What is Ccd Payment: Understanding Secure Transactions

Have you ever come across the term “CCD Payment” and wondered what it really means? You’re not alone.

In a world where digital transactions are becoming the norm, understanding the different payment methods is crucial. CCD Payment isn’t just another technical jargon; it’s a concept that could streamline how you handle your financial transactions. This introduction will demystify what CCD Payment is, and by the end of this article, you’ll not only understand it but also see how it can benefit your everyday life.

Let’s dive into this exciting aspect of digital finance together, and discover how embracing CCD Payment can make your financial dealings smoother and more efficient. Stay with us, because this could be the game-changer you’ve been looking for.

Defining Ccd Payment

CCD stands for Cash Concentration and Disbursement. It helps in managing money. Businesses use CCD for moving funds. The system is fast and safe. It makes handling money simple. Transfers happen between banks. This method is efficient. It reduces manual work. People use it for paying bills. It ensures payments are genau. Mistakes are less likely. CCD helps in saving time. It is a popular choice for companies. Many banks offer this service. CCD is trusted worldwide. It helps with business operations. The system is easy to understand. It aids in cash management.

How Ccd Payment Works

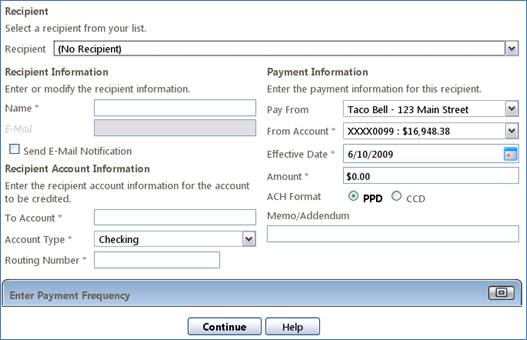

CCD Payment is a way to transfer money. It stands for Cash Concentration or Disbursement. This method helps businesses manage cash. It makes sending and receiving money easy. Banks play a big role. They process these payments.

Money moves from one account to another. This happens through the Automatisiertes Clearinghaus (ACH). ACH is a safe network. It handles a lot of transactions daily. Many companies use CCD for paying bills. It is also used for collecting money.

CCD Payment saves time. It reduces errors. This is important for businesses. They want to focus on their work. Not worry about payments. CCD makes this possible. It is a reliable system. Many trust it. It is fast and efficient.

Key Features Of Ccd Payment

CCD payment uses strong Verschlüsselung to keep your money safe. It protects your information from hackers. Your data is private and secure. No one can access it without permission. This makes CCD payment a trusted choice for everyone.

It is easy to use CCD payment. You can pay with just a few clicks. No need for long forms or waiting. It is simple and fast. Anyone can do it. Even a child can learn quickly.

Transactions are very fast with CCD payment. Money moves quickly from you to the seller. There is no long waiting time. This speed helps in urgent situations. It is a fast way to pay.

Benefits Of Ccd Payment

CCD Payment offers strong security for transactions. It uses erweiterte Verschlüsselung to protect data. This keeps your information safe from hackers. You can feel secure using CCD Payment.

Payments with CCD are fast and simple. You don’t have to wait long. It saves time and effort. Transactions are done in a few clicks. This makes buying and selling easy.

CCD Payment works all over the world. You can use it in many countries. It supports multiple currencies. This makes it easy to pay anywhere. CCD Payment connects people globally.

Comparing Ccd Payment To Traditional Methods

Credit cards are a common way to pay. They let you buy now and pay later. But there are fees. Some people might not like fees. CCD Payment can be better. CCD has less fees. This makes it cheaper. Credit cards also need approval. CCD is faster. No need for approval time.

Bank transfers move money from one bank to another. They can be slow. Sometimes, they take days. CCD Payment is quicker. You don’t wait long. Bank transfers need many details. CCD is simple. Just a few steps and done.

Digital wallets hold your money online. They are like virtual purses. Easy to use. But they need internet. What if you have no internet? CCD Payment works offline too. It is handy in places with no internet. Digital wallets can have limits. CCD has fewer limits. So, it is flexible.

Challenges In Ccd Payment Adoption

CCD payment systems need advanced tech. Not every place has good tech. Some areas lack internet. Without internet, CCD payment fails. Devices must be up-to-date. Old devices can’t handle new tech. This makes adoption tough.

Many users fear CCD payment. They worry about data theft. Trust is low if systems look unsafe. People want safe transactions. Safety builds trust. Without trust, adoption slows. Users need assurance for their data safety.

CCD payment faces strict rules. Governments need to approve systems. Approval can take time. Some rules are hard to follow. Companies must meet these rules. Without meeting rules, companies face fines. This can delay CCD adoption.

Future Of Ccd Payment

New technologies change how CCD payments work. Blockchain makes transactions more secure. Artificial Intelligence helps with customer service. Mobile Apps make paying easier. People use their phones to pay for things. Internet of Things connects devices for smoother payments. Biometrische Authentifizierung makes payments safer. Facial recognition Und fingerprints help secure transactions.

Digitale Geldbörsen are popular. People like to pay without cash. Contactless cards are fast and easy. Online-Shopping is growing. More people buy things online. E-commerce platforms support CCD payments. Kryptowährung is used for some payments. Virtuelle Karten are safe for online shopping. Subscription services use CCD payments. Recurring payments make life easier.

Voice-activated payments could be next. Smart assistants help make payments. Wearable devices might pay for stuff. Smart watches can be used for CCD payments. Augmented reality makes shopping interactive. Custom payment experiences will be more common. Sicherheitsfunktionen will improve. Data analytics will make payments smart. Personalized offers will attract customers.

Häufig gestellte Fragen

What Is Ccd Payment Used For?

CCD payment, or Corporate Credit or Debit payment, is used for transferring funds between businesses. It supports various transactions like payroll, vendor payments, and other B2B transactions. This payment type is preferred for its speed, security, and efficiency, making it ideal for corporate financial operations.

How Does Ccd Payment Work?

CCD payment works by transferring funds electronically between bank accounts. Businesses initiate transactions via Automated Clearing House (ACH) networks. This process ensures secure and efficient fund transfers. The system verifies transactions, ensuring funds are debited and credited accurately. This makes CCD a reliable choice for businesses.

Is Ccd Payment Secure?

Yes, CCD payment is secure. It uses the Automated Clearing House (ACH) network, which employs advanced security protocols. These protocols protect sensitive financial data during transactions. Businesses trust CCD payments for their reliability and safety. The system continuously monitors transactions to prevent fraud and unauthorized access.

What Are The Benefits Of Ccd Payments?

CCD payments offer numerous benefits, including fast and secure transactions. They reduce processing costs and minimize the risk of errors. Businesses enjoy improved cash flow management and efficiency. The process is automated, which saves time and resources. CCD is a preferred choice for corporate transactions.

Abschluss

Understanding CCD payment is essential for modern transactions. It simplifies payments. Businesses benefit from its efficiency. Users enjoy faster, reliable transactions. Learning about CCD payment enhances your financial literacy. It’s crucial in today’s digital world. Stay informed to make better financial decisions.

This knowledge empowers you. Embrace the ease and security CCD payment offers. You’ll find it beneficial in daily life. Keep exploring to stay ahead. As technology evolves, understanding payment methods becomes vital. Stay curious, keep learning, and adapt to new financial tools.

Your financial future depends on it.