What is a Payment API: Streamline Transactions Effortlessly

Are you tired of cumbersome payment processes that slow down your business operations? Or perhaps you’re curious about how to seamlessly integrate payment solutions into your website or app?

Enter the world of Payment APIs—a game-changer in the digital payment landscape. Imagine a world where transactions are swift, secure, and convenient, all thanks to this powerful tool. You’ll discover what a Payment API is, how it works, and why it’s becoming indispensable for businesses like yours.

Prepare to unlock the secrets of streamlined transactions and enhanced customer experiences. Ready to simplify your payment systems and boost your business efficiency? Let’s dive in!

Payment Api Basics

A Payment API is a tool. It helps businesses process payments. It connects online stores to banks. This makes buying things easy. Payment APIs ensure sichere Transaktionen. They protect money and data. Businesses use them to accept credit cards. Also, digital wallets are popular.

Setting up a Payment API is simple. Developers use code snippets. These are small pieces of code. They help connect the API to websites. Some APIs offer extra features. For example, fraud detection. This helps keep transactions safe.

Payment APIs save time. Businesses don’t need to build systems. They use APIs that are ready-made. So, they focus on selling products. Customers enjoy smooth buying experiences. Everyone benefits from Payment APIs.

Key Features Of Payment Apis

Payment APIs offer easy integration with websites and apps. Developers can connect payment systems without much hassle. This saves time and effort. It ensures a smooth user experience. Customers pay without leaving the site. This keeps them happy and engaged.

Sicherheit is crucial for any payment process. Payment APIs use Verschlüsselung to protect data. They keep customer information safe. Users can trust the system. This builds confidence in online transactions.

Businesses can reach global audiences with multi-currency support. Payment APIs handle different currencies easily. This allows selling products worldwide. Customers can pay in their own currency. It simplifies the buying process.

Instant processing is vital for quick transactions. Payment APIs process payments in real-time. This means no waiting for confirmation. Customers get immediate feedback. It makes shopping fast and efficient.

Vorteile für Unternehmen

Payment APIs make buying easy for customers. They offer schnell Und sicher checkouts. Customers feel safe sharing their payment information. This builds trust and makes them come back. Happy customers mean more business. They also like the convenience of multiple payment options.

Payment APIs help businesses work faster. They reduce manual work, saving time. Less time spent on transactions means more time for other tasks. APIs also help track payments easily. This makes managing money simpler for businesses. Efficient systems help businesses grow.

Businesses can grow with Payment APIs. They handle more transactions as businesses expand. APIs offer Flexibilität to adapt to new needs. They integrate with different platforms. This makes them suitable for any business size. Easy to adjust and upgrade.

Popular Payment Api Providers

Streifen helps websites accept money online. It is easy to use. Stripe is known for its strong security. Many big companies trust Stripe. It works in many countries. Stripe also supports many currencies.

PayPal is a well-known payment service. It is popular worldwide. People use PayPal to send and receive money. PayPal is easy to set up. It is safe for online payments. Many online stores use PayPal.

Quadrat offers tools for small businesses. It helps them accept payments. Square is simple to set up. It is perfect for shops and restaurants. Square provides a card reader for phones. It is a good choice for small business owners.

Adyen is used by big companies. It works with many payment methods. Adyen supports global transactions. It offers strong fraud protection. Companies like Netflix use Adyen. It is perfect for businesses of any size.

Choosing The Right Payment Api

Understand what your business needs. This is very important. List your goals. Are you selling products online? Or providing services? Different needs require different solutions. Find out if you need Internationale Zahlungen. Or just local ones. Think about the volume of transactions. More transactions might need a stronger system.

Budget is crucial for choosing a Payment API. Check the fees. Some APIs charge per transaction. Others have a Monatsgebühr. Calculate the total cost. Compare it with your budget. See if they offer free trials. This helps you test without spending much. Make sure the cost fits your business size.

Security is a must. Your customers trust you with their money. Make sure the API has strong securitySuchen Sie nach PCI compliance. This means it follows safety rules. Check if they offer Betrugsschutz. This keeps transactions safe. Choose APIs that regularly update their systems. This guards against new threats.

Future Trends In Payment Apis

AI helps payment systems learn from data. It makes payments faster. Machine learning predicts what users might buy. Payment APIs use these predictions. They offer personalized payment options. Fraud detection improves with AI. It spots unusual activities quickly. This keeps money safe. Payment APIs adapt over time with AI.

Blockchain stores transaction data in blocks. These blocks are secure. Payment APIs use blockchain for safer transactions. Decentralized ledgers make tracking easy. It reduces the risk of fraud. Blockchain ensures Transparenz. Everyone can see transactions. Payment APIs gain trust with blockchain. It offers faster and cheaper payments.

Mobile payments are growing. Payment APIs connect apps to banks. They make payments simple and quick. Kontaktloses Bezahlen are popular. Users tap to pay with phones. Digitale Geldbörsen store card info safely. Payment APIs support these wallets. They offer smooth transactions. Mobile payment methods evolve constantly. APIs keep up with changes.

Implementation Best Practices

Testing is important before using a payment API. Thorough testing ensures the API works correctly. Debugging helps find and fix errors. Always test with different data. Simulate real transactions. This helps identify issues early. Use automated tests for efficiency. They save time and reduce human error. Testing environments should mimic the real system. This helps in accurate results. Regularly update tests as the API changes.

Monitoring keeps the payment API running smoothly. Use tools to watch performance. Identify slowdowns quickly. Wartung involves regular updates. These updates fix bugs and improve security. Check for errors daily. This prevents problems from growing. Always backup data. It protects against loss. Set alerts for unusual activity. This helps in quick action. Regular checks ensure reliability.

Kundendienst is crucial for payment APIs. Integrate a support system early. Schnelle Antworten to issues build trust. Use chatbots for basic help. They provide instant support. Train staff for complex problems. Ensure support is available 24/7. Feedback helps improve the API. Encourage users to share their thoughts. Make support easy to access. A well-supported API leads to happy users.

Häufig gestellte Fragen

What Is A Payment Api Used For?

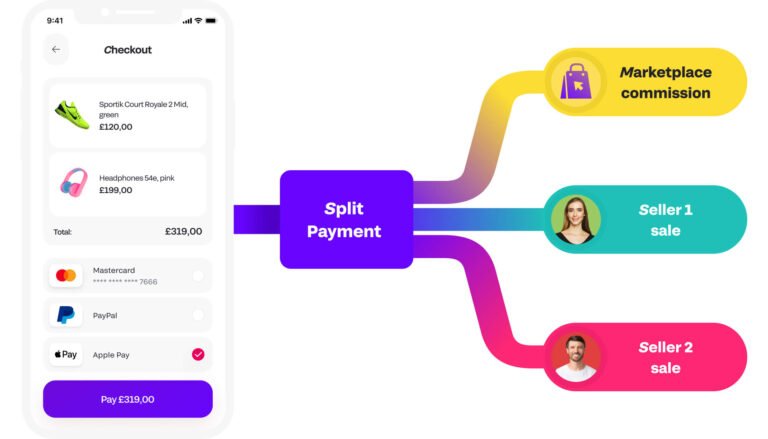

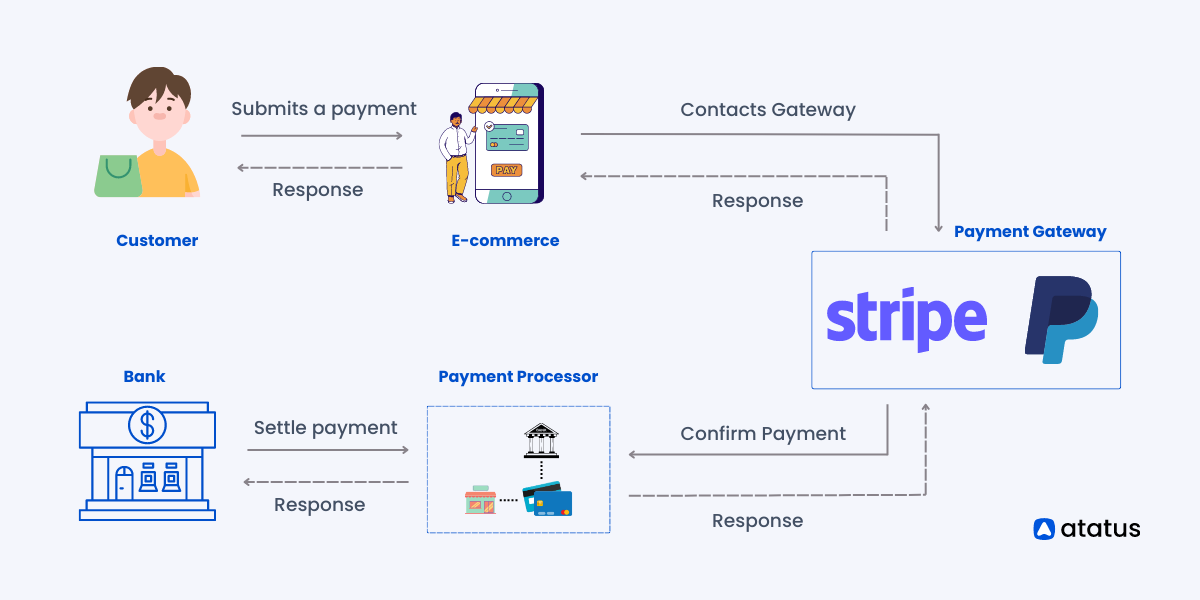

A Payment API is used to process online transactions securely. It connects e-commerce platforms to payment processors. This enables businesses to accept payments from customers easily. It supports various payment methods like credit cards and digital wallets. Payment APIs simplify and automate transaction handling, ensuring a seamless checkout experience.

How Does A Payment Api Work?

A Payment API works by integrating with a website or app to handle payments. When a customer makes a purchase, the API securely transmits payment information to the processor. The processor then communicates with the customer’s bank to authorize the transaction.

Once approved, the payment is completed, ensuring security and efficiency.

Why Are Payment Apis Important For Businesses?

Payment APIs are crucial for businesses to handle transactions efficiently. They provide a secure and reliable way to accept payments online. This enhances the user experience by offering a smooth checkout process. Additionally, they support multiple payment methods, increasing customer convenience and potentially boosting sales.

What Are The Benefits Of Using Payment Apis?

Using Payment APIs offers several benefits, including enhanced security and simplified transaction processing. They support various payment methods, accommodating diverse customer preferences. Payment APIs also streamline the checkout process, improving user experience and reducing cart abandonment. This can lead to increased sales and customer satisfaction.

Abschluss

Payment APIs are key in modern digital transactions. They streamline payment processes. Businesses benefit from faster and secure transactions. Customers enjoy a smooth checkout experience. Adopting a payment API can boost your business efficiency. It keeps your transactions safe and reliable.

Understanding how they work is crucial. It ensures better integration into your systems. Payment APIs are important in today’s digital economy. They make financial transactions easier for everyone. Start exploring payment APIs for your business needs. Make transactions seamless and efficient.

Your business can grow with the right payment solutions.