Wie kann ich einfach Geld von Paypal auf ein Bankkonto überweisen?

Are you wondering how to transfer money from your PayPal account to your bank account? You’re not alone.

Many people find themselves puzzled by the steps involved in moving their funds seamlessly. Imagine the relief and satisfaction you’ll feel once you know exactly how to do it. With just a few simple clicks, you can have your money safely transferred, giving you more control over your finances.

In this guide, we’ll break down the process into easy-to-follow steps that anyone can master. By the end of this article, you’ll feel empowered and ready to manage your money more efficiently. Let’s dive in and make your financial transactions smoother than ever.

Verknüpfen Ihres Bankkontos

Transferring money from PayPal to your bank account is a straightforward process, but it starts with an essential step: linking your bank account. This might sound like a tech-heavy task, but with PayPal’s user-friendly interface, you’ll find it surprisingly simple. Whether you’re a seasoned PayPal user or just starting out, knowing how to link your bank account effectively can save you time and ensure your transactions are smooth and secure.

Accessing Bank Settings

Start by logging into your PayPal account. Head over to your profile or settings section, where you’ll find the option for ‘Bank and Cards.’ Clicking on this will lead you to the bank settings. This is where the magic happens. It’s a bit like opening the door to a vault; once you’re in, you have control over your financial connections. Ask yourself, how often do you check these settings to ensure everything is up-to-date?

Adding Bank Account Details

Once you’re in the bank settings, the next step is to add your bank account details. You’ll need your bank name, account number, and routing number. It’s like filling out a quick form—simple yet crucial. Double-check your details to avoid any hiccups. Imagine the relief of knowing your bank account is securely linked, ready to receive funds whenever you need.

Verifying Bank Account

After adding your bank account, PayPal will ask you to verify it. Usually, this involves confirming small deposits made by PayPal into your bank account. It’s a clever way to ensure everything is correctly linked. Once verified, your bank account is ready for transactions. Have you ever thought about the importance of these small steps in protecting your financial data?

Linking your bank account with PayPal opens up a world of financial convenience. It’s more than just a transaction; it’s about building a secure bridge between your online and offline finances. Ready to make that connection? Dive in and see how easy it is to manage your money with PayPal.

Initiieren einer Übertragung

Transferring money from PayPal to a bank account is straightforward. Log into PayPal, select ‘Transfer Funds’, choose your bank, and enter the amount. Confirm the details, and the transfer begins.

Logging Into Paypal

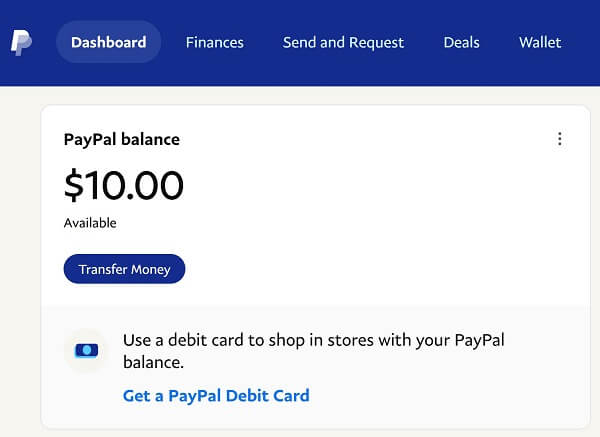

Start by opening the PayPal app or website. Enter your email address and password to access your account. If you’ve forgotten your password, use the ‘Forgot Password’ option to reset it. Security is crucial. Make sure you’re logging in from a secure device. Check for the lock icon in your browser’s URL bar to ensure the connection is secure. ###Once logged in, look for the ‘Wallet’ option on the dashboard. This is typically located at the top of the page. Clicking on it will bring up options related to your funds. Look for the ‘Transfer Money’ button. It might be in a different location if you’re using a mobile device, but it’s generally easy to find. It’s your gateway to moving money from PayPal to your bank. ###

Selecting Bank Account

After hitting ‘Transfer Money,’ you’ll be prompted to select a destination account. If you haven’t linked your bank account yet, you’ll need to add one. Follow the on-screen instructions to add your bank details. Make sure to double-check your bank account information. One wrong digit can delay your transfer. Also, note that linking a new bank account might require additional verification steps. Are there any specific challenges you face when transferring money online? Knowing the exact steps can often alleviate the stress of managing your finances digitally.Abschließen der Übertragung

Transferring money from PayPal to a bank account is straightforward. Knowing each step ensures a smooth process. Follow these easy steps to complete your transfer.

Eingabe des Überweisungsbetrags

First, log into your PayPal account. Locate the “Transfer Money” option. Click to begin the process. Choose the bank account for the transfer. Enter the amount you wish to transfer. Ensure the amount is correct. Double-check for errors. A small mistake can delay your transaction.

Überprüfen der Übertragungsdetails

Next, review all details of your transfer. Pay attention to the transfer amount. Verify the bank account details. Make sure you selected the correct account. Confirm everything is accurate. This step avoids potential issues. Thorough review saves time in the long run.

Bestätigung der Übertragung

Finally, confirm your transfer. Click the “Confirm” button. PayPal processes your request. Transfers usually take a few business days. Check your email for a confirmation message. Monitor your bank account for the incoming funds. Patience is key during this waiting period.

Übertragungszeiträume verstehen

Transferring money from PayPal to a bank account is simple. Log into your PayPal account, select ‘Transfer to bank,’ and follow the prompts. The transfer usually takes 1-3 business days, depending on your bank’s processing times. It’s a straightforward way to manage your funds.

Understanding the transfer timeframes from PayPal to your bank account is crucial for managing your finances effectively. Have you ever been in a situation where you urgently needed funds, but were unsure how long a PayPal transfer would take? Knowing these timeframes can help alleviate stress and ensure you’re prepared for any financial situation.Standard Processing Times

When you initiate a transfer from PayPal to your bank account, you’ll typically encounter standard processing times. Generally, transfers can take anywhere from 1 to 5 business days. The exact duration may vary based on your bank’s policies and the country you reside in. Always plan ahead, especially if you need the money for an important purchase or bill payment.Factors Affecting Delays

Several factors can lead to delays in transferring money from PayPal to your bank account. A common issue is incorrect bank details; even a minor error can cause a hiccup in the process. Double-check your information before confirming a transfer. The timing of your transfer request also plays a role. Initiating a transfer late on a Friday or during a holiday period might extend the processing time. Banks often have reduced hours and staffing during these times, which can affect how quickly transactions are processed. Have you ever considered how security checks can impact transfer times? High-value transfers may trigger extra security measures, which can slow down the process. If you’re transferring a large sum, factor in potential delays due to these checks. Understanding these factors can help you anticipate when your funds will arrive, allowing you to plan accordingly. Are you ready to take control of your financial transfers and avoid unnecessary delays?Fehlerbehebung bei häufigen Problemen

Transferring money from PayPal to a bank account can sometimes be tricky. Check linked accounts and ensure they are verified. Follow prompts carefully, and update any necessary information to avoid delays.

Resolving Verification Problems

Verification issues are a common stumbling block. Ensure your bank account details on PayPal are correct. Double-check your account number, routing number, and any other required information. A minor error can halt the entire process. Sometimes, PayPal might need you to verify your identity. This usually involves submitting documents like an ID or proof of address. Make sure these documents are clear and match the details on your PayPal account. Have you completed the small deposit verification? PayPal often deposits tiny amounts into your bank account to confirm it’s yours. You need to verify these amounts on PayPal to proceed with transfers. If you miss this step, your transfers might not go through. ###Handling Transfer Errors

Transfer errors can occur due to insufficient funds or technical glitches. Check your PayPal balance to ensure you have enough funds to cover the transfer and any associated fees. Network issues can also disrupt transfers. If you encounter an error, log out and try again after a few minutes. Make sure your internet connection is stable. You might see error messages that seem confusing. Note them down and search for solutions online. Many PayPal users share their experiences and fixes that worked for them. ###Contacting Paypal Support

When all else fails, reaching out to PayPal Support is a viable option. You can contact them via the Help Center on the PayPal website. Choose the issue you’re facing, and you’ll be guided through a series of steps. Consider using PayPal’s messaging system for a quicker response. It’s often more convenient than waiting on hold for a phone call. Be clear about the issue and provide all necessary details to help them assist you effectively. Feeling stuck can be frustrating, but remember, support is there to help you. Have you ever had to contact support for an issue and found the solution was simpler than you thought? Sometimes, a fresh perspective can make all the difference.

Exploring Alternative Transfer Methods

Transferring money from PayPal to your bank account seems simple. Yet, exploring alternative methods offers more flexibility and speed. Traditional transfers sometimes delay. Alternative methods bridge this gap. They provide options for different needs.

Sofortüberweisungen

Instant transfers speed up the process. They allow quick access to funds. You get money within minutes. This method requires a linked debit card. A small fee applies for instant service. It’s ideal for urgent situations.

Dienste von Drittanbietern

Third-party services offer another way to transfer money. They connect PayPal to your bank account. These services may charge fees. They sometimes offer better exchange rates. Research is key to finding a reliable service. Always ensure the service is secure and trusted.

Häufig gestellte Fragen

How To Link Bank Account To Paypal?

To link your bank account, log into PayPal, go to ‘Wallet’, and select ‘Link a bank account’. Follow the instructions to enter your bank details. This allows you to transfer funds easily from PayPal to your bank.

Can I Transfer Money To Any Bank?

Yes, you can transfer money to any bank account that you’ve linked to your PayPal. Ensure the bank account is active and correctly linked. This gives you flexibility in managing your funds across different banks.

Fallen für die Geldüberweisung Gebühren an?

Typically, transferring money from PayPal to your bank is free. However, some transactions may incur fees depending on your location or currency. Always check PayPal’s fee structure to avoid surprises.

Wie lange dauert eine Überweisung?

Transfers from PayPal to your bank account usually take 1-3 business days. The exact duration may vary based on your bank’s processing time. Ensure your bank details are correct for smooth transactions.

Abschluss

Transferring money from PayPal to a bank account is simple. Follow the steps carefully for a smooth transaction. Remember to check your bank details before confirming the transfer. This ensures the money reaches the correct account. Regularly update your PayPal and bank information.

This helps avoid any issues. Stay informed about any fees involved. This keeps your budget on track. Using these tips, you can manage your funds confidently. So, the next time you need to transfer, you will know exactly what to do.

Viel Spaß beim Banking!