Können Sie problemlos Geld von Sofi auf ein Bankkonto überweisen?

Are you wondering if it’s possible to transfer money from your SoFi account to your bank account? You’re not alone.

With the rise of digital banking, many people are exploring new ways to manage their finances efficiently. Imagine having the flexibility to move your money seamlessly, without any hassle. This can provide peace of mind and control over your finances.

We’ll uncover how you can transfer money from SoFi to your bank account, ensuring you have all the information you need to make informed decisions. Stick with us, and by the end, you’ll feel empowered to take full advantage of your financial resources.

Sofi Money Basics

Sofi Money is an online financial service offering easy money management. It combines checking and savings features into one account. Users can earn interest on deposits and access funds easily.

What Is Sofi Money?

Sofi Money is designed to help users manage finances efficiently. It offers a high-interest rate compared to traditional banks. Users can access their money anytime, anywhere.

Features Of Sofi Money

Sofi Money provides a debit card for daily transactions. It allows fee-free ATM access worldwide. Users enjoy no monthly fees and free overdraft protection.

Benefits Of Using Sofi Money

Using Sofi Money helps track spending and savings. It simplifies budgeting with its user-friendly app. Users also receive cashback rewards on purchases.

Geld auf ein Bankkonto überweisen

Transferring funds from Sofi Money is straightforward. Users can send money to any linked bank account. Transactions are secure and quick, ensuring convenience.

Setting Up Your Sofi Account

Easily transfer money from your Sofi account to a bank account. Connect your bank details for seamless transactions. Enjoy the convenience of moving funds with just a few clicks.

Account Creation

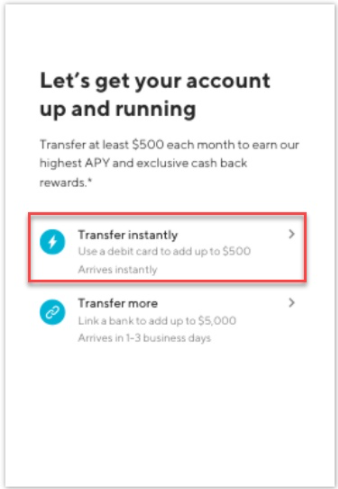

Creating your Sofi account is a simple process that can be completed in minutes. Begin by downloading the Sofi app or visiting the Sofi website. You’ll need to provide basic information like your name, email, and phone number. After entering your details, you’ll be prompted to verify your identity. This might involve uploading a photo of your ID or answering a few questions. Once verified, you can set up your username and password. Have you ever felt overwhelmed by complex app setups? Sofi ensures their process is user-friendly, aiming to get you started without hassle. ###Linking Bank Accounts

Now that your Sofi account is active, linking your bank account is the next step. This allows you to transfer money effortlessly between your Sofi account and your bank. To link your bank account, navigate to the ‘Banking’ section in the Sofi app. You’ll see an option to ‘Add Bank Account.’ Click on it and follow the prompts. You’ll need your bank’s routing number and your account number. Enter these details carefully to avoid any errors. Once you’ve linked your bank account, Sofi may conduct a small test transaction to confirm everything is set up correctly. Have you ever wondered about the security of your financial details? Sofi employs advanced encryption to protect your data, ensuring your peace of mind. By taking these steps, you’ll be ready to manage your money with Sofi, enjoying the convenience of transferring funds whenever you need. Have you set up your Sofi account yet? If not, what’s holding you back?Transferring Money To Bank Account

Transferring money from Sofi to a bank account is straightforward. Users can initiate transfers directly through the Sofi app. Simply choose the transfer option, enter your bank details, and confirm.

Transferring money from SoFi to a bank account is a straightforward process that many users find incredibly convenient. Whether you’re moving funds to manage your daily expenses or to save for a rainy day, understanding how to efficiently transfer money is essential. SoFi offers a user-friendly platform that makes this process smooth and hassle-free.Initiieren einer Übertragung

To start a transfer, first log into your SoFi account. Once you’re in, navigate to the “Transfer” section. You’ll see options to transfer money in or out. Select the option for transferring to a bank account. Enter the amount you wish to transfer. Double-check your bank details to avoid any mishaps. Mistakes here could delay your transfer. One personal tip: I always set a reminder to verify the transaction details before hitting “Submit.” It’s a quick habit that can save you time and stress.Übertragungszeiträume

Once you’ve initiated the transfer, you might wonder how long it will take for the funds to reach your bank account. Typically, SoFi transfers can take 1-3 business days. However, transfers initiated during weekends or holidays may take a bit longer. Imagine needing funds urgently only to realize it’s a long weekend. Planning transfers around your schedule can help you avoid such scenarios. Have you ever missed an important payment because of transfer delays? Being aware of these timeframes can help you plan better and avoid unnecessary fees or inconveniences.Gebühren und Kosten

Transferring money from your SoFi account to a traditional bank account is a common task for many users. But before you initiate a transfer, it’s essential to understand the fees and charges associated with this process. Knowing what costs you might incur and how to avoid them can save you money and ensure a smooth transaction.

Understanding Costs

Do you ever wonder if there’s a hidden fee lurking behind your transaction? With SoFi, the good news is that you won’t face unexpected charges when transferring money to your bank account. SoFi emphasizes transparency, allowing users to transfer funds without worrying about surprise costs.

While SoFi itself doesn’t charge fees for standard transfers, consider the potential costs from your receiving bank. Some banks might impose fees for incoming transfers, especially if they involve currency conversion. Always check with your bank to avoid any unwelcome surprises.

Fee-free Transfers

How often do you get the chance to move money without paying a penny? SoFi offers a refreshing break from the norm with their fee-free transfer service. You can move your funds effortlessly without any fees deducted from your balance.

Imagine transferring money to your bank account without the usual hassle of calculating fees. This simplicity can streamline your financial management and allow you to focus on other aspects of your finances. Ensure your transactions remain fee-free by verifying that both your SoFi account and your bank support these seamless transfers.

Wouldn’t you love to keep more of your money where it belongs—in your pocket? Take advantage of SoFi’s user-friendly approach and enjoy the freedom of transferring money without the burden of fees.

Sicherheitsmaßnahmen

Transferring money from Sofi to a bank account involves secure processes. Sofi uses encryption to protect personal data during transactions. Users can trust the platform’s security measures for safe money transfers.

Encryption And Protection

When you transfer money from SoFi, your data is encrypted. This means your sensitive information is turned into complex codes that are nearly impossible to decipher by unauthorized parties. Encryption ensures that even if data is intercepted, it remains unreadable and useless to hackers. SoFi uses industry-standard encryption protocols. These are the same trusted methods used by banks and financial institutions worldwide. You can feel confident knowing that your personal and financial details are shielded by top-tier security measures.Tipps zur Betrugsprävention

Being aware of fraud prevention tips can further protect your money. Always double-check the details of the bank account you’re transferring to. A single digit error can send your money to the wrong place. Enable two-factor authentication on your SoFi account. This adds an extra layer of security by requiring a second form of verification, like a text message code, before transactions are authorized. Lastly, regularly monitor your accounts for any unauthorized transactions. Prompt action can prevent potential fraud from escalating. Have you ever noticed a strange transaction in your account? Being vigilant about reviewing your statements can make all the difference.Häufige Probleme

Transferring money from Sofi to a bank account seems simple. Sometimes, though, users face issues. These problems can frustrate and confuse. Knowing common issues helps avoid stress. Let’s explore frequent challenges and their solutions.

Übertragungsverzögerungen

One common issue is transfer delays. Transfers might take longer than expected. This can cause anxiety, especially if funds are needed urgently. Delays occur due to processing times. Bank holidays and weekends may also affect transfers. It’s wise to account for these potential delays. Always plan transfers in advance to avoid inconvenience.

Tipps zur Fehlerbehebung

Encountering issues with transfers? Try these troubleshooting tips. First, check your internet connection. A weak connection can disrupt the transfer process. Next, ensure your Sofi account has enough funds. Insufficient funds can halt a transfer. Verify your bank account details. Incorrect details can cause failed transfers. Lastly, contact Sofi customer support for assistance. They’re available to help resolve any issues. With these tips, you can tackle most transfer problems.

Kundenservice

When transferring money from your SoFi account to a traditional bank account, customer support can play a vital role in ensuring a smooth experience. You might wonder how responsive and effective SoFi’s support team is, especially if you encounter any hiccups during the transfer process. Let’s dive into the different aspects of SoFi’s customer support, including contact methods and problem resolution.

Contact Methods

SoFi offers multiple ways to get in touch with their customer support team. You can reach out via phone, email, or even through their app. It’s comforting to know you have options, whether you prefer speaking directly to someone or handling your issues digitally.

Imagine having a question at midnight; their online chat support might be your best friend. It’s always helpful to keep the support contact information handy. Wouldn’t it be great to have assistance at your fingertips whenever you need it?

Problem Resolution

Have you ever felt stuck in a loop trying to solve a banking issue? SoFi aims to break that cycle with efficient problem resolution. Their support team is trained to handle a variety of issues, from technical glitches to transaction discrepancies.

One user shared how they quickly resolved a transfer issue within hours after reaching out. Wouldn’t you appreciate a service that resolves problems swiftly, allowing you to return to what matters most? The key is clear communication and a proactive approach.

As you navigate the process of transferring funds, keep in mind that understanding your issue clearly and communicating it effectively can lead to faster resolutions. Have you considered keeping a checklist of potential issues? It might save you time and stress in the long run.

With these insights, you can approach customer support with confidence, knowing you have the tools and information to manage any situation that arises during your money transfer from SoFi to your bank account.

Comparing With Other Platforms

Transferring money from SoFi to a bank account is straightforward. Unlike other platforms, SoFi offers direct bank transfers. Users enjoy seamless transactions with minimal fees, enhancing their banking experience.

Transferring money between platforms has become an essential part of managing finances today. With numerous options available, you might wonder how SoFi stacks up against other platforms when it comes to transferring money to a bank account. Each platform offers unique features, and understanding these can help you make informed decisions about your financial management. ###Competitor Analysis

When comparing SoFi to other financial platforms, it’s crucial to look at the features and benefits each offers. SoFi provides a seamless way to transfer money to your bank account with no fees, which is a significant plus. On the other hand, platforms like PayPal and Venmo may charge fees for instant transfers. This makes SoFi a more attractive option if you’re looking to save on transaction costs. Consider also the speed of transactions. While PayPal and Venmo can offer instant transfers at a cost, SoFi’s standard transfers might take a bit longer. This difference in speed may impact your choice depending on how urgently you need access to your funds. ###Benutzererfahrung

User experience is another critical factor when choosing a platform for money transfers. SoFi’s app interface is clean and user-friendly, which makes the transfer process straightforward. Users often appreciate the simplicity of initiating transfers within a few taps. However, some might find platforms like Cash App more intuitive due to its minimalist design and straightforward navigation. Imagine needing to transfer money late at night. You’d want a platform that’s easy to use even when you’re tired. SoFi excels in this regard, but so do many of its competitors, like Zelle, which also prioritizes ease of use. Are you the type of person who prefers step-by-step guidance or do you dive right in? SoFi caters to both by providing clear instructions and an intuitive interface. Ultimately, the choice of platform may come down to your personal preferences and specific needs. Each platform has its strengths and weaknesses, and understanding these can help you choose the best option for transferring money to your bank account.User Testimonials

Transferring money from SoFi to a bank account can be straightforward. Users share varied experiences about this process. Let’s delve into their stories and challenges. Understanding these can help you navigate similar situations.

Erfolgsgeschichten

Many users find the transfer process smooth and efficient. Jane, a SoFi user, transferred funds to her bank in minutes. She appreciated the quick service. Her bank updated her account without delay. This ease boosts user confidence in SoFi’s services.

Another user, Mark, shared his positive experience. He needed to send money for an urgent bill. SoFi’s transfer system was reliable and fast. Mark felt relieved seeing the funds reflected promptly. Such stories highlight SoFi’s dependable service.

User Challenges

Some users face occasional hurdles. Tom encountered a delay during his first transfer. He contacted customer support for help. They resolved the issue swiftly. Tom’s experience underscores the importance of support services.

Linda had a different challenge. Her bank required additional verification. This added a step to her transfer process. Linda felt frustrated at first. Yet, with guidance, she completed her transaction. Her story shows the need for patience and understanding.

These testimonials offer insights into SoFi’s transfer services. Users share successes and challenges. Learning from their experiences aids in navigating potential hurdles effectively.

Häufig gestellte Fragen

How Do I Transfer Money From Sofi To A Bank?

Transferring money from SoFi to your bank is simple. Log into your SoFi account, select ‘Transfer’, and enter your bank details. Specify the amount and confirm. The process is usually quick, but times may vary depending on bank policies.

Is There A Fee To Transfer From Sofi?

SoFi typically does not charge a fee for transferring money to a bank account. However, check with your bank for any potential fees on their end. Always review SoFi’s terms to ensure no fees have been updated.

How Long Does A Sofi Transfer Take?

Transfers from SoFi to a bank account usually take one to three business days. However, the exact timing may vary based on your bank’s processing times. It’s always advisable to check with your bank for specifics.

Can I Transfer Money Internationally From Sofi?

Currently, SoFi does not support international money transfers directly. You can transfer funds to your U. S. bank, and then use international services. Consider using other platforms for international transfers to ensure efficiency.

Abschluss

Transferring money from Sofi to a bank account is straightforward. Follow the steps carefully. Ensure your accounts are linked correctly. This will make the process smooth. Always double-check your bank details. Mistakes can delay transactions. Many find Sofi’s platform user-friendly.

It’s designed for ease of use. Security is also a priority. Your funds are safe. Need help? Sofi’s support team is available. They can assist with any issues. Remember, managing money wisely is important. It ensures financial stability. Enjoy the convenience Sofi offers.

It makes banking simpler.