What Will Tremaine’s Monthly Payment Be: Find Out Now!

Have you ever found yourself wondering what your monthly payment might be when considering a new purchase or loan? You’re not alone.

Many people, just like you, are eager to crack the code of monthly budgeting and financial planning. Today, we’re diving into the intriguing question: “What Will Tremaine’s Monthly Payment Be? ” Whether you’re planning to buy a car, a house, or even start a new business, understanding how monthly payments work is crucial.

This article will guide you through the essential factors that determine these payments, using Tremaine’s scenario as a relatable example. By the end of this read, you’ll be equipped with the knowledge to make informed financial decisions confidently. Let’s unravel the mystery of monthly payments together.

Factors Influencing Monthly Payment

The size of the Darlehen affects monthly payments. Bigger loans mean larger payments. Smaller loans mean less to pay each month. Choose wisely to match your budget.

Interest rates can change monthly payments. Lower rates mean less money paid over time. Higher rates increase the payment amount. Keep an eye on rate changes.

Der loan term impacts payment size. Long terms spread payments over many years. Short terms mean higher payments each month. Decide based on your financial plans.

A bigger Anzahlung reduces monthly payments. Paying more upfront lowers the overall loan amount. Smaller down payments mean larger monthly bills.

Calculating Monthly Payment

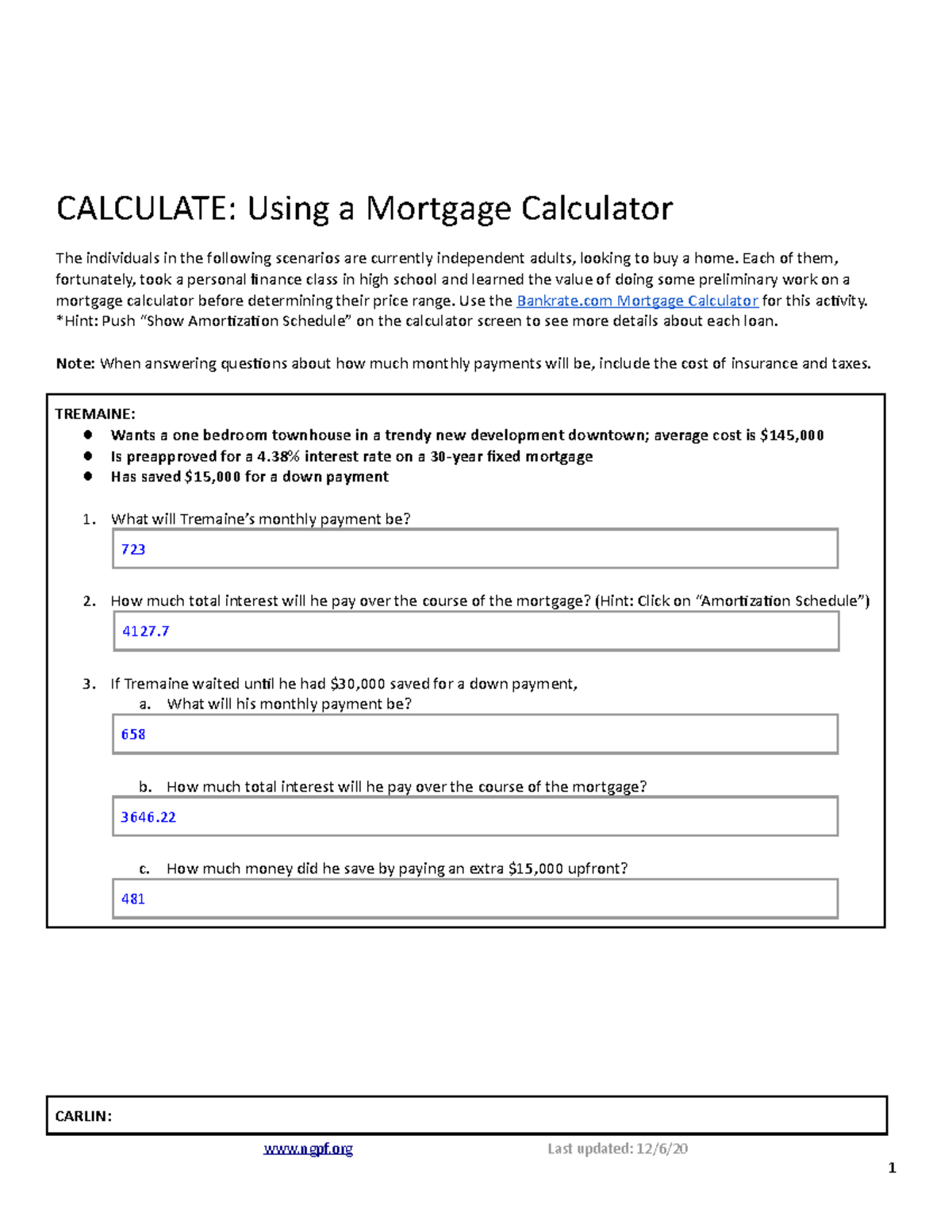

Amortization formula helps to find monthly payments. It considers interest rates and loan duration. Tremaine’s monthly payment depends on these factors. Principal amount also affects the payment. This formula creates a plan for paying off loans. It’s useful for budgeting and planning finances.

Online calculators are easy to use. They show quick results. Tremaine can input loan details. The calculator will compute the payment. It’s simple and quick. Many websites offer free calculators. These tools can save time. They provide accurate results.

Extra payments reduce loan duration. They can lower interest costs. Tremaine can pay off the loan faster. Even small amounts help. It’s important to plan these payments. Extra payments make a big difference. They offer more savings over time.

Comparing Loan Offers

Interest rates tell you how much extra money you pay. A lower rate means paying less money over time. It’s good to check different banks. Compare rates to see which one is best. Interest can add up fast. Watch out for high rates that seem low at first.

Loans often come with extra fees. These can be application fees oder Verspätungsgebühren. Some loans have no fees. Others have many. Always ask about fees before signing. Even small fees can add up. It’s important to know all costs.

Flexibility in a loan is important. Can you pay early without fees? Some loans let you change payment dates. This is helpful if plans change. Flexible loans can be better for surprises. Always ask about loan terms. This helps avoid problems later.

Improving Loan Terms

A higher Kreditwürdigkeit can lead to better loan terms. Paying bills on time boosts your score. Keeping credit card balances low helps too. Avoid opening too many new accounts. This can lower your score. Check your credit report for errors. Correct any mistakes you find. A better score can mean lower interest rates.

Talk to lenders for better loan terms. Be honest about your financial situation. Ask for lower interest rates. Request reduced fees if possible. Offer a larger down payment. This can make lenders more flexible. Show them you are a reliable borrower. This can help you get what you want.

Shorter loan terms often mean lower interest. Monthly payments might be higher. But you pay less over time. You can save money this way. Consider your monthly budget first. Can you handle higher payments? If yes, choosing shorter terms might be wise.

Budgeting For Monthly Payments

First, list all sources of Einkommen. Include salary, bonuses, and any side jobs. Next, write down all monatliche Ausgaben. Think about rent, food, and transport costs. Look at your bills for extra costs like subscriptions. Subtract total expenses from total income. This shows how much is left for other payments.

Make a list of all monthly bills. Include rent or mortgage, utilities, and groceries. Write down the due dates for each bill. This helps avoid late fees. Use a calendar or planner to track these dates. Set reminders to pay bills on time. This keeps finances in order.

Save a small amount each month. Even a little helps. Aim for three to six months of expenses. This fund covers unexpected costs. Think about car repairs or medical bills. Put this money in a separate account. Keep it safe and only use it for true emergencies.

Häufig gestellte Fragen

What Factors Determine Tremaine’s Monthly Payment?

Tremaine’s monthly payment depends on several factors. These include the loan amount, interest rate, and loan term. His credit score and down payment can also influence the payment. Understanding these factors can help Tremaine estimate his monthly costs accurately.

How Does Interest Rate Affect Tremaine’s Payment?

The interest rate significantly impacts Tremaine’s monthly payment. A higher interest rate means higher monthly payments. Conversely, a lower interest rate can lead to reduced payments. It’s crucial for Tremaine to shop for the best rates to manage his budget effectively.

Can Tremaine Lower His Monthly Payment?

Yes, Tremaine can lower his monthly payment. He can do this by refinancing to a lower interest rate. Extending the loan term can also reduce the monthly amount. However, this may increase the total interest paid over the loan’s life.

What Is The Role Of A Down Payment?

A down payment reduces the loan amount, impacting Tremaine’s monthly payment. A larger down payment can result in lower monthly costs. It can also potentially secure better loan terms and interest rates, making it an important consideration.

Abschluss

Tremaine’s monthly payment depends on several factors. These include loan type, interest rate, and loan term. Understanding each can help you plan better. A clear budget aids in managing monthly expenses. It’s crucial to compare different loan offers. This ensures you find the best fit.

Online calculators can also provide quick estimates. They simplify the process. It’s always wise to consult with financial experts. Their guidance can offer valuable insights. With the right strategy, managing monthly payments becomes easier. Stay informed and make smart financial choices.