What is Unapplied Cash Payment Income? Discover Insights

Have you ever noticed a mysterious line item called “Unapplied Cash Payment Income” on your financial statements and wondered what it means? You’re not alone.

This term can seem puzzling, especially if you’re not an accounting expert. But don’t worry! By the end of this article, you’ll have a clear understanding of what unapplied cash payment income is and why it matters to your business’s financial health.

Imagine being able to confidently navigate your financial reports, knowing exactly where your money is and how it’s being accounted for. Stay with us to uncover the secrets behind this often-overlooked financial term and discover how it can impact your business’s bottom line.

Unapplied Cash Payment Income Basics

Unapplied cash payment income is money received but not linked to a specific invoice. This can happen when a payment is made without clear details. Businesses might face challenges with these payments. They must identify which invoice the payment belongs to. Properly managing unapplied cash helps maintain accurate financial records.

Keeping track of these payments is crucial. It ensures the business knows its true income. If payments stay unapplied, it might confuse financial reports. It’s vital for businesses to regularly check and apply these payments. Doing so can prevent errors in financial statements.

How It Occurs In Business Transactions

Unapplied cash payment income happens in businesses often. Sometimes, a customer pays money, but the business doesn’t know where to apply it. This can happen when invoices are unclear or if a customer doesn’t mention details. Businesses then hold this cash in a special account.

It is important for businesses to track this carefully. If not, it can cause confusion. Employees may not know which debts are paid. This can lead to mistakes in records. It is also necessary for businesses to communicate with customers. This helps solve the unapplied cash quickly.

Businesses should use good software for tracking payments. This helps in reducing mistakes. Klare Kommunikation with customers is very important. This ensures that payments are applied correctly. Keeping accurate records helps in maintaining trust with clients.

Common Causes

Cash payments may go to wrong accounts. This mistake is common. Businesses may forget to check payment details. Wrong account numbers can cause this. Verwirrung in recording can lead to misallocation. Staff may enter incorrect information. Double-checking can prevent this issue.

Payments sometimes take too long to process. Banks may take days to clear payments. This delay creates unapplied cash income. Systems may face errors. Payment processing software might crash. This slows down the process. Regular checks can help avoid delays.

Some payments are not full. Customers might pay only part of the bill. This leads to unapplied cash income. Businesses must track each payment. Careful record-keeping is needed. Invoices should show amounts clearly. Kommunikation with customers is important.

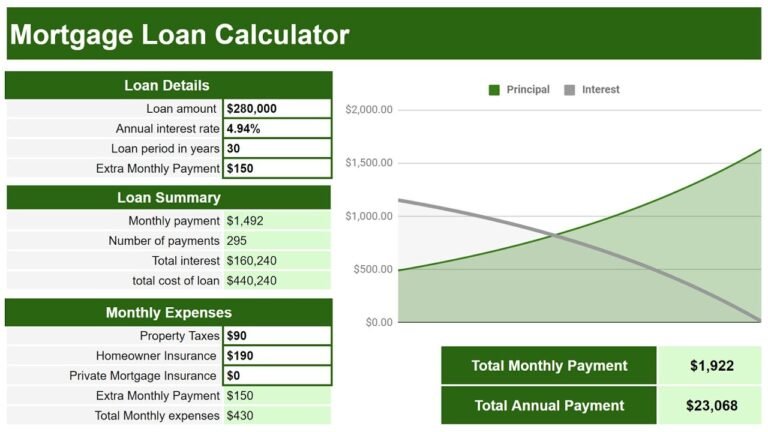

Impacts On Financial Statements

Unapplied cash payment income can confuse financial records. It shows money received but not yet matched to invoices. This affects the accounts receivable section. The balance may look larger than it truly is. It impacts the cash flow statement too. Cash appears higher but is not truly available. This can mislead stakeholders. They might think the company has more liquidity. It affects the income statement as well. Revenue may appear inflated. This can lead to incorrect financial decisions. Proper accounting helps avoid these issues. Companies should aim for clarity. Clear records are crucial for trust.

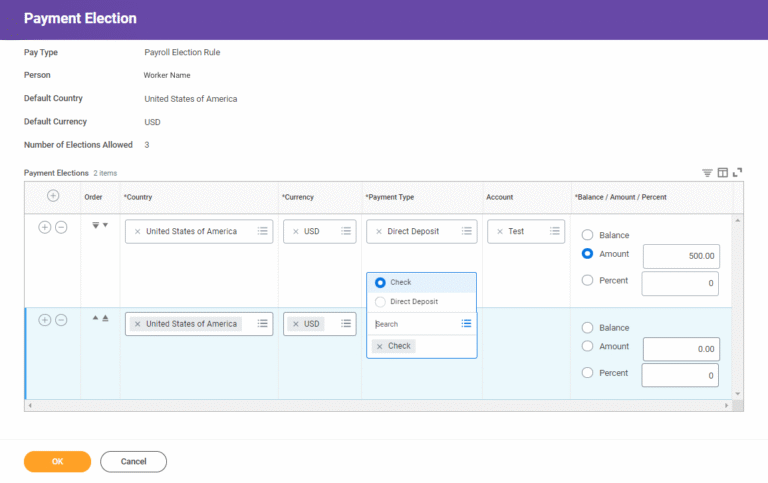

Accounting Practices For Management

Businesses receive payments from customers. Sometimes, these payments are unapplied. This means they are not linked to an invoice. It’s important to track these payments. Sendungsverfolgung helps in maintaining accurate records. It also prevents errors in financial statements. Use accounting software to Schiene these payments. Mark them properly in the system. This ensures they are applied correctly later.

Reconciliation is a key part of accounting. It involves checking records against each other. For unapplied payments, reconciliation is vital. Compare bank statements with your records. This helps find any mismatches. Resolve these mismatches quickly. Use simple tools or software for reconciliation. It saves time and reduces mistakes. Regular reconciliation keeps your books clean. It helps in maintaining vertrauenswürdig financial data.

Tools And Software Solutions

Many businesses use tools and software to manage cash payments. These solutions help track unapplied cash with ease. Software can show which payments need attention. This reduces errors and saves time. It is important to choose the right software. Some tools are easy to use. Others need training. Look for software that fits the business size. Small businesses might need simple tools. Larger companies may choose advanced options. Always check for Kundensupport. Good support makes solving problems easier. Many software options offer free trials. Test them before buying. This helps make the right choice.

Best Practices For Prevention

Conducting regular account audits helps to find mistakes. It ensures payments are properly applied. Audits reduce the risk of errors. They keep records accurate. Check accounts monthly or quarterly. Missing payments can cause issues. Audits show those problems early. Correct them before they grow.

Clear communication with clients prevents confusion. Always inform clients about their payments. Ask questions if details are unclear. Good communication builds trust. It helps avoid payment mistakes. Clients should feel understood. Respond to their questions quickly. Use simple language in messages. Make sure all details are correct. This reduces misunderstandings.

Case Studies

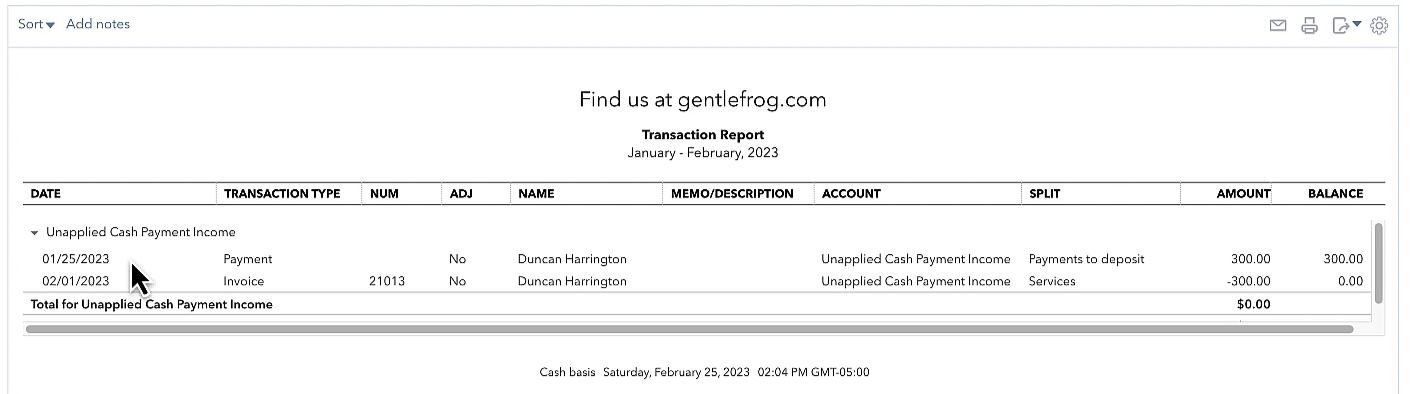

Unapplied Cash Payment Income refers to funds received but not yet allocated to specific invoices. This often happens in businesses managing multiple transactions. Proper tracking ensures accurate financial records and customer account management.

Subheading

Sometimes, businesses receive payments that don’t match any invoices. These are called unapplied cash payments. They can cause confusion in records. A case study shows how a small shop dealt with this. The shop got money from a customer. But, they had no open invoice for it. The shopkeeper felt puzzled. She called the customer for details. The customer explained it was an advance payment.

This payment was for future orders. The shopkeeper noted it as unapplied cash. Later, when the order came, she applied the payment. This helped keep the books clear. Another case involved a service provider. They received a large sum with no reference. They posted it as unapplied until they found the right invoice. This kept their finances tidy.

Future Trends

Unapplied cash payment income is a growing topic in finance. Businesses are finding new ways to handle unapplied cash. Technologie helps track and manage these payments. Software tools are getting better at predicting future trends. Automatisierung plays a big role in reducing human errors. This saves time and money for companies.

Data analysis shows patterns in cash flow. Trends help businesses plan better. They can see where cash gets stuck. Companies focus on improving payment systems. They want faster processing and fewer delays. Customer satisfaction improves with better payment systems. It leads to trust and loyalty.

Blockchain technology is becoming popular. It adds security to transactions. Businesses use it for safe payments. Future might bring more changes. Companies will adapt to new tools. They will find efficient ways to handle unapplied cash.

Häufig gestellte Fragen

What Is Unapplied Cash Payment Income?

Unapplied cash payment income refers to money received that hasn’t been matched to an invoice. This often occurs when payments are received in advance or without clear instructions. Businesses need to investigate and allocate these funds properly to ensure accurate financial records and reporting.

How Does Unapplied Cash Affect Accounting?

Unapplied cash can distort financial statements by misrepresenting revenue and outstanding receivables. It might show inflated cash reserves while leaving invoices marked unpaid. Properly applying these payments ensures accurate financial data, aiding in effective financial analysis and decision-making.

Why Is Unapplied Cash Important?

Unapplied cash is crucial for maintaining accurate accounting records. It ensures correct revenue recognition and prevents discrepancies in financial reports. Proper management of unapplied cash helps businesses maintain good customer relationships by accurately reflecting payment status.

How Can Businesses Manage Unapplied Cash?

Businesses can manage unapplied cash by regularly reconciling payments and invoices. Implementing efficient accounting software and maintaining clear communication with customers can also help. Regular reviews and adjustments ensure payments are applied correctly, reducing errors and improving financial transparency.

Abschluss

Understanding unapplied cash payment income is crucial for managing finances. It affects your company’s cash flow and accounting records. Identifying and resolving unapplied payments helps maintain accurate books. This practice ensures efficient financial management. Regular reviews can prevent potential issues.

Keep your financial records clean and organized. It benefits both your business and your clients. Pay attention to details. They matter. A systematic approach minimizes errors and confusion. Applying payments correctly enhances trust and transparency. Stay proactive in handling unapplied cash.

It leads to smoother operations and better customer relationships.