Die Zahlungen sind abgeschlossen am: Feiern Sie die Schuldenfreiheit!

Has finished making payments on your loan? Congratulations!

You’re now standing at the doorstep of newfound financial freedom. But what comes next? The journey doesn’t end here. In fact, it’s just beginning. Imagine what you can do with the money that was once tied up in monthly payments.

Your financial landscape has shifted, opening up a world of possibilities. But before you decide how to allocate these newfound funds, there are important steps to consider to ensure your financial health continues to thrive. Curious about making the most of this exciting new chapter? Read on to explore smart strategies and tips that can help you maximize your financial potential now that you’ve reached this significant milestone.

Journey To Debt Freedom

Debt can feel like a heavy burden. Many people struggle with finanzieller Stress. Bills pile up. Interest rates grow quickly. It seems hard to find a way out. Some face unerwartete Kosten. Others deal with job loss. These challenges make it tough to pay debts. It takes time Und effort to manage these issues.

Small steps make a big difference. Budgetierung helps track expenses. Schneiden unnecessary costs saves money. Negotiating lower rates is smart. Selling items brings extra cash. Setting goals keeps motivation high. Each step is crucial in reducing debt. Celebrating small wins boosts confidence. Together, these steps lead to freedom.

Discipline is key to success. Stick to the plan. Avoid impulsive buys. Speichern before spending. Schiene every dollar. Spend wisely. Stay committed to goals. It’s hard but rewarding. Patience and focus make the journey easier. With time, debt becomes manageable. Freedom feels closer with each disciplined choice.

Emotional Relief

Making that final payment feels like a big weight lifted. Stress from monthly bills can be very tiring. Now, you have more freedom to think about other things. No more worrying about paying debts. This brings a lot of peace to your life.

Finishing payments can boost your mood. It helps you feel more relaxed and happy. You can now focus on things you love. Your mind gets clearer. No more constant thoughts about money problems. This helps in feeling more positive every day.

Financial Benefits

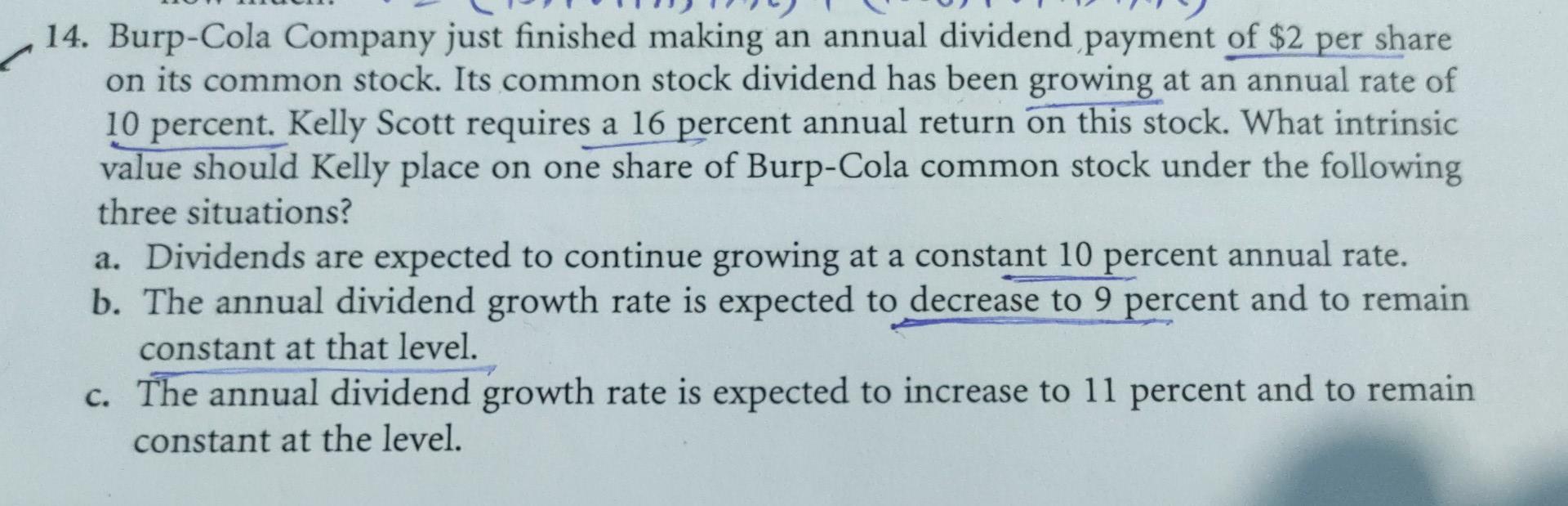

Paying off a loan or debt can boost your savings. Each month, the money once spent on payments is now yours. This extra cash can help in many ways. You can save for a rainy day. Or maybe a special family trip. It’s a great feeling to watch your savings grow. You might even save for a new goal. Like buying a bike or a computer. The choices are endless. And all because you finished paying a debt.

Extra money means new paths open up. You can start investing. Buying stocks or bonds is one option. Some people like to invest in real estate. Buying a small home or land can be smart. Investieren helps your money grow over time. It’s like planting a tree and watching it get bigger. Every little bit counts. Even small investments can make a big difference. The future looks bright with these opportunities.

Lifestyle Changes

With extra money in hand, exploring new places becomes easy. Planning a trip can be exciting. Discovering new cultures is rewarding. Reisen brings joy. It adds memories. Leisure time is important. Relaxing is a treat. Visiting beaches, mountains, or cities brings peace. Reisen experiences enrich life. They create stories. Enjoying leisure time boosts happiness. It refreshes the mind. Reisen Und leisure are essential for a balanced life.

Starting new hobbies is fun. Painting, cooking, or gardening are good choices. Hobbies bring joy. They spark creativity. Learning guitar or knitting is enjoyable. Hobbies keep the mind busy. They offer a break from routine. Trying new activities is exciting. Hobbies help meet new friends. They improve skills. Enjoying hobbies makes life interesting. They add color to everyday moments.

Sharing The Experience

Completing payments can feel like a big relief. It shows how strong you are. You can inspire others by sharing your story. Tell them about the challenges you faced. Explain how you stayed focused. Your journey might help someone else. People learn from real stories. They see what’s possible. You give hope to others. Encourage them to keep going. Let them know they can do it too.

Community support is very important. People need help sometimes. Friends and family can make a big difference. They cheer you on. They listen when things get hard. A community gives you strength. You don’t feel alone. You know others care about you. Being part of a group helps you stay strong. Together, you can achieve great things. You support each other through the journey. It’s like having a team by your side.

Maintaining Financial Freedom

Schulden can sneak up on anyone. It is important to stay alert. Avoid using credit cards for big purchases. Pay for things using cash whenever possible. Think twice before borrowing money. Borrowing can lead to more debt.

Speichern money regularly. Saving helps in emergencies. Plan for the future. Budgetierung is your friend. Stick to your budget. Budgetierung prevents overspending.

Machen Sie eine list of monthly expenses. Categorize each expense. Prioritize important costs. Adjust spending habits. Rezension your budget monthly. Schiene your spending. Use a notebook or app for tracking. Allocate funds for savings. Keep extra for emergencies. Avoid impulse buys.

Häufig gestellte Fragen

What Happens After Payments Are Finished?

After finishing payments, you own the asset outright. The lender no longer has a claim on it. Ensure all paperwork is complete to remove any liens. Check your credit report to confirm the account is marked as paid. This can positively impact your credit score over time.

How To Confirm Payments Are Complete?

To confirm, review your loan statements for a zero balance. Contact the lender for a payoff confirmation letter. This document verifies that you’ve fulfilled all payment obligations. Keep this letter for your records. It’s also wise to check your credit report to ensure it reflects the paid-off status.

Does Finishing Payments Affect My Credit Score?

Yes, finishing payments can positively affect your credit score. It shows responsible credit management. A paid-off loan reduces your debt-to-income ratio. However, the account closure might initially cause a slight dip. Over time, your score should improve with consistent, responsible financial behavior.

What Documents To Keep After Payments?

Keep your payoff confirmation letter, final statement, and any release of lien documents. These prove you’ve completed payments. They are essential for any future disputes or claims. Store them safely along with your financial records. This ensures you have proof of ownership and payment completion.

Abschluss

Completing payments can feel like a huge relief. You now have more financial freedom. This achievement allows you to focus on new goals. It’s a great chance to start saving for future needs. Consider investing in experiences or things that truly matter.

Enjoy the peace of mind that comes with financial stability. Celebrate this important milestone responsibly. Keep managing your money wisely. This way, you can maintain a stable financial path. Remember, every step forward counts. Keep moving ahead with confidence.