Können Sie eine Anleihe mit einer Kreditkarte bezahlen?

Have you ever found yourself in a situation where you need to pay a bond quickly? You might be wondering if a credit card could be a viable option. While it's possible to use a credit card for bond payments, the acceptance can vary considerably depending on the type of bond and the agency involved. It's crucial to weigh the convenience against factors like Transaktionsgebühren and the implications of hohe Zinsen. So, what should you consider before pulling out your card for this purpose?

Anleihezahlungen verstehen

When you're faced with the need to pay a bond, it's crucial to understand the various Zahlungsarten available and how they can impact your Finanzielle Situation. Bonds can typically be paid using cash, checks, or elektronische Überweisungen, each with its own benefits and drawbacks. Cash transactions provide immediacy but lack a paper trail, which may be risky. Checks offer documentation, but they can take time to clear, delaying access to funds. Electronic transfers are swift and secure, yet they may incur additional fees. Evaluating these options carefully helps guarantee you choose the safest method aligned with your financial capacity. Always consider the Gesamtkosten, including any potential fees, to maintain control over your financial health during this process.

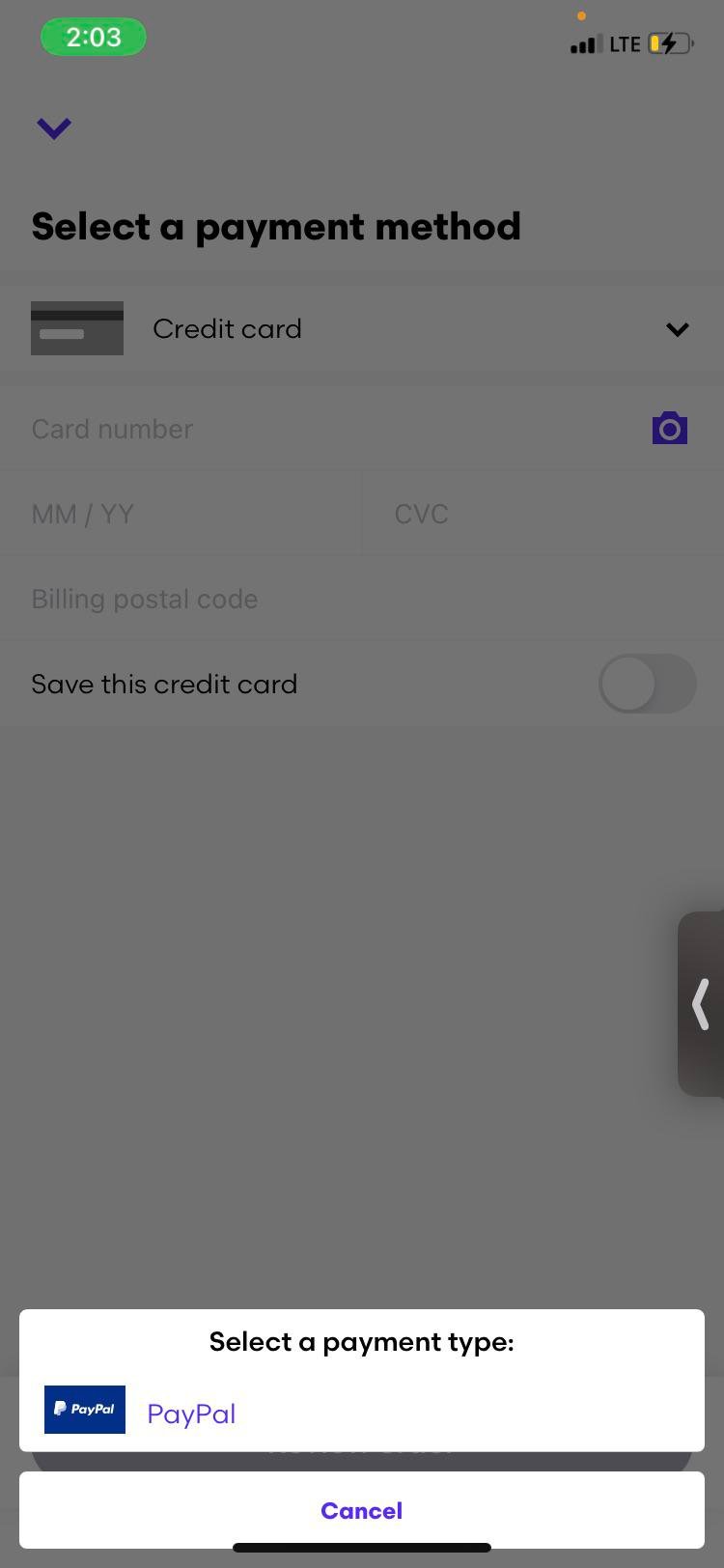

Credit Card Acceptance for Bonds

How often are credit cards accepted für bond payments, and what factors should you consider before using this method? Acceptance varies widely based on the type of bond and the agency involved. Some jurisdictions allow credit card payments for bail bonds, while others do not. Before opting for this method, assess the mögliche Gebühren associated with credit card transactions, as they can add to your overall cost. Additionally, consider your Kreditlimit; you don't want to exceed it, leading to possible penalties or interest. Finally, verify that the agency or service you're dealing with is reputable to avoid scams. Being informed can help you make a safe and effective choice when paying a bond.

Vorteile der Verwendung von Kreditkarten

Verwenden Kreditkarten to pay bonds can offer several advantages, such as Bequemlichkeit und die Fähigkeit, Cashflow verwalten more effectively. By using a credit card, you can quickly cover bond payments without needing immediate cash. This can be particularly helpful in emergencies, allowing you to secure a bond while preserving your liquid assets. Additionally, many credit cards come with integrierter Betrugsschutz, giving you peace of mind with your transaction. You might also earn rewards or cash back on your purchase, which adds an extra layer of benefit. Overall, using a credit card for bond payments can enhance your finanzielle Flexibilität while ensuring safer transactions, making it a practical choice for many individuals.

Potential Limitations and Fees

There can be significant limitations and fees associated with paying a bond with a credit card, which you should carefully consider before proceeding. Here are three key factors to keep in mind:

- Transaktionsgebühren: Many bonding agencies impose a fee, often a percentage of the bond amount, which can add to your overall cost.

- Kreditlimits: Your credit card may have a limit that prevents you from covering the full bond amount, forcing you to find alternative payment methods.

- Zinssätze: If you can't pay off the balance quickly, the high-interest rates on credit cards could lead to substantial debt.

Alternative Zahlungsmethoden

Entdecken alternative Zahlungsmethoden can provide you with more Flexibilität and potentially lower costs when securing a bond. Many bonding companies accept cash, checks, or money orders, which can often help you avoid credit card fees. Additionally, you might consider Zahlungspläne, allowing you to spread the cost over time, easing financial pressure. Some companies may also accept direct bank transfers, which are usually sicher and can expedite the transaction process. Always verify the payment methods accepted by your bonding agency. It's important to verify that whichever method you choose is not only cost-effective but also secure, protecting your personal and financial information throughout the process.

Tipps zur Verwendung von Kreditkarten

When considering credit cards for bond payments, it's essential to understand the associated fees and interest rates that could affect your overall cost. To use your credit card safely and effectively, keep these tips in mind:

- Gebühren prüfen: Before proceeding, verify if the bond issuer charges a fee for credit card payments. These fees can add up quickly.

- Monitor Interest Rates: Be aware of your credit card's interest rate. If you can't pay off the balance immediately, you might incur high interest charges.

- Nutzen Sie Belohnungen mit Bedacht: If your card offers rewards, make sure they outweigh any fees. This can provide additional value for your payment.