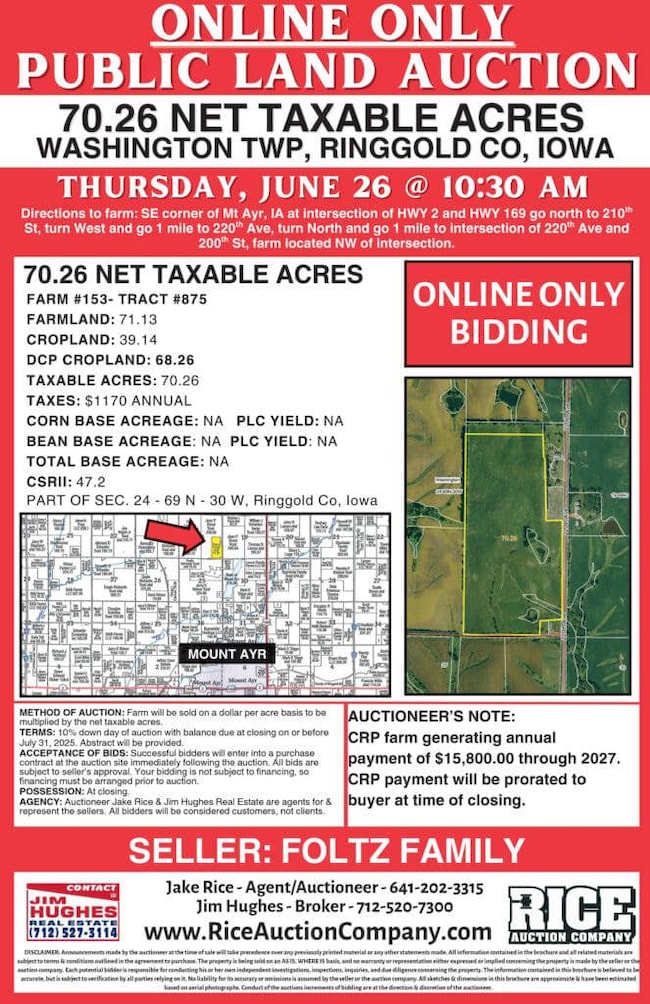

CRP stands for Conservation Reserve Program. Farmers get paid for land conservation. This helps the environment. It prevents soil erosion. It also improves water quality. Farmers agree not to farm on certain land. They receive payments for this agreement.

Payments are considered income. Farmers must report these payments. They are taxable. It’s important to keep track of all payments. This helps during tax season. Farmers should consult with tax experts. They can guide on reporting payments correctly.

Understanding CRP payments is crucial. Farmers benefit from both conservation and financial support. Always check with experts for any changes. Rules can change over time. Staying informed helps avoid mistakes.

Implicaciones fiscales

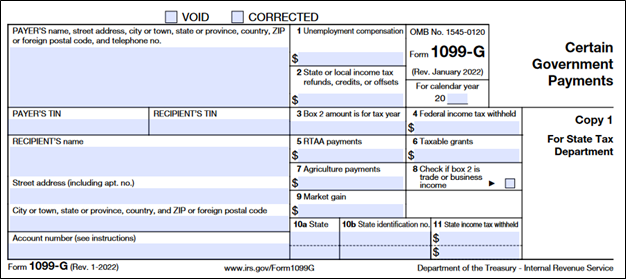

CRP payments are often taxable by the federal government. Farmers should know this. It’s important to report these payments on your tax return. The IRS considers them as ingreso. Always check your tax documents. CRP payments go on the Schedule F form. This helps keep things clear. Some exceptions might apply. Check with a tax professional for details. They can offer guidance.

States have different rules for CRP payments. Some states tax these payments. Others do not. It’s crucial to know your state’s policy. This information is on the state’s tax website. Farmers should review it each year. If confused, ask a tax expert for advice. They can explain the rules in simple terms. This helps avoid surprises during tax season.

Exemptions And Deductions

Not everyone can get tax exemptions on CRP payments. Farmers and landowners might qualify. Check if you meet the rules. Age and income can affect your chance. Some people get exemptions for special reasons. Disability or veterans might help you qualify. Always check the latest rules. They can change yearly.

Some costs can lower your taxes. Farming expenses might be deducted. This includes seeds and tools. Land care costs might also help. Keep track of all your spending. It can save money. Professional help is sometimes needed. An accountant can guide you. Be sure to keep all your receipts. They are important for tax deductions.

Reporting Crp Income

CRP payments must be reported to the tax office. Farmers need proper documentation. Pay records are important. These show how much money was received. Tax forms should also be ready. Keep all papers in a safe place. This helps when filing taxes.

Filing taxes with CRP income is easy. Use correct forms. Fill in income details. Follow all instructions. Check for errors before submitting. Errors can cause problems. Submit forms on time. Late submissions might lead to fines. Ask for help if unsure about the process.

Conceptos erróneos comunes

People often think CRP payments are not taxable. This is not true. The IRS considers CRP payments as ingresos imponibles. Some believe only large payments get taxed. But, even small payments are taxable. Another myth is that farmers are exempt from taxes on CRP. All payments, big or small, must be reported.

Many get confused about how to report these payments. It’s simple. Just add the CRP payments to your yearly income. Some worry about double taxation. They fear paying twice. This is not true. You only pay tax once on CRP payments.

Buscando asesoramiento profesional

Understanding if CRP payments are taxable can be complex. Professional advice helps clarify tax obligations. It’s crucial to consult a tax expert for accurate information.

When To Consult A Tax Advisor

Consultar a un asesor fiscal is important if you receive CRP payments. They help you understand if your payments are taxable. Tax rules can be tricky. An advisor will explain them simply. They know the latest tax laws. This keeps you from making mistakes. Advisors can save you money. They can find deductions you might miss. Talking to them early is smart. It prepares you for tax season.

Questions To Ask Your Advisor

- Are CRP payments considered taxable income?

- How can I report CRP payments on my taxes?

- What deductions are available for CRP payments?

- Will CRP payments affect my overall tax rate?

- Do I need to keep specific records for CRP payments?

Future Changes And Updates

New laws might change how CRP payments are taxed. Congress often reviews tax rules. Sometimes they make important changes. These changes can affect many people. It’s good to stay ready for these updates. Farmers should watch for new legislation. Tax experts can help explain these changes. They can tell what changes mean for CRP payments. Comprensión these updates is helpful. It ensures smooth tax filing.

Get news from fuentes confiables. Government websites often share updates. Tax advisors can give valuable insights. They help in understanding new laws. Many websites offer simple explanations. They make complex laws easy. Regular reading helps stay informed. Being aware makes tax filing easier. Farmers can avoid surprises. It’s always good to know the latest.

Preguntas frecuentes

Are Crp Payments Considered Taxable Income?

Yes, CRP payments are generally considered taxable income by the IRS. Recipients must report these payments on their federal tax returns. Depending on your state, CRP payments may also be subject to state taxes. It’s advisable to consult a tax professional for guidance specific to your situation.

How Do I Report Crp Payments On Taxes?

Report CRP payments as farm income on Schedule F of your tax return. If you don’t farm, report them as other income. It’s important to keep accurate records of all payments received. Consulting a tax advisor can help ensure proper reporting and compliance with tax regulations.

Are There Any Tax Exemptions For Crp Payments?

Certain exemptions may apply, particularly for retired or disabled individuals. These exemptions depend on specific criteria and circumstances. Always check the IRS guidelines or consult a tax professional. This will help you understand any potential exemptions applicable to your situation.

Do State Taxes Apply To Crp Payments?

Yes, CRP payments may be subject to state taxes, depending on your state’s regulations. It’s crucial to check with your state tax authority or consult a tax professional. Understanding your state’s tax requirements ensures compliance and helps avoid potential penalties.

Conclusión

Understanding CRP payments and taxes is crucial. Always check the latest tax rules. This ensures compliance and peace of mind. Consult a tax professional for personalized advice. They can clarify specific situations. Accurate reporting can prevent future issues. Stay informed about changes in tax laws.

This helps in making informed decisions. Knowledge is power when dealing with taxes. Proper planning can save money and stress. Be proactive in managing your financial responsibilities. This will lead to smoother financial experiences.