¿Se puede pagar el anticipo del coche con tarjeta de crédito? Consejos útiles

Are you considering buying a new car but wondering if you can use your credit card for the down payment? You’re not alone.

Many people like you are exploring this option, hoping to earn rewards or manage their cash flow better. But is it a smart move? As you read on, you’ll discover the potential benefits and pitfalls of using your credit card for such a big purchase.

We’ll uncover the secrets that dealerships might not tell you and help you make an informed decision. So, before you swipe that card, let’s dive into the details to see if this choice aligns with your financial goals. Stick around; your wallet might thank you!

Pros And Cons

Usando un tarjeta de crédito for a car down payment has pros. It can be convenient and fast. You might earn recompensas like points or cashback. This option helps if you don’t have cash now. Be careful. Credit cards have altas tasas de interés. You could end up paying more later. Your card may have a limit. This could affect your puntuación crediticia.

Some dealerships might not accept cards. They prefer cash or check. Ask before you plan to use a card. Be sure to check fees. Some cards have tarifas de transacción. These fees add to your costs. Paying with a credit card can be risky. Think about the pros and cons. Decide what works best for you.

Entendiendo los límites de las tarjetas de crédito

Many people have a límite de tarjeta de crédito. This is the maximum amount you can spend. It’s important to know your limit before using your card. You can’t spend more than your limit. If the car down payment is higher than your limit, you can’t use your card. Always check your card balance. Ensure you have enough credit available. Some cards offer higher limits. Others have lower limits. Knowing your limit helps you plan better. It avoids extra fees or penalties. Many banks provide online tools. These tools help you track your spending. Always use them to stay informed. It’s a smart way to manage your money.

Impact On Credit Score

Using a credit card for a car down payment can change your credit utilization rate. This rate shows how much credit you use from your limit. A high utilization rate can lower your credit score. It’s best to keep it below 30%. Paying off the balance quickly helps. This keeps your score safe.

Historial de pagos is very important for your credit score. Making payments on time boosts your score. Late payments hurt your score. Always pay at least the minimum amount by the due date. This keeps your credit healthy. Missing payments makes it harder to get loans. Stay on top of your payments for a good score.

:max_bytes(150000):strip_icc()/Heres-how-get-car-no-down-payment_final-1c94e62ad4644532a18289cf826f6cce.png)

Interest Rates And Fees

Paying a car down payment with a credit card may involve high interest rates. Fees can add up quickly. It’s important to check terms before committing.

Tarifas de transferencia de saldo

Balance transfer fees can be tricky. These fees usually range from 3% to 5%. Sometimes, a credit card may have no fee for balance transfers. Tarifas bajas can save money. High fees can add up quickly. It’s important to check these fees before making a transfer. Remember, fees can change.

Cash Advance Rates

Cash advance rates are often higher than regular rates. These rates can start at 20%. Some cards have rates near 30%. Using cash advance can be costly. High rates mean more money spent on interest. It’s wise to know the rates before taking a cash advance. Look for cards with lower rates.

Recompensas y beneficios

Using a credit card for a car down payment can be smart. Some credit cards offer recompensas de reembolso. This means you get money back when you spend. If you have a card with 1% cashback, a $5,000 payment earns you $50. It’s like a small discount. But always pay the balance fast. Credit card interest can be high. Paying late can cost you more than the cashback.

Some cards give travel points instead of cashback. These points can help you get free flights or hotel stays. A big purchase like a car down payment can earn a lot of points. But check if there are any fees. Some cards have high fees for using them. Always know your card’s terms before you pay.

Alternatives To Credit Cards

Personal loans are a smart choice for a car down payment. They often offer tasas de interés más bajas than credit cards. This can save you money over time. Loans also have fixed payment plans, making budgeting easier. You borrow a set amount. Pay it back over time. It’s simple. Many banks and credit unions offer personal loans. You may need a good credit score. But they can be a great option for many buyers.

Dealership financing might be another option. Some dealerships offer their own financing plans. This can be conveniente. You deal directly with the seller. Sometimes, they offer special deals or discounts. These can lower your monthly payments. It’s important to read the terms carefully. Make sure you understand the tasas de interés and fees. Ask questions if you need to. This can be a good choice for some buyers.

Tips For Safe Transactions

Securing Your Information is very important. Always keep your datos de la tarjeta de crédito safe. Use strong passwords for online accounts. Never share your ALFILER o código de seguridad with anyone. Check if the website is secure before entering your details. Look for a padlock symbol in the browser.

Avoiding Scams is also crucial. Be careful with emails asking for card information. They may be scams. Always verify the sender’s identity. Keep an eye on your extractos de tarjetas de crédito. Report any unusual activity immediately. Scammers can be tricky. Always stay alert and protect your money.

Negotiating With Dealerships

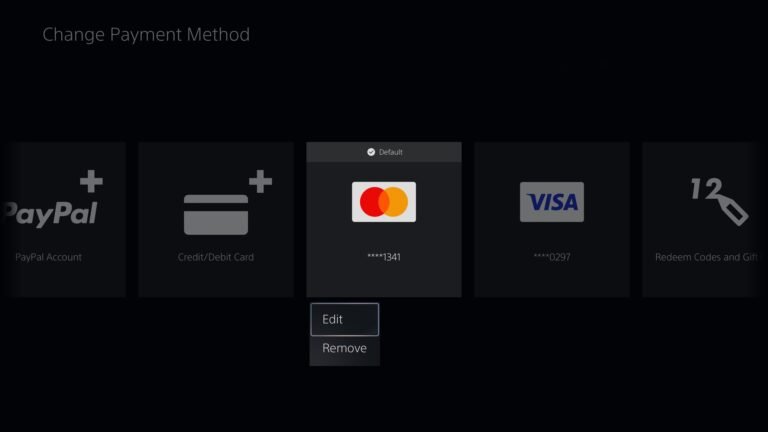

Using a credit card for a car down payment can be possible at some dealerships. It depends on their policies. Check with the dealership first, as fees might apply. Some dealerships accept this method, allowing you to earn rewards or manage cash flow better.

Flexibilidad de pago

Dealerships often provide payment flexibility to attract more customers. You can choose different payment options to suit your needs. Using a tarjeta de crédito for a car down payment might be possible. But it depends on the dealership’s policy. Some dealerships may accept credit cards for down payments. Others might prefer cash or bank transfers. It’s important to ask the dealership about their payment options. This helps avoid any surprises during the purchase process. Being informed can make the buying experience smoother. Always check for any fees related to credit card use.

Incentive Programs

Dealerships sometimes offer incentive programs to encourage purchases. These can include discounts, rebates, or special financing deals. Incentives can help save money on your car purchase. Always ask about available incentive programs. This ensures you get the best deal possible. Some programs might be limited to certain payment methods. Understanding these details can help you plan your payment strategy. Make sure to read all terms and conditions before deciding. This ensures you make an informed decision.

Preguntas frecuentes

Can I Use A Credit Card For Car Down Payment?

Yes, many dealerships accept credit cards for down payments. However, check if there are any fees. Ensure your credit limit covers the amount. Using a credit card can help earn rewards, but interest rates may apply if not paid off promptly.

Always consult your dealer and credit card provider.

What Are The Benefits Of Using A Credit Card?

Using a credit card can provide rewards and points. It offers a quick and convenient payment method. You might also benefit from purchase protection. However, ensure you can pay the balance to avoid high interest rates. Always weigh the benefits against potential costs.

Are There Fees For Credit Card Down Payments?

Dealerships might charge a processing fee for credit card payments. This fee can range from 1% to 3%. It’s essential to inquire beforehand to avoid surprises. Additionally, some credit cards have fees for large transactions. Always verify with both the dealership and your credit card issuer.

Will Using A Credit Card Affect My Credit Score?

Using a credit card can impact your credit score positively or negatively. Paying on time boosts your score. However, high utilization can lower your score. Ensure your credit limit accommodates the payment to avoid negative impacts. Monitoring your credit utilization rate is crucial.

Conclusión

Using a credit card for a car down payment has pros and cons. It offers convenience and rewards. But it can lead to high-interest debt. Always check with the dealer first. Some may not accept credit cards. Consider your credit limit and interest rate.

Evaluate your financial situation carefully. Ensure you can manage the monthly payments. Explore other financing options too. A personal loan might suit your needs better. Make a choice that fits your budget and goals. Financial decisions today impact your future.

Plan wisely for long-term benefits.