So kündigen Sie Ihr Chase-Kreditkartenkonto

Wenn Sie Ihr Chase-Kreditkartenkonto kündigen möchten, sollten Sie einige wichtige Schritte unternehmen, um einen reibungslosen Ablauf zu gewährleisten. Sie sollten Überprüfen Sie Ihren Kontostatus, einschließlich aller ausstehenden Guthaben und Prämien, bevor Sie Ihre Entscheidung treffen. Sobald Sie vorbereitet sind, Kontaktaufnahme mit dem Chase-Kundendienst ist wichtig, aber zu wissen, was einen erwartet, kann einen großen Unterschied machen. Welche wichtigen Details sollten Sie zur Hand haben und wie können Sie Schützen Sie Ihre Kreditwürdigkeit während dieses Prozesses? Lassen Sie uns diese Aspekte genauer untersuchen.

Gründe für die Kündigung Ihrer Karte

Es gibt mehrere triftige Gründe, die Sie in Betracht ziehen könnten Kündigung Ihrer Chase-KreditkarteWenn Sie ein Opfer eines Betrugs oder Ihr Konto wurde kompromittiert, ist es verständlich, dass Sie die Verbindungen für Ihre Sicherheit trennen möchten. Darüber hinaus, wenn Sie mit Schulden kämpfen, kann Ihnen die Kündigung helfen, sich auf die Verwaltung Ihrer Finanzen effektiver zu konzentrieren. Sie werden vielleicht auch feststellen, dass die Die Gebühren der Karte überwiegen ihre Vorteile, insbesondere wenn Sie die Prämien oder Angebote nicht nutzen. Sollten Sie eine bessere Karte mit niedrigeren Zinsen oder besseren Vorteilen gefunden haben, kann ein Wechsel sinnvoll sein. Prüfen Sie immer Ihre finanzielle Situation, bevor Sie Entscheidungen zur Sicherung Ihrer finanziellen Situation treffen.

Überprüfen Sie Ihren Kontostatus

Bevor Sie Ihre Chase-Kreditkarte kündigen, sollten Sie Ihren Kontostand überprüfen, um sich über ausstehende Beträge, Prämien oder mögliche Gebühren zu informieren. So sind Sie vor Ihrer Entscheidung umfassend informiert. Hier sind vier wichtige Aspekte, die Sie überprüfen sollten:

- Ausstehende Salden: Wissen Sie, wie viel Sie schulden, um Überraschungen zu vermeiden.

- Prämienpunkte: Bewerten Sie alle Prämien, die Sie angesammelt haben und möglicherweise einlösen möchten.

- Jahresgebühren: Stellen Sie fest, ob Gebühren anfallen, die Ihre endgültige Entscheidung beeinflussen könnten.

- Zahlungsverlauf: Überprüfen Sie Ihren Zahlungsverlauf, um Ihre Kreditwürdigkeit zu verstehen.

Mithilfe dieser Schritte können Sie eine fundierte Entscheidung zur Kündigung Ihres Kontos treffen und sicherstellen, dass Sie keine wichtigen Details übersehen.

Ausstehende Salden begleichen

Bevor Sie mit der Kündigung Ihrer Chase-Kreditkarte fortfahren, müssen Sie unbedingt alle offenen Beträge begleichen. So vermeiden Sie zusätzliche Gebühren und eine mögliche Beeinträchtigung Ihrer Kreditwürdigkeit. Hier finden Sie eine kurze Übersicht über die Zahlungsabwicklung:

| Zahlungsmethode | Vorteile | Nachteile |

|---|---|---|

| Online-Zahlung | Schnell und bequem | Erfordert Internetzugang |

| Zahlung per Post | Kann jederzeit durchgeführt werden | Langsamere Verarbeitungszeit |

| Telefonzahlung | Sofortige Bestätigung | Es fallen möglicherweise Gebühren an |

Überprüfen Sie unbedingt Ihren letzten Kontoauszug auf den genauen Saldo. Sobald Sie alles bezahlt haben, bewahren Sie die Bestätigung für Ihre Unterlagen auf. Dies gibt Ihnen Sicherheit bei der Kündigung.

Prämien und Punkte einlösen

Nachdem Sie Ihre offenen Beträge beglichen haben, können Sie die Prämien und Punkte Ihrer Chase-Kreditkarte einlösen. Nutzen Sie diese Vorteile unbedingt, bevor Sie Ihr Konto schließen. Hier sind einige sichere Möglichkeiten, Ihre Prämien einzulösen:

- Cashback: Wandeln Sie Ihre Punkte in Bargeld um und zahlen Sie es auf Ihr Bankkonto ein.

- Reisen: Buchen Sie Flüge, Hotels oder Mietwagen mit Ihren Punkten über das Chase-Reiseportal.

- Geschenkkarten: Tauschen Sie Punkte gegen Geschenkkarten beliebter Einzelhändler ein.

- Waren: Durchsuchen Sie den Chase-Prämienkatalog nach Elektronik, Haushaltsartikeln und mehr.

Achten Sie auf Ablaufdaten und lösen Sie Ihre Prämien rechtzeitig ein. So bleibt der angesammelte Wert erhalten.

Sammeln Sie wichtige Informationen

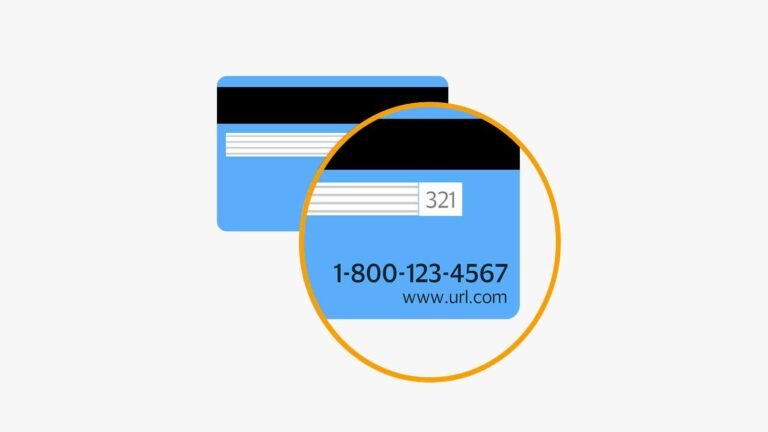

Um eine reibungsloser Kündigungsprozess Ihres Chase-Kreditkartenkontos müssen Sie Wichtige Informationen wie Ihre Kontonummer und jede offener Betrag Details. Suchen Sie zunächst Ihre letzte Kreditkartenabrechnung. Diese enthält die Kontonummer und den aktuellen Kontostand. Notieren Sie sich auch alle kürzlich getätigten Einkäufe oder Zahlungen, da diese Ihren endgültigen Kontostand beeinflussen können. Es ist auch hilfreich, Ihre persönliche Identifikationsinformationen Halten Sie wichtige Informationen wie Ihre Sozialversicherungsnummer oder Ihr Geburtsdatum bereit, falls Sie diese während des Kündigungsprozesses benötigen. Wenn Sie alle diese Informationen organisiert haben, können Sie auf eventuell auftretende Fragen oder Bedenken schnell reagieren. Das macht den Prozess für Sie sicherer und effizienter.

Kontaktieren Sie den Kundenservice

Um die Kündigung Ihres Kreditkartenkontos einzuleiten, ist es wichtig, den Kundenservice von Chase zu kontaktieren. Halten Sie Ihre Informationen bereit, um ein reibungsloses Gespräch zu gewährleisten. Folgendes sollten Sie vorbereiten:

- Kontonummer: Halten Sie Ihre Kreditkartennummer bereit.

- Persönliche Identifikation: Seien Sie bereit, Ihre Identität mit persönlichen Informationen zu bestätigen.

- Grund für die Stornierung: Denken Sie darüber nach, warum Sie stornieren. Dies könnte dazu beitragen, dass Ihnen besser geholfen werden kann.

- Alternative Kontaktmethode: Erwägen Sie, für die Nachverfolgung eine E-Mail-Adresse oder eine alternative Telefonnummer anzugeben.

Bleiben Sie beim Anruf ruhig und präzise. Der Mitarbeiter führt Sie durch den Kündigungsprozess. Ihre Sicherheit und Privatsphäre haben dabei oberste Priorität.

Befolgen Sie die Stornierungsanweisungen

Für eine erfolgreiche Kündigung Ihres Chase-Kreditkartenkontos ist es wichtig, den Anweisungen des Mitarbeiters zu folgen. Er wird Ihnen spezifische, auf Ihre Situation zugeschnittene Schritte erläutern. Notieren Sie sich unbedingt alle Bestätigungsnummern und bitten Sie um eine schriftliche Bestätigung Ihrer Kündigung.

Hier ist eine praktische Tabelle, die Ihnen dabei hilft, sich an die wichtigsten Aktionen zu erinnern:

| Schritt | Erforderliche Aktion | Bedeutung |

|---|---|---|

| Guthaben überprüfen | Prüfen Sie, ob noch Beiträge offen sind | Vermeiden Sie unerwartete Gebühren |

| Stornierung bestätigen | Fordern Sie eine Bestätigungs-E-Mail an | Garantiestornierung wird bearbeitet |

| Karte zerstören | Zerschneiden Sie Ihre Karte sicher | Schutz vor Betrug |

Überwachen Sie Ihre Kreditauskunft

Nach der Kündigung Ihrer Chase-Kreditkarte ist es wichtig, Ihre Kreditauskunft im Auge zu behalten, um sicherzustellen, dass alles in Ordnung ist und keine Probleme bestehen. Die Überwachung Ihrer Kreditauskunft kann Ihnen helfen, Fehler frühzeitig zu erkennen und Ihre finanzielle Gesundheit zu schützen. Hier sind vier wichtige Schritte:

- Auf Kontoschließung prüfen: Überprüfen Sie, ob die Kreditkarte in Ihrem Bericht als geschlossen angezeigt wird.

- Suchen Sie nach falschen Salden: Stellen Sie sicher, dass auf der gesperrten Karte keine ausstehenden Beträge vorhanden sind.

- Zahlungsverlauf überprüfen: Bestätigen Sie, dass alle Zahlungen korrekt gemeldet wurden.

- Achten Sie auf Identitätsdiebstahl: Achten Sie auf unbekannte Konten oder Anfragen.

Durch die regelmäßige Überwachung Ihrer Kreditauskunft können Sie beruhigt sein und Ihre finanzielle Sicherheit wahren.

Entsorgen Sie Ihre Karte sicher

Sobald Sie Ihre Chase-Kreditkarte gekündigtist es entscheidend, die physische Karte entsorgen Sicher, um sich vor potenziellem Betrug zu schützen. Schneiden Sie die Karte zunächst in kleine Stücke und achten Sie darauf, Chip und Magnetstreifen zu durchtrennen. So verhindern Sie, dass jemand Ihre Karte rekonstruiert und auf Ihre persönlichen Daten zugreift.

Sie können die Karte auch schreddern, wenn Sie einen Aktenvernichter haben, der Plastik verarbeitet. Vergessen Sie nach der Entsorgung nicht, Entsorgen Sie alle Dokumente sicher im Zusammenhang mit Ihrem Konto, wie Rechnungen oder Kontoauszüge. Schließlich halten Sie ein Auge auf Ihre Kredit-Auskunft für alle unbefugte Aktivitäten nach der StornierungDurch diese Schritte wird gewährleistet, dass Ihre Daten auch lange nach der Schließung Ihres Kontos geschützt bleiben.

Erwägen Sie alternative Optionen

Bevor Sie Ihre Chase-Kreditkarte kündigen, sollten Sie alternative Optionen prüfen, die Ihren finanziellen Bedürfnissen besser entsprechen. Es gibt verschiedene Strategien, die Ihnen die gewünschten Vorteile bieten, ohne dass Sie Ihr Konto schließen müssen. Hier sind einige Alternativen, über die Sie nachdenken sollten:

- Gebühren aushandeln: Kontaktieren Sie den Kundendienst, um den Erlass der Jahresgebühr oder eine Senkung der Zinssätze zu besprechen.

- Prämienprogramme: Prüfen Sie, ob der Wechsel zu einer anderen Karte bei Chase Ihnen bessere, auf Ihre Ausgabegewohnheiten zugeschnittene Prämien bieten könnte.

- Saldoübertragung: Erwägen Sie die Übertragung Ihres Guthabens auf eine Karte mit einem niedrigeren Zinssatz, um Zinszahlungen zu sparen.

- Konto-Downgrade: Fragen Sie nach einem Downgrade auf eine Karte ohne Jahresgebühr, damit Ihr Konto offen bleibt und gleichzeitig die Kosten gesenkt werden.

Diese Optionen könnten Ihnen dabei helfen, eine fundiertere Entscheidung zu treffen.