Kann ich die Cash App verwenden, um Geld an mich selbst zu überweisen?

Sie fragen sich wahrscheinlich, ob Sie Cash App Zu Geld überweisen zu sich selbst, und die Antwort ist ja. Aber bevor Sie beginnen, ist es wichtig, den Prozess und alle Mögliche Auswirkungen. Geld mit der Cash App an sich selbst zu überweisen, ist ähnlich wie Geld an jemand anderen zu senden – Sie müssen Ihre eigenen Daten als Empfänger eingeben und den Betrag festlegen. Aber wie sieht es mit Gebühren aus? Sicherheitsrisikenund mehrere Konten verknüpfen? Wenn Sie die Cash App für Selbstüberweisungen verwenden möchten, sollten Sie mehr über diese Faktoren wissen, um sicherzustellen, dass Sie den Dienst effektiv nutzen.

Geld zwischen Konten überweisen

Wenn Sie Gelder verschieben von einem Cash App-Konto zu einem anderen, können Sie dies schnell und einfach tun, und wir führen Sie durch den Prozess. Um Geld überweisen Um zwischen Konten zu wechseln, müssen beide Konten mit derselben E-Mail-Adresse oder Telefonnummer verknüpft sein. Anschließend können Sie die Funktion "Bezahlen" nutzen, um Geld von einem Konto auf das andere zu überweisen. Geben Sie einfach die E-Mail-Adresse des Empfängers oder Telefonnummer, wählen Sie den Betrag, den Sie überweisen möchten, und Bestätigen Sie die TransaktionDas Geld ist sofort auf dem Empfängerkonto verfügbar. Stellen Sie sicher, dass Sie die Empfängerinformationen überprüft haben, um Fehler zu vermeiden. Mit Cash App ist der Geldtransfer zwischen Konten ein unkomplizierter und sicherer Ablauf.

So funktioniert die Cash App

Um die Besonderheiten von Cash AppSchauen wir uns die Funktionsweise genauer an und beginnen mit den Grundlagen des Sendens und Empfangens von Geld über die Plattform. Wenn Sie sich für Cash App anmelden, verknüpfen Sie eine Debitkarte, Kreditkarteoder Bankkonto auf Ihr Konto. Diese Finanzierungsquelle wird verwendet, um Geld senden für andere, und hier werden Sie auch Geld erhalten An Sie gesendet. Um Geld zu senden, geben Sie die E-Mail-Adresse, Telefonnummer oder den eindeutigen Cash-App-Namen des Empfängers sowie den gewünschten Betrag ein. Der Empfänger erhält eine Benachrichtigung, und das Geld wird seinem Cash-App-Konto gutgeschrieben. Mit einem ähnlichen Verfahren können Sie auch Geld von anderen anfordern.

Einrichten mehrerer Konten

Sie können haben mehrere Cash App-Konten, aber jedes Konto muss mit einem eindeutige E-Mail-Adresse oder Telefonnummer und haben eine separates Bankkonto oder Debitkarte als Finanzierungsquelle. Dies ist ein wesentlicher Sicherheitsmaßnahme um unbefugten Zugriff zu verhindern und die Sicherheit Ihrer Transaktionen zu gewährleisten. Das Einrichten mehrerer Konten kann sinnvoll sein, wenn Sie Ihre privaten und geschäftlichen Finanzen getrennt halten möchten oder die Finanzen eines Familienmitglieds verwalten. Um ein zusätzliches Konto zu erstellen, müssen Sie dieselben Schritte durchführen Anmeldevorgang Verwenden Sie wie bei Ihrem ersten Konto eine andere E-Mail-Adresse oder Telefonnummer. Beachten Sie für jedes Konto die gleichen Sicherheitsmaßnahmen.

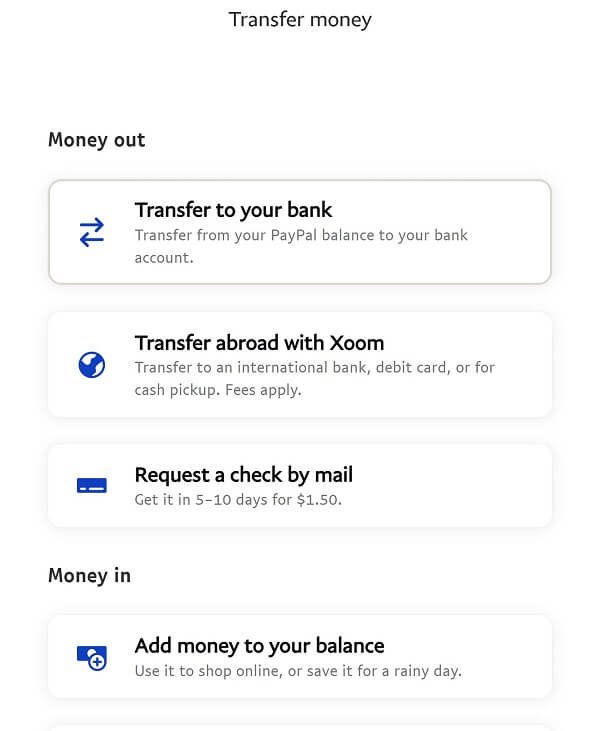

Verknüpfen von Bankkonten mit der Cash App

Verknüpfen eines Bankkontos mit Cash App ist ein unkomplizierter Prozess, der es ermöglicht Direkteinzahlungen und ermöglicht mühelose Überweisungen zwischen Ihrem Bank- und Cash App-Konto. Gehen Sie dazu auf die Registerkarte "Banking" auf Ihrem Cash App-Startbildschirm und wählen Sie "Link Bank, und wählen Sie dann Ihre Bank aus der Liste der verfügbaren Optionen aus. Falls Ihre Bank nicht aufgeführt ist, können Sie die Daten Ihrer Bank manuell eingeben. Möglicherweise werden Sie aufgefordert, sich bei Ihrem Online-Banking-Konto anzumelden oder Ihre Bankdaten einzugeben. Sobald Ihr Konto verknüpft ist, müssen Sie verifiziere es, was einige Tage dauern kann. Nach der Überprüfung können Sie Geld überweisen zwischen Ihrem Bank- und Cash App-Konto sicher und einfach.

Geld an sich selbst senden

Außer dem Senden von Geld an andere, Cash App ermöglicht es Benutzern auch, Geld überweisen über verschiedene Konten oder Zahlungsmethoden hinweg, sodass Sie Geld einfach dorthin transferieren können, wo es benötigt wird. Sie können Geld an sich selbst senden von einem Cash App-Konto zu einem anderen oder von Ihrem Cash App-Konto zu Ihrem verknüpftes Bankkonto oder Debitkarte. Diese Funktion ist praktisch, wenn Sie Geld von einem Konto auf ein anderes überweisen oder ein neues Konto aufladen möchten. Um Geld an sich selbst zu senden, folgen Sie einfach den gleichen Schritten wie beim Senden an eine andere Person, geben Sie jedoch Ihre eigenen Daten als Empfänger ein. Cash App's sichere Plattform garantiert, dass Ihre Transaktionen geschützt und schnell abgeschlossen werden.

Geld von sich selbst erhalten

Geld von Ihnen selbst über die Cash App zu erhalten, ist im Grunde die Kehrseite des Geldversands an Sie selbst. Das Geld kommt genauso schnell und sicher auf dem Zielkonto an. Hier sind einige Dinge, die Sie beachten sollten, wenn Geld von sich selbst erhalten:

- Sie erhalten eine Benachrichtigung bei Geldeingang in Ihrem Konto.

- Das Geld wird sofort einsatzbereit, unabhängig davon, ob Sie es an jemand anderen senden, investieren oder abheben möchten.

- Geld von sich selbst erhalten erfordert keine zusätzlichen Gebühren (über das hinaus, was bereits mit der Übertragung verbunden ist).

- Die Gelder werden auf Ihr Konto eingezahlt Cash App-Guthaben.

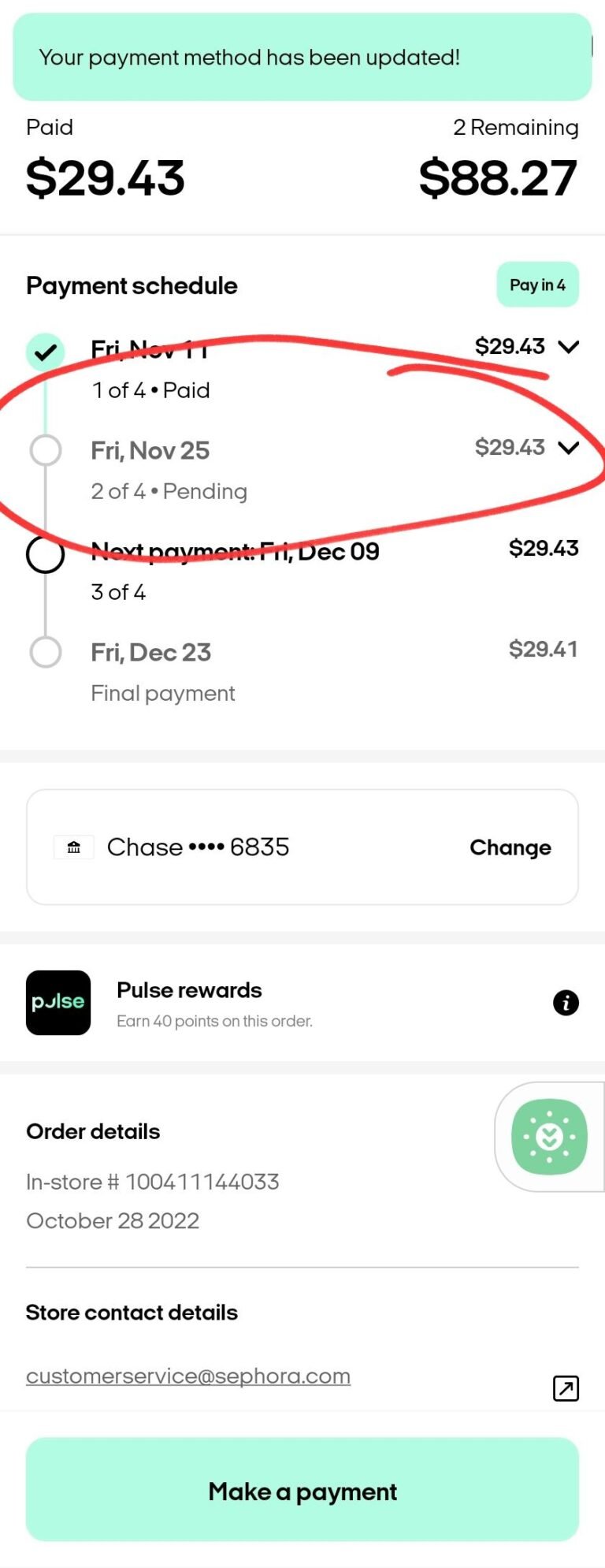

Gebühren für Cash App-Überweisungen

Nachdem Sie nun wissen, wie das Empfangen von Geld von Ihnen selbst funktioniert, fragen Sie sich wahrscheinlich, wie viel es kostet, Ihr Geld zu bewegen. Und hier kommt Cash App ins Spiel. Überweisungsgebühren kommen herein. Cash App erhebt eine Überweisungsgebühr von 1,5% für Soforteinzahlungen auf Ihre Debitkarte oder Ihr Bankkonto. Es fallen jedoch keine Gebühren für Standardeinlagen, die etwa ein bis drei Werktage dauern. Darüber hinaus, wenn Sie Geld erhalten über direkte EinzahlungEs fallen keine Überweisungsgebühren an. Wichtig zu beachten ist, dass diese Gebühren nur bei Überweisungen von Cash App auf ein anderes Konto anfallen. Beim Senden oder Empfangen von Geld innerhalb der Cash App fallen keine Überweisungsgebühren an. Dies hilft Ihnen bei der Planung und Berechnung möglicher Gebühren bei der Verwaltung Ihrer Finanzen.

Potenzielle Sicherheitsrisiken

Dein Sicherheit des Cash App-Kontos ist wichtig, und es gibt mehrere potenzielle Risiken Sie sollten wissen, wie Sie Ihr Geld und Ihre persönlichen Daten schützen können. Wenn Sie Geld an sich selbst überweisen, sollten Sie Ihr Konto vor potenziellen Bedrohungen schützen. Hier sind einige potenzielle Sicherheitsrisiken, auf die Sie achten sollten:

- *Phishing-Betrug*: Betrüger versuchen möglicherweise, Sie dazu zu bringen, Ihre Anmeldedaten oder andere vertrauliche Informationen preiszugeben.

- *Unbefugter Zugriff*: Wenn jemand Zugriff auf Ihr Konto erhält, könnte er ohne Ihr Wissen Geld überweisen.

- *Malware und Viren*: Schadsoftware kann die Sicherheit Ihres Kontos gefährden.

- *Risiken im öffentlichen WLAN*: Die Verwendung von öffentlichem WLAN für den Zugriff auf Ihr Cash App-Konto kann Ihre Daten gefährden.

Alternativen zur Verwendung der Cash App

Wenn Sie nach anderen Möglichkeiten suchen, Geld überweisengibt es mehrere Alternativen zur Verwendung Cash App die ähnliche Dienste anbieten, oft mit ihren eigenen einzigartigen Funktionen und Vorteilen. Vielleicht möchten Sie darüber nachdenken PayPal, mit dem Sie weltweit Geld senden und empfangen können. Venmo ist eine weitere Option, insbesondere wenn Sie Geld an Freunde oder Familie überweisen. Zelle ist auch eine gute Wahl, wenn Sie Geld direkt von Ihrem Bankkonto überweisen möchten. Google Pay und Apple Pay bieten eine bequeme und sichere Möglichkeit, Geld mit Ihrem Smartphone zu senden und zu empfangen. Jede dieser Alternativen legt Wert auf Sicherheit und bietet verschiedene Sicherheitsfunktionen wie Verschlüsselung und Zwei-Faktor-Authentifizierung zum Schutz Ihrer Transaktionen. Wenn Sie mehr Optionen wünschen, lohnt es sich, sie näher zu erkunden.