Warum sollten College-Studenten Kreditkarten haben?

Steering through college life without a Kreditkarte is like sailing without a compass; you may get by, but you're missing out on vital guidance. You might wonder why adding a credit card to your financial toolkit could be beneficial. From building a solide Kredithistorie to learning essential budgeting skills, the advantages can be significant. Plus, having a credit card can provide a safety net for those unerwartete Ausgaben that often arise during your college years. But what if there are hidden pitfalls you need to be aware of before making that decision?

Aufbau einer Kredithistorie

Aufbau eines solide Kredithistorie during college can set you up for financial success, so it's vital to understand how using a credit card responsibly can help you achieve that. When you use a credit card and den Rest bezahlen on time, you demonstrate reliability to creditors. This responsible behavior can boost your credit score, which plays an important role in future financial decisions, such as renting an apartment or applying for loans. Plus, having a credit card can establish a foundation for future credit needs. Remember, though, to keep your spending within manageable limits. Staying informed about your Kreditauslastungsquote and avoiding late payments are key strategies to guarantee your credit history remains strong and safe.

Finanzielle Verantwortung lernen

Mastering finanzielle Verantwortung while in college is essential, as it not only prepares you for future financial independence but also helps you develop smart spending habits that can last a lifetime. Using a credit card wisely can teach you about Budgetierung, tracking expenses, and understanding interest rates. By regularly monitoring your spending and making timely payments, you'll learn the importance of living within your means. This practice can prevent you from falling into debt and foster a sense of security. Furthermore, it encourages you to think critically about your purchases and prioritize needs over wants. Ultimately, developing these skills now will pave the way for a financially secure future, allowing you to navigate life's complexities with confidence and clarity.

Managing Unexpected Expenses

Unexpected expenses can pop up at any time during college, and having a Kreditkarte can provide a safety net that helps you manage these financial surprises without derailing your budget. Whether it's an unexpected car repair, medical bill, or last-minute textbook purchase, a credit card offers a quick solution to cover these costs. It allows you to pay for essential needs immediately while giving you time to plan how to pay it back. However, it's vital to use your card wisely. Keep your credit utilization low and begleichen Sie Ihr Guthaben each month to avoid high-interest charges. By doing so, you'll maintain your financial health and guarantee that unerwartete Ausgaben don't lead to long-term debt.

Belohnungen und Vorteile

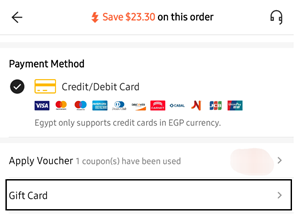

Taking advantage of credit card rewards can greatly enhance your college experience, providing perks that range from cash back on everyday purchases to travel rewards for future adventures. By using your card wisely, you can gain benefits that help you save money and enjoy life as a student. Here are some enticing rewards you might consider:

- Cash back on groceries and essentials

- Travel points for discounts on flights and hotels

- Exclusive discounts at popular retailers

- Sign-up bonuses that give you a head start

These rewards not only help you manage your budget but also make your college life more enjoyable. Just remember to pay your balance in full to avoid interest charges, ensuring you reap the benefits safely.

Preparing for Future Needs

While enjoying the rewards of Kreditkarten, it's also important to think about how they can help you prepare for future financial needs, setting a strong foundation for your post-college life. Managing a credit card responsibly can enhance your Kreditwürdigkeit, which is vital for future loans, like a car or home mortgage. You'll also learn Budgetierungsfähigkeiten as you track spending and make timely payments. Establishing a gute Kredithistorie now means you'll have better options later. Plus, it teaches you financial discipline, essential for maneuvering life's expenses. Just remember to use credit wisely, keeping your balance low and paying it off each month. This proactive approach not only secures your immediate needs but also safeguards your financial future.