Wie hoch ist die Anzahlung für eine Eigentumswohnung: Wichtige Anleitung

Are you dreaming of owning your own condo but feeling overwhelmed by the thought of a down payment? You’re not alone.

Understanding how much you need to save can be a daunting task, especially with so much conflicting information out there. But don’t worry, this guide is here to help you navigate through the numbers with ease. Imagine unlocking the door to your own space, knowing exactly what it took to get there.

You’ll discover the secrets to determining the right down payment for your budget, helping you take confident steps towards your home-owning dreams. Stick around to learn more about what goes into calculating that all-important number and how you can make your condo purchase a reality.

Factors Influencing Down Payment

A strong Kreditwürdigkeit helps in getting lower down payments. Lenders trust people with high scores. They see them as less risky. Lower scores can mean bigger down payments. It’s important to check your score. Make sure it’s accurate. Pay bills on time to improve your score.

Stable income

Different loans need different down payments. FHA loans “`

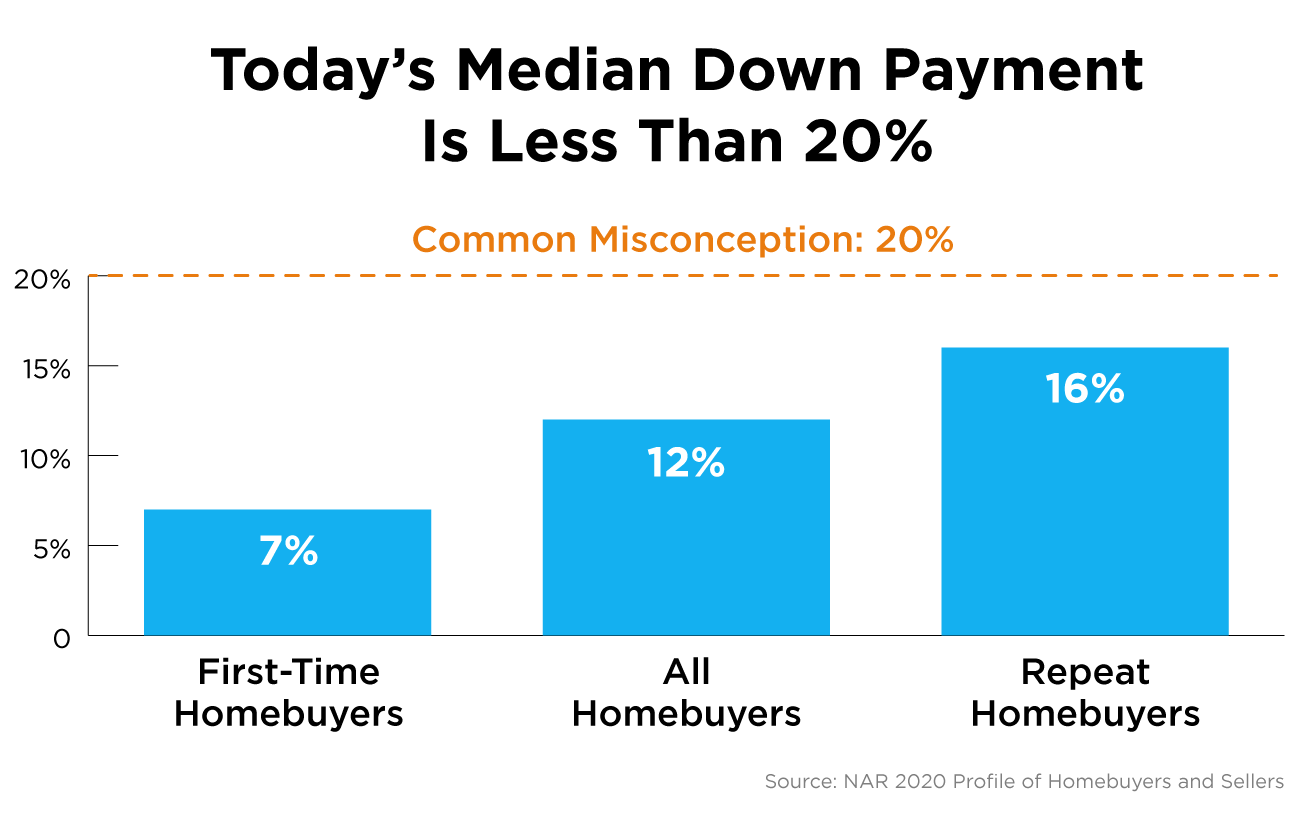

Typical Down Payment Percentages

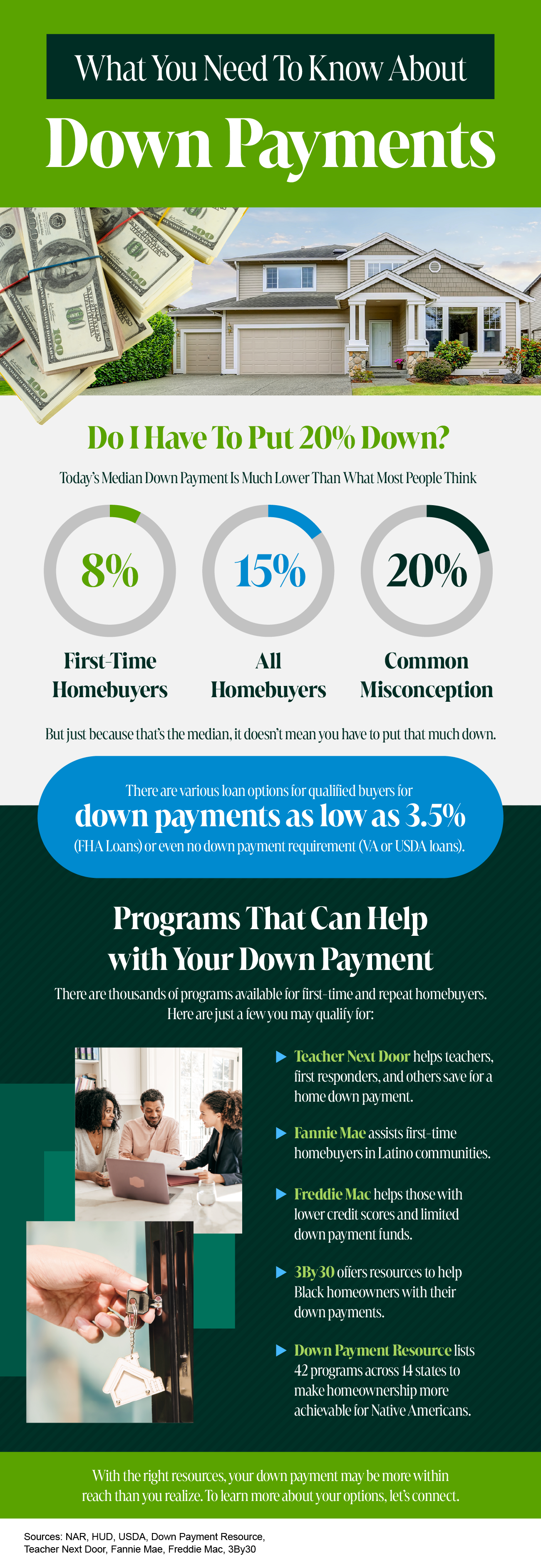

With conventional loans, a Anzahlung of 20% is common. Some lenders allow as low as 5%. Lower down payments mean higher monthly costs. A bigger down payment can save money over time. It reduces loan interest and insurance.

FHA loans need a smaller down payment. Often, it’s just 3.5%. This helps people with less money saved. It also helps those with lower credit scores. FHA loans are popular for first-time buyers. They make buying a home easier.

VA and USDA loans are special. They often need zero down payment. These loans help veterans and rural buyers. They make it easier to own a home. But, not everyone can use these loans. Only some people qualify for them.

Saving For A Down Payment

Set a clear savings goal for your condo. Track all your expenses. Cut unnecessary costs. Save a little every month. Use a simple budget app. It helps you stay on track. Celebrate small savings wins. This keeps you motivated.

Invest smartly with small amounts. Look into safe options. Bonds and savings accounts are good. Avoid risky stocks. You can lose money there. Check how much interest you earn. More interest means more savings. Be patient. Investments grow over time.

Some programs help with down payments. They offer low-interest loans. Grants are also available. Check if you qualify for these. Visit government websites for details. Ask a financial advisor. They can guide you. Saving becomes easier with help.

First-time Buyer Incentives

Grants and loans can help new condo buyers. These options make buying easier. Grants give money you don’t pay back. Loans offer money you repay over time. Both reduce your initial costs. Many programs exist to assist new buyers. Check local options for what’s available.

Tax benefits help lower costs. First-time buyers can save money. Some tax programs offer credits or deductions. These reduce the amount you owe. Ask an expert about available tax benefits. They can offer advice on saving money.

Local programs can offer extra help. Some areas provide special support. These programs may offer reduced interest rates. They might even assist with closing costs. Explore local resources for more information. Local programs can make buying a condo easier.

Impact Of Down Payment On Mortgage

A bigger Anzahlung kann Ihre interest rate. Lenders see less risk. This helps save money over time. A smaller down payment might mean higher rates. More interest adds up fast.

A large down payment reduces monatliche Zahlungen. You borrow less, so pay less monthly. Small payments are easier to handle. This means more money for other needs.

Paying less than 20% down? You need Private Mortgage Insurance (PMI). PMI protects the lender, not you. It adds to monthly costs. More down payment can avoid PMI. This saves extra money each month.

Steps To Determine Down Payment Amount

Think about your current savings Und monthly income. List all expenses to see what you can afford. Make a budget plan for the condo purchase. This helps in understanding how much you can pay upfront. It’s key to be realistic about what you can spend. Don’t forget to include other costs like taxes and fees.

Talk to different lenders to learn about loan options. They can explain Zinssätze Und down payment requirements. This helps in finding the best deal for your financial situation. Lenders will ask for documents to assess your ability to pay. Be prepared with your Finanzunterlagen for a smooth process.

Use online calculators to estimate your down payment. Enter details like home price and desired loan terms. Calculators give a quick idea of how much you’ll need. This tool is helpful to plan your budget easily. Make adjustments as needed to fit your needs.

Häufige Fehler, die Sie vermeiden sollten

Many people forget the versteckte Kosten when buying a condo. Taxes, insurance, and maintenance fees can add up. These expenses affect your budget. Always plan for these costs.

Closing costs can surprise you. These fees include lawyer charges, inspection fees, and more. You must budget for these fees. They are part of the buying process.

Some people choose the first loan offer they get. This can be costly. Different banks offer different rates. Shopping around can save you money. Compare loans before deciding.

Häufig gestellte Fragen

What Is A Typical Condo Down Payment Percentage?

A typical condo down payment is usually around 20% of the purchase price. However, this can vary based on lender requirements and borrower qualifications. Some lenders might offer lower down payment options, such as 10% or even 5%, depending on the buyer’s creditworthiness and financial situation.

Can I Buy A Condo With 5% Down?

Yes, it is possible to buy a condo with a 5% down payment. Some lenders offer this option, especially for first-time homebuyers. However, a lower down payment might require private mortgage insurance (PMI) and could lead to higher monthly payments.

How Does Down Payment Affect Mortgage Rates?

A larger down payment can lead to better mortgage rates. Lenders view borrowers with larger down payments as less risky. This often results in lower interest rates. Conversely, smaller down payments might result in higher rates and additional costs, like private mortgage insurance.

Are There Down Payment Assistance Programs For Condos?

Yes, there are down payment assistance programs available for condo purchases. These programs are often aimed at first-time homebuyers or those with limited income. They can provide grants or low-interest loans to help cover the down payment costs, making homeownership more accessible.

Abschluss

Understanding condo down payments is crucial for potential buyers. The required amount varies. It depends on factors like lender rules and location. Research helps in planning finances better. Speak with a trusted real estate agent. They offer valuable insights and guidance.

Saving early makes the process smoother. A clear budget keeps goals realistic. Stay informed and make wise decisions. Homeownership is a significant step. With knowledge, buying a condo becomes more manageable. Always be prepared for any surprises. Happy home buying!