Wie lange dauert die Geldüberweisung bei Axs?

You're about to send money through AXS, but you're unsure how long it'll take to reach the recipient. While AXS transfers are generally quick, the exact timeframe depends on several factors, including the type of Übertragungsmethode you choose and the Bearbeitungszeiten of the sending and receiving banks. In some cases, the money can arrive in a matter of minutes; in others, it may take a few hours or even days. To get a better sense of what to expect, let's take a closer look at the typical transfer times and what can affect them.

Typical AXS Transfer Times

How long does an AXS transfer typically take, and what's involved in the process? You're probably keen to know when your transaction will be processed. Typically, an AXS transfer takes a few minutes to a few hours to complete, depending on the specifics of your transaction. The transfer time includes processing by the AXS system, Überprüfung, and settlement. Verification is a critical step to guarantee the security and integrity of the transaction. Once verified, the transaction is settled, and the funds are transferred to the recipient's account. You can expect a smooth and efficient transfer process with AXS. The exact timing may vary, but rest assured that AXS is working to process your transaction securely and quickly.

Faktoren, die die Übertragungsgeschwindigkeit beeinflussen

Während AXS transfers are generally quick and efficient, the speed at which your transaction is processed can be influenced by several factors, which we'll explore below. You should know that the type of Übertragungsmethode you choose can greatly impact the speed of your transaction. Additionally, the Bearbeitungszeiten of the sending and receiving banks can also affect how quickly your money is transferred. Furthermore, the Uhrzeit and day of the week when you initiate the transfer can influence the speed, as banks and financial institutions have different operating hours and processing schedules. Holidays and weekends can also cause delays. All these factors can add up, so it is crucial to take them into account when planning your transfer.

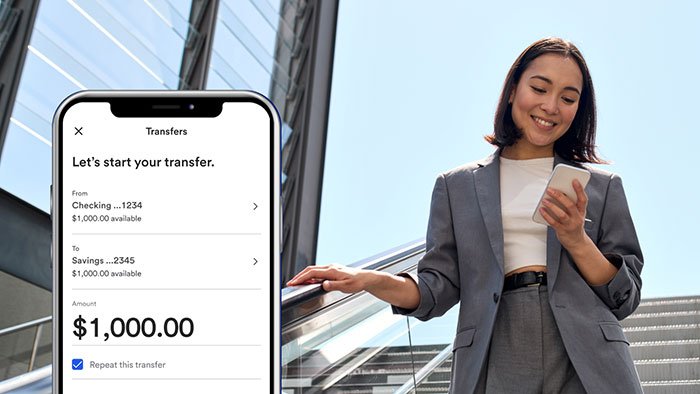

Sending Money With AXS

Typically, sending money with AXS is a straightforward process that can be completed in a few steps, allowing you to transfer funds quickly and efficiently. You can initiate a transfer using the AXS website or mobile app. Here are the key steps involved:

- Authenticate Your Account: Securely log in to your AXS account using your credentials.

- Empfängerinformationen eingeben: Provide the recipient's details, including their name, email, and account information.

- Confirm the Transfer: Review and confirm the transfer amount, recipient information, and any applicable fees.

Receiving Money With AXS

When someone sends you money using AXS, you'll usually receive an E-Mail-Benachrichtigung that a transfer is pending and that the funds are being deposited into your account. This notification will typically include the sender's name, the Überweisungsbetrag, and an voraussichtliche Lieferzeit. You can track the status of the transfer by logging into your AXS account. Once the funds are deposited, you can use them immediately. AXS typically transfers funds directly into your bank account or debit card. Make certain to review the transfer details carefully to guarantee everything is correct. If you have any issues or concerns, you can contact AXS customer support for assistance. By monitoring your account and tracking transfers, you can guarantee a safe and smooth transaction Verfahren.

Instant Transfer Options

AXS offers several instant transfer options that allow you to receive funds in real-time or near real-time. These options provide a convenient way to access your money quickly and safely. Here are three instant transfer options you can consider:

- Debitkartenüberweisung: Transfer funds directly to your debit card, allowing you to access your money instantly.

- Bank Account Transfer: Transfer funds to your bank account, with most banks processing the transfer in real-time or within a few hours.

- Digital Wallet Transfer: Transfer funds to your digital wallet, such as PayPal or Google Pay, providing a quick and secure way to access your money.

These instant transfer options give you the flexibility to manage your funds quickly and efficiently, while ensuring the security of your transactions.

Standard Transfer Timeline

While instant transfers are available, you also have the option to choose a standard transfer, which takes a bit longer to process and usually deposits funds into your account within a few business days. This option is often free or low-cost, making it a more affordable choice.

| Übertragungsmethode | Bearbeitungszeit | Deposit Time |

|---|---|---|

| Standardtransfer | 1-2 Werktage | 1-3 Werktage |

| ACH-Überweisung | 1-2 Werktage | 2-4 Werktage |

| Banküberweisung | 1 Werktag | 1 Werktag |

Keep in mind that standard transfer times may vary depending on the transfer method and your bank's processing times. It's always a good idea to check with Axs and your bank to confirm the estimated deposit time for your specific transfer.

Causes of Transfer Delays

Several factors can cause delays in the transfer process, and understanding these potential roadblocks can help you better plan and manage your transactions. You can't control everything, but knowing what might slow down your transfer can help you avoid potential pitfalls.

Here are three common causes of transfer delays:

- Falsche Empfängerinformationen: Double-check the recipient's details, as a single mistake can send your transfer into limbo.

- Unzureichende Mittel: Make sure you have enough money in your account to cover the transfer amount.

- Security checks: Axs may flag your transfer for review, which can cause a delay – this is a security measure to protect your account.

How to Track Your Transfers

To guarantee your transfer reaches its destination smoothly, you can seinen Fortschritt verfolgen through Axs's online platform or mobile app. You'll receive updates on the status of your transfer, from initiation to completion. This way, you can stay informed and address any potential issues promptly. To track your transfer, simply log in to your Axs account, navigate to the 'Transfers' section, and select the relevant transaction. You'll see the current status, including any processing or delivery times. If you notice any delays or issues, you can contact Axs's customer support for assistance. By monitoring your transfer, you can enjoy peace of mind and make certain your money reaches its intended recipient safely and efficiently. This tracking feature is available 24/7, providing you with constant visibility.

AXS Transfer Limitations

Axs transfer limitations play an essential role in determining how much money you can send, both regarding the maximum amount allowed per transaction and the cumulative total over a specific time period. You'll want to know these limits to avoid any issues with your transfers.

Hier sind drei wichtige Dinge, die Sie beachten sollten:

- Tägliche Überweisungslimits: Axs has a daily limit on the amount you can send, which varies depending on your account type and verification status.

- Monatliche Überweisungslimits: There's also a monthly limit on the cumulative total you can send, which resets at the beginning of each month.

- Transaktionslimits: Each transaction has its own limit, which may be lower than your daily or monthly limit.