Un banco que no ha recibido el pago: desafíos de los préstamos

Imagine this: You’ve taken out a loan to buy your dream home or start a new business. Everything seems perfect until suddenly, a payment is missed.

Now, think about this scenario from the bank’s perspective. A bank that has not received payment on a loan is not just dealing with a simple delay. It’s grappling with complex challenges that could impact its operations and your financial future.

Have you ever wondered what happens when a payment is missed? How do banks handle these situations, and what does it mean for you as a borrower? Understanding this can empower you to make informed financial decisions and possibly avoid costly mistakes. Let’s delve into the fascinating world of banking and loans, where numbers meet human stories. Discover what goes on behind the scenes when payments don’t arrive on time. Learn how banks respond, the steps they take, and what this could mean for you. Get ready to uncover insights that could save you money and stress in the long run. Curious? Let’s explore this crucial topic together.

Loan Approval Process

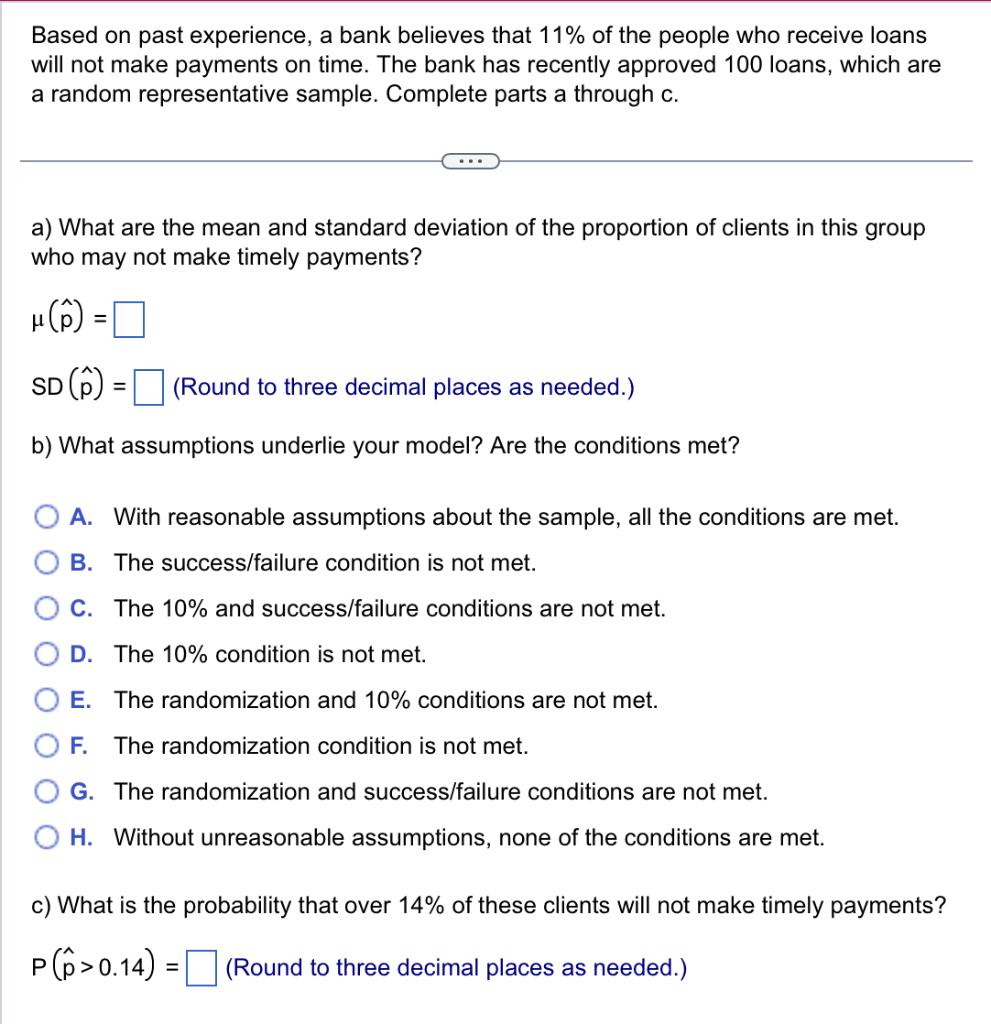

Banks study puntuaciones crediticias. They decide if someone can pay back a loan. A good score means less risk. They check past payments and debts. Ingreso is also important. More income means easier loan approval. Banks want to know how stable the income is. If someone earns regularly, it’s better.

Colateral is something valuable. It helps secure a loan. If someone can’t pay, the bank takes the collateral. Cars, homes, or jewelry can be collateral. Banks check the value of these items. Higher value means safer loans. They also check if the items are owned by the borrower. Ownership is very important.

Loan terms tell how much money is borrowed. They also show how much interest is paid. Banks explain the payment schedule. Borrowers need to agree to these terms. They sign papers to finalize the loan. Comprensión the terms is crucial. Borrowers must know what they are signing.

Common Reasons For Non-payment

Many borrowers face financial struggles. They might lose their jobs. They might also have unexpected medical bills. These challenges make paying loans hard. Families often need to choose between necesidades esenciales and loan payments. Food, shelter, and healthcare come first. Loan payments may be delayed.

Un economic downturn can affect everyone. Companies might close down. People may have less money. Jobs become scarce. With less income, borrowers find it tough to pay loans. Banks see more late payments during these times. It’s a common issue.

Interest rate fluctuations can increase loan costs. Borrowers might pay more each month. This sudden change can surprise them. They might not have planned for higher payments. Some struggle to adjust. This can lead to missed payments. Banks often notice this pattern.

Impact On Bank Operations

Banks need money to work well. Loans not paid on time can stop the flow of money. This makes it hard for banks to give out new loans. Every missed payment can cause worry. Banks may need to find other ways to get money. This takes time and effort.

Loan problems make banks think more about risk. They might check loans closely. Extra checks can slow down bank work. It also costs more money. Banks may change their rules to avoid future problems. This can help, but it takes time to set up.

A bank’s name is very important. Problems with loans can hurt trust. People might worry about the bank’s safety. This can lead to fewer customers. Banks need a good name to grow. Keeping a good name needs hard work and care.

Strategies For Recovery

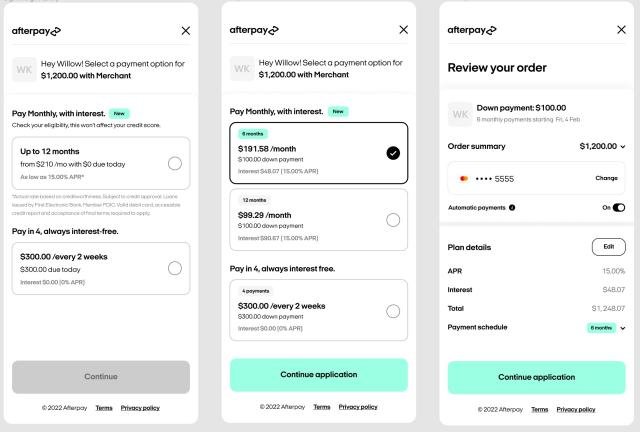

Banks can talk with borrowers to find a solution. New terms might help both parties. They can change the tasa de interés o extend the loan period. This way, borrowers have more time to pay. The bank receives regular payments again. Talking openly is key here. Both sides should aim for a fair deal.

Debt restructuring helps banks and borrowers. It involves changing the loan structure. The bank might reduce the loan amount. Or, it might change payment schedules. This makes it easier for borrowers. They can pay smaller amounts over time. For the bank, it means more chances to get paid back.

Sometimes, banks must use legal methods. This ensures they get their money back. They might go to court for help. The court can enforce payment rules. This is a last option. Legal steps can be long and costly. It’s better to resolve issues before this stage.

Technological Solutions

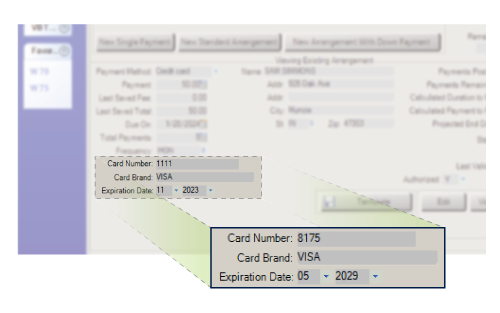

Banks use automated risk assessment tools. These tools check if a person can repay a loan. They look at a person’s past payments. They also check how much money a person earns. This helps banks decide if a person should get a loan. It makes the process faster and safer.

Digital payment tracking helps banks see payments quickly. It shows who paid and when. This keeps records clear and accurate. Banks can send reminders if a payment is late. It helps them manage loans better. It also gives people a way to know their payment status.

Data analytics helps banks predict payment issues. They use data to see patterns. This helps them know who might miss a payment. Banks can then offer help to these people. They can give advice or change payment plans. This helps reduce loan problems.

Future Of Banking And Loan Management

New technologies change the way banks work. Digital platforms offer better ways to manage loans. Blockchain ensures secure and transparent transactions. Inteligencia artificial helps predict loan risks. These tools make banking safer. They also make it faster. Banks must keep up with these changes.

Rules for banks change often. They must follow new laws to stay open. Compliance is key to avoid fines. Banks need smart systems to manage rules. Software can track changes in regulations. This makes it easier to adapt. Staying updated helps banks serve customers well.

Banks need strong loan portfolios. This helps them in tough times. Diversification is important. It spreads risk across different sectors. Careful assessment of borrowers is crucial. This reduces chances of defaults. Banks should focus on long-term stability. A good portfolio supports growth.

Preguntas frecuentes

What Happens If A Bank Doesn’t Receive Loan Payment?

If a bank doesn’t receive a loan payment, it may charge late fees. The bank may also report the missed payment to credit bureaus, affecting the borrower’s credit score. If the payment is not made after several notices, the bank might initiate legal proceedings to recover the loan amount.

How Do Banks Handle Unpaid Loans?

Banks handle unpaid loans by first sending reminders to the borrower. If payment is not received, they may start charging late fees. After prolonged non-payment, they might initiate legal action or sell the loan to a collection agency. This process aims to recover the outstanding loan amount.

Can A Bank Write Off Unpaid Loans?

Yes, banks can write off unpaid loans as bad debt. This usually happens after exhaustive efforts to recover the amount have failed. Writing off a loan doesn’t erase the borrower’s obligation to pay. The bank might still pursue collection through agencies or legal means.

Why Do Banks Charge Late Fees On Loans?

Banks charge late fees on loans to encourage timely payments. These fees compensate for administrative costs and potential losses from delayed payments. Late fees also serve as a deterrent, reminding borrowers of the importance of adhering to the loan repayment schedule.

This ensures consistent cash flow for the bank.

Conclusión

A bank not receiving loan payments faces serious challenges. It affects financial stability and future lending. Banks must act quickly to recover funds. Effective communication with borrowers is key. Legal measures may be necessary if payments are missed. Regular monitoring helps detect payment issues early.

This ensures minimal impact on the bank’s operations. Clear strategies for loan recovery are crucial. They support the bank’s long-term health. Understanding these steps benefits both banks and borrowers. It promotes a healthy financial environment for all parties involved.