How Much is a Down Payment for Braces With Insurance?

Are you considering braces for yourself or your child but feeling overwhelmed by the costs? You’re not alone.

Many people wonder about the financial commitment involved, especially when it comes to the down payment. With insurance, the costs can become a bit more manageable, but figuring out the exact amount you’ll need upfront isn’t always straightforward. Understanding how much a down payment for braces with insurance will set you back can save you a lot of stress and help you plan better.

In this guide, we’ll break down the essentials, so you can feel confident and prepared. Keep reading to discover how to navigate these costs, unlock potential savings, and make the best decision for your dental health.

Factors Influencing Down Payment

Insurance Coverage Details can change the amount you pay. Some plans cover more. Others cover less. Check your plan. Know what it covers. This can make a big difference. Ask your provider for details. Understand your benefits well.

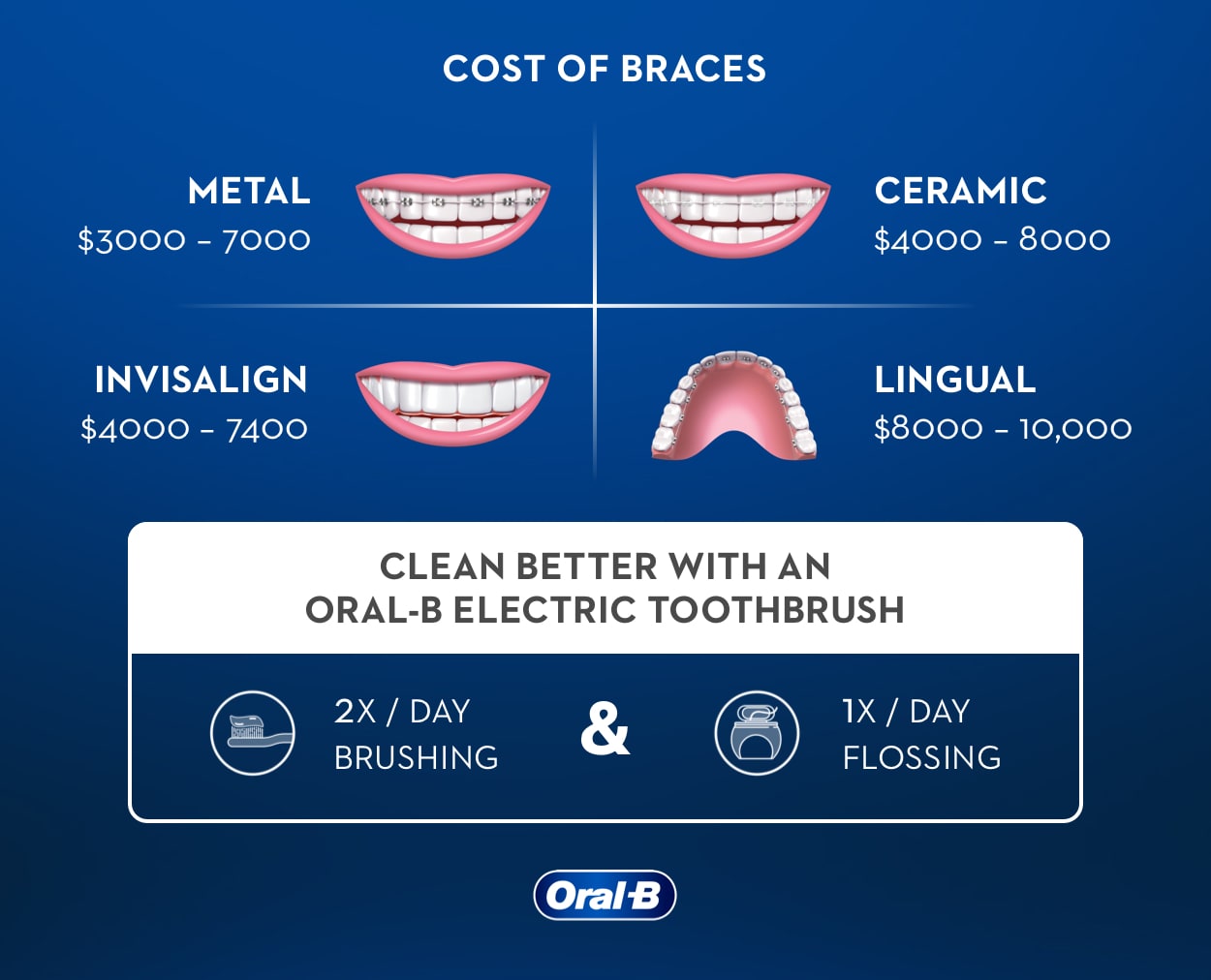

Orthodontic Treatment Type affects costs too. Different braces cost different amounts. Metal braces might be cheaper. Clear aligners can cost more. Choose the type that fits your budget. This choice impacts your down payment.

Provider Policies are important. Some providers ask for more money upfront. Others might offer payment plans. Always ask about policies. Compare providers if needed. This helps in managing your payments.

Typical Down Payment Amounts

Most standard insurance plans cover some part of braces. Families usually pay 20% to 30% of the total cost. This means, if braces cost $5,000, the family might pay $1,000 to $1,500 upfront. This is the Anzahlung.

Premium plans often cover more than standard plans. Families might pay only 10% to 15% of the braces cost. For example, if braces cost $5,000, the down payment could be $500 to $750. This helps families save more money.

Without insurance, families pay the full cost of braces. This means paying the whole $5,000 upfront. Some clinics offer Zahlungspläne. Families can pay small amounts each month instead of all at once.

Ways To Reduce Down Payment

Braces with insurance can lower costs, but a down payment might still be needed. Explore flexible payment plans offered by dental clinics to reduce this upfront expense. Some clinics offer discounts or financing options to make payments manageable.

Flexible Payment Plans

Many orthodontists offer flexible payment plans. You can pay in smaller chunks. This makes it easier for many families. Often, you can choose a monthly plan. This can fit your budget better. A small Anzahlung is usually required. Ask about their terms. It helps to know all your options.

In-network Providers

Choosing an in-network provider can save money. Insurance covers more with these providers. Less out-of-pocket cost for you. Check your insurance list. Find a provider in their network. This choice can reduce your down payment. It’s a smart way to save money.

Discount Programs

Some places have discount programs for braces. These programs lower costs. Ask your orthodontist about them. Sometimes, discounts are for certain groups. Military families or seniors, for example. Take advantage of these programs. They help make braces more affordable.

Questions To Ask Your Orthodontist

Coverage specifics are very important. Ask what your insurance covers. Does it cover full or partial costs? Understand your plan’s details. This helps in planning your budget.

Payment schedule options vary. Some plans offer monthly payments. Others might require a larger upfront payment. Ask about all payment choices. Choose the one that fits your budget best.

Watch out for versteckte Kosten. Sometimes, there are extra fees. These can include consultation fees or adjustments. Always ask about potential extra charges. This ensures no surprises later.

Alternatives To Traditional Braces

Exploring orthodontic options can lead to significant savings. Down payments for braces with insurance might be lower. Clear aligners and self-ligating braces offer cost-effective alternatives to traditional braces.

Invisalign And Clear Aligners

Invisalign and clear aligners are see-through. They fit over teeth like magic. These aligners are removable. Easy to clean. No metal wires or brackets. Comfortable to wear and popular among teens.

Retainers

Retainers hold teeth in place. They are small and simple. After braces, retainers are important. They keep your smile straight. Many types are available. Some are fixed, others are removable. Easy to manage and maintain.

Lingual Braces

Lingual braces are hidden behind teeth. Invisible from the front. Good for people who want privacy. Custom-made for each person. They work like regular braces. They can be tricky to clean. But they are effective.

Häufig gestellte Fragen

How Much Is The Average Down Payment For Braces?

The average down payment for braces ranges from $500 to $1,500. Insurance can significantly reduce this cost. The exact amount depends on your insurance plan and the orthodontist’s policy. It’s best to consult your insurance provider and orthodontist for precise figures.

Does Insurance Cover The Entire Cost Of Braces?

Insurance typically covers part of the cost, not the entire amount. Most plans cover 25% to 50% of the treatment cost. The coverage depends on your specific dental plan. You should review your policy details or contact your insurance provider for exact coverage information.

Can I Pay The Braces Down Payment In Installments?

Yes, many orthodontists offer payment plans for the down payment. These plans allow you to spread the cost over several months. It’s a flexible option for managing orthodontic expenses. Discuss available options with your orthodontist to find a suitable plan.

Are There Additional Costs Besides The Down Payment?

Yes, besides the down payment, there are additional costs. These may include monthly payments, adjustments, and retainers. Insurance may cover some of these expenses. It’s important to discuss all potential costs with your orthodontist before starting treatment.

Abschluss

Understanding down payments for braces with insurance is important. Costs can vary widely. Factors like insurance coverage and orthodontist fees matter. Always check with your provider for specifics. Research and plan your finances ahead. This helps avoid surprises. Talk to your orthodontist about payment plans.

Many offer flexible options. Consider the long-term benefits of braces. They improve dental health and confidence. Weigh all your options before deciding. Making informed choices leads to better outcomes. Remember, a healthy smile is worth the investment.