Können Sie Geld von der Bank auf Venmo überweisen?

Sie fragen sich wahrscheinlich, ob Sie Geld überweisen from your bank account to Venmo. The answer is yes, but you'll need to Verknüpfen Sie Ihr Bankkonto to Venmo first. You'll provide your bank account and routing numbers, and Venmo will verify the information with two small test deposits. Once that's done, you can initiate transfers from your bank to Venmo. But here's the thing: while standard transfers are free, they're not instant. You'll need to wait 1-3 Werktage for the money to arrive. But what if you need the money sooner?

Verknüpfen des Bankkontos mit Venmo

To initiate transfers from your bank to Venmo, you'll first need to Verknüpfen Sie Ihr Bankkonto to the Venmo platform. You'll be asked to provide your bank account and Bankleitzahlen, which can be found on your check or through your online banking portal. Once you've entered this information, Venmo will verify your account by sending two small Testeinzahlungen, which you'll need to bestätigen. After confirmation, your bank account will be linked to Venmo, and you can initiate transfers. It's important to verify that your bank account information is accurate and up-to-date to avoid any transfer issues or delays. Additionally, Venmo uses encryption and sichere Server to protect your account information, providing a safe and reliable transfer process.

Adding Debit Card to Venmo

Once your bank account is linked to Venmo, you can also eine Debitkarte hinzufügen to your account, providing an alternative funding source for transfers and payments. To add a debit card, you'll need to go to the Venmo app, navigate to the "Settings" section, and select "Zahlungsarten." From there, you can tap "Add Debit or Credit Card" and enter your card information. Venmo will then Überprüfen Sie Ihre Kartendetails and link it to your account. You can use this debit card to fund your Venmo transactions, giving you more flexibility and options for managing your finances. By adding a debit card, you can also set it as your Standardzahlungsmethode for future transactions.

Anforderungen für Venmo-Banküberweisungen

Before initiating a bank transfer on Venmo, you'll need to meet certain requirements to confirm a smooth and secure transaction. First, you must have a Venmo account in good standingund Ihr Bankkonto muss eligible for online transactions. Additionally, you'll need to Verifizieren Sie Ihr Bankkonto on Venmo, which involves confirming your account and routing numbers. You may also need to provide identification, such as a driver's license or state ID, to comply with Vorschriften zur Bekämpfung der Geldwäsche. It's crucial to verify your Venmo and bank account information is up-to-date and accurate to avoid any transfer issues. By meeting these requirements, you can transfer funds from your bank to Venmo securely and efficiently.

Überweisungslimits und Gebühren

When transferring money from your bank to Venmo, you'll encounter certain limits and fees that vary depending on the Übertragungsmethode and your account type. If you're using a Standardüberweisung, which takes a few business days, you won't pay a fee. Sofortüberweisungen, however, which take only a few minutes, incur a small fee (typically 1-1.75% of the transfer amount). With regard to limits, standard transfers usually have a larger maximum limit compared to instant transfers. Additionally, certain types of accounts, like student accounts, may have more restrictive Übertragungslimits. Venmo also has overall limits on how much money can be transferred per transaction and per day. Exceeding these limits will prevent the transfer from taking place.

So leiten Sie eine Überweisung ein

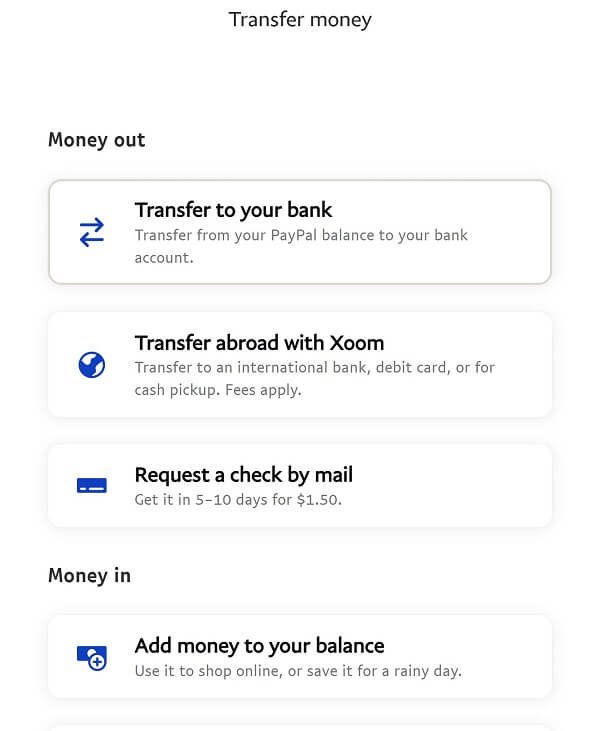

To initiate a transfer from your bank to Venmo, you'll need to link your bank account to your Venmo account, which can be done through the Venmo mobile app or website. Once linked, you can initiate a transfer by following these steps:

| Schritt | Aktion | Details |

|---|---|---|

| 1 | Select Funding Source | Choose your linked bank account |

| 2 | Überweisungsbetrag eingeben | Specify the amount you want to transfer |

| 3 | Übertragung bestätigen | Review and confirm the transfer details |

| 4 | Authorize Transfer | Authenticate the transfer using your bank credentials |

| 5 | Receive Funds | Transferred funds will be deposited into your Venmo account |

Remember to verify your bank account information and transfer details to guarantee a secure and successful transaction.

Zeitrahmen für die Überweisungsbearbeitung

Now that you've initiated a transfer from your bank to Venmo, you're likely wondering how long it'll take for the funds to become available in your Venmo account. The transfer processing timeframe typically varies depending on the type of transfer and the time of day it's initiated. Standardüberweisungen, also known as ACH-Überweisungen, usually take 1-3 business days to process. These transfers are processed in batches, and the timing depends on the bank's and Venmo's processing schedules. If you need faster access to your funds, you can opt for an Sofortüberweisung, which typically incurs a small fee. Venmo will provide an voraussichtliche Lieferzeit when you initiate the transfer, giving you a better idea of when to expect the funds to become available.

Fehlerbehebung bei häufigen Problemen

Some common issues may arise during the Übertragungsprozess, and being aware of their causes and solutions can help you resolve them quickly and get your funds up and running in your Venmo account. If your transfer is delayed or fails, it's likely due to incorrect bank account information, unzureichende Mitteloder ein technical glitch. Double-check your account details and balance to confirm everything is in order. If issues persist, contact your bank or Venmo's customer support for assistance. Additionally, be cautious of Phishing-Betrug and unauthorized transfers by regularly monitoring your accounts and reporting any suspicious activity. By staying vigilant and addressing issues promptly, you can guarantee a smooth and secure transfer experience.