Does Credit Acceptance Require Down Payment? Find Out!

Have you ever found yourself wondering about the specifics of securing an auto loan? Especially when it comes to understanding the requirements of different lenders?

If you’re considering Credit Acceptance for your next vehicle purchase, you might be asking, “Does Credit Acceptance require a down payment? ” You’re not alone in this quest for clarity. After all, understanding the nuances of loan agreements can significantly impact your purchasing decisions and financial planning.

We’ll break down the essentials of Credit Acceptance’s down payment policies. Our aim is to equip you with the knowledge you need to make informed choices. You’ll discover whether a down payment is necessary and how it might affect your overall loan. This could be the key to unlocking your next great car deal. So, stick with us as we dive into the details that matter to you.

Credit Acceptance Basics

Credit Acceptance started in 1972. It helps people buy cars. Many people have bad credit. This company gives them a chance. They can get car loans. Trust is very important. They work with car dealers. Together, they help customers. Dealers send loan applications to Credit Acceptance. The company checks them. If approved, the customer gets a loan. It is easy. Customers can buy a car. Even with bad credit.

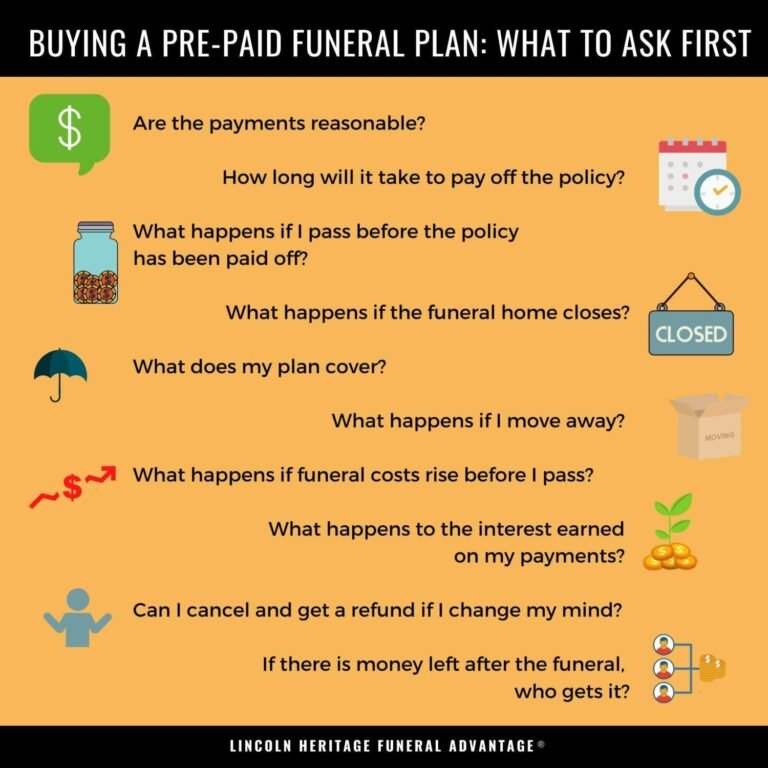

Credit Acceptance offers different loans. These loans help buy cars. Customers can choose the best one. Some loans need a down payment. Others do not. It depends on the loan type. A Anzahlung is money paid upfront. It lowers loan amount. Lower loan means lower monthly pay. Customers must check loan details. Important to understand terms. Also, interest rates are crucial. They affect the total payment. Choosing the right loan is key. It helps avoid extra costs.

Down Payment Essentials

A Anzahlung is money you pay when buying a car. It’s the first payment you make. This money shows you are serious. It reduces the amount you need to borrow. Less money borrowed means smaller monthly bills.

People save up for this. It is an important step. Paying more upfront can help in the long run. It might lower costs over time.

Putting more money down can change loan deals. A larger Anzahlung can mean less interest. This saves money. It might also mean shorter loan terms.

Some people pay little to start. This might make loans cost more. Choosing the right amount is key. It helps in planning your budget well.

Credit Acceptance Policies

Credit Acceptance often requires a Anzahlung. This helps reduce the loan amount. It also lowers the risk for the lender. Policies vary by dealer. Some ask for more money upfront. Others may ask for less. It’s best to check with the dealer. They can explain specific needs. Always read the terms carefully.

Der amount of down payment can vary. Credit score plays a big role. A high score may mean a lower payment. Income is also important. Stable income can help get better terms. The price of the car matters too. Expensive cars might need a bigger down payment. Each situation is unique. It’s smart to ask questions. Get all details before deciding.

Benefits Of Making A Down Payment

Making a down payment reduces the total loan amount. Lower loan amounts mean less money to pay back. This can make monthly payments smaller. Smaller payments are easier to manage. A smaller loan can be paid off faster. Paying off loans quickly can improve credit scores.

A down payment can lead to niedrigere Zinsen. Lenders see you as less risky. Lower risk means better loan terms. Better terms can save you money. Interest is the extra money you pay on loans. Less interest means paying less overall. Lower rates make loans more affordable.

Alternatives To Down Payment

Credit Acceptance may not always require a down payment. Alternatives like trade-ins or financing options can help. Exploring these choices can ease the buying process without upfront cash.

Trade-in Options

Trade-in options can help reduce the need for a down payment. You give your old car to the dealer. They use its value to lower the price of your new car. This helps save money. You might need to pay less upfront. This option is good if your old car is in good shape.

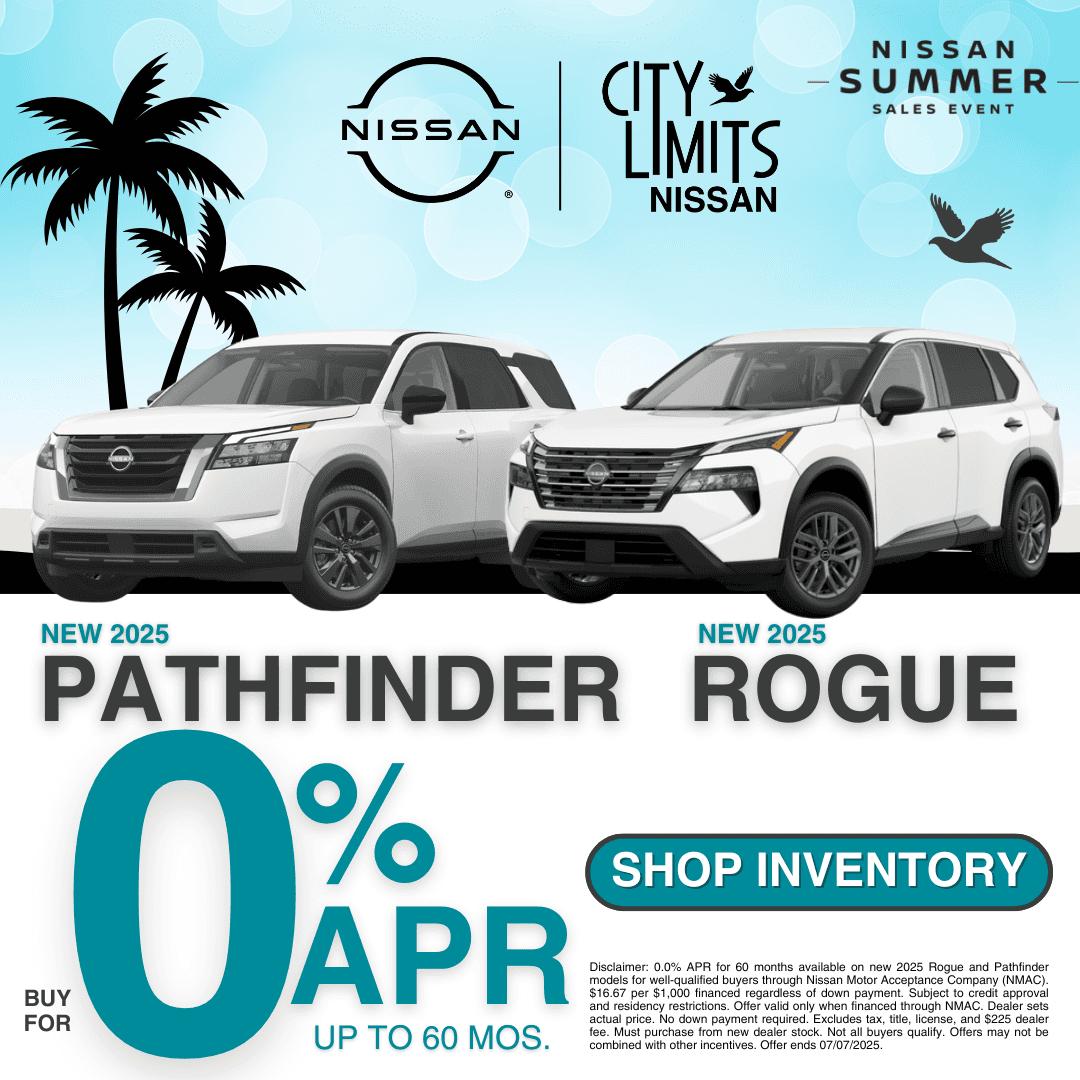

Incentives And Promotions

Incentives Und promotions can also help. Dealers often have special offers. These can include cash back. Sometimes, they offer lower interest rates. These deals can make a car cheaper. Always ask about current promotions. They change often. You might find a great deal.

Tips For Financing With Credit Acceptance

Keeping debts low helps in building a strong credit score. Paying bills on time is crucial. It’s important to check credit reports regularly. Look for any mistakes and get them fixed. Don’t apply for too many credit cards at once. This can lower your score. Use old credit cards wisely. Long history can boost your score. High balances can hurt your score. Keep balances low.

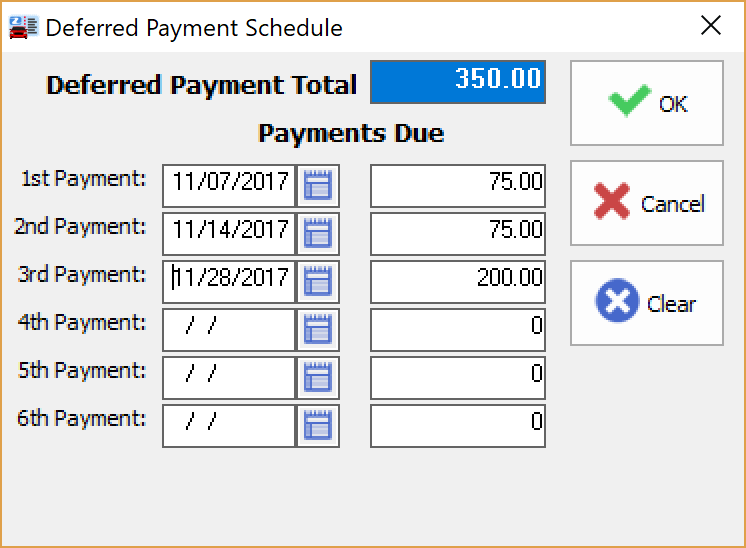

Ask questions about the loan terms. Understand all the details before signing. Interest rates matter. Lower rates mean less money paid over time. Monthly payments should fit your budget. Ask if there’s a chance to adjust payment terms. Longer loan terms might lead to paying more interest. Short terms might have higher payments. Consider both options. Always read the fine print. Know all fees involved.

Häufig gestellte Fragen

Does Credit Acceptance Require A Down Payment?

Credit Acceptance typically requires a down payment for their auto loans. The amount varies based on the applicant’s credit profile and the vehicle’s price. A down payment can help reduce monthly payments and improve loan approval chances. It’s advisable to check specific requirements directly with Credit Acceptance or their dealership partners.

How Much Is The Down Payment For Credit Acceptance?

The down payment for Credit Acceptance varies based on several factors. These include the applicant’s credit history and the vehicle’s cost. Typically, it ranges from a few hundred to several thousand dollars. Contact Credit Acceptance or your dealer for precise information tailored to your financial situation.

Can I Get A Car Loan Without A Down Payment?

It’s possible but challenging to get a car loan without a down payment. Credit Acceptance usually requires one. However, some dealerships might offer no-down-payment options based on specific promotions or your creditworthiness. It’s best to discuss directly with the lender or dealership for available options.

Does Credit Acceptance Offer Flexible Down Payment Options?

Yes, Credit Acceptance may offer flexible down payment options. These depend on your credit score and financial situation. Discussing with a dealership or a Credit Acceptance representative can provide customized solutions. They can work with you to determine a suitable down payment plan.

Abschluss

Credit Acceptance often requires a down payment. This can vary by dealership. A down payment may lower monthly payments. It also shows commitment to the loan. Consider your budget before making decisions. Always read the loan terms carefully. Ask questions if anything is unclear.

Understand all fees involved. Being informed helps make better choices. This ensures a smoother car-buying process. Happy car shopping!