¿Cuánto pago inicial para un condominio?: Guía esencial

Are you dreaming of owning a condo but unsure how much you need for a down payment? You’re not alone.

Navigating the financial landscape of buying a home can be daunting, especially when it comes to understanding the initial costs. The down payment is a crucial part of your home-buying journey, and knowing how much you need can set you on the right path.

Imagine the relief of stepping through the doors of your own condo, knowing you’ve made a smart financial move. We’ll break down exactly how much you should be prepared to pay upfront, providing you with clear insights and practical tips. Stay tuned to discover how to make your condo dream a reality without unnecessary stress.

Down Payment Basics

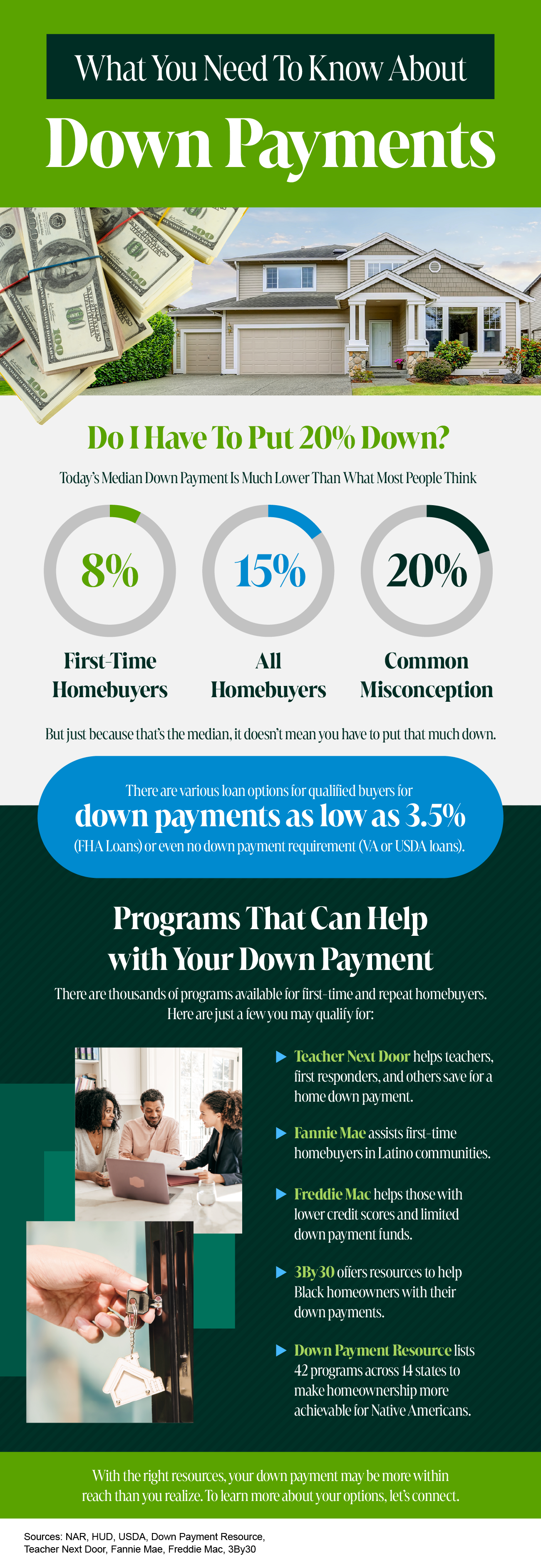

Buying a condo needs a depósito. It’s money you pay upfront. This shows you are serious. The depósito amount can vary. 20% is common. But 5% o 10% is also possible.

Banks like bigger down payments. It means less risk for them. A bigger down payment can mean a smaller loan. This means lower monthly payments. It’s easier for your budget.

Saving for a down payment can take time. Start early. Plan how much you need. Stick to your goal. Making a budget helps. Avoid extra spending. Save a little each month. Over time, it adds up. Soon, you will have enough.

Factors Influencing Down Payment

A good puntuación crediticia can lower your down payment. Lenders trust those with high scores. They see them as safe borrowers. If the score is low, more money might be needed upfront. Keeping a high credit score helps in saving money.

Different loans need different down payments. Some loans need less money down. Others might ask for more. It’s important to know your loan type. This helps in planning your savings. Choose a loan that fits your budget.

Where the condo is matters. City condos might need bigger down payments. In smaller towns, the cost could be less. Location can change how much you pay. Always check the area before deciding. This helps in making smart choices.

Typical Down Payment Percentages

Buyers often pay 20% down for condos. It helps avoid private mortgage insurance. Some lenders allow 10% down with good credit. Large down payments can lower interest rates.

FHA loans need only 3.5% down. They help first-time buyers. They require mortgage insurance. More flexible for lower credit scores. Good for those with limited savings.

VA loans offer 0% down for veterans. USDA loans also need 0% down. They focus on rural areas. Both require eligibility checks. They save money up front.

Saving For A Down Payment

Creando una presupuesto is vital. Start with your monthly income. List all gastos like rent, food, and bills. Reduce unnecessary spending. Save the extra money. Setting goals helps. Decide how much to save each month. Track your progress. Use apps or notebooks. Stay motivated. Celebrate small wins.

Investing grows your money. Choose safe options like savings accounts. Stocks are risky. Bonds are stable. Research before investing. Consider mutual funds. They are managed by experts. Ask for advice if unsure. Diversify your investments. Spread risk and increase gains. Watch the market. Adjust as needed.

Programs can help. Look for government aids. They offer grants and loans. Check eligibility. Some require low income. Others focus on first-time buyers. Contact local housing offices. Ask for details. Fill forms correctly. Apply on time. Follow up regularly. Support is available. Don’t hesitate to seek it.

Pros And Cons Of Larger Down Payments

Paying more upfront can lower your monthly bills. This helps to ease financial stress. Lower monthly bills mean more money for other things. Saving for the future becomes easier.

A big down payment can also help get better loan terms. Lenders see you as less risky. This may lead to a tasa de interés más baja. Over time, you save more money.

On the flip side, saving a large amount takes time. This might delay your dream of owning a condo. Tying up too much cash in your home can reduce your savings. Emergency funds may run low.

Negotiating The Down Payment

Choosing the right lender is very important. Prestamistas offer different loan options. Some require large down payments, others do not. Discuss your needs clearly. Ask about tasas de interés y terms. Get all details in writing. Understand every term before you sign. It helps avoid surprises. Always compare multiple lenders. This ensures the best deal for you.

Real estate agents can be helpful guides. They know the market trends. Agents provide advice on depósito options. They connect buyers with trusted lenders. Agents help find affordable condos. They negotiate on your behalf. Their guidance is valuable. Always choose an agent with good reviews. It builds trust and confidence.

Seller concessions can lower your costs. Sellers sometimes pay closing fees. This saves you money. Concessions can include repair costs. Ask sellers for these benefits. Negotiate firmly but politely. Sellers may agree to better terms. This helps reduce your down payment. Always understand concession details. They must be clear in contracts.

Impact On Mortgage Terms

A large down payment can lower your interest rate. Lenders feel safer. Lower risk, lower rates. A smaller down payment might increase interest rates. This can mean higher monthly payments. Paying more over time. It’s wise to aim for a bigger down payment.

Down payment size affects loan duration. Larger down payments can shorten loan terms. Shorter loans mean paying less interest over time. Smaller down payments can lead to longer loan terms. You might pay more in the end. Choose wisely for better financial health.

Preguntas frecuentes

What Is The Typical Down Payment For A Condo?

The typical down payment for a condo ranges from 5% to 20% of the purchase price. The exact amount depends on the lender’s requirements and your financial situation. A higher down payment can lower your monthly payments and interest rates.

Can I Buy A Condo With 3% Down?

Yes, some lenders offer loan programs that allow a 3% down payment for condos. These programs often have stricter requirements like good credit scores and private mortgage insurance. Check with your lender to see if you qualify for such programs.

Is 20% Down Payment Required For A Condo?

No, a 20% down payment is not always required for a condo. While it can help avoid private mortgage insurance, many lenders offer options with lower down payments. It’s important to consider your financial situation and lender terms when deciding on a down payment amount.

How Does Down Payment Affect Condo Mortgage?

A larger down payment reduces your mortgage balance, potentially lowering monthly payments and interest rates. It can also eliminate the need for private mortgage insurance. A higher down payment might make you a more attractive borrower to lenders, offering better loan terms.

Conclusión

Determining the right down payment for a condo is crucial. It affects your finances and future stability. Research and planning help make informed decisions. Consider your budget and financial goals. Speak with real estate professionals for advice. They can guide you through the process.

Save diligently to reach your down payment target. A well-thought-out plan ensures you secure your dream condo. Remember, every step brings you closer to your new home. Stay focused, and you’ll achieve your homeownership goals.