Können Sie den Saldo der Kreditkarte einer anderen Person übertragen?

Sie könnten darüber nachdenken, jemand anderen zu übertragen Kreditkartenschulden auf Ihr Konto, aber können Sie das wirklich tun? Die meisten Kreditkartenaussteller haben strenge Richtlinien dagegen, vor allem um Betrug zu verhindern. Wenn Sie jemandem helfen möchten, sollten Sie Alternativen prüfen, die effektiver und weniger riskant sein könnten. Das Verständnis der Nuancen von Saldenübertragungen und ihre Auswirkungen auf Ihre finanzielle Situation ist von entscheidender Bedeutung. Welche Optionen stehen zur Verfügung und wie wirken sie sich auf Ihre Kreditwürdigkeit? Die Antwort könnte Sie überraschen.

Saldenübertragungen verstehen

A Saldoübertragung ermöglicht Ihnen die Übertragung bestehender Kreditkartenschulden auf eine neue Karte, oft mit niedrigere Zinsen, wodurch Sie Geld sparen und Ihr Guthaben schneller abbezahlen können. Dieser Prozess kann Ihre monatliche Zahlungen und Zinsen, was es einfacher macht, Verwalten Sie Ihre FinanzenWenn Sie eine Saldenübertragung in Erwägung ziehen, prüfen Sie die mit der neuen Karte verbundenen Gebühren, da einige möglicherweise eine Überweisungsgebühr im Voraus erheben. Es ist auch wichtig, die Aktionszeitraum; Nach Ablauf der Laufzeit kann der Zinssatz steigen. Achten Sie stets auf pünktliche Zahlungen, um Strafgebühren zu vermeiden. Durch den strategischen Einsatz von Saldenübertragungen können Sie Ihre Schulden wieder in den Griff bekommen und auf eine sicherere finanzielle Zukunft hinarbeiten.

Berechtigungskriterien für Überweisungen

Bei der Betrachtung einer Saldoübertragungmüssen Sie bestimmte Zulassungskriterien vom neuen Kreditkartenaussteller festgelegt. Zuerst Ihre Kreditwürdigkeit muss typischerweise innerhalb eines bestimmten Bereichs liegen; eine höhere Punktzahl kann Ihre Chancen auf Genehmigung verbessern. Als nächstes kann der Aussteller verlangen, dass Sie eine stabiles Einkommen um sicherzustellen, dass Sie den neuen Saldo verwalten können. Darüber hinaus beschränken einige Herausgeber Überweisungen von bestimmten Karten, daher müssen Sie überprüfen, ob Ihre aktuelle Karte dafür geeignet ist. Achten Sie auf Ihre bestehenden Schulden-Einkommens-Verhältnis, da dies Ihre Berechtigung beeinflussen kann. Prüfen Sie abschließend, ob Überweisungslimits oder Gebühren anfallen, da diese Ihre Entscheidung beeinflussen könnten. Die Erfüllung dieser Kriterien erhöht Ihre Chancen auf eine erfolgreiche Saldenübertragung.

Können Sie die Schulden einer anderen Person übertragen?

Die Übertragung der Schulden einer anderen Person auf Ihr Kreditkarte wird von den meisten Emittenten normalerweise nicht zugelassen, da sie in der Regel verlangen, dass der Kontoinhaber die gleiche Person ist, die für die Schulden verantwortlich ist. Diese Richtlinie soll verhindern, Betrug und garantieren, dass nur Personen mit direkten finanziellen Verpflichtungen die Schulden bewältigen können. Wenn Sie jemandem helfen möchten, indem Sie seine Schulden abbezahlen, ziehen Sie andere Optionen in Betracht wie Privatkredite oder Mitunterzeichnung. Diese Alternativen könnten es Ihnen ermöglichen, zu helfen, ohne Ihr Kreditwürdigkeit oder gegen die Richtlinien des Emittenten verstoßen. Überprüfen Sie immer die Bedingungen und mögliche Auswirkungen auf Ihre Kreditwürdigkeit, bevor Sie Entscheidungen über Schuldenübertragungen oder Unterstützung treffen. Die Sicherheit in Ihrem Finanzgeschäfte ist unerlässlich.

Arten von Balance-Transfer-Karten

Wenn Sie die verschiedenen Arten von Balance-Transfer-Karten kennen, können Sie die richtige Option für ein effektiveres Schuldenmanagement wählen. Hier sind drei gängige Typen, die Sie in Betracht ziehen könnten:

- 0% Einführungs-APR-Karten: Diese Karten bieten einen Aktionszeitraum ohne Zinsen, sodass Sie Ihren Saldo schneller abbezahlen können.

- Karten für den Saldotransfer mit niedrigen Zinsen: Diese bieten nach der Einführungsphase einen niedrigeren laufenden Zinssatz und sind daher eine gute Wahl, wenn Sie mehr Zeit benötigen.

Mögliche Gebühren und Kosten

Oft übersehen, mögliche Gebühren und Kosten verbunden mit Saldenübertragungen kann Ihre gesamte Spar- und Rückzahlungsstrategie stark beeinflussen. Viele Saldotransferkarten berechnen eine Vorabgebühr, in der Regel zwischen 3% und 5% des überwiesenen Betrags. Diese Gebühr kann schnell alle erhofften Einsparungen aufzehren. Beachten Sie außerdem Folgendes: Aktionszinsen Dieser kann nach einer bestimmten Zeit auf einen höheren Standardsatz zurückgesetzt werden. Eine versäumte Zahlung kann außerdem zu Verzugsgebühren führen und Ihre anfänglichen Einsparungen zunichte machen. Es ist wichtig, Lesen Sie das Kleingedruckte und berechnen Sie, ob Ihnen der Wechsel langfristig wirklich weiterhilft. So können Sie besser entscheiden, ob sich der Wechsel lohnt.

Auswirkungen auf Ihre Kreditwürdigkeit

Wenn Sie eine Saldenübertragung veranlassen, ist es wichtig zu prüfen, wie sich diese kurz- und langfristig auf Ihre Kreditwürdigkeit auswirken kann. Hier sind einige wichtige Überlegungen:

- Kreditauslastung: Durch die Übertragung eines Guthabens kann Ihre Auslastungsquote gesenkt werden, was sich positiv auf Ihre Punktzahl auswirkt.

- Neue Kreditanfrage: Das Eröffnen eines neuen Kontos kann eine strenge Prüfung erfordern, die Ihre Punktzahl vorübergehend verringern kann.

Das Verständnis dieser Faktoren kann Ihnen helfen, den Saldenübertragungsprozess sicherer zu gestalten. Wenn Sie sich der möglichen Auswirkungen bewusst sind, können Sie fundierte Entscheidungen treffen, die Ihre Kreditwürdigkeit langfristig schützen.

Rechtliche Aspekte, die Sie kennen sollten

Es ist wichtig, sich der rechtlichen Auswirkungen von Saldenübertragungen bewusst zu sein, da diese Ihre finanziellen Pflichten und Rechte erheblich beeinflussen können. Wenn Sie eine Übertragung in Erwägung ziehen, sollten Sie sicherstellen, dass Sie die Richtlinien des Kartenausstellers einhalten, da nicht autorisierte Übertragungen zu rechtlichen Problemen führen können. Außerdem ist es wichtig zu verstehen, dass Sie nach der Übertragung für die Schulden haften, auch wenn diese von der Karte einer anderen Person stammen.

| Rechtlicher Aspekt | Überlegungen |

|---|---|

| Genehmigung | Stellen Sie sicher, dass Sie die Berechtigung zur Übertragung haben. |

| Schuldenverantwortung | Sie haften für die Schulden nach der Übertragung. |

| Geschäftsbedingungen | Lesen Sie die Richtlinien des Kartenausstellers gründlich durch. |

| Auswirkungen von Betrug | Vermeiden Sie nicht autorisierte Überweisungen, um rechtliche Probleme zu vermeiden. |

Alternativen zu Saldenübertragungen

Alternativen zum Saldotransfer bieten Ihnen effektive Strategien zur Verwaltung Ihrer Kreditkartenschulden, ohne dass zusätzliche Gebühren anfallen. Hier sind einige Optionen, die Sie in Betracht ziehen sollten:

- Schulden-Schneeball-Methode: Konzentrieren Sie sich darauf, zuerst Ihre kleinsten Schulden zu begleichen. Dies kann Ihnen schnelle Erfolge bringen und Ihre Motivation steigern.

- Kredite zur Schuldenkonsolidierung: Sie können einen Privatkredit mit einem niedrigeren Zinssatz erhalten, um mehrere Kreditkartenschulden zu begleichen und so Ihre Zahlungen zu vereinfachen.

Diese Alternativen können Ihnen helfen, die Kontrolle über Ihre Finanzen zurückzugewinnen und gleichzeitig die mit Saldenübertragungen verbundenen Risiken und Gebühren zu minimieren. Wägen Sie Ihre Optionen sorgfältig ab, um die beste Lösung für Ihre Situation zu finden.

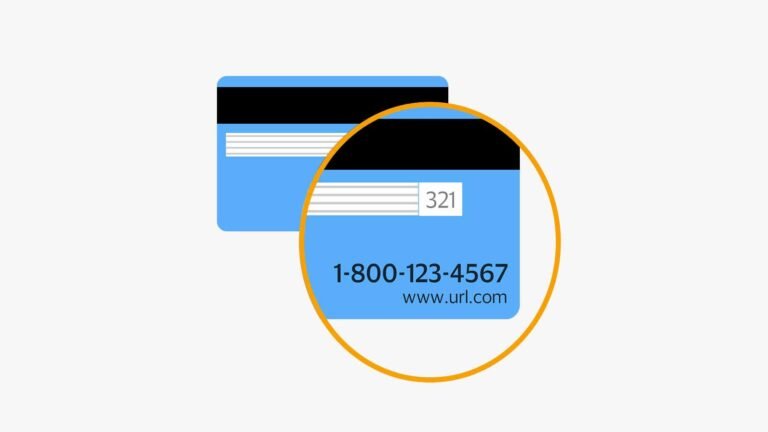

Schritte zum Ausführen einer Übertragung

Ausführen eines Saldoübertragung erfordert sorgfältige Planung um Ihnen maximale Vorteile und minimale Kosten zu garantieren. Prüfen Sie zunächst, ob Ihr Kreditkartenaussteller Überweisungen von einem anderen Konto zulässt, da die Richtlinien variieren. Sammeln Sie anschließend die notwendigen Informationen, einschließlich der Kontonummer und des Kontostands der Karte, von der Sie überweisen. Beantragen Sie anschließend eine geeignete Saldotransferkarte. Achten Sie dabei auf niedrige Zinsen und Gebühren. Sobald die Genehmigung erteilt ist, leiten Sie die Überweisung ein, indem Sie dem Aussteller die erforderlichen Angaben mitteilen. Verfolgen Sie den Überweisungsverlauf, um sicherzustellen, dass er innerhalb der Aktionszeitraum. Schließlich leisten Sie weiterhin pünktliche Zahlungen, um Strafen zu vermeiden und Ihre Kreditwürdigkeit. Dieser Ansatz trägt dazu bei, einen reibungslosen und sicheren Saldentransfer zu gewährleisten.