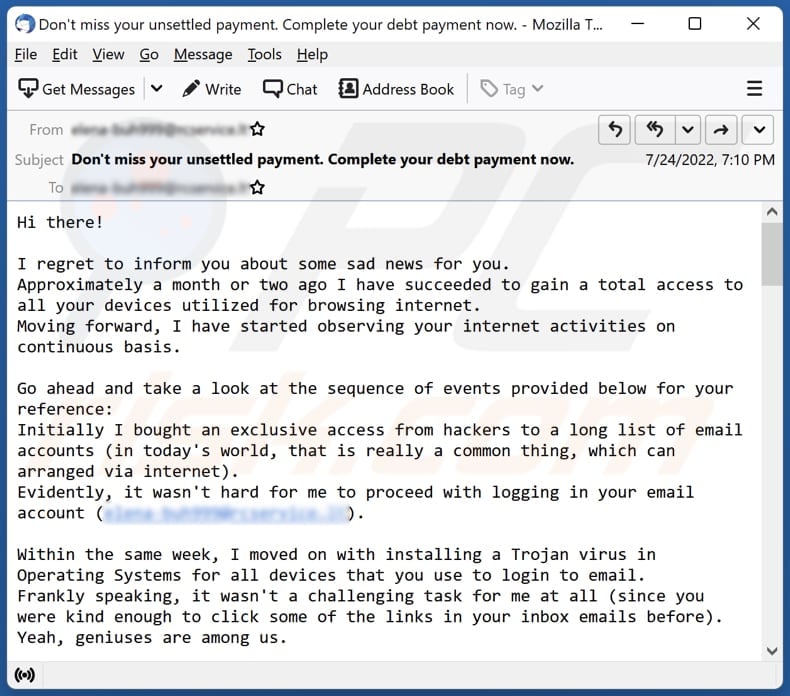

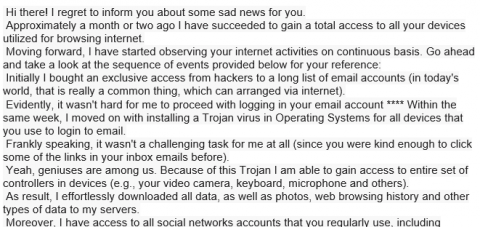

Don’T Miss Your Unsettled Payment: Act Now to Secure Funds

Imagine this: you’re going about your day, checking off tasks from your to-do list, when suddenly a notification pops up, reminding you of an unsettled payment. Your heart skips a beat.

You start to wonder, “Did I really forget to pay that? ” It’s an all-too-common scenario that can lead to late fees, damaged credit scores, and unnecessary stress. But fear not! Understanding how to manage and never miss an unsettled payment can save you not only money but also peace of mind.

We’ll guide you through simple yet effective strategies to ensure that your payments are always on track. Keep reading to discover how you can take control of your finances and avoid the pitfalls of missed payments.

Importance Of Timely Payment

Paying bills on time helps avoid late fees. Late fees can add up quickly. They make bills even harder to pay. Timely payment keeps your credit score healthy. A good credit score makes borrowing easier. It can make loans cheaper too.

Paying on time shows responsibility. It builds trust with people and companies. They are more likely to work with you. Paying late can hurt relationships. People may not want to help you. They may charge more for late payments.

Stress can come from unpaid bills. Pünktliche Zahlungen help avoid stress. You can sleep better knowing bills are paid. It helps you plan and budget better too.

Common Reasons For Unsettled Payments

People often forget to pay their bills on time. Busy schedules can make us miss deadlines. Sometimes, there are bank errors that cause delays. Payment details might be wrong. This can cause a payment to not go through. Technische Probleme with online payments are common. Internet problems can also stop payments. Unzureichende Mittel in your account is another reason. Always check your balance before paying. Some people do not receive notifications about due payments. Make sure your contact information is correct. Currency differences can affect international payments. Always check the exchange rates. Doppelte Kontrolle everything before sending money.

Identifying Outstanding Payments

Finden ausstehende Zahlungen is important. Many people forget these payments. Check your bills often. Look for due dates on each bill. Sometimes, bills hide in junk mail. Always open your mail. Emails can have unseen bills too. Check your inbox weekly. Use a calendar to track bills. This helps you stay organized. Write down each payment date. Mark it on your calendar. This way, you won’t forget.

Verwenden Online-Banking is helpful. It shows all your bills in one place. You can see what you owe. Setting up Warnungen is smart. They remind you about payments. Alerts can come through email or text. This makes it easy to remember. Keeping track of bills saves money. It stops Verspätungsgebühren and charges. Always know what you owe. Pay your bills on time.

Effective Payment Tracking Methods

Manual tools help track payments easily. Use a notebook to jot down payment details. Write dates and amounts clearly. Spreadsheets are also useful. Create columns for name, date, and amount. Always update the spreadsheet. Keep it neat and organized. Checklists can remind you of unpaid bills. Tick off payments once made. These methods need regular updates. They require focus and attention.

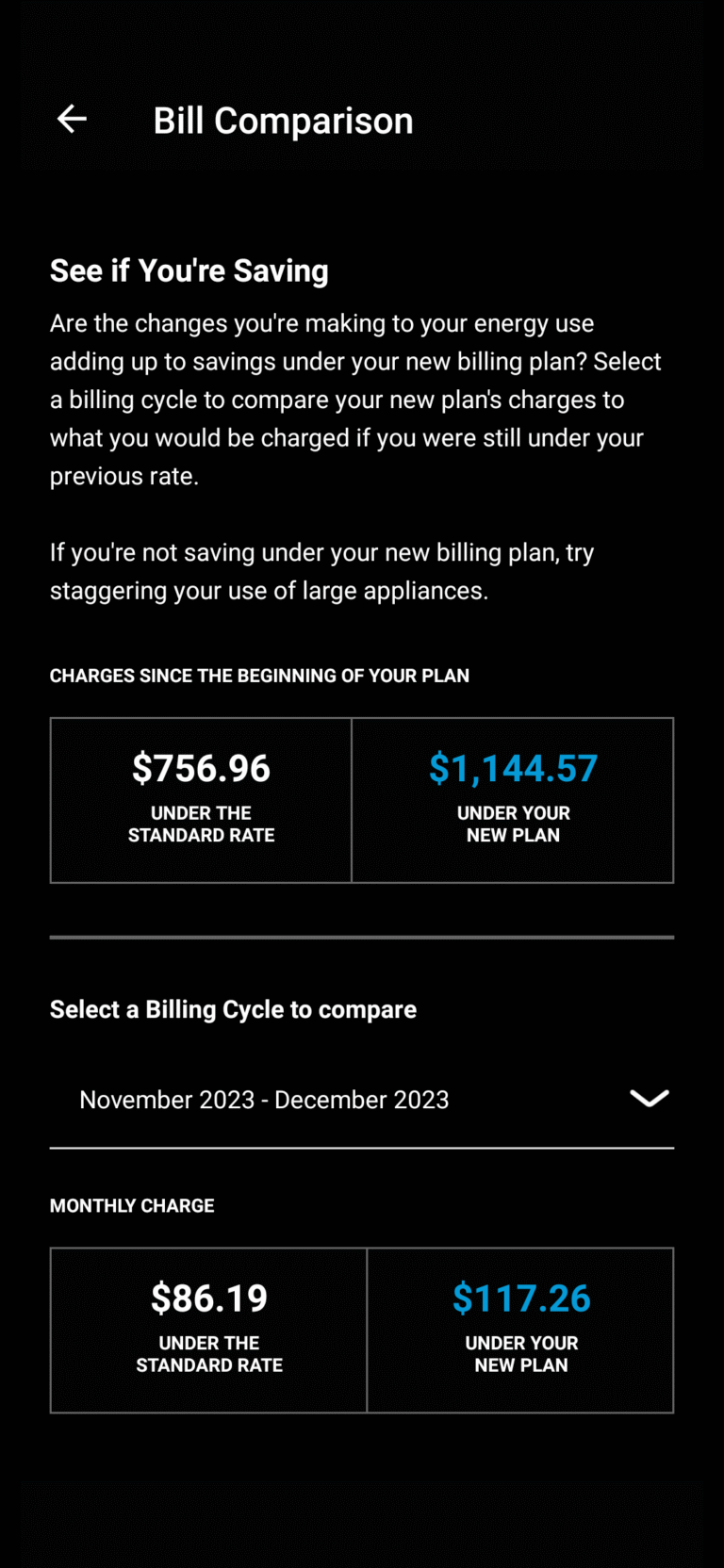

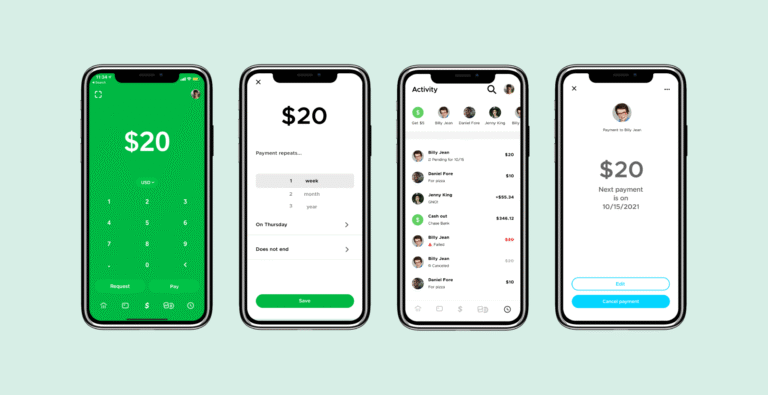

Apps make payment tracking simple. Many apps send reminders. They show due dates and amounts. Use Online-Banking for easy checks. It offers quick updates. Budget planners help keep track. They show spending habits clearly. These tools save time. They reduce errors. Digital solutions are convenient. They are accessible anywhere.

Communicating With Debtors

Craft gentle reminders for your debtors. Use kind words and a calm tone. Begin with a friendly greeting. Mention the unpaid amount clearly. Remind them of the original payment date. Offer help if they need it. Keep your message short. Avoid harsh words or threats. People respond better to kindness. Always thank them for their time. This builds trust and respect.

Discuss flexible payment options with debtors. Offer installment plans if needed. Make sure the terms are clear. Both parties must agree on a date. Respect their financial situation. Suggest a payment schedule that suits both. Always be patient and understanding. Ensure communication is open and honest. Trust is key to successful negotiation. End with a positive note. Show appreciation for their cooperation.

Legal Avenues For Payment Recovery

Kennen Sie Ihre gesetzliche Rechte is important when recovering payments. Laws protect both parties in a deal. These rights help you claim your money. Everyone must follow these rules. Contracts are key. They show what each side agreed to. If someone breaks the contract, you can take action. Rechtsberatung is useful. Lawyers know the laws well. They guide you on what to do. Understanding these rights saves time. It also makes recovery easier. You should always ask for help if unsure.

Picking the correct legal path is crucial. Different situations need different actions. Small claims courts handle minor cases. These courts are fast and simple. For larger cases, you might need a higher court. Mediation is another option. It involves talking and solving the issue together. This can be quicker and less costly. Each path has pros and cons. Consider your case details before deciding. Choose wisely for better results. Consulting a legal expert is often beneficial.

Vermeidung zukünftiger Zahlungsprobleme

Clear contracts help avoid payment problems. They show what is expected from both sides. Contracts should list all tasks and Zahlungsbedingungen. Make sure everyone understands the contract. If someone is confused, explain the details. Contracts should be signed by all parties. This shows everyone agrees to the terms. Written agreements are better than verbal ones. They protect you if a dispute arises.

Payment policies guide how payments are made. Set due dates for payments. This helps people pay on time. Offer different ways to pay. This makes it easy for everyone. Remind people when payments are due. Send friendly reminders. If a payment is late, charge a small fee. Fees encourage people to pay on time. Make sure policies are clear to everyone.

Benefits Of Professional Assistance

Experts help you understand your payment issues. They explain complex terms simply. You feel more confident about your finances. With their help, you make better decisions. This saves you money.

Professionals have experience in handling payments. They find mistakes quickly. This means fewer errors in your bills. You pay only what you owe. No extra charges.

Getting help saves time. Instead of worrying, you relax. Professionals handle the hard work. You focus on other important things in your life.

Häufig gestellte Fragen

What Happens If I Miss A Payment Deadline?

Missing a payment deadline can lead to late fees and interest charges. It may negatively impact your credit score. To avoid these issues, set reminders or automate payments. Contact your creditor to discuss payment options if you anticipate a delay.

How Can I Track My Unsettled Payments?

You can track your unsettled payments using budgeting apps or financial management tools. Regularly review your bank statements and credit card bills. Maintaining an updated list of due dates ensures you stay organized. This helps in preventing missed payments and potential fees.

Why Is Timely Payment Important?

Timely payment is crucial for maintaining a healthy credit score. It helps avoid late fees and interest accumulation. Consistent payments build trust with creditors and improve financial stability. This can lead to better terms on future loans or credit.

Can Unsettled Payments Affect My Credit Score?

Yes, unsettled payments can negatively affect your credit score. Late or missed payments are reported to credit bureaus. This can decrease your credit rating and impact future credit opportunities. It’s essential to address unsettled payments promptly.

Abschluss

Missing payments can lead to stress. Stay on top of them. Check your accounts regularly. Set reminders to pay on time. This helps avoid late fees. Keep records of all transactions. Organize your finances effectively. This way, you stay informed.

Financial health is important. Being proactive saves time and money. A little effort now prevents future hassles. Prioritize settling unpaid bills. It boosts your credit score. Remember, managing finances is a skill. Practice makes it easier. You can do it.

Stay focused and responsible. Your financial peace depends on it. Make it a priority today.