Ist die Abrechnung von Interbankenentgelten für Zahlungskarten legitim? Entdecken Sie die Wahrheit

When you first hear about the Payment Card Interchange Fee Settlement, it’s natural to wonder if it’s legit. You might be asking yourself whether this settlement is something you should pay attention to or if it’s just another financial myth.

You’re not alone in your curiosity. Many people are trying to understand what this settlement means for them and their wallets. Imagine finding out that you might be entitled to a refund on fees you’ve unknowingly paid on credit card transactions.

Intriguing, right? This potential windfall could be closer than you think, but only if you know how to navigate the complexities surrounding it. We’ll unravel the mystery of the Payment Card Interchange Fee Settlement. We’ll guide you through what it is, why it exists, and most importantly, whether it’s something you can benefit from. Stick with us, and by the end, you’ll have a clear understanding of whether this settlement is a legitimate opportunity for you. Let’s dive in and see if there’s money waiting for you to claim!

Background Of Interchange Fees

Interchange fees are charges that merchants pay to banks. These fees are for processing credit and debit card transactions. The goal is to cover the cost of handling these payments. They help banks maintain systems and offer secure transactions. Without these fees, banks might not offer card services. Merchants need to understand these fees. They affect pricing and profits. Knowing the purpose can help plan better. These fees are essential in the card payment ecosystem. They ensure smooth transactions.

Banken, merchants, Und Zahlungsnetzwerke play vital roles. Banks issue credit and debit cards. Merchants accept these cards for payments. Payment networks like Visa and Mastercard facilitate transactions. They set interchange fee rates. Merchants pay these fees to banks through payment networks. All three must work together. Each has a specific role. Banks provide cards. Merchants offer products. Networks ensure safe transactions. This teamwork makes card payments possible. Smooth and efficient.

The Settlement Explained

Exploring the legitimacy of the Payment Card Interchange Fee Settlement reveals its impact on businesses. This settlement addresses excessive fees, offering potential relief. Understanding its validity is crucial for affected merchants seeking financial recovery.

Origins Of The Settlement

Der Payment Card Interchange Fee Settlement started due to merchant complaints. Merchants felt that fees were too high. They believed these fees hurt their businesses. Big companies like Visum Und MasterCard were involved. They charged fees for card transactions. The settlement was to fix these issues. It aimed to help merchants.

Merchants wanted fair terms. They wanted lower fees. They also wanted better rules. Merchants and card companies reached an agreement. This agreement was the settlement. It was a legal resolution. The settlement was big news. It affected many businesses. It changed how fees were charged.

Geschäftsbedingungen

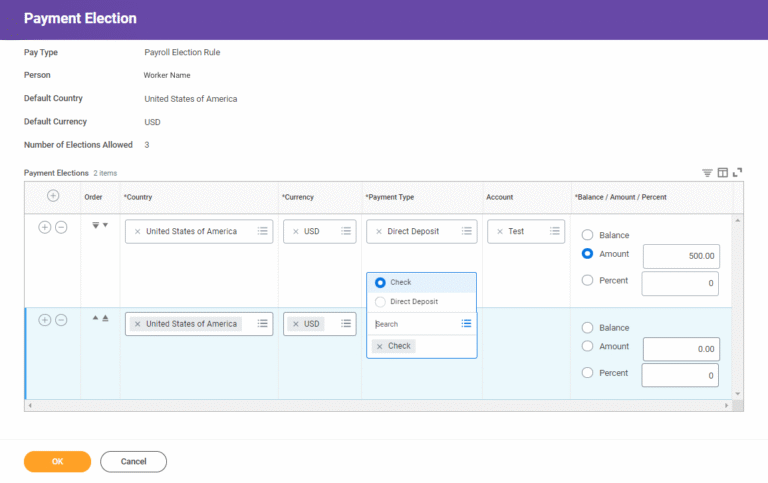

The settlement has specific terms. Merchants get money back. They are paid for past fees. New rules are set for future fees. Card companies must follow these rules. Merchants can decide if they join the settlement. Joining means accepting terms. Not joining means no money back. Merchants must read all rules carefully. It’s important to understand the conditions. The settlement aims for fairness. It should help merchants and card companies.

Legitimacy Concerns

Many people wonder about the legitimacy of the Payment Card Interchange Fee Settlement. Lawyers discuss the legal aspects of this settlement. Some say it is a fair deal for all. Others feel it is not. The settlement involves many big companies. These companies have a lot at stake. Judges have looked at the settlement too. They ensure all laws are followed. This keeps the process fair and legal.

Consumers have mixed feelings about the settlement. Some think it is a good idea. They feel it will help with card fees. Others are not so sure. They worry about versteckte Kosten. Some people think only big businesses win. Small businesses are worried too. They fear they might not get a fair share. Consumers want clear information. They need to know how this affects them. Many hope for better deals on card fees.

Pros And Cons Of The Settlement

Merchants may receive a Erstattung on past fees. This can help cover costs. They also gain a clearer view of fee structures. This can aid in planning and budgeting. Merchants might find it easier to negotiate fees. This can lead to better deals over time. Improved transparency can boost trust with payment companies.

Some merchants might see small refunds. This may not cover their costs. Legal processes can be long and complicated. This could cause stress and confusion. Not all merchants might benefit equally. Some might feel left out. The settlement could change future fee agreements. This might limit options for businesses.

Impact On Businesses

Small businesses feel the pinch from interchange fees. They have less power to negotiate. Higher costs can affect their profit. Some may raise prices. Others may cut back on services. Large businesses handle these fees better. They have more power. They can negotiate better deals. This gives them an edge.

The settlement affects big and small businesses differently. Small shops may struggle more. They see higher costs as a bigger problem. Large companies manage better. They have resources to handle fees. This makes them more competitive.

Over time, small and large businesses will adapt. Some small businesses might close. Others may find new ways to save. Large businesses will continue to grow. They may get even stronger. The settlement could change the market. Only time will tell.

Future Of Interchange Fees

Exploring the legitimacy of payment card interchange fee settlements raises many questions. These fees impact merchants’ costs and consumers’ prices. Understanding their future and potential changes is crucial for businesses and customers alike.

Potential Changes In Regulations

Regulations around interchange fees might change soon. Rules could become stricter. Banks and card companies may adjust fees. The goal is to protect consumers. Niedrigere Gebühren can help businesses too. New rules will affect everyone using cards. Understanding changes is important for card users. Keep an eye on news about these fees.

Emerging Trends

Trends in payment systems are evolving. Digital payments are growing fast. People prefer contactless cards now. Mobile Geldbörsen are on the rise. Sicherheit is a big focus for companies. Innovation in technology will continue. More people will use Online-Zahlungen. These trends shape the future of fees.

Häufig gestellte Fragen

What Is A Payment Card Interchange Fee?

A payment card interchange fee is a transaction fee merchants pay to card-issuing banks. This fee covers the cost of card acceptance. Interchange fees are usually a percentage of the transaction amount. They are vital for the functioning of the card payment network.

Why Is There A Settlement For Interchange Fees?

The settlement for interchange fees addresses past disputes between merchants and card networks. Merchants claimed excessive fees were charged. The settlement compensates affected merchants. It aims to resolve legal conflicts and improve fee transparency. This settlement is part of ongoing regulatory and legal efforts.

How Does The Settlement Affect Consumers?

The settlement is unlikely to directly affect consumers. It primarily involves compensation to merchants. However, there could be indirect effects. Merchants might adjust pricing or fees. Consumers should stay informed about any policy changes by their card providers.

Who Benefits From The Interchange Fee Settlement?

The primary beneficiaries of the settlement are the merchants. They receive compensation for alleged excessive fees. Card networks and banks also benefit. They can avoid prolonged litigation. The settlement aims to create a balanced environment for all parties involved.

Abschluss

Deciding if the Payment Card Interchange Fee Settlement is legit can be tricky. It’s crucial to research and understand all details. Many find it genuine, while some have concerns. Always check official sources for updates and information. Consider consulting a legal expert if unsure.

Staying informed helps in making wise decisions. Remember, your financial safety matters most. Don’t rush into agreements without clarity. This settlement could be beneficial, but caution is key. Make sure you know what you’re agreeing to. Stay vigilant and protect your interests.

Your money, your responsibility.